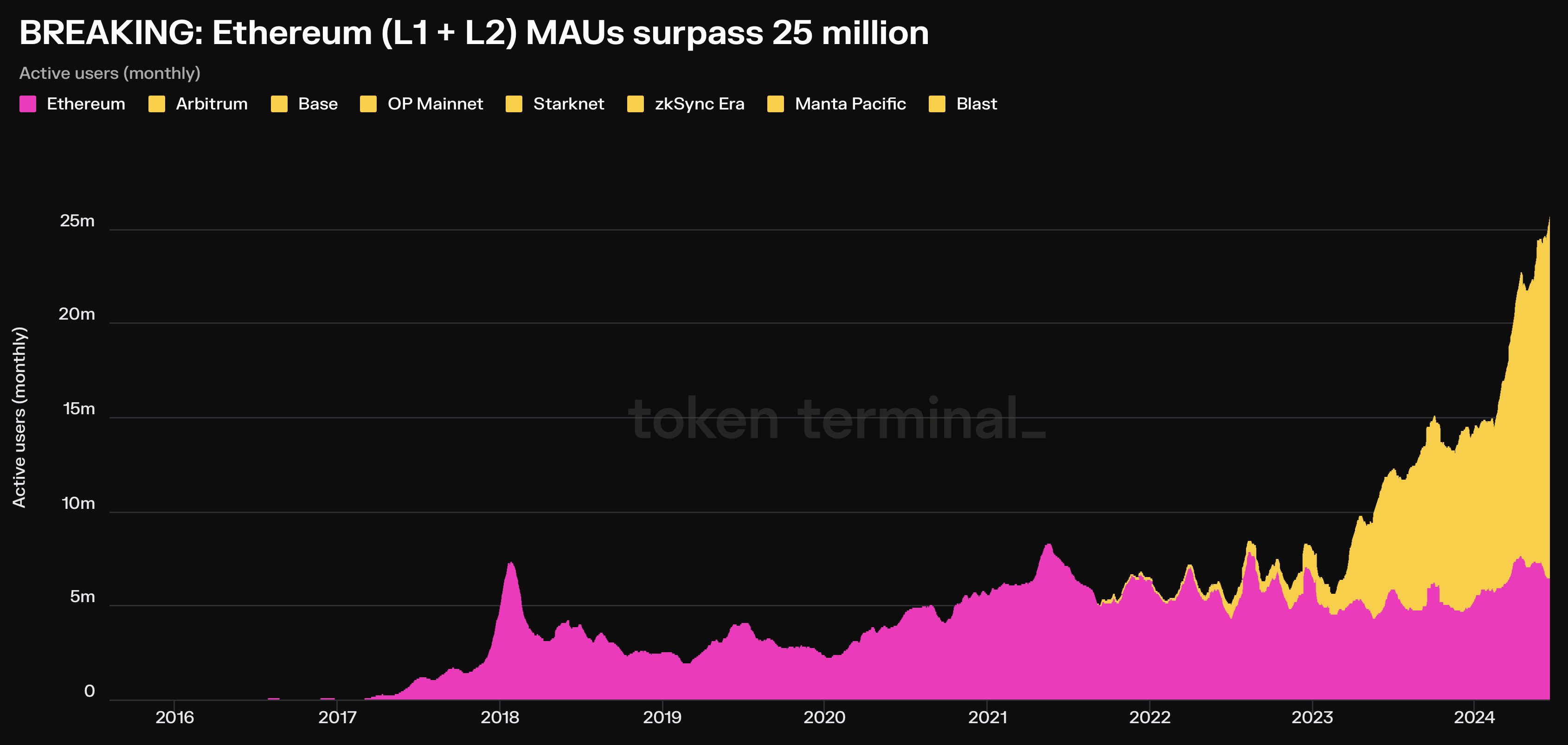

- Monthly active users of the Ethereum chain’s Layer 1 and 2 projects have surpassed the 25 million mark per Token Terminal data.

- Despite the rise of Ethereum competitors such as Solana, Ether, with its meme coin story, remains relevant among traders.

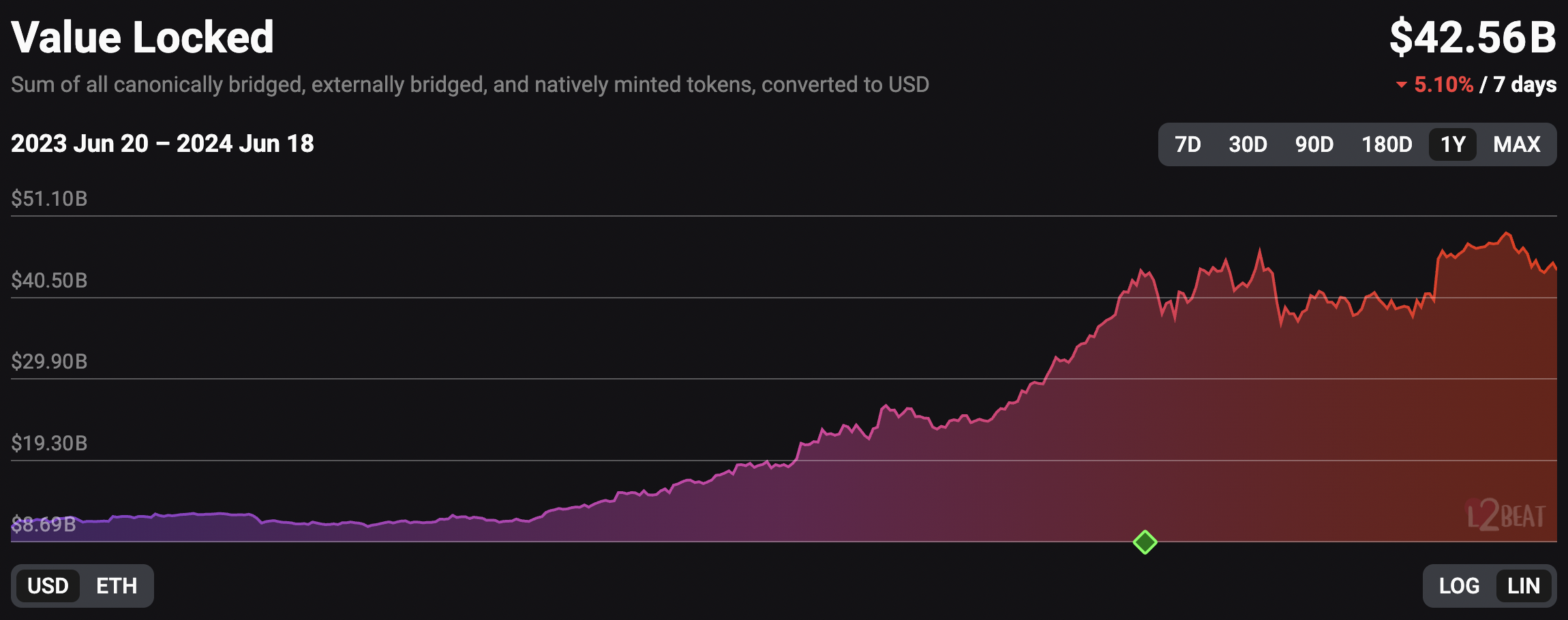

- The total value of Layer 2 and 3 projects is over $43.99 billion at the time of writing.

Ethereum’s Layer 1 and Layer 2 chains have seen a consistent increase in activity in 2024. Monthly active users (MAU) have surpassed the 25 million milestone per data aggregator Token Terminal.

Despite the rise of various narratives such as meme coins and celeb tokens that popularized the Solana chain – Ethereum’s competitor – among traders, Ether has seen a spike in the number of active users.

Ethereum Layer 1 and 2 Monthly Active Users Reach Milestone

Crypto data aggregator Token Terminal shows that the monthly number of active users of Ethereum Layer 1 and 2 exceeded 25 million. At a time when competitors like Solana have seen a spike in mindshare (attention from market participants) and the number of projects launched every day, Ether is holding its own, according to data from Token Terminal, early Tuesday, June 18.

Ethereum Layer 1 and 2 MAUs

Data from crypto tracker L2Beat shows that the total value locked (TVL) in Layer 2 and 3 projects in the ecosystem exceeds $43.99 billion at the time of writing.

Total value locked in Layer 2 and 3 chains as seen on L2Beat

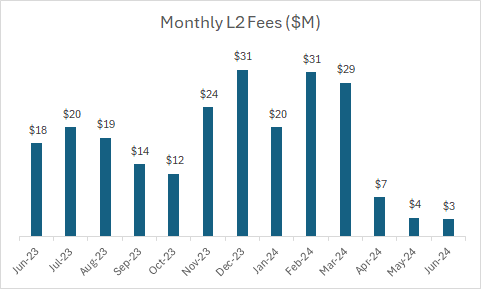

With a significant drop in Layer 2 fees, there has been a rise in adoption of the chains among merchants. This contributes to the increase in the number of monthly active users on Ethereum. The monthly cost dropped from $18 to $3 between June 2023 and 2024, as shown in the chart below.

The monthly Tier 2 costs will change from June 2023 to June 2024

Top Ethereum Layer 2 scale tokens Polygon (MATIC), Mantle (MNT) and Optimism (OP) have extended their losses between 5% and 9% in the past 24 hours, according to CoinGecko data.

The market cap of Layer 2 tokens has fallen more than 11% in the past 24 hours, giving traders an opportunity to buy the dip on Tuesday.