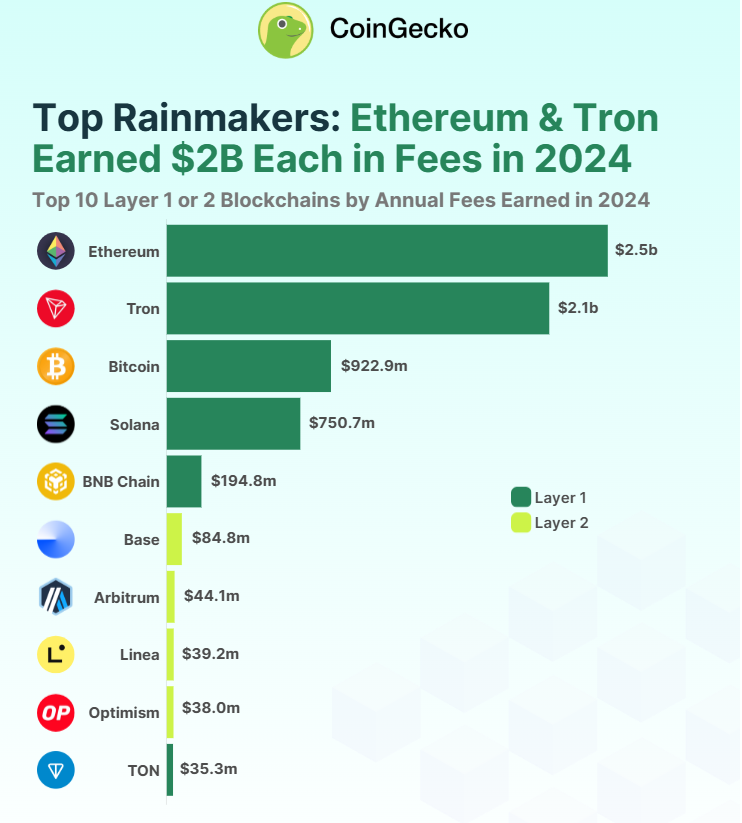

The year 2024 was pivotal for digital assets, reaching numerous historic milestones. The latest data shows that blockchains collectively generated $6.9 billion in fees in 2024.

Ethereum led the charge, followed by Tron and Bitcoin, which secured their place in the top three. In addition, Solana experienced a significant increase in reimbursements.

Ethereum to Dominate Blockchain Fee Revenue in 2024

According to CoinGecko’s report, Ethereum generated $2.48 billion in gas fees, marking an annual increase of 3.0%.

“This suggests that Ethereum continues to lead in fee revenue, despite the Dencun upgrade in March 2024 that reduced L2 transaction fees, and continued user migration from the L1 chain to its L2 scaling solutions,” the report said.

Top blockchains by revenue. Source: CoinGecko

Ethereum fee income contrasted with disappointing price performance, which fell short of expectations in 2024.

While many cryptocurrencies reached all-time highs this year, ETH failed to follow suit. Furthermore, Ethereum ETFs underperformed compared to Bitcoin, with inflows only increasing in November.

Meanwhile, Tron experienced a remarkable growth spurt, raking in $2.15 billion in fees, up 116.7% from $922 million in 2023.

The blockchain benefited from the increasing use of stablecoins, with monthly fees rising from $38 million in January 2023 to a peak of $342 million in December 2024. Tron’s performance surpassed Ethereum’s in the last six months of the year, although that remains to be seen. whether it can maintain this lead in 2025.

Bitcoin, on the other hand, earned $922 million in fees, reflecting a steady increase in activity including Ordinal NFTs, BRC-20 tokens and increasing interest in Bitcoin-based applications.

Solana’s meteoric rise

Notably, Solana, known for its fast transactions, posted an extraordinary 2,838.0% increase in fee income, reaching $750.65 million in 2024.

“Solana was by far the most popular blockchain ecosystem last year, with transaction volume rising to the point of network congestion in April 2024,” the report said.

The company’s dominance in decentralized exchange trading (DEX) also increased in the fourth quarter, with its market share rising above 30%.

The network also hit a record peak in fees and revenue on January 20. A significant portion of this growth was due to the rise of the TRUMP and MELANIA coins. This new milestone followed SOL’s all-time high on January 19, 2025.

While layer 1 blockchains dominated the majority of costs, contributing $6.6 billion, layer 2 blockchains were not left behind, adding $294.92 million. Four of the top 10 highest-grossing blockchains were tier 2 solutions – Base, Arbitrum, Linea and Optimism – and surpassed tier 1s like TON in fees.

Base led the L2s with $84.78 million in gas fees through 2024, benefiting from strong adoption and Coinbase integration.