- Ethereum’s market cap rose to $65.45 billion.

- ETH’s liquid supply has gone downhill over the past two years.

Ethereum [ETH] the strike showed no signs of saturation as the total supply committed to ETH’s deposit contract rose to a new all-time high (ATH).

ETH stake on a roll

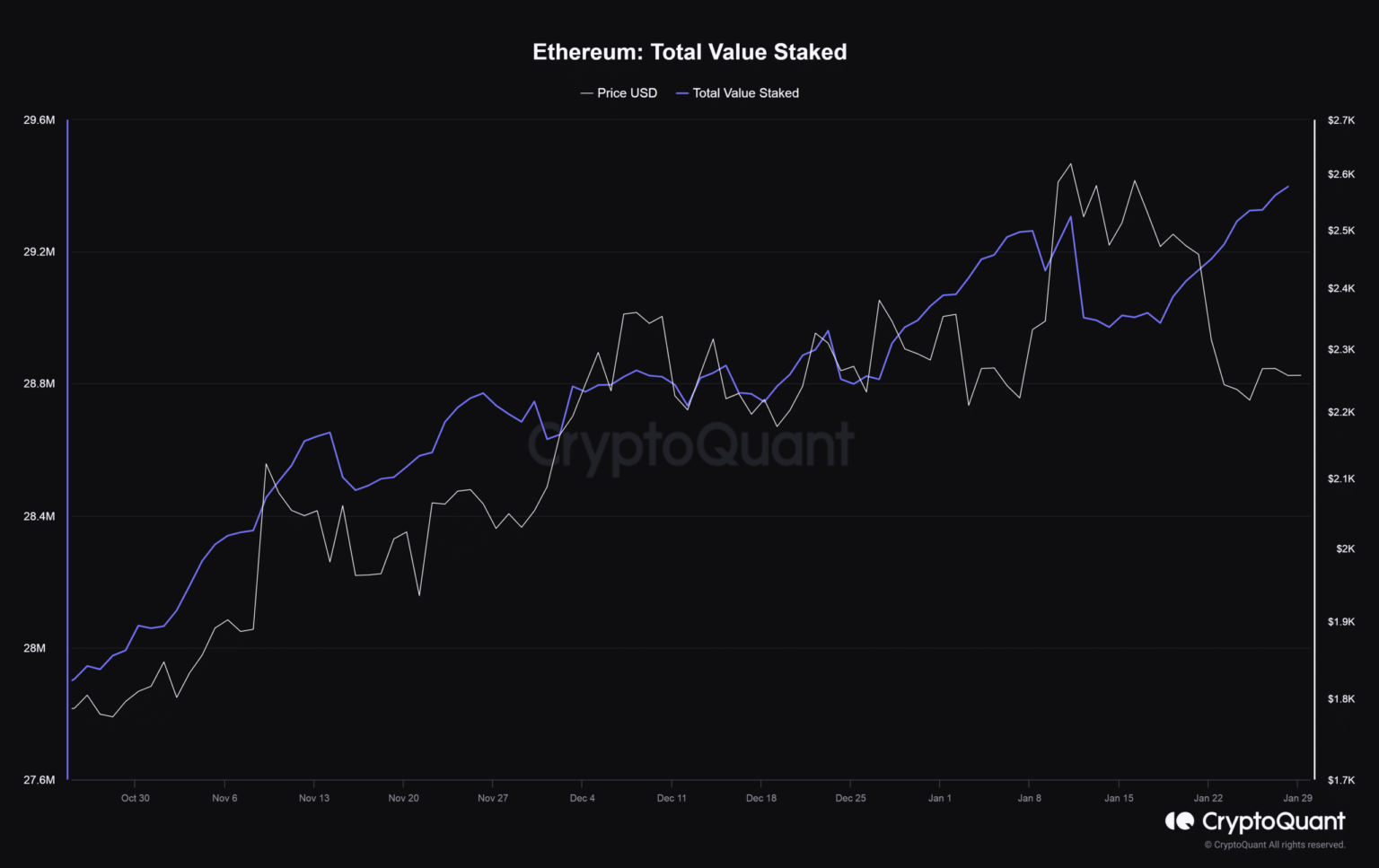

According to AMBCrypto’s analysis of CryptoQuant data, approximately 29.39 million ETH coins had been staked on the blockchain at the time of writing, representing almost a quarter of the total circulating supply.

Source: CryptoQuant

This increased the total USD value of staked coins to $65.45 billion, accounting for approximately 35% of the total market capitalization of all proof-of-stake (PoS) assertions, AMBCrypto found using data from Set up rewards.

Users have shown an increased interest in staking since the Shapella Upgrade was introduced last April.

Staking, which was considered a risky proposition due to the ambiguity surrounding the withdrawal, received a boost after the mining of ETH was allowed.

ETH supply has increased by 55% since Shapella.

An interesting aspect of the rise was how holders’ strike decisions became independent of ETH’s price performance. Notice in the chart above how the supply of stakes increased in January, despite ETH’s decline.

Will Exhausting Rewards Stop the Flow?

Although ETH staking has grown in popularity over the months, it has reduced stake returns, with users participating in the activity in the first place.

As Staking Rewards data shows, the average annualized rewards rate fell from 5% in early January to 3.54% at the time of writing.

However, this was expected as the rewards are inversely proportional to the amount of ETH deposited into the network and the number of stakers involved.

Source: Staking Rewards

It remained to be seen whether the strike rate would hold up in the long term as yields continue to decline.

However, one thing was clear: ETH holders prioritized guaranteed, stable returns over risky market trading.

Is your portfolio green? Check out the ETH profit calculator

The perception of ETH is changing drastically

According to CryptoQuant, ETH’s liquid supply, which is intended for active trading, has gone downhill over the past two years.

A rotation of capital from trading to staking implied that the second largest cryptocurrency was seen as a long-term investment.

Source: CryptoQuant