- Ethereum has strengthened its recovery price with price action indicating seller exhaustion.

- Bullish speculators are betting on the debut of a US-based spot Ethereum ETF to trigger a bullish reversal.

Ethereum [ETH] traded in the green on July 9 after an eventful previous day when potential issuers of a US spot Ethereum exchange-traded fund (ETF) submitted their amended registration forms.

VanEck, 21Shares, Franklin Templeton, Grayscale, Fidelity and BlackRock filed their updated Form S-1s with Bitwise, which was the first to file its updated registration statement last Friday.

US spot Ethereum ETF listing on the horizon

Grayscale has filed two amended documents: one for the Grayscale Ethereum Trust (ETHE) and one for the Mini Trust.

Only Invesco missed the July 8 deadline set by the U.S. Securities and Exchange Commission (SEC) last month when it returned issuers’ initial registration forms with highlighted areas that needed to be resolved before they could be refiled.

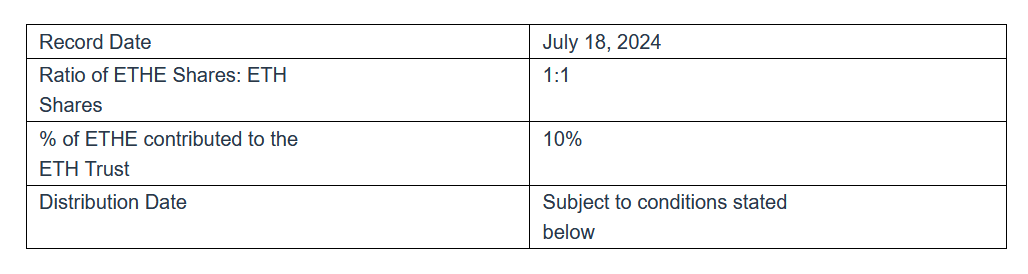

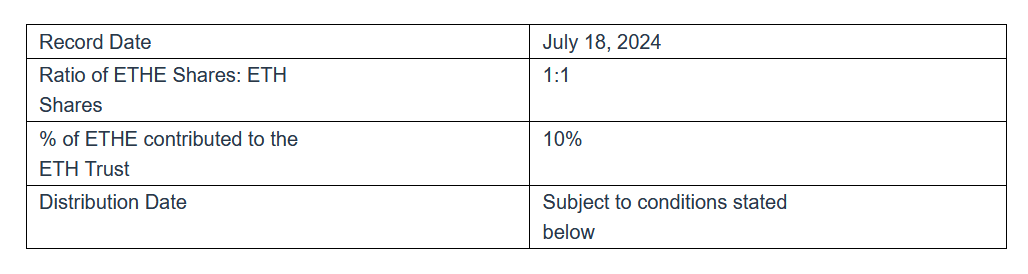

Grayscale shared in a separate announcement to investors that the first issuance and first distribution of shares of the new Ethereum Mini Trust (ETH Trust) will take place on July 18.

Source: grayscale

The asset manager also confirmed in the announcement that it plans to list the ETH Trust on NYSE Arca pending approval.

One more hurdle before it’s time

Regarding next steps, Bloomberg ETF analyst Eric Balchunas said the SEC is expected to review the refiled registration statements and contact the issuers with a plan for the final listing.

Balchunas wrote on X,

“[The] SEC requested the S-1s on July 8, but told issuers it did not [necessary] yet. They will soon provide advice to issuers along with the game plan. Then the documents come back with the costs (and all the other blanks) filled in and then it’s time to go.

The markets have been eagerly awaiting the final green light, which would allow spot Ethereum ETFs to begin trading.

Balchunas predicted that the proposed ETFs could go live on July 18, although a precise timeline will depend on feedback from the US federal securities regulator.

Balchunas added,

“We don’t have a new over/under launch date yet because we haven’t heard what the SEC’s game plan is yet […] But if you forced me to jump the gun and give my best guess at the date, I’d go with July 18th.

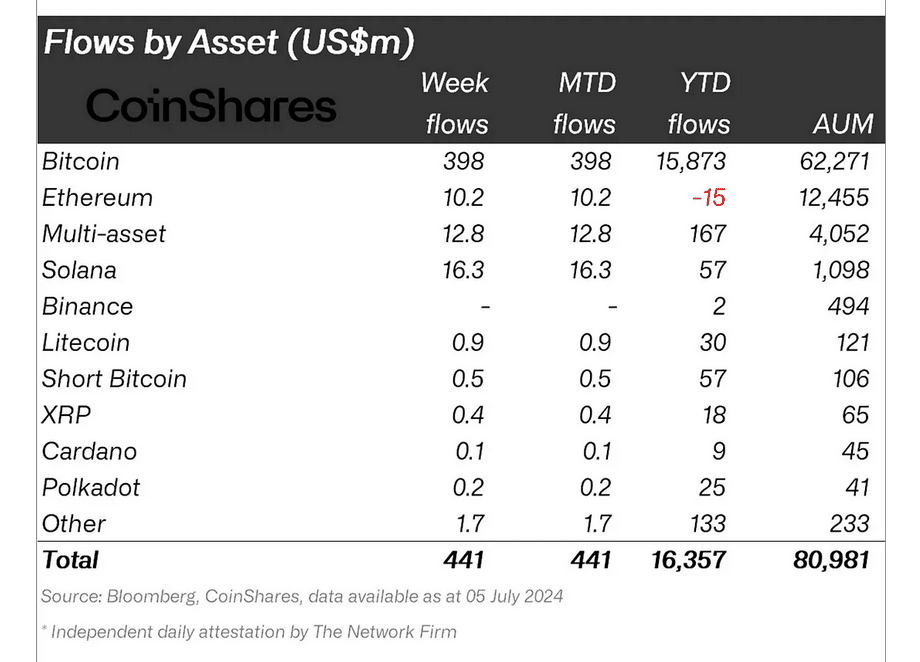

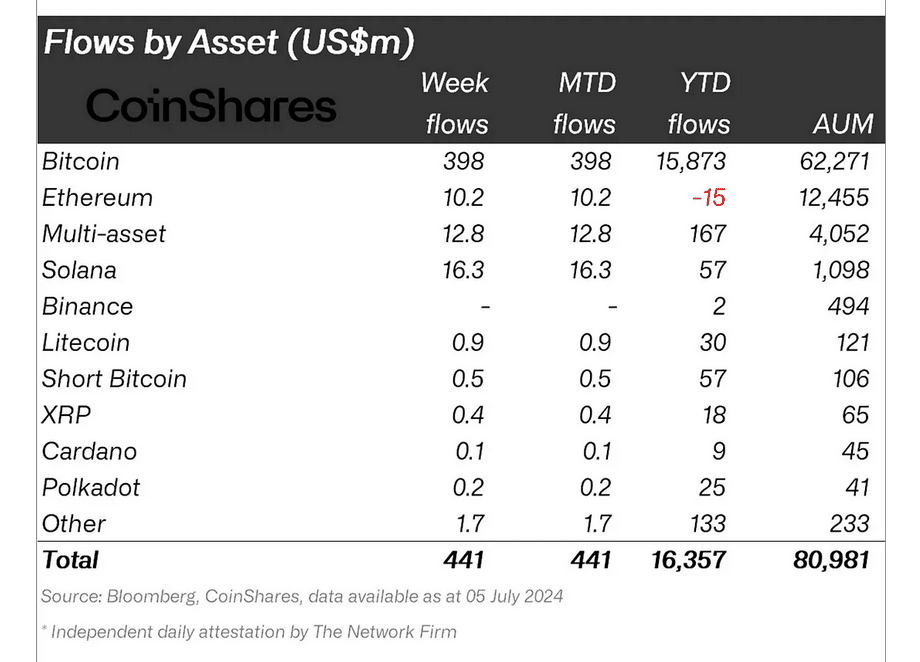

In its weekly report on digital asset fund flows, published on July 8, CoinShares reports noted that Ethereum-based investment products saw inflows totaling $10.2 million last week.

Source: CoinShares

The report also placed Solana at the top of the asset list in terms of weekly crypto asset flows – with inflows of $16.3 million compared to Ethereum’s $10.2 million.

It’s worth noting that VanEck and 21Share are separately seeking approval for their spot Solana ETFs – the VanEck Solana Trust and the 21Shares Core Solana ETF.

The Chicago Board Options Exchange (CBOE) filed two Forms 19b-4 with the SEC on July 8 for the VanEck and 21Share products. VanEck and 21Shares previously filed their SEC Form S-1s on June 27 and June 28, respectively.

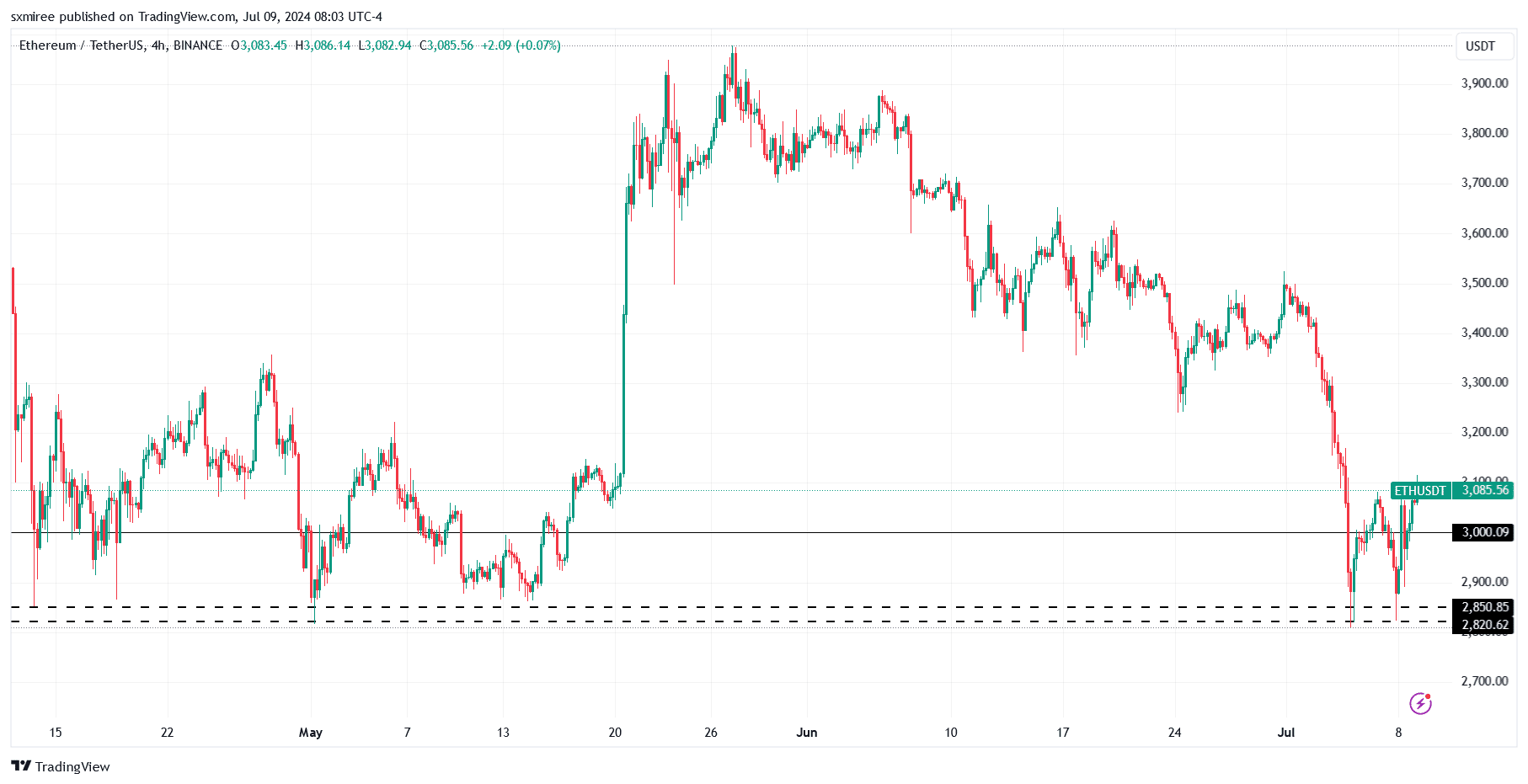

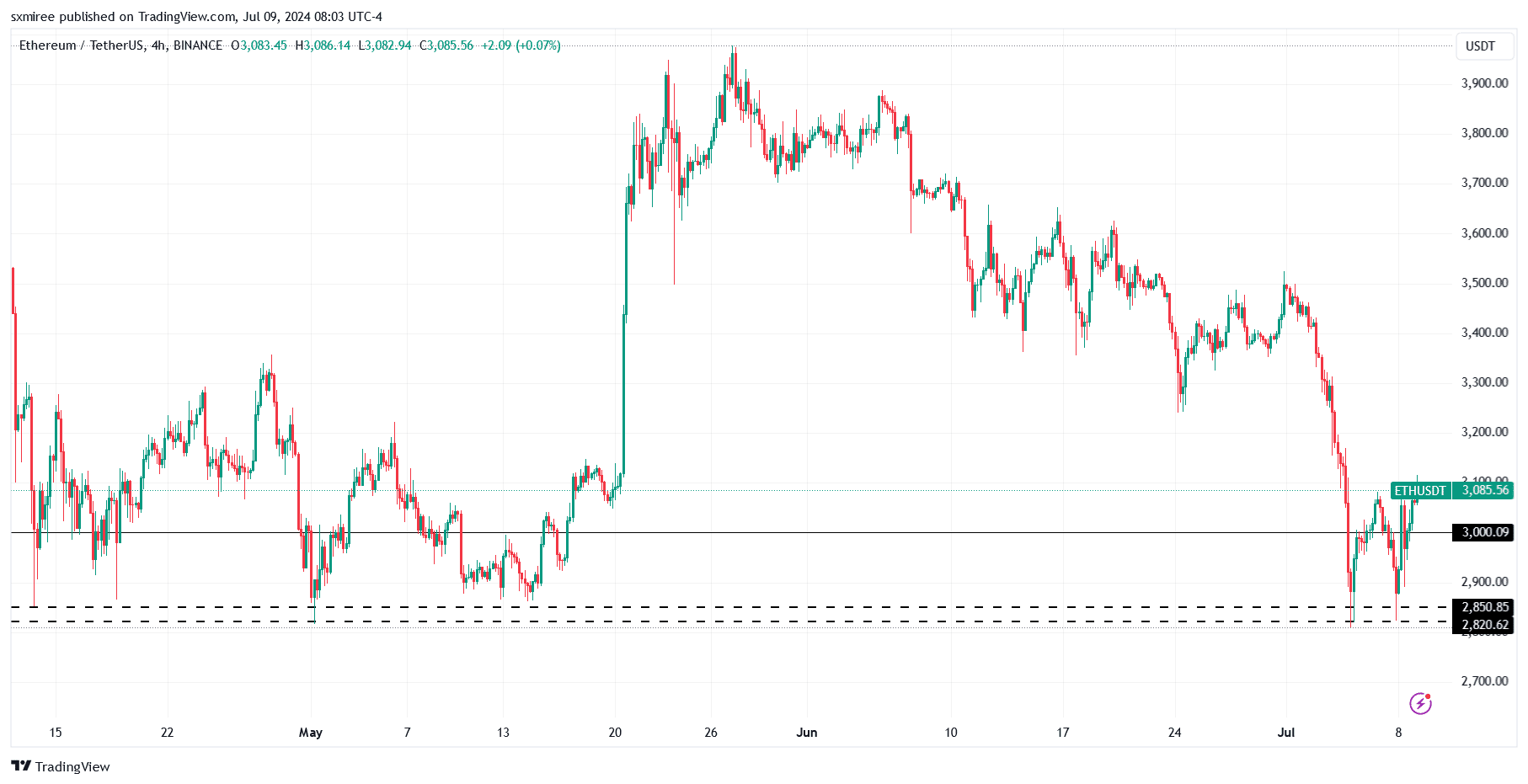

ETH/USDT technical analysis

ETH briefly retested the support zone around $2,800 to $2,850 on July 8 before bouncing above the psychological $3,000 level before the daily close.

The recovery that continued at press time was driven by a successful defense of the long-held support zone that the bulls previously defended between April and mid-May.

Source: TradingView

Stable prices over the past 24 hours support technical indicators and signals pointing to a possible recovery.

Read Ethereum’s [ETH] Price forecast 2024-2025

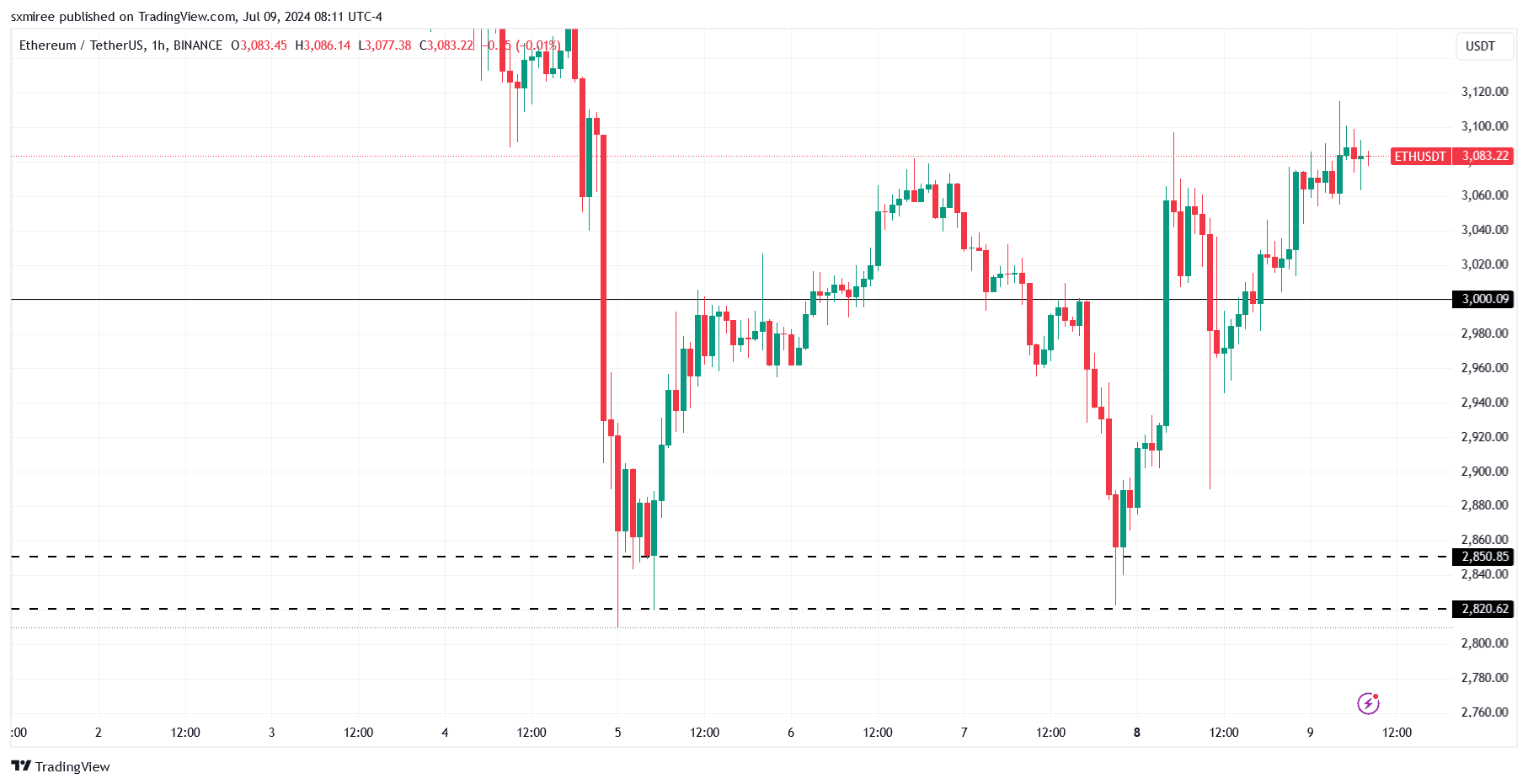

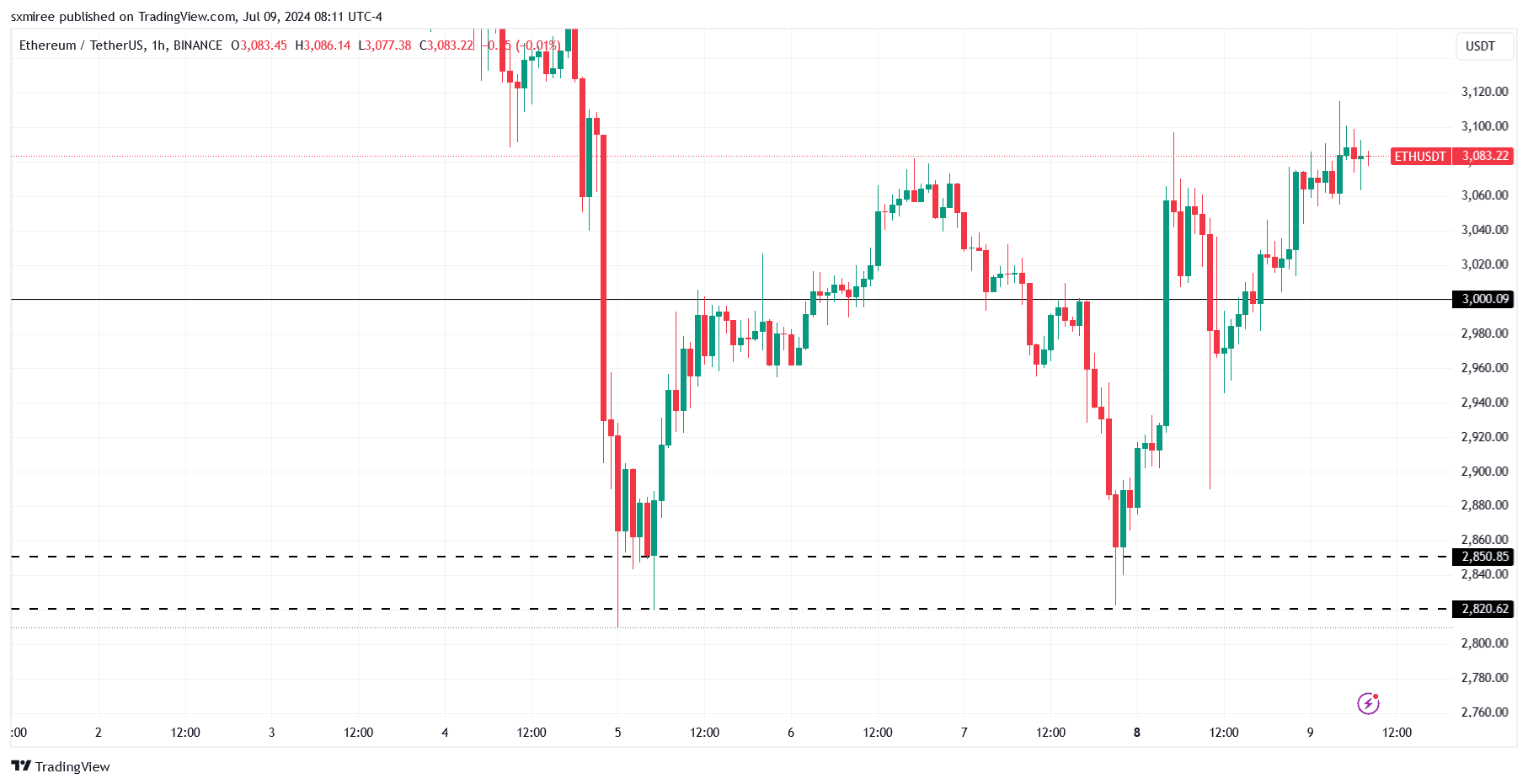

On the hourly chart, the ETH/USDT pair followed a W-shaped double-bottom pattern above the weekend’s crucial support, heralding a bullish reversal.

Source: TradingView

Long wick candles around the critical support at $2,800 – $2,850 further indicate seller exhaustion in the zone and a possible trend reversal to the upside.