- ETHs $ 2.7k breakout led to a short squeeze, but rising exchange reserves signal weakening momentum

- The decoupling of Ethereum from Bitcoin calls for concern about sustainability, with L2S and shopping participation shaking

Ethereum’s [ETH] Break over the $ 2,700 brand shocked the market and only caused more than $ 50 million in short liquidations on Binance.

But under the surface there is a little more complex: rising exchange reserves and remarkable whale running suggest that the bullish momentum can lose steam.

At the same time, the recent price of Bitcoin van Ethereum – once seen as a sign of growing power – now disconnects new concern about sustainability and direction for the wider Ethereum ecosystem.

Short squeeze ignites when Eth $ 2.7k breaks

The rise in Ethereum beyond the $ 2,700 resistance level led to a competitive liquidation event on Binance, according to more than $ 50 million in short positions, according to Cryptoquant facts.

Source: Cryptuquant

This zone, marked as a liquidity cluster on the Delta-graphic Liquidation, became a magnet for stop-lussies while ETH pierced.

Source: Cryptuquant

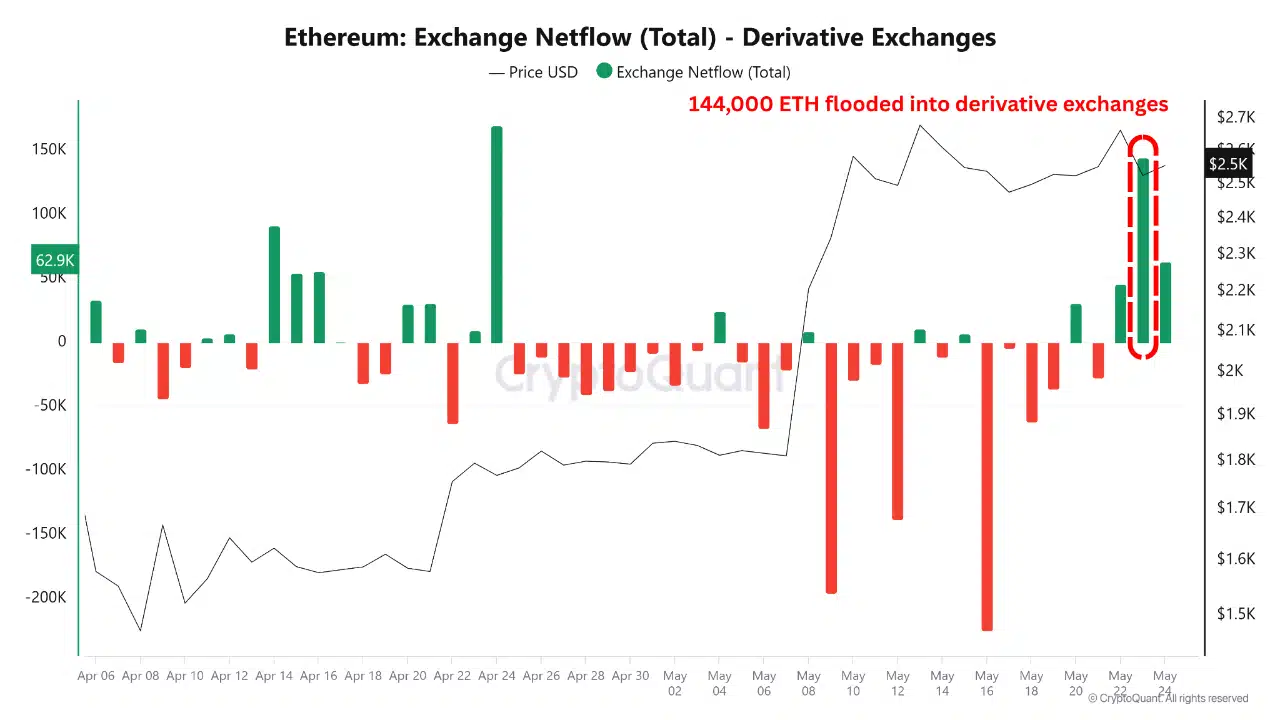

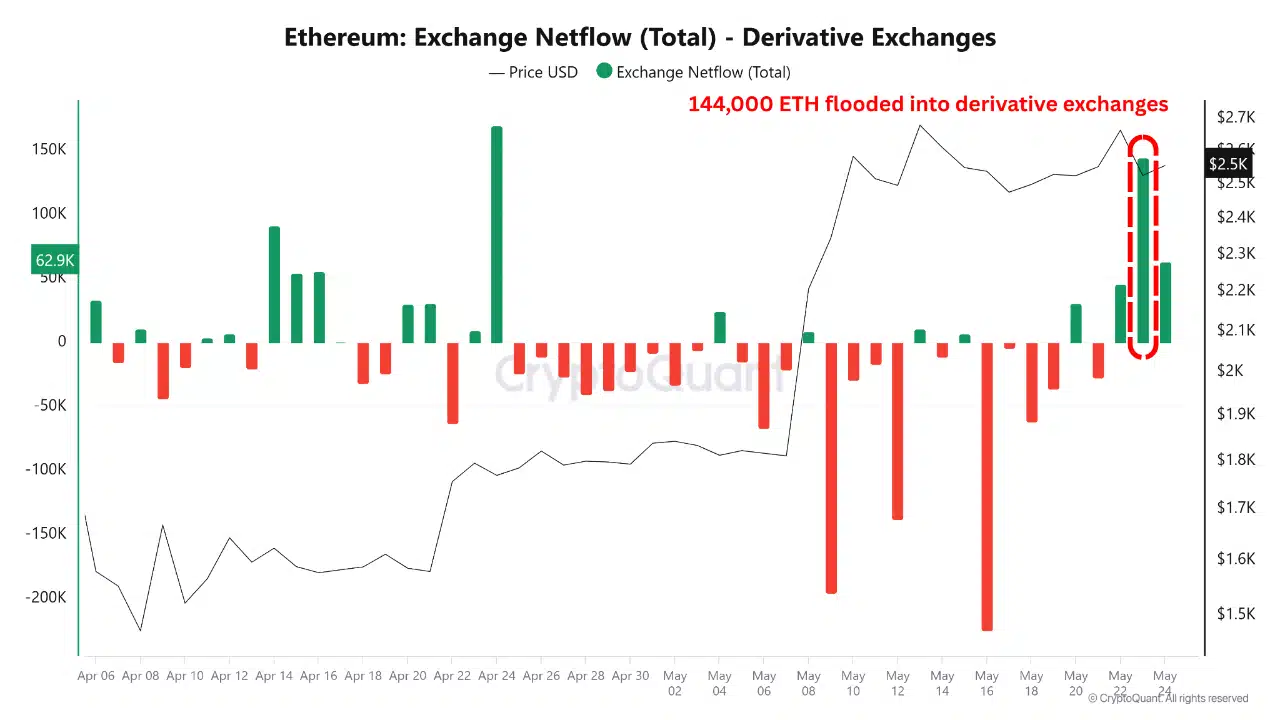

However, that squeeze was immediately followed by more than 144,000 ETH that flowed in derivative exchange reserves – a red flag. Such inflow usually precedes renewed short positioning, not prior to the continuation of the trend.

While the bulls briefly claimed the victory, the rapid intake and heat cap pressure warning suggest caution in the midst of the initial euphoria.

Ethereum-Bitcoin correlation collapses

For years, Ethereum and Bitcoin moved almost-lockstep and often shared a correlation above 0.7. But that relationship has almost evaporated.

According to Cryptuquant, The 1-year correlation of ETH with BTC fell to only 0.05 from 22 May against 0.63 at the start of the year.

Source: Cryptuquant

This sudden decoupling disrupts one of the most consistent patterns of the cryptomarket, forcing a reassessment of traditional portfolio strategies.

More critically coincides with the relative underperformance of ETH during the Bitcoin meeting.

Decoupling of Demps Momentum

The divergence of Ethereum of Bitcoin is eroding the trust of the market. Without the rugwind of synchronized BTC rallies, the Ethereum ecosystem is struggling to support growth.

Retail participation seems to be thinner and leading L2s such as optimism, arbitrum and polygon have not received a grip in 2025. Prediction models that were once dependent on Bitcoin’s directionalality, losing predictive power.

Ethereum can evolve into a more autonomous assets powered by internal fundamentals, but that independence risks it during bull cycles.

For now, the decoupling seems to be more only wind than evolution.