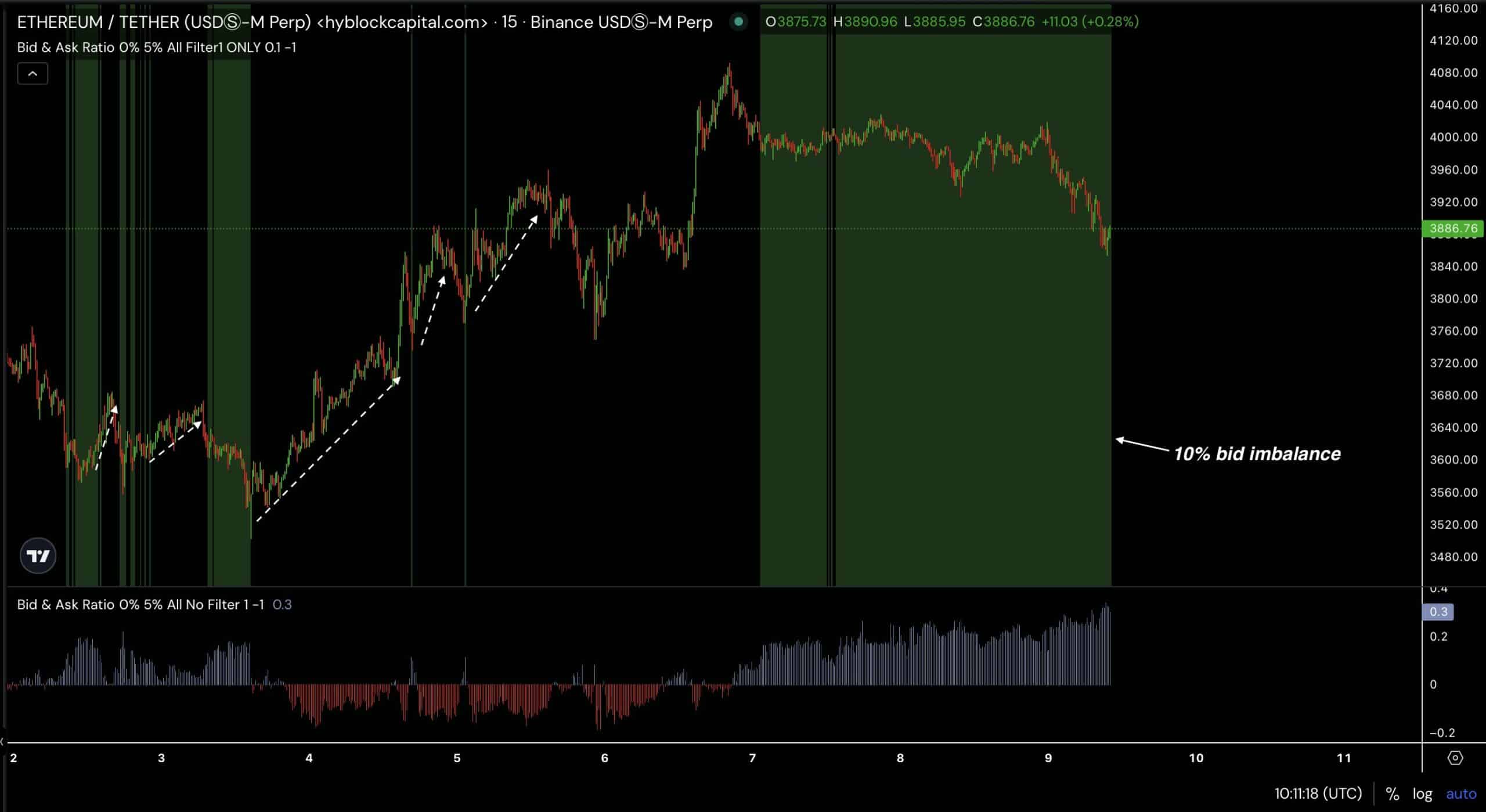

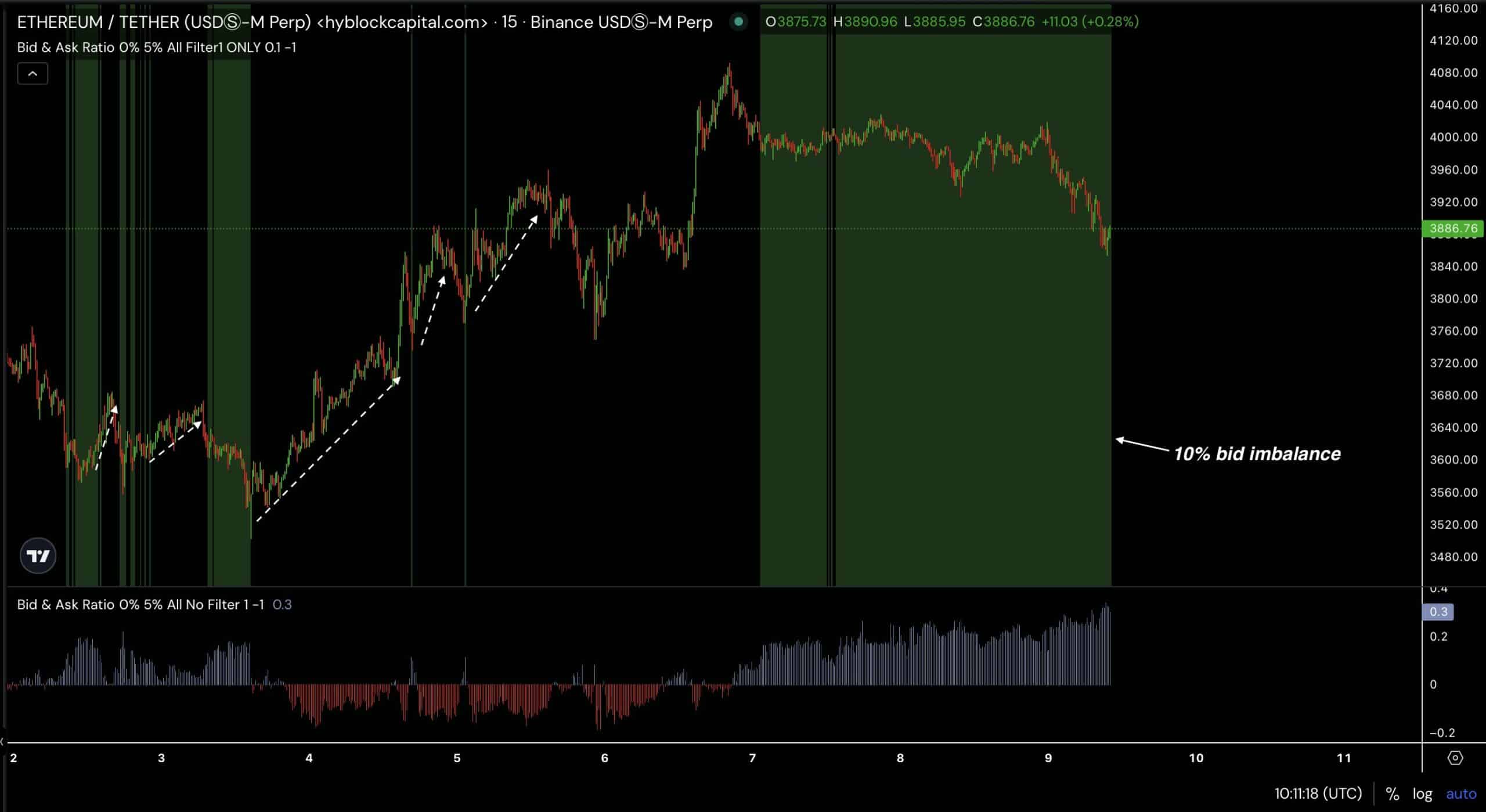

- Ethereum’s order book ratio indicated low supply and high demand at $3,886.

- ETH could revisit $3500 at the 200EMA before continuing the rally.

Ethereum [ETH] showed a notable bid imbalance of 10% within the order book depth range of 0-5%, indicating a potential supply-demand gap at a price level around $3,886.76.

These price points favored bidding at 10%, indicating stronger buying interest than selling pressure.

This imbalance indicated bullish sentiment, as more traders were willing to buy ETH at or above that market price, potentially pushing prices higher if the trend continues.

Source: Hyblock Capital

Additionally, there were spikes in trading volume associated with significant price movements, both upward and downward.

The increase in bid dominance, along with high trading volumes, points to possible continued bullish momentum for ETH. Historical trends show that such imbalances often precede price increases.

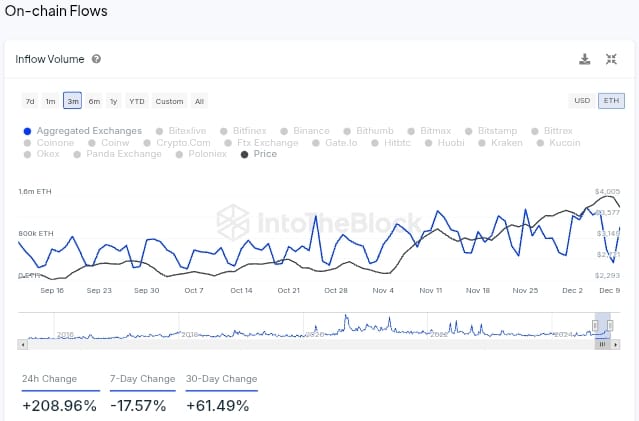

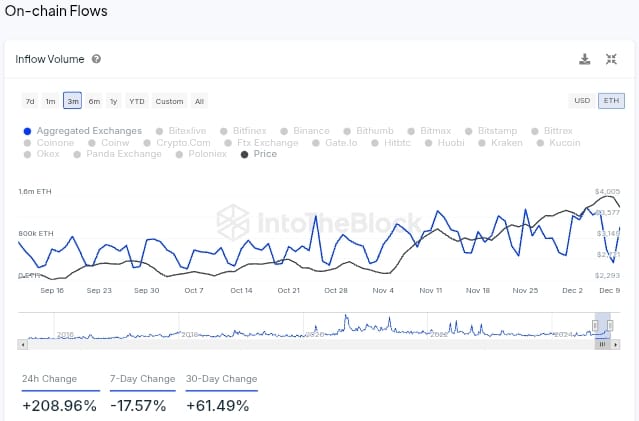

Inflow volume in stock exchanges

However, ETH saw an increase in inflow volume on the exchanges as it rose 208.96% in the last 24 hours. This suggested that investors could move ETH to exchanges, possibly to take profits or prepare for possible sales.

The weekly change showed a 17.57% drop in inflow volume, indicating less ETH was moved onto exchanges compared to the previous week, which could mean a reduction in selling pressure.

Source: IntoTheBlock

Conversely, monthly changes increased by 61.49%, indicating that there had generally been a greater propensity to transfer ETH to exchanges over the past month than in previous periods.

The inflows could temper the bullish outlook suggested by the backlog ratio, which indicated low supply and high demand.

As the inflow suggests potential selling pressure, it could lead to a temporary drop in ETH prices despite underlying demand signals.

How low can ETH go before bottoming out?

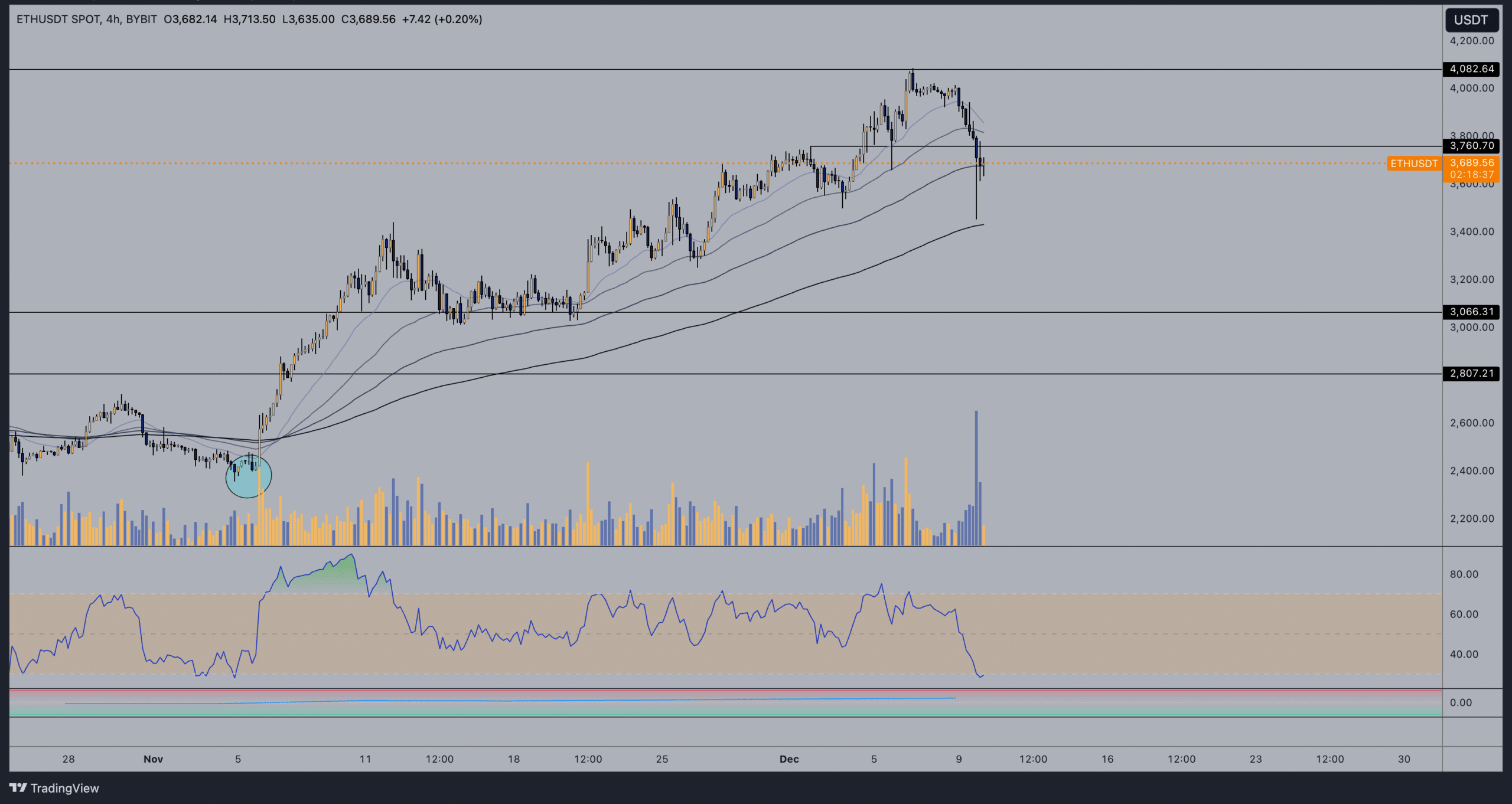

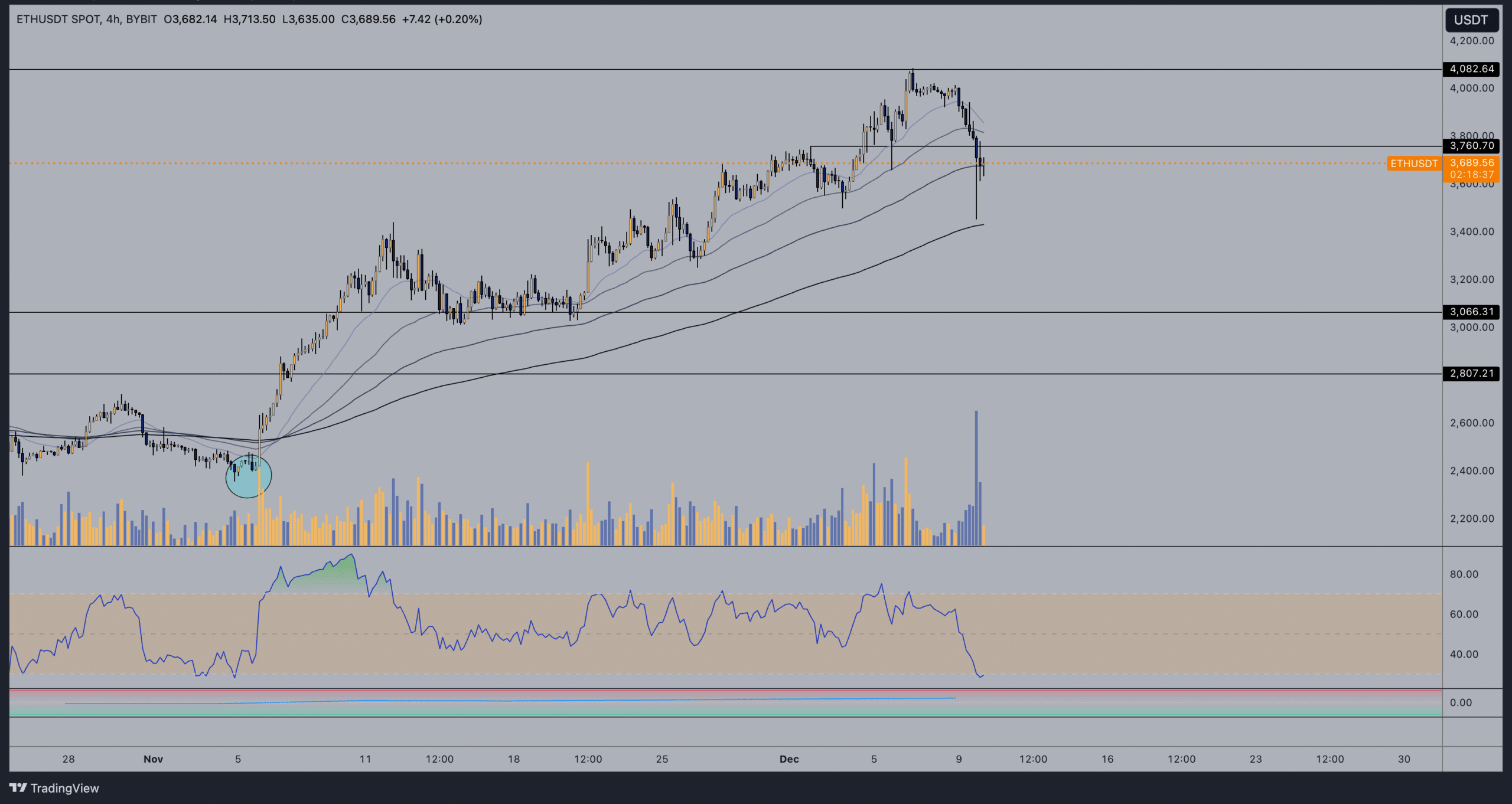

With that in mind, ETH could be poised for a small pullback before reversing for a continuation of the bullish trend as it traded around $3,689 after falling from higher resistance around $4,082.

Trading volume increased during the sell-off, indicating a decline, but with the RSI close to the oversold zone, now below 30, it indicated an overextended bear move that could lead to a reversal if buyers intervene.

ETH’s decline below the 20EMA and 50EMA indicated short-term bearish momentum, contrasting with the potential long-term support provided by the 200EMA.

Source: trading view

Ethereum showed signs of testing a key support level at the 200EMA around $3,500, with potential for reversal indicated by an oversold RSI.

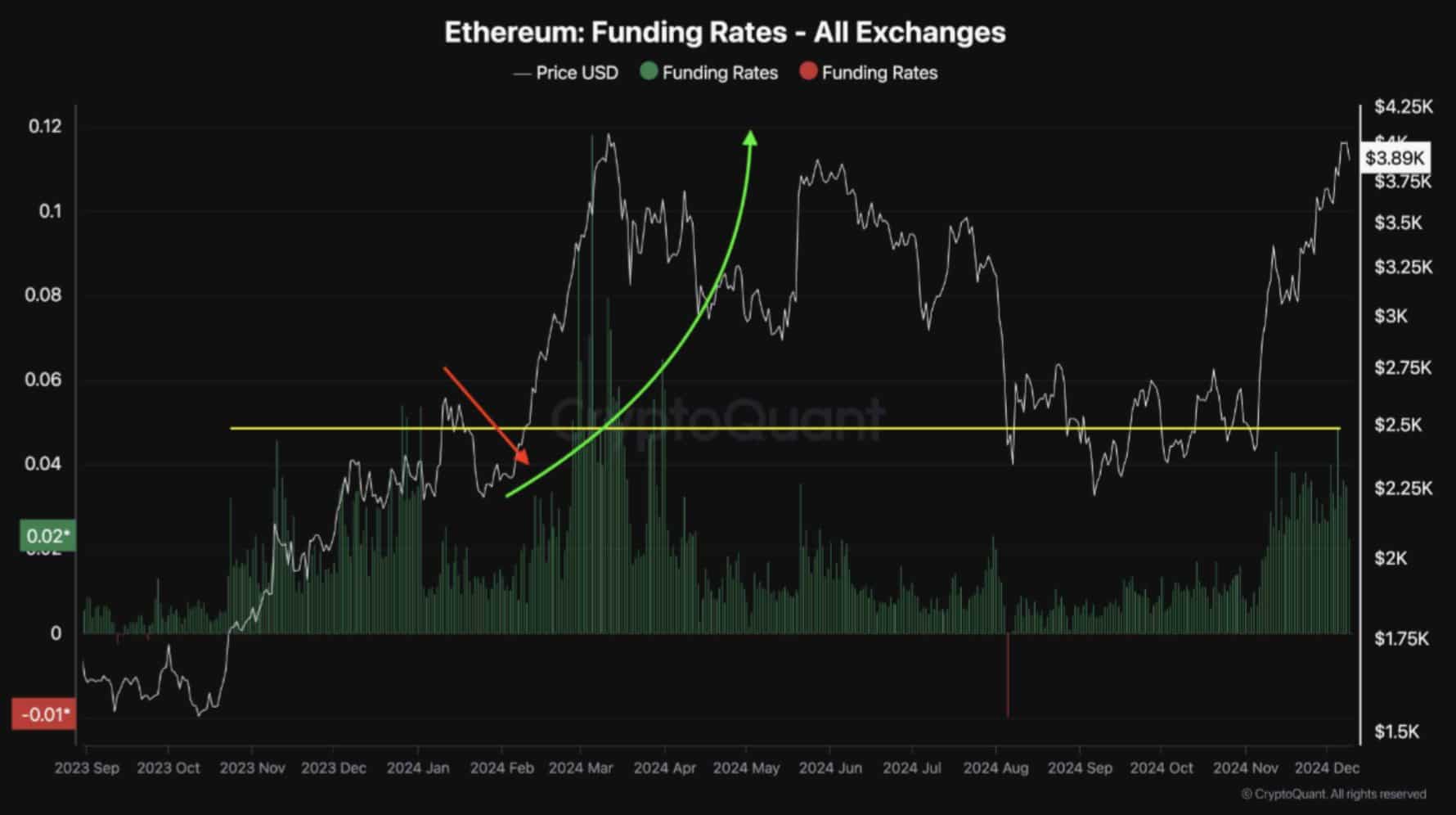

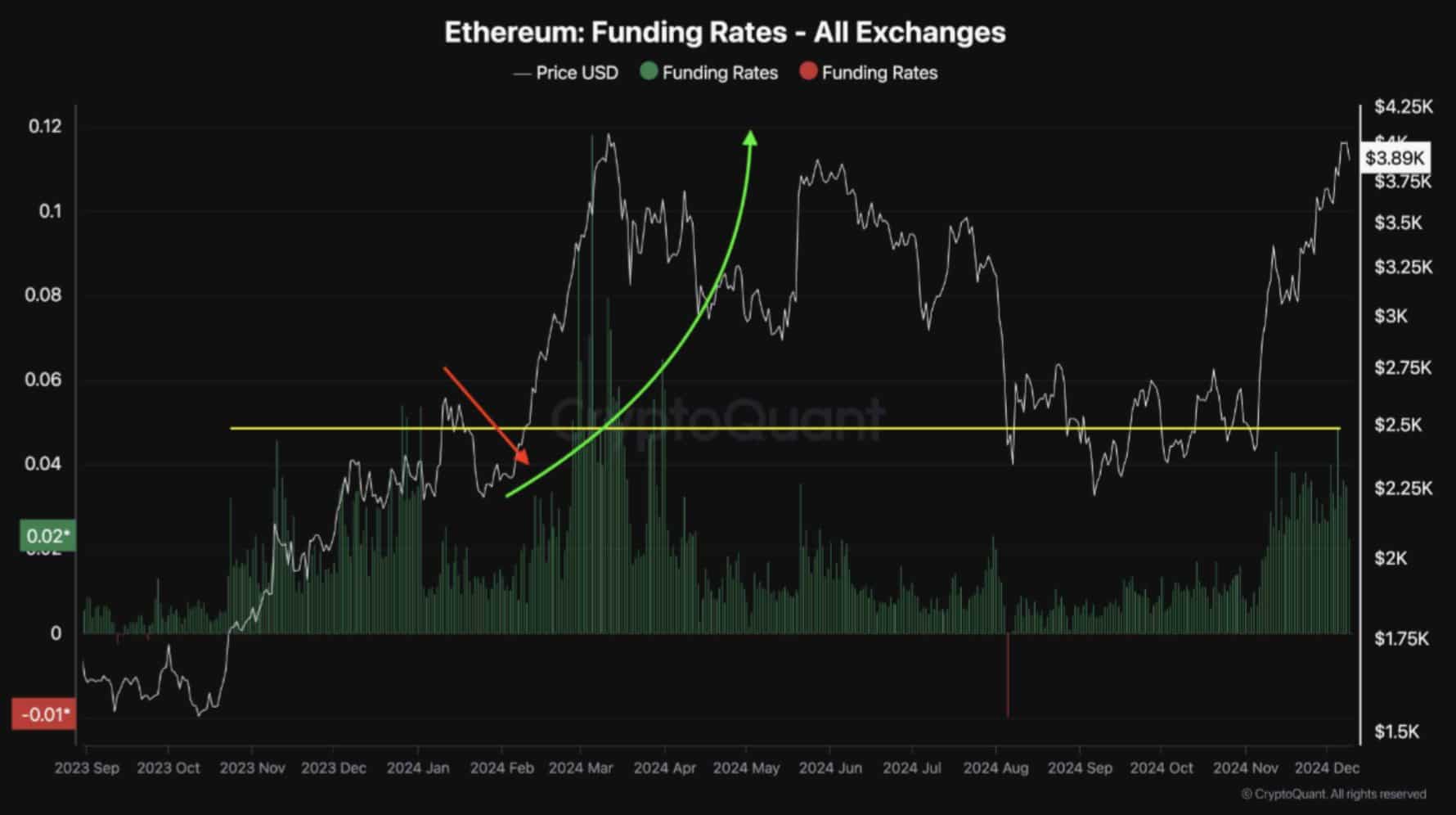

If this level holds, a rally to higher levels can be expected as funding rates reach a multi-month high, indicating increased trader confidence and a potential expectation of higher prices.

The peak of the financing rate above 0.04%, which coincided with price movements, meant a sharp increase in traders’ leverage, which often preceded price volatility.

Source: CryptoQuant

Read Ethereum’s [ETH] Price forecast 2024–2025

High funding rates indicated strong bullish market sentiment, although they could lead to short-term corrections due to over-indebtedness.

The resurgence of high financing rates, such as those in early 2024, shows significant market commitment and optimism. However, this could trigger a correction if the market overheats.