- While open interest increased, financing rates remained stagnant.

- The price of the altcoin could continue to fluctuate between $3,400 and $3,600 in the short term.

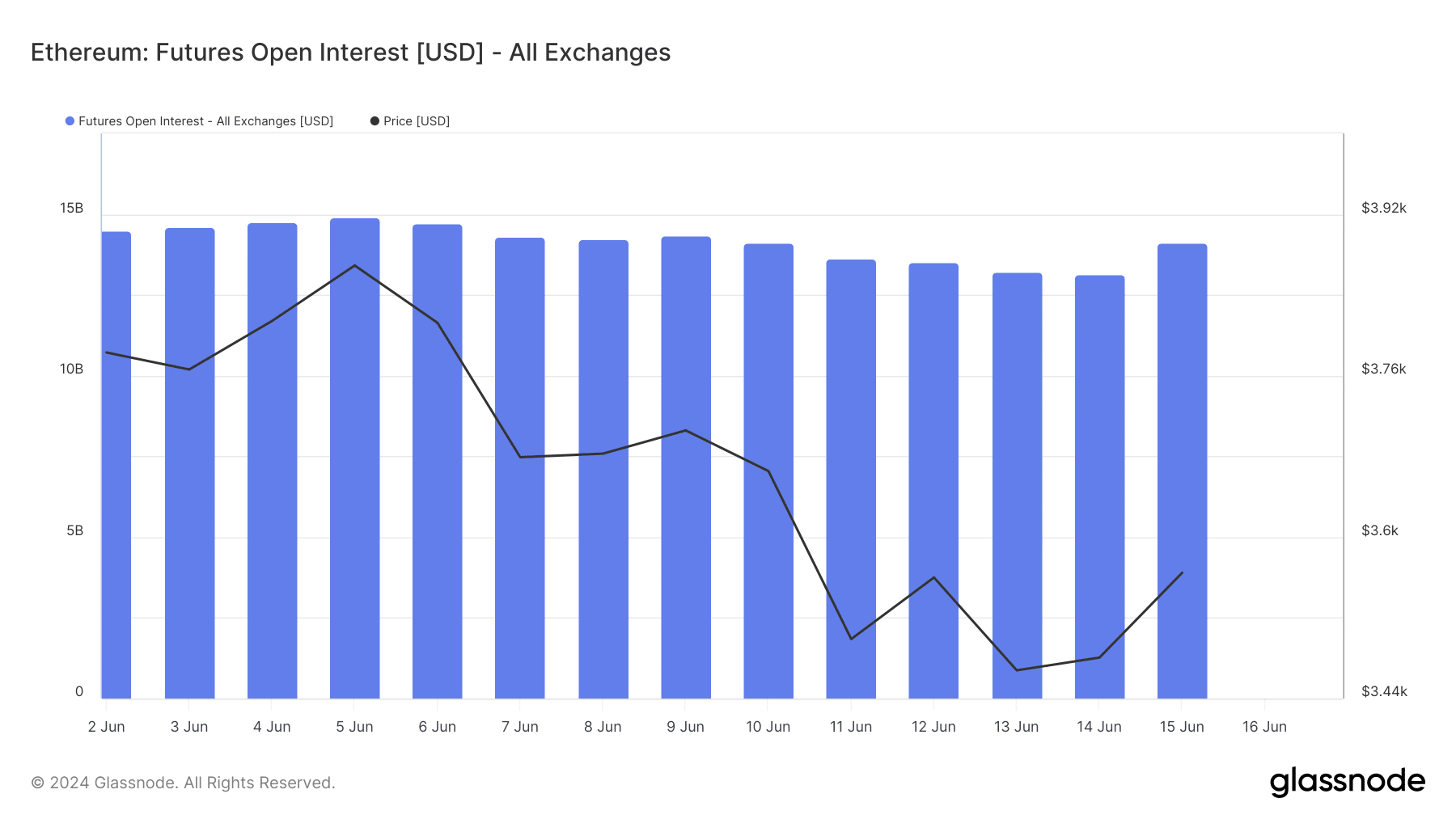

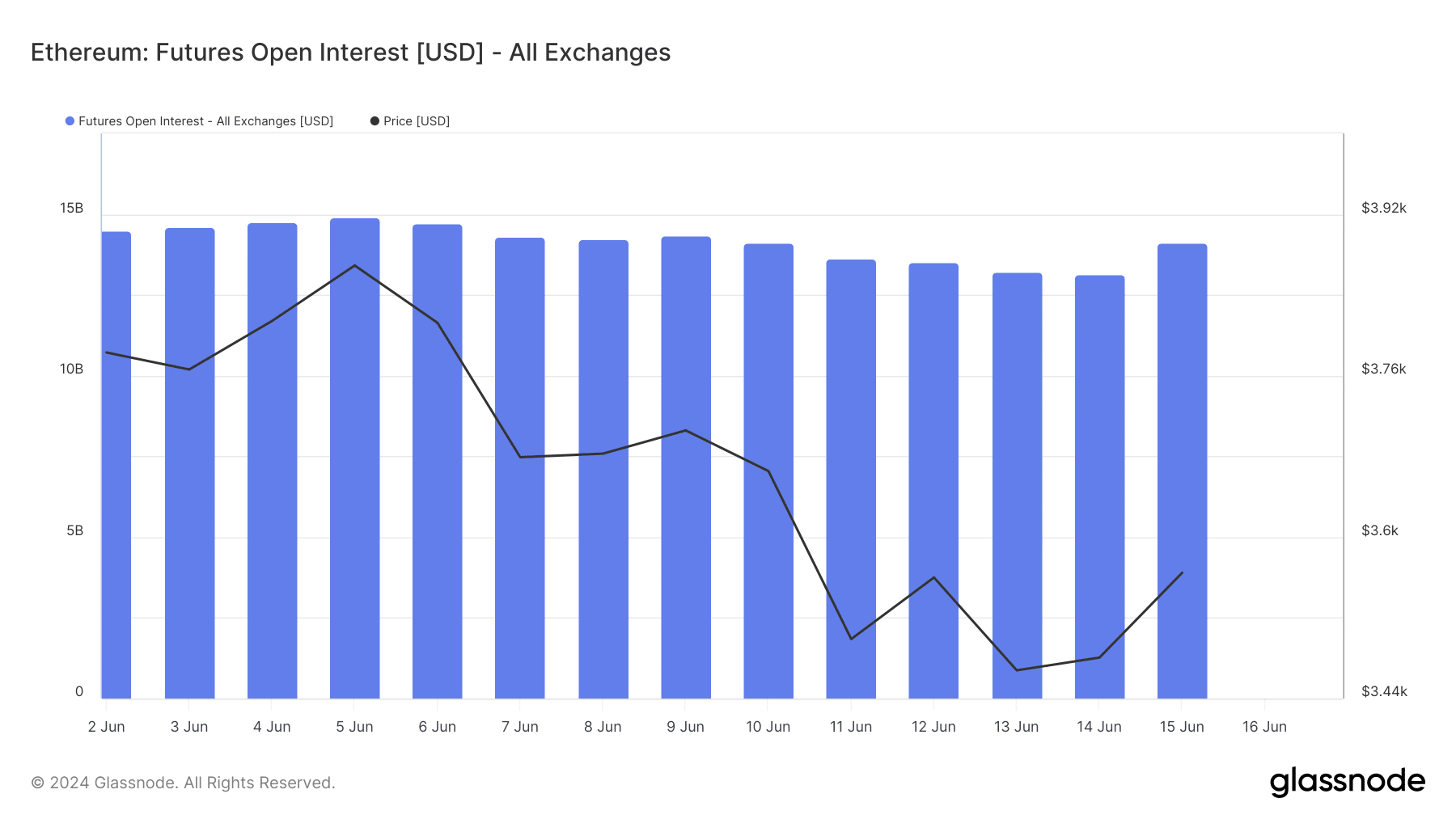

One day after Ethereum [ETH] Open Interest dropped to $13.14 billion and added another billion to its value. At the time of writing, Open Interest (OI) stood at $14.10 billion, according to data from Glassnode.

OI is the value of outstanding futures contracts in the market. When it drops, it means traders are closing positions related to the cryptocurrency. However, an increase suggests otherwise.

Speculation is a ticket to a new high

This is evident from the increase in the number of Ethereum contracts increased speculative activity about the altcoin. In many cases, an increase in OI provides strength in the price direction.

It may be no different for ETH. At the time of writing, ETH has changed hands at $3,563, marking a slight increase of 1.10% in the past hour.

It looks like this could be the start of a significant uptrend for the cryptocurrency.

Source: Glassnode

However, trading volume was down 35.36% in the past 24 hours. The drop in trading volume is a sign that activity related to ETH was lower in the spot market.

If spot market activity continues to decline while derivatives market trading increases, ETH’s price could linger around $3,500 to $3,600.

But if buying pressure increases in the spot market, the altcoin could jump towards $3,800.

The skepticism lingers

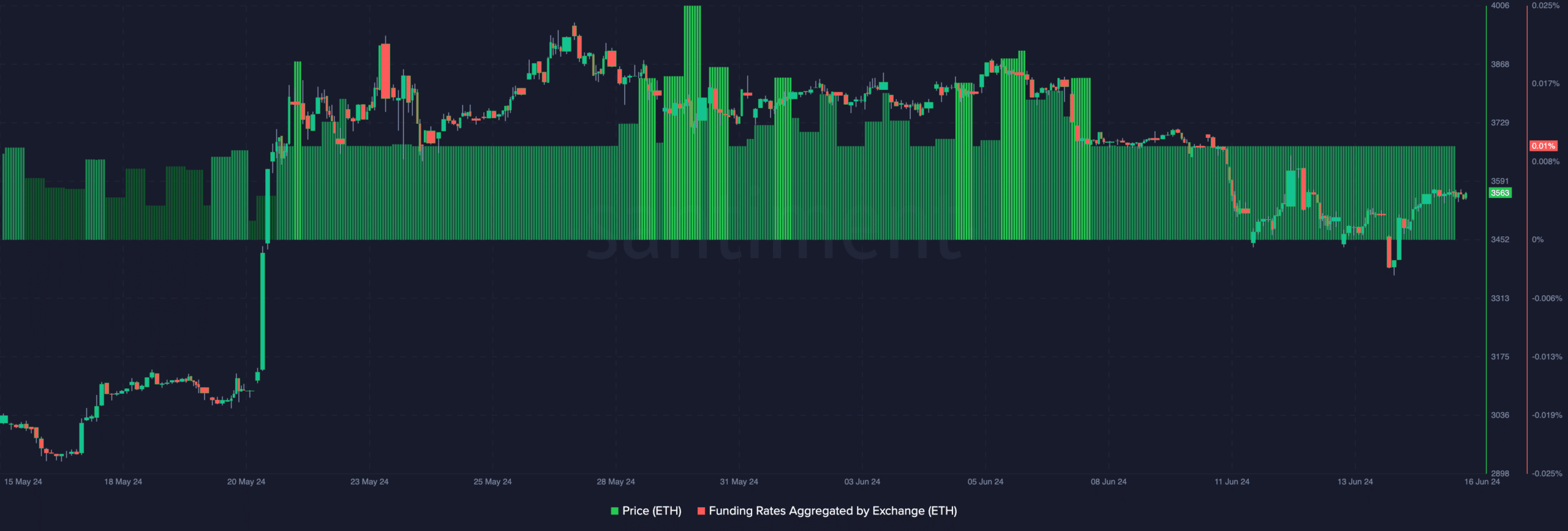

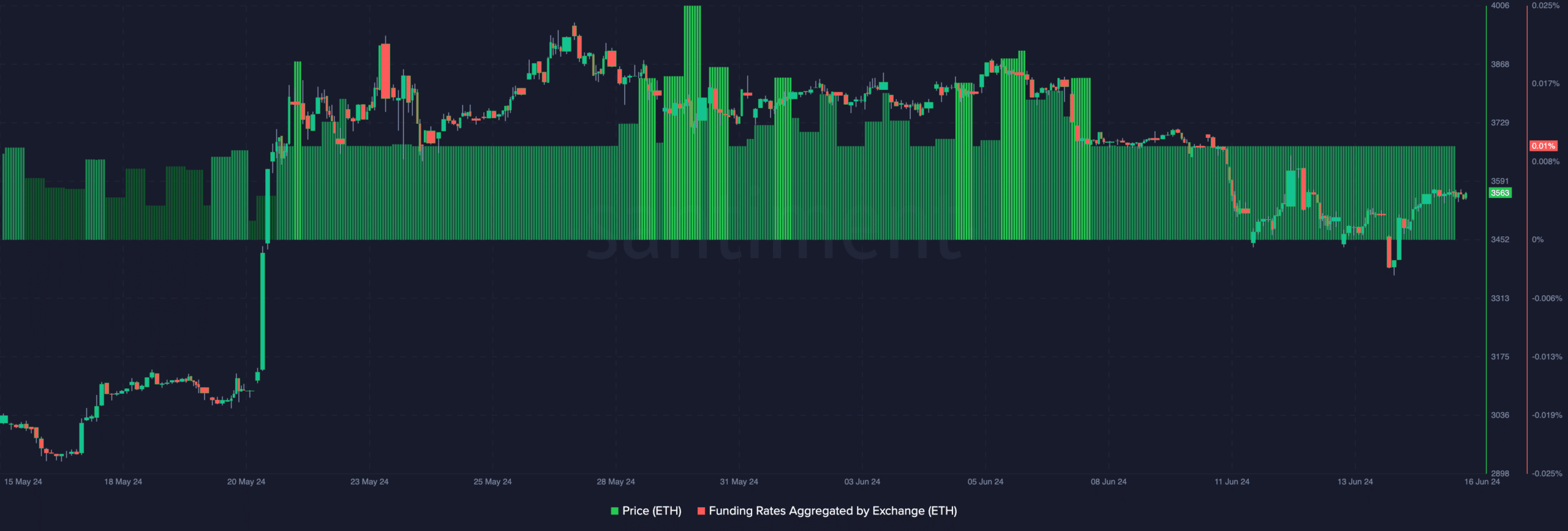

Despite the outlook, Ethereum’s funding rate has remained stable since June 8. The financing rate is the cost of maintaining an open position in the derivatives market.

If the financing is positive, this means that the contract price is more expensive than the spot price. In a situation like this, longs pay short to keep their positions open.

On the other hand, negative financing implies that shorts make longs. Also, the contract value of the cryptocurrency is at a discount.

The low financing rate and high price apply to ETH resources that spot volume could increase soon.

If this is the case, the reasonable inference could be a bullish move for Ethereum. Nevertheless, the price of the cryptocurrency may not reach $4,000 in the coming week.

Source: Santiment

In addition, AMBCrypto looked at the Taker Sell Ratio. To obtain this ratio, we must divide the sales volume by the total number of perpetual swaps.

When the ratio is lower than 0.5, it means that the selling pressure has decreased. However, a value higher than 0.5 indicates the selling is dominant on the market.

Realistic or not, here is the market cap of ETH in BTC terms

At the time of writing, Ethereum’s Taker Sell Ratio was 0.50, according to data from CryptoQuant. If conditions remain the same, ETH’s price may struggle to reach $4,000 as previously mentioned.

In the coming week, the cryptocurrency could trade between $3,400 and $3,600, similar to previous weeks.