An analyst has explained that Ethereum could see a further rally based on on-chain data. This is the level that ETH can eventually surpass.

Ethereum has no significant on-chain resistance ahead

In a new after at X, analyst Ali discussed what Ethereum’s support and resistance levels look like based on on-chain data. In on-chain analysis, the potential of each level to provide any notable support/resistance to the price depends on the number of investors who acquired their coins.

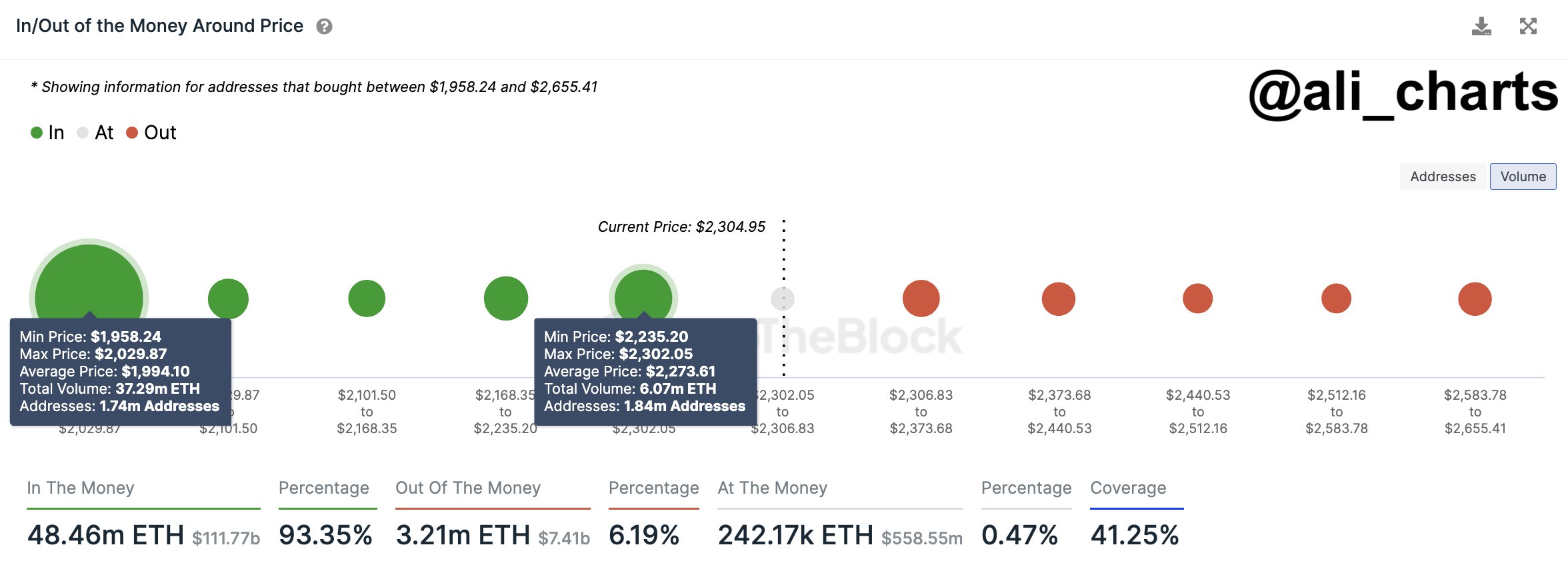

Here is a chart showing the amount of ETH purchased at some of the price ranges the asset has previously visited:

The density of cost basis at each of the different ETH price ranges | Source: @ali_charts on X

The chart shows that the range of $2,235 to $2,302 covers the cost basis of a significant number of coins. More specifically, 1.84 million addresses within this range have acquired more than 6 million ETH.

Currently, the Ethereum price is trading just above this range, implying that all these investors are in the green. If Ethereum’s spot price returns within this range, these holders could see some reaction as their profit-loss line would be retested.

Since these holders would have made a profit just before the retest, they may want to buy more, as they may think that the same price range that was previously profitable could prove to be a valuable purchase again.

Because the bandwidth among investors is large, this buying effect that can occur during a retest could ultimately support the price. If support fails, the price could fall between $1,958 and $2,029.

This range is much more robust and has a cost base of over 37 million ETH. Ali notes that this support could potentially offset any corrections.

Now Ethereum has strong support below, and as can be seen from the chart, at the same time there is no major wall of demand above it. Losing investors (those with a cost basis higher than the current spot price) may be desperate to escape the market, so the price rising to their breakeven can be a tempting exit opportunity.

If many holders are incurring losses, their demand zone could provide significant resistance to price due to such selling. ETH has no such obstacles in nearby price ranges, allowing the coin to rise further. “The path for ETH is clear, with no significant supply barriers in sight, pointing to a potential rise to $2,700 or higher,” the analyst explains.

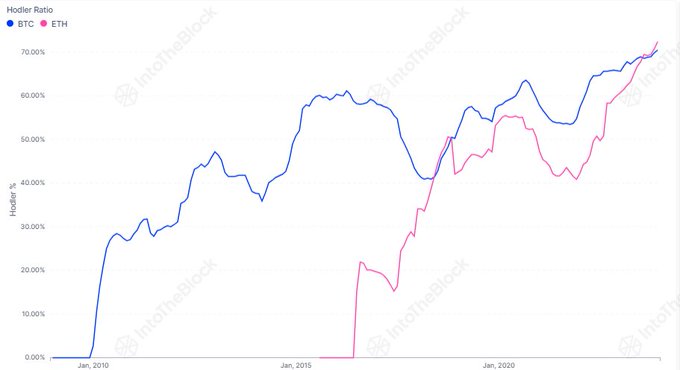

The market information platform InTheBlok also shared a chart that could provide further evidence for a bullish case for Ethereum.

The trend in the HODLer ratio for Bitcoin and Ethereum | Source: IntoTheBlock

As visible in the chart above, the percentage of Ethereum investors that can be classified as ‘HODLers’ (1 year+ holding time) has skyrocketed recently. “This year, the percentage of long-term ETH holders surpassed that of Bitcoin for the second time ever!” notes IntoTheBlock.

ETH price

Ethereum is currently trading at $2,316, not far above the aforementioned support zone.

Looks like the price of the coin hasn't been moving much recently | Source: ETHUSD on TradingView

Featured image of Kanchanara on Unsplash.com, charts from TradingView.com, IntoTheBlock.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.