- Large ETH holders have added more than 10% to their holdings in the past year.

- 52% of ETH is now concentrated among large holders.

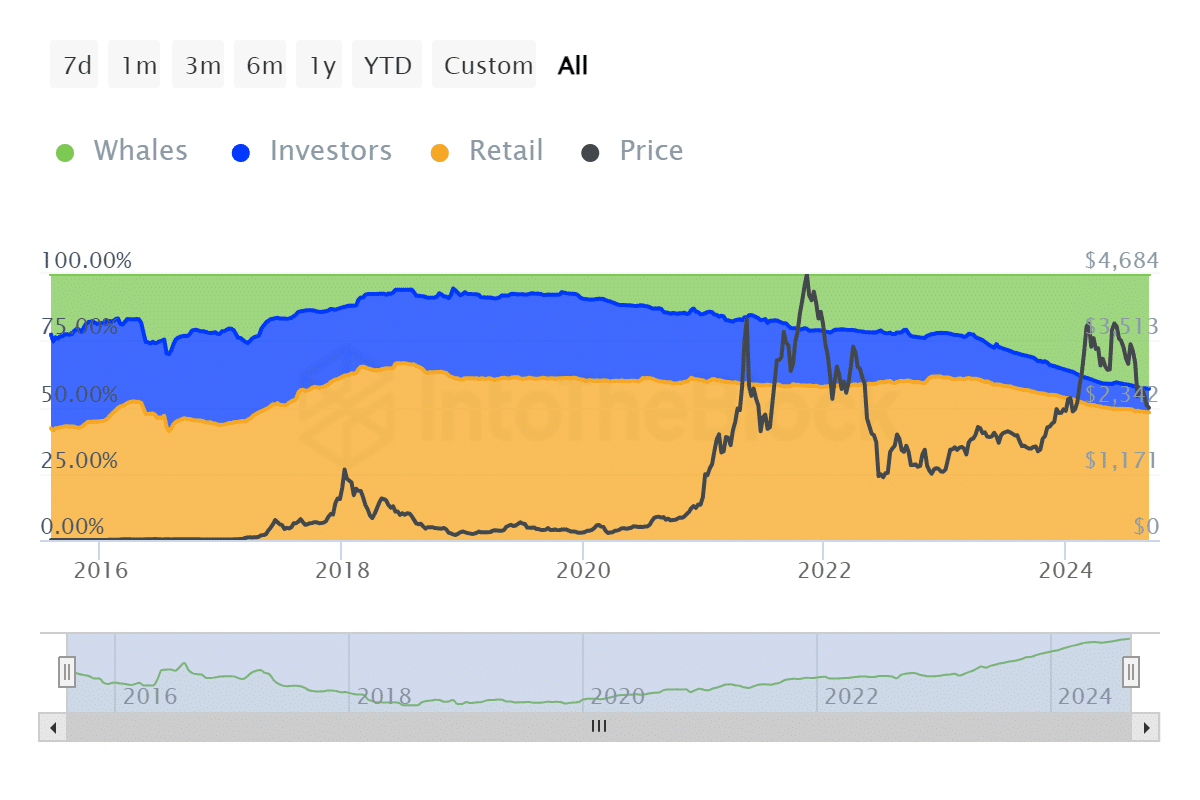

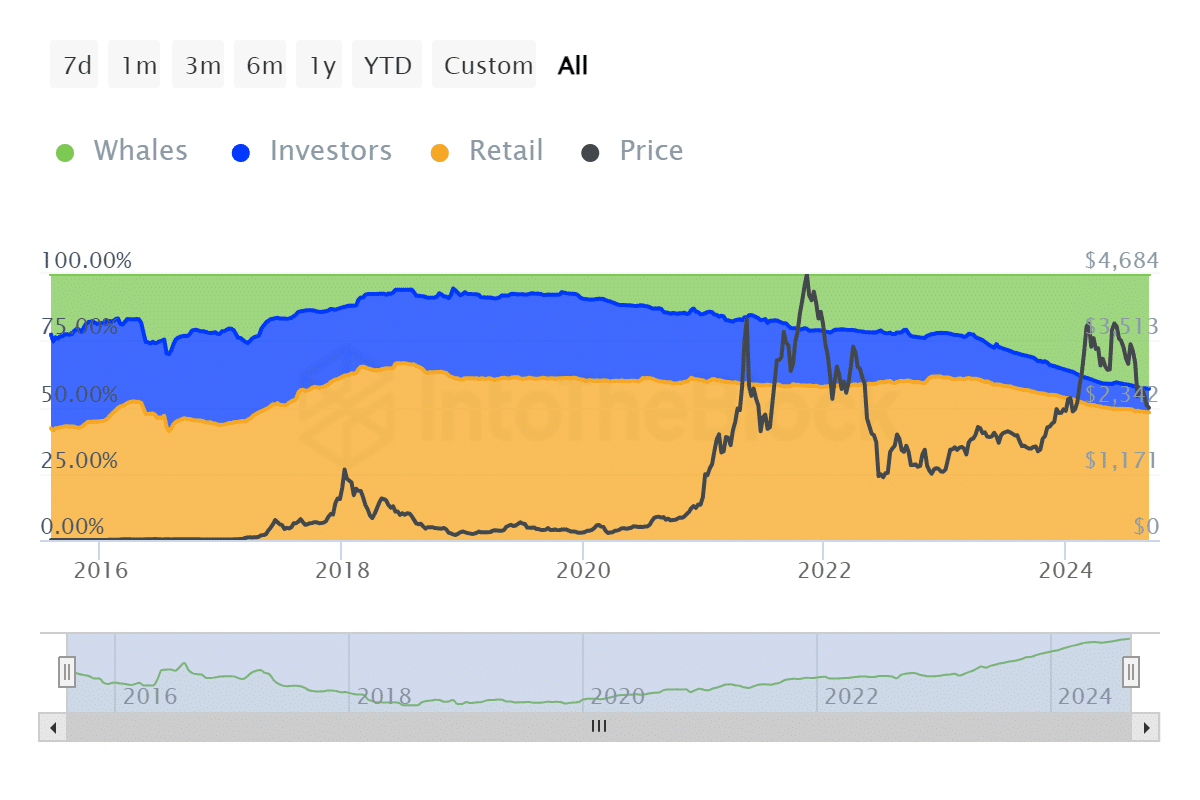

Ethereum [ETH] has experienced significant growth in the number of large keepers, often called whales. New data shows that the percentage of ETH supply held by these whales was gradually overtaking the amount held by retail investors.

Major holders, including Whales, control more than half of the total ETH supply.

Large holders get more Ethereum

According to data from InTheBlokEthereum whales now own approximately 58.37 million ETH, representing over 43% of the total Ethereum supply.

This represents a significant increase from the 30% they owned last year, suggesting that large holders have added more than 10% to their holdings in the past year.

Source: IntoTheBlock

The data also shows that this accumulation accelerated significantly after the Shanghai upgrade, which enabled Ethereum withdrawals for stakers.

Total whale supply is now approaching 48% from retail investors, showing that whales are quickly catching up.

Furthermore, over 52% of Ethereum’s total supply is now concentrated among large holders, including both whales and institutional addresses.

The stakes of Ethereum increase with large accumulation

In early 2023, the accumulation of large Ethereum holders increased significantly, coinciding with Shanghai’s upgrade. Retail investors owned approximately 56% of the total ETH supply at the time.

However, as ownership of large addresses grew, the supply from private investors gradually decreased.

Interestingly enough, the analysis of foreign exchange reserves showed that these reserves continued to decline during this period. This indicates that the ETH sold by retail investors and other groups was absorbed by large holders rather than ending up on exchanges.

This suggests that whales were actively buying up the ETH being sold by smaller holders, reducing the available supply on exchanges and tightening liquidity.

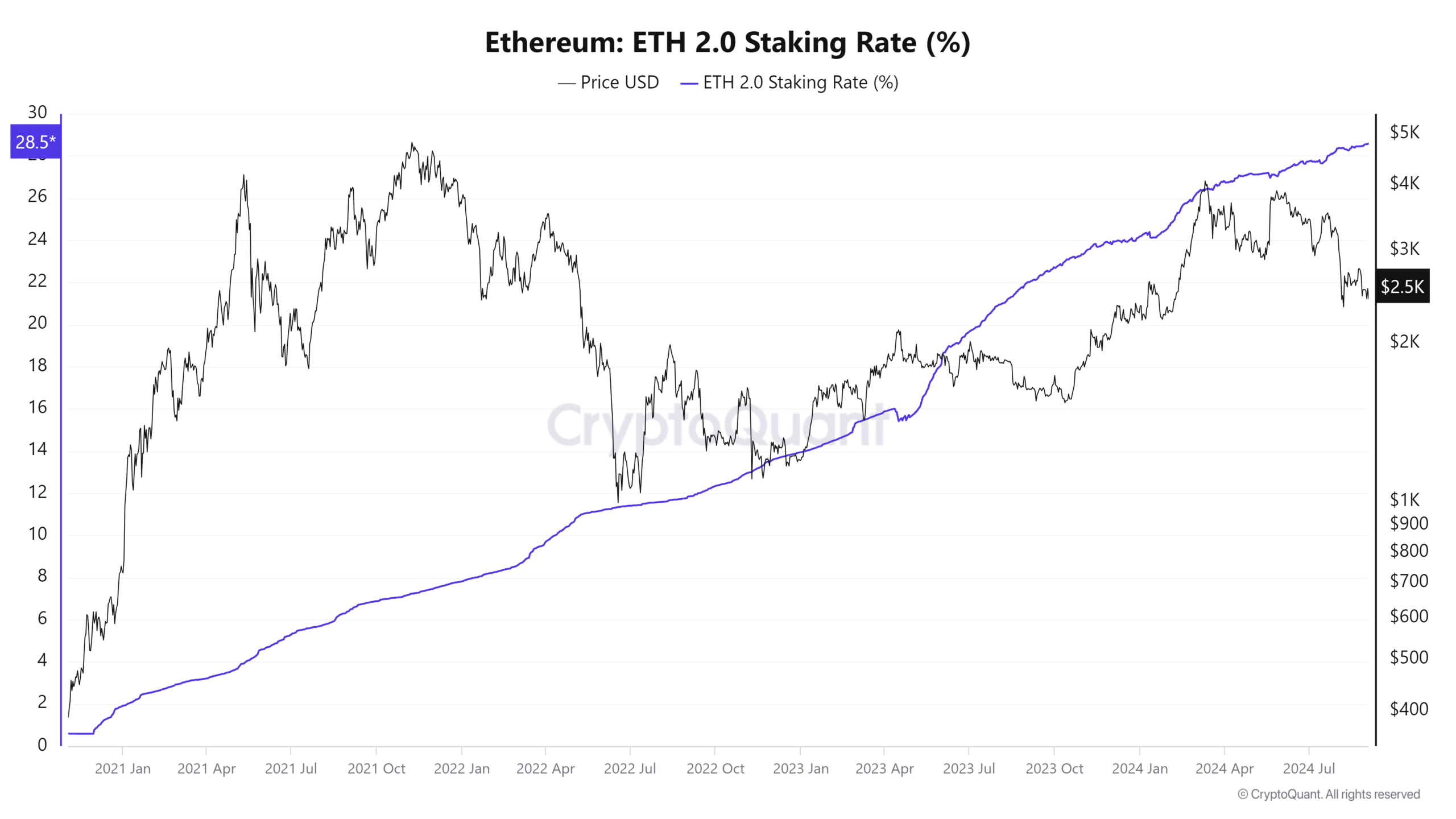

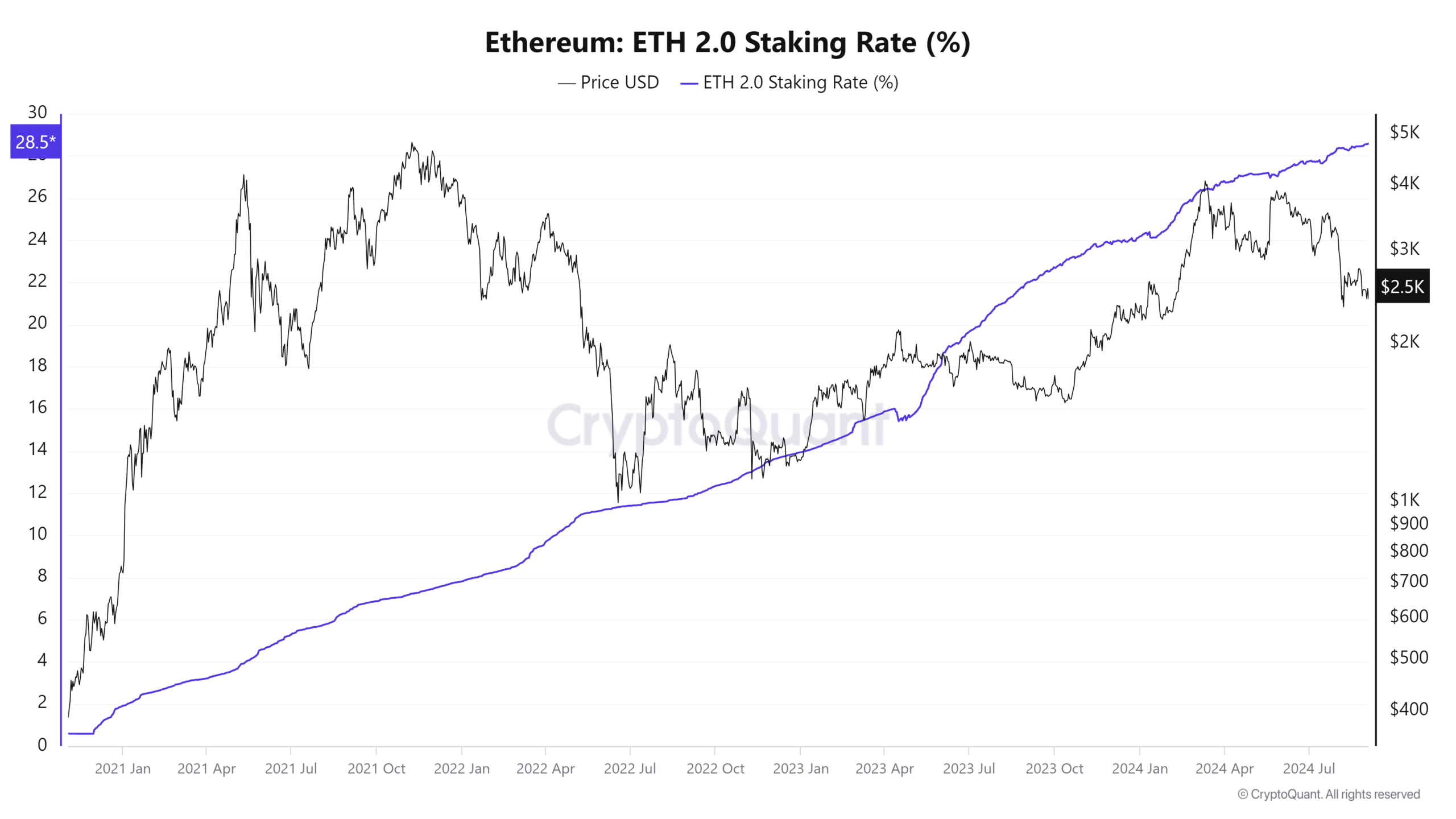

Furthermore, the percentage of ETH staked has continued to rise. At the time of writing, more than 28% of the total Ethereum supply has currently been staked. This indicates that a large portion of the ETH sold by individuals and other holders has likely been staked rather than traded on exchanges.

The combination of staked ETH and whale accumulation supports a bullish outlook for Ethereum. A decreasing supply of exchange and an increasing supply of stakes often lead to supply constraints, which may cause prices to rise in the long term.

Source: CryptoQuant

ETH remains bearish

At the time of writing, Ethereum (ETH) is trading around $2,340, after rising 2.7% in the last trading session. This marks the third consecutive day of price increases for ETH.

However, despite this recent upward move, more is needed to change Ethereum’s overall trend, which remains bearish.

Read Ethereum (ETH) Price Prediction 2024-25

The ongoing bearish trend indicates that while there is positive momentum in the short term, broader market sentiment is still leaning toward caution.

Ethereum would need to break major resistance levels and sustain a stronger uptrend before a more significant shift can occur.