- ETH’s open interest has risen 15% in two days.

- Now that the BTC Spot ETF has been approved, market volatility has arisen.

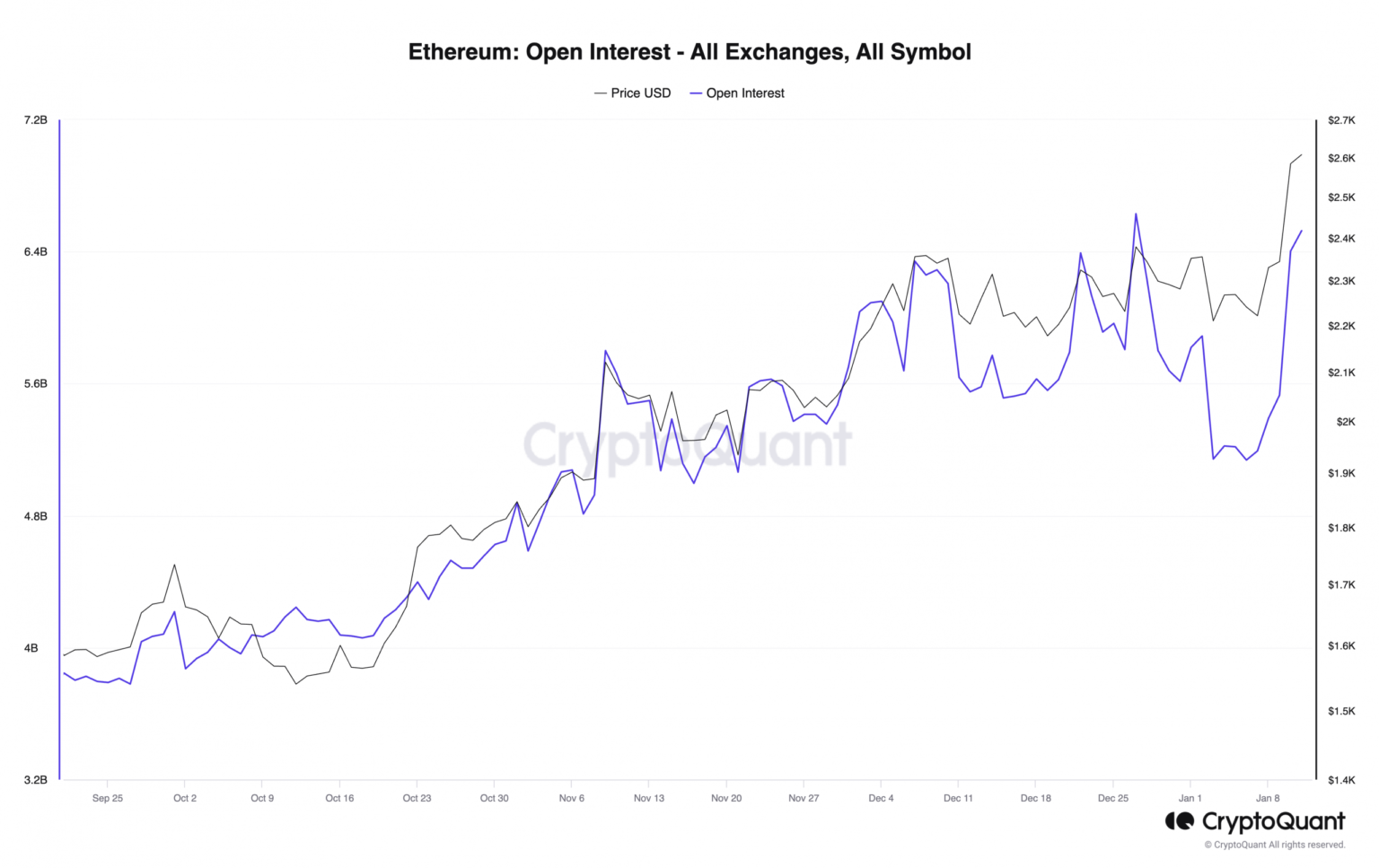

The derivatives market for Ethereum [ETH] has witnessed a dramatic increase in recent days, with open interest hitting a multi-week high, according to data from CryptoQuant.

This sudden spike in activity started after a now debunked announcement arose from the US Securities and Exchange Commission (SEC) X account (formerly Twitter), which states that the regulator had approved a Bitcoin-based exchange-traded fund (ETF).

At the time of writing, ETH open interest across all exchanges was $6.4 billion, up 15% since the fake post was made on January 9.

Source: CryptoQuant

When an asset’s open interest rises in this way, it indicates greater activity in the derivatives market for that currency. More people may be entering or exiting positions, hedging their bets or speculating on the price.

If the increase in open interest brings a corresponding increase in the price, this indicates that new money is entering the market, potentially pushing the price higher. This has been the case for ETH, whose value has risen by double digits since January 9, according to data from CoinMarketCap.

A review of the coin’s funding rates on derivatives crypto exchanges confirmed this bullish trend. Since open interest started rising, ETH funding rates have been positive.

This suggested that most trading positions opened since January 9 were in favor of continued price growth.

As the price of ETH rises, several short positions are being liquidated. According to data from Mint glassAs of January 10, short positions worth $61.33 million were wiped from the market, compared to the $28.03 long liquidations recorded on the same day.

Now that Bitcoin ETFs are here

In a later announcement on January 10, SEC Chairman Gary Gensler confirmed the agency’s approval of all 11 spot Bitcoin platforms. [BTC] ETF applications.

The long-awaited approval has since led to a surge in ETH trading activity over the past 24 hours. With an 80% growth in trading volume over that period, the price has risen 10%, according to data from CoinMarketCap.

ETH’s price movements observed on a 12-hour chart confirmed the upswing in coin accumulation, with key momentum indicators stuck at overbought highs.

At the time of writing, the coin’s Relative Strength Index (RSI) was 73.64, while the Money Flow Index (MFI) was 79.53.

Source: TradingView

Realistic or not, here is the market cap of ETH in BTC terms

However, price growth has led to a gradual increase in market volatility. According to measurements of ETH’s Bollinger Bands indicator, the upper and lower differences that make up this indicator started to widen at the time of writing.

When these differences become larger, it indicates an increase in volatility. It often means that the price of an asset experiences larger fluctuations than normal.