- The short position of Ethereum is increasing as lungs in the midst of rising OI signaled retail investors are bearish.

- Binance dumps huge amounts of ETH and other cryptos despite The MacD confirms a bullish crossover.

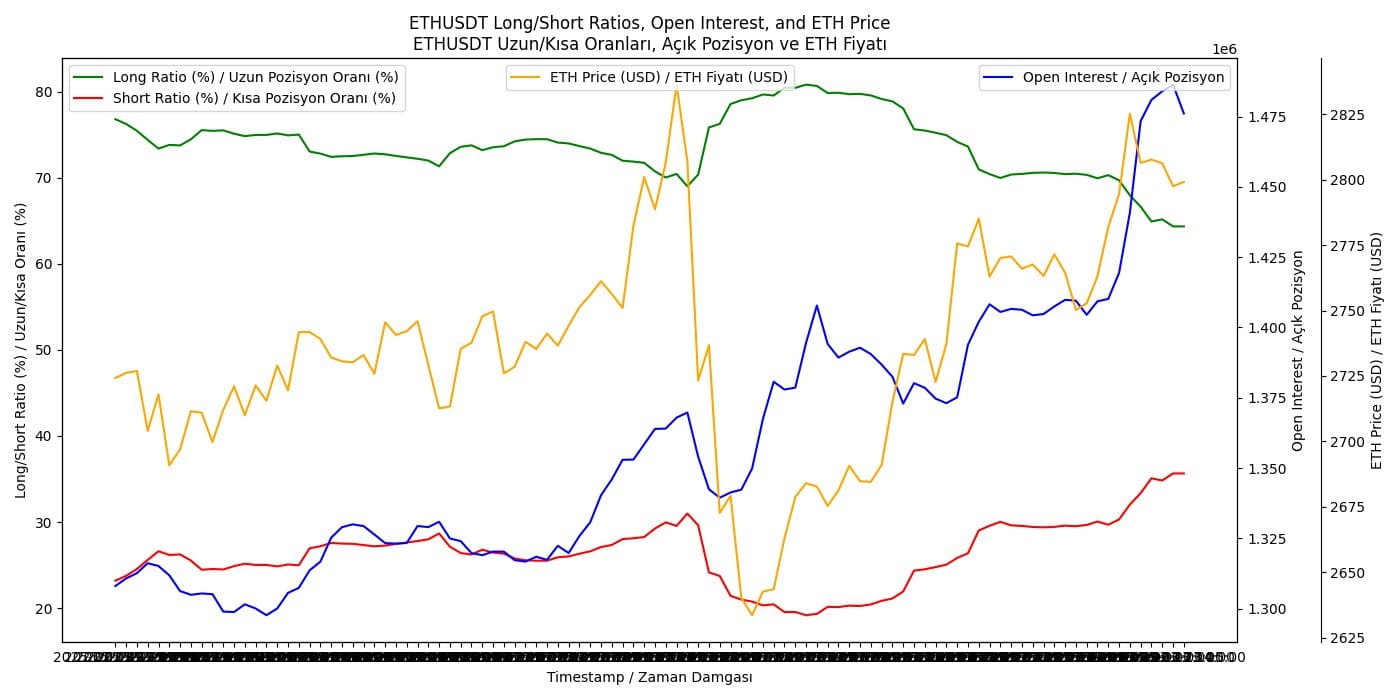

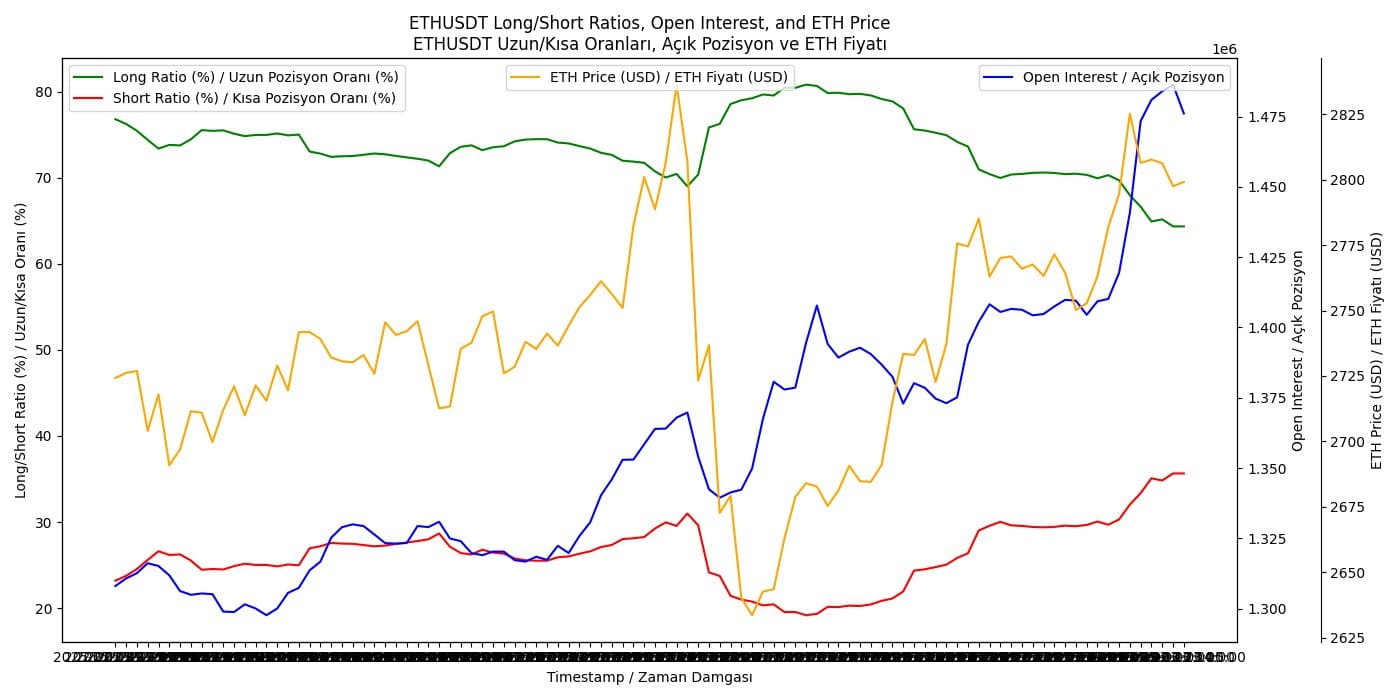

The percentage of short positions in the retail trade for Ethereum [ETH] has risen while that of long positions is decreasing. The short ratio has risen above 30%, while the long ratio has fallen below 75%.

This shift is accompanied by enlarging open interest (OI), which suggests that retail investors bet on Ethereum.

From the moment of the press, the price of ETH has risen higher than $ 2,775, but if this Bearish sentiment has the upper hand, a withdrawal to $ 2,700 is possible.

Conversely, if OI continues to rise while shorts are pressed, ETH can break $ 2,825 and strive for higher levels. As the long positions decrease, this can mean fear of the growth potential of Ethereum in the short term.

Source: X

If this trend continues, ETH can test lower support levels. Conversely, if the market sentiment shifts and long positions start to rise, we can observe a rebound to $ 2800 or higher.

Binance continues to discharge ETH en masse

The sentiment of retail investors corresponds to Binance, which has transferred significant amounts of Ethereum to centralized exchange bridges and market makers. The amounts vary from 1.003k ETH worth $ 2.79 million to 1.52k ETH worth $ 4.25 million.

This high level of activity, including large inflow for market makers and exchanges, may indicate that Binance facilitates liquidity or possibly reduces its participations in response to market conditions.

The potential implications for the price of Ethereum are mixed.

Source: Arkham

On the one hand, if these transfers are intended to meet the increasing demand for trade fairs or for making market products, it can stabilize or even increase the ETH price as a result of higher liquidity and trade volume.

If this is Binance that liquidates its participations, this can lead to a price drop due to an increased range on the market.

This means that further sales-side pressure of exchanges could confirm a bearish trend whether, if paid with sufficient buy-side requirement, a bullish reversal can lead.

MacD confirms a bullish crossover

The price action of Ethereum, however, unveiled a bullish signal, where the MACD crosses its signal line.

This bullish crossover, combined with stabilization at the most important support level around $ 2,650 after the Bybit -hack, suggests potential for a price reduction.

The direct target after this bullish signal could be the recent resistance to $ 3,000. If Ethereum breaks this barrier, the next critical level can be around $ 4,000 and then.

Source: TradingView

Conversely, if the bullish momentum decreases and does not suffice, ETH can re -test the support at $ 2,650.

A break below this point can lead to further falls, with the following considerable support at $ 2,490.