- Ethereum fundamentals are hitting record highs, but price appreciation has remained inconsistent.

- Analyst Boomer Saraga predicted that Ethereum’s price will soon reflect the strong activity on the chain.

Ethereum [ETH] has remained incompatible with its bullish nature, even despite the recent launch of its exchange-traded funds. So far, the asset has continued to rise, but eventually it will be shortened.

For example, although the asset is up 8.3% over the past week, at the time of writing it was in a decline, down 3.7% in the last 24 hours, with a current trading price of $2,624.

Is the price of Ethereum lagging behind?

Boomer Saraga, the founder and CEO of Khelp Financial, recently shed light on Ethereum’s price performance in a interview with Schwab Network on August 14.

According to Saraga, Ethereum saw all the noticeable positivity in terms of fundamentals, but the price continued to “lag.”

In particular, Saraga pointed out that Ethereum’s on-chain activities suggested it was functioning at peak levels, but the asset is still unable to produce significant new wealth as it once did.

However, according to the CEO, a delay may not be a denial for ETH. This indicates that he is optimistic that Ethereum will do so surpasses the previous all-time record of more than $4,800.

Saraga commented:

“From a fundamental standpoint, Ethereum is hitting an all-time high, and I expect the price to follow suit.”

The Fundamental Growth of ETH

Looking at Ethereum’s fundamentals, it is worth noting Saraga’s statement that Ethereum’s price is lagging, which is evident from on-chain activity.

Source: DefiLlama

Facts showed that Ethereum’s network was reportedly securing more collateral – known as Total Value Locked (TVL) – than ever before, with DefiLlama’s current figures showing a TVL of $48.30 billion.

This was a significant increase from less than $30 billion in September of the previous year.

Read Ethereum’s [ETH] Price forecast 2024-25

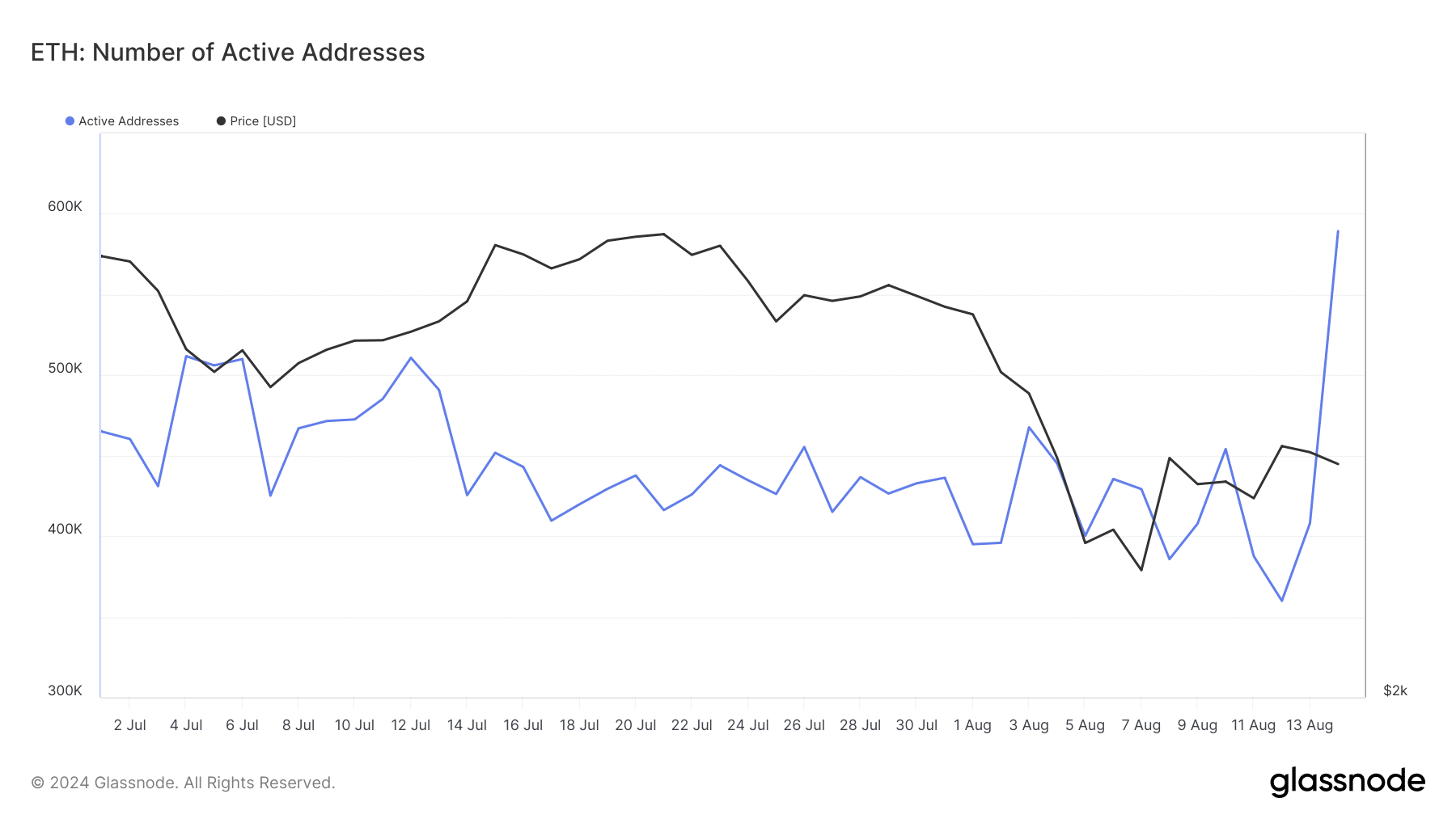

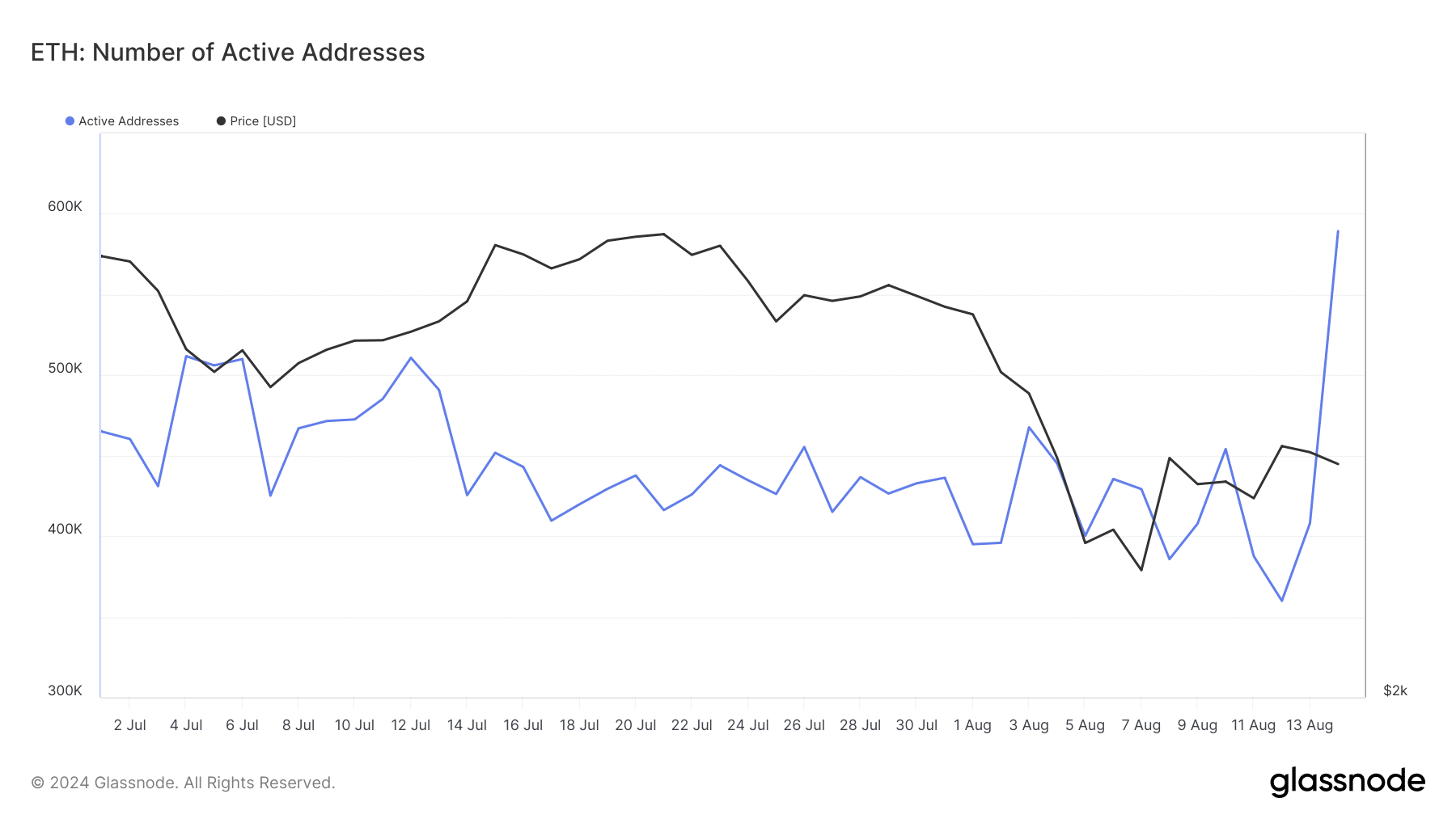

Ethereum’s number of active addresses has also increased experienced a dramatic increase, from less than 400,000 earlier this week to almost 600,000 at the time of writing.

Source: Glassnode

This growth in active participation is a strong indicator of Ethereum’s ecosystem, despite price declines. It reflects a broader commitment to the platform, likely driven by both speculative interests and genuine utility.