- ETH is up more than 13% in the past seven days.

- Most indicators and metrics remained bullish on Ethereum.

Bitcoins [BTC] The adoption of spot ETFs wreaked havoc in the crypto world as it resulted in a price drop for most coins. However, Ethereum [ETH] had other plans as it registered double-digit growth over the past seven days.

Will investors witness another bull rally in the coming week?

The aftermath of ETF approval

According to CoinMarketCapETH has risen more than 13% in the past seven days. At the time of writing, ETH was trading at $2,543.60 with a market cap of over $305 billion. Sentiment around the token also turned positive.

Furthermore, on January 13, Santiment reported that sentiment towards top capital assets such as Ethereum remained at extremely bullish levels.

📊 As the weekend gets underway, sentiment towards top cap assets remains at extremely bullish levels, with the spotlight on them following the #ETF Approvals. These are mainly traders #bullish direction #Ethereum after its market value rose above $2,700 for the first time

(Continued) 👇 pic.twitter.com/JxitOuX6Ww

— Santiment (@santimentfeed) January 13, 2024

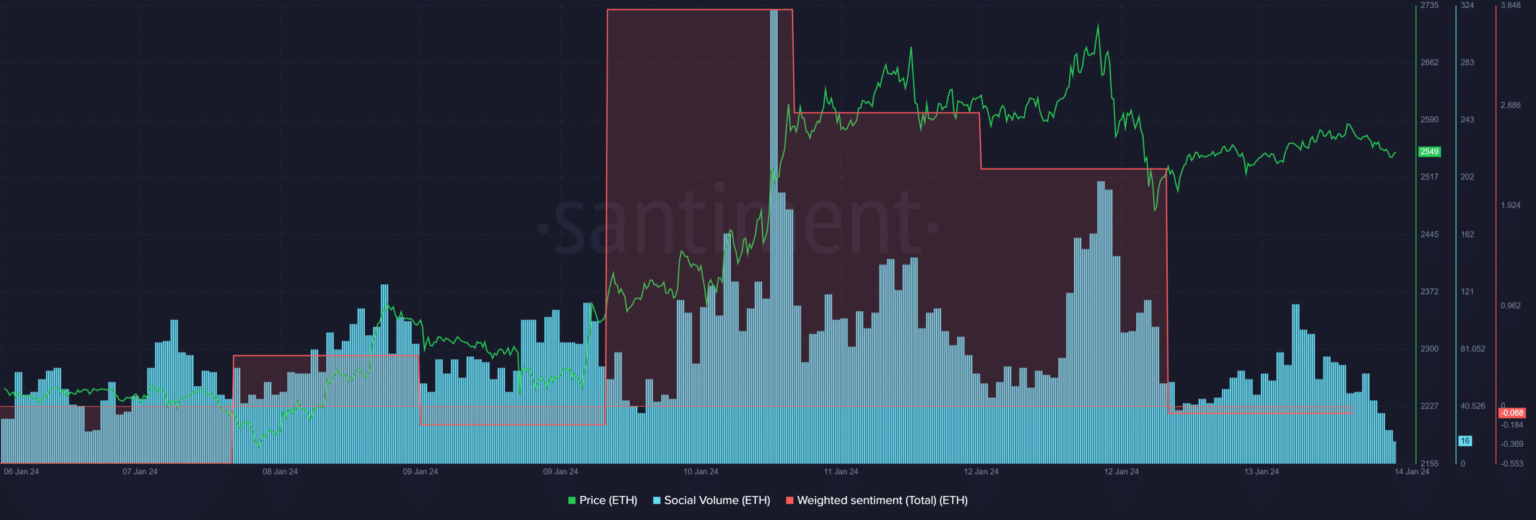

AMBCrypto’s analysis of Santiment’s data also revealed a similar story. Ethereum’s weighted sentiment recorded a huge spike last week, meaning bullish sentiment was dominant.

Interestingly, despite the rise in bullish sentiment, ETH‘s social volume registered a decline in the recent past.

Source: Santiment

What you can expect from Ethereum

To better understand whether the high bullish sentiment would result in a further increase in the token’s price, AMBCrypto took a deeper look at the state of Ethereum.

Our analysis found that supply of ETH on exchanges recently fell below supply off exchanges, meaning buying pressure on the token was high.

Whales’ confidence in the token also increased slightly as prime addresses rose slightly last week.

Source: Santiment

Ethereum’s Bollinger Bands revealed that the price was in a high volatility zone. Moreover, the MACD also showed a clear bullish advantage in the market, increasing the likelihood of a sustained price increase in the following days.

However, the Relative Strength Index (RSI) has recorded a downward trend in the recent past, which could pose limitations ETH‘s price won’t go up.

Source: TradingView

Read Ethereums [ETH] Price prediction 2023-24

If Ethereum manages to further increase its price, the token could face some resistance zones. That’s why AMBCrypto took a look at ETH’s liquidation heat map.

According to our analysis, if an ETH bull rally is inevitable, the token would face strong resistance around $2,740 as the token’s liquidation previously peaked at that level.

Source: Hyblock Capital