- Sentiment seemed optimistic ahead of the ETH ETF launch, with 40% of the total Ethereum supply now locked.

- Bulls have kept the bears at bay, suggesting that ETH could head towards $3,500.

On July 11, an unknown market participant transferred 6,400 Ethereum [ETH] to the Beacon deposit portfolio. The Beacon Chain is the system responsible for validating new blocks on the Ethereum network.

Therefore, send coins Using this wallet implies that holders would rather lock in the supply than trade in it.

Locking up many coins could reduce selling pressure, and in the case of ETH, it could prevent the price from falling below $3,000.

ETH supply continues to decline

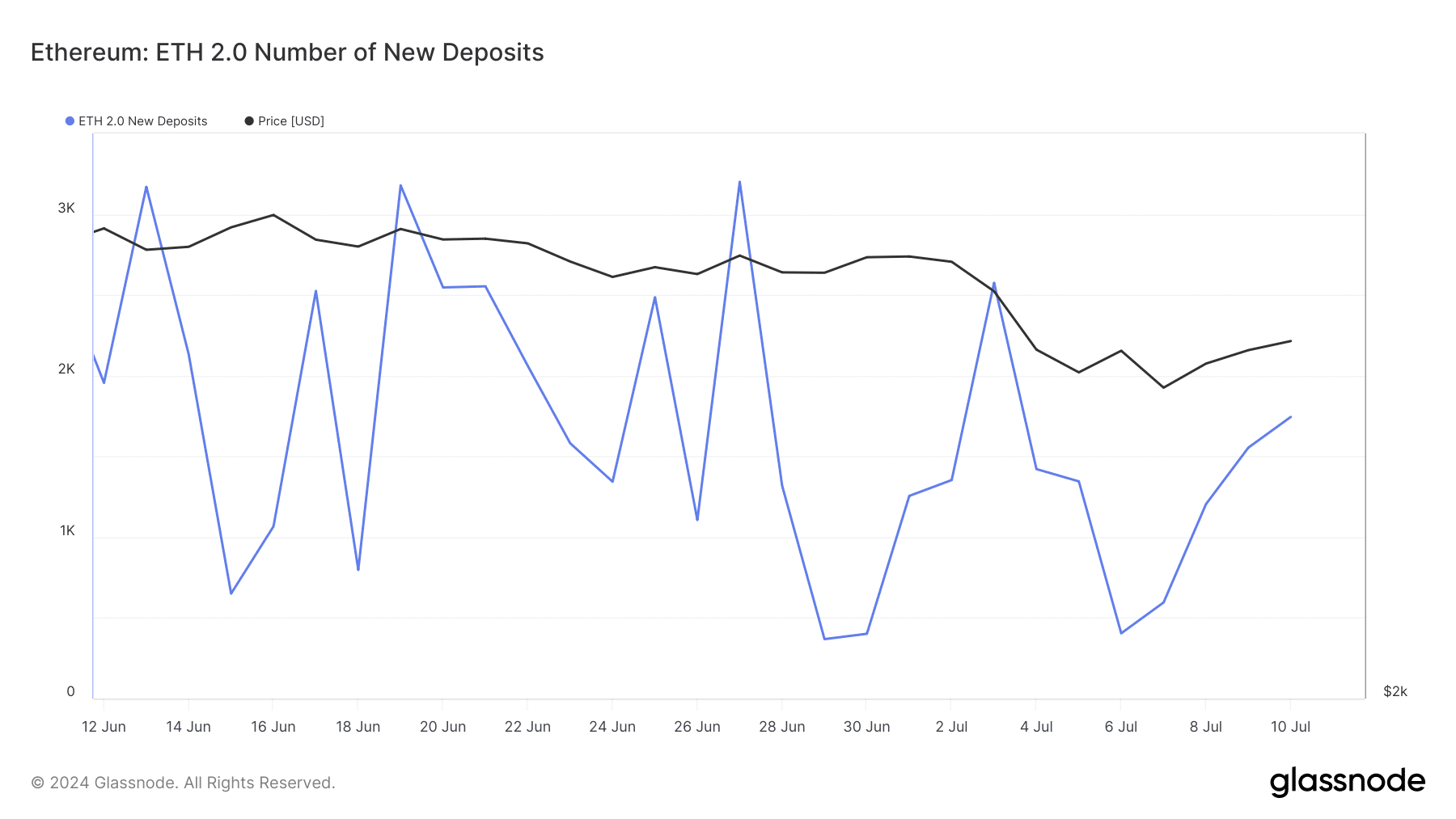

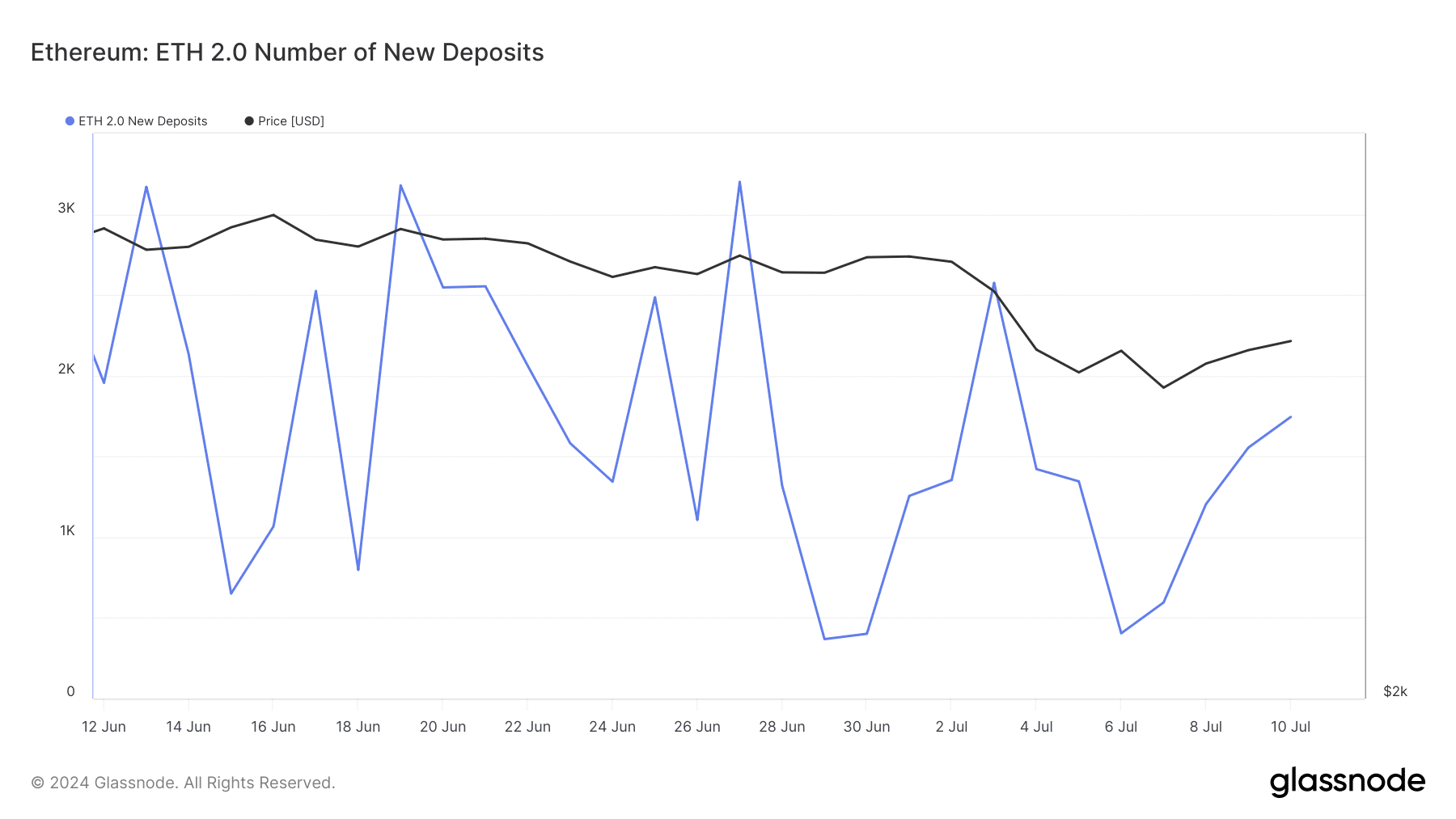

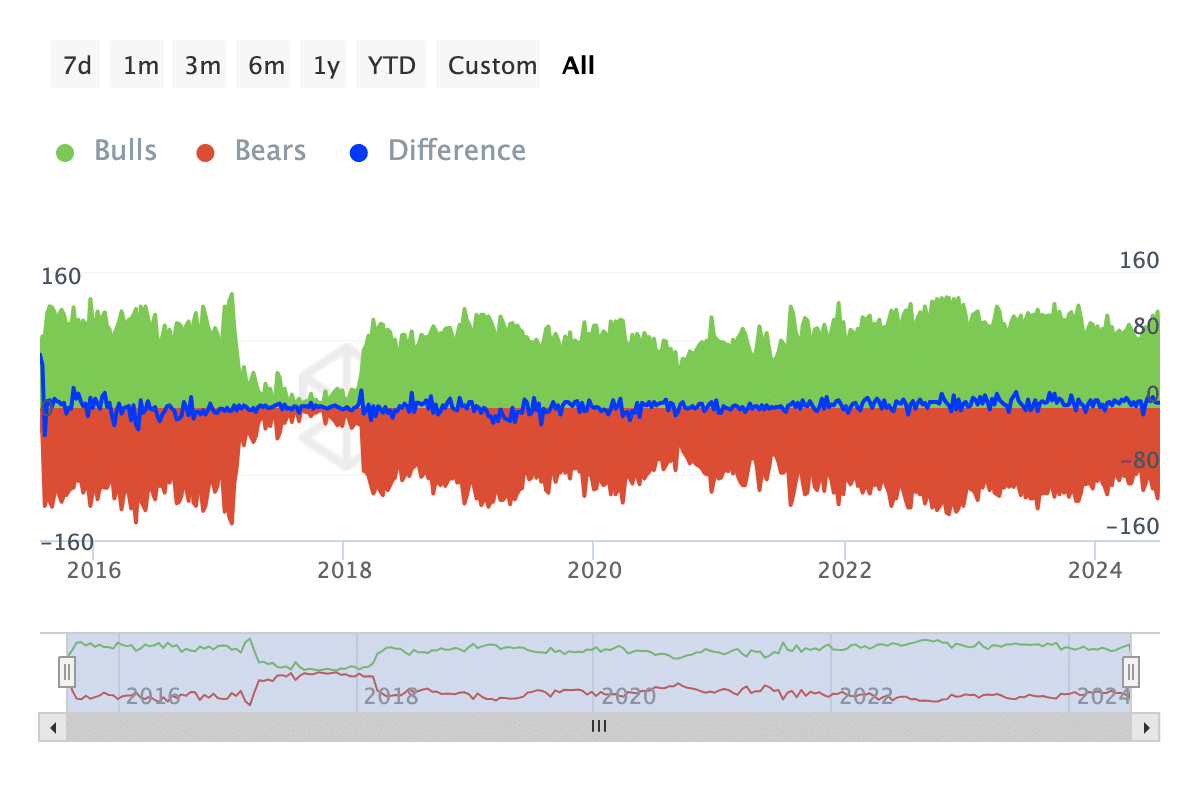

However, that was not the only thing. According to Glassnode, the ETH 2.0 has seen new deposits increasing.

When this statistic increases, it means holders of the altcoins are throwing away at least 32 ETH in anticipation of rewards.

Coincidentally, this is happening at a time when the launch of the spot Ethereum ETF is approaching. Judging from this development, the drop in circulation suggests that the Ethereum community seems optimistic about the event.

Source: Glassnode

Should more ETH be blocked, the price of the cryptocurrency could rise. In total, the total blocked Ethereum supply was 40%. Of this, 28% has been deployed and 12% bridged via smart contracts.

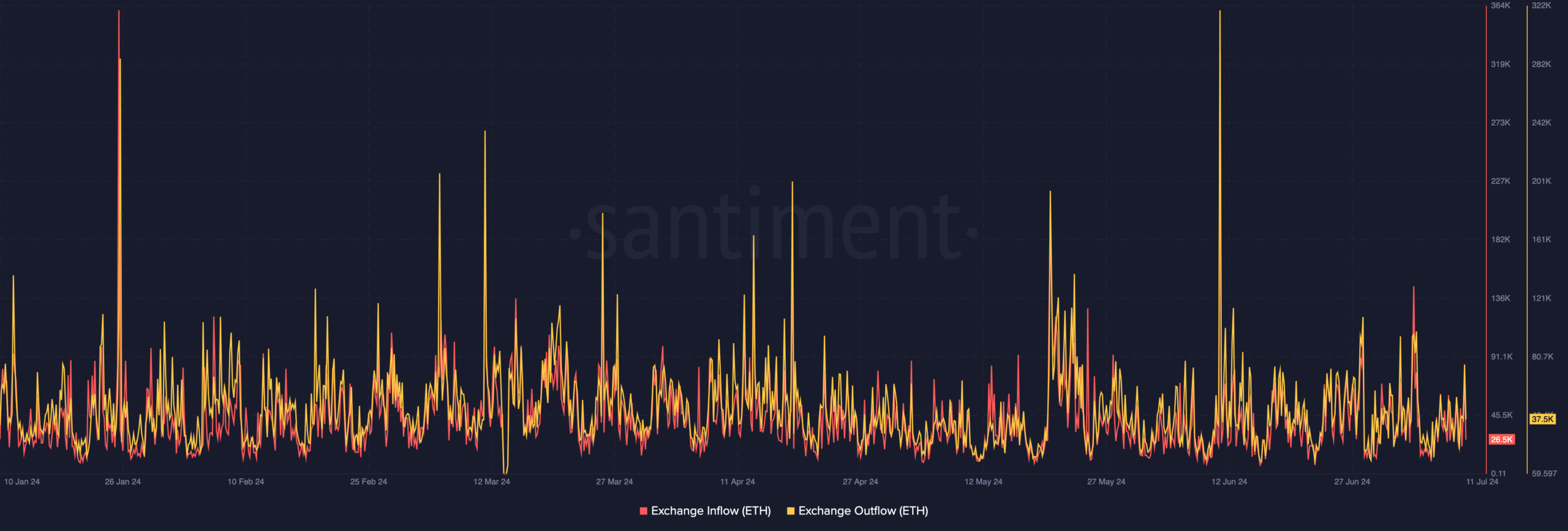

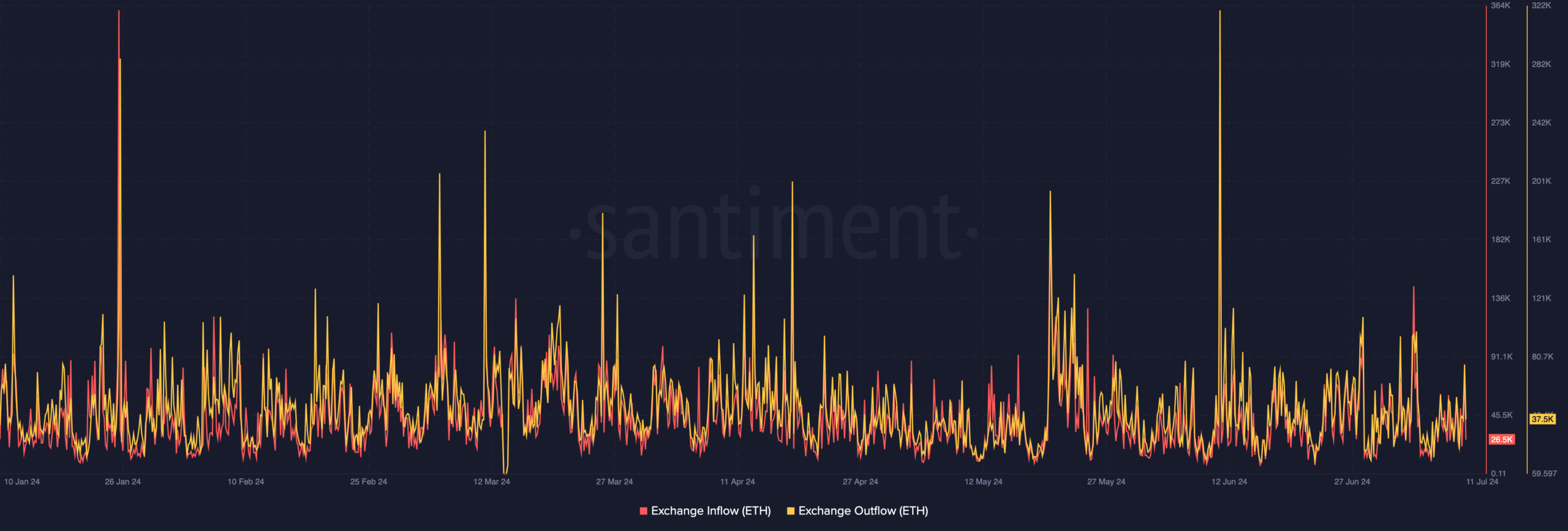

But for the price to rise, the number of coins on exchanges must decrease. To check if this was the case, AMBCrypto assessed Ethereum inflows and outflows.

The exchange’s inflows track the number of cryptocurrencies sent to the exchange from external sources. The exchange’s outflow, on the other hand, is the number of withdrawn ETH.

If the inflow of the currency exceeds the outflow, the price risks a correction. There is an increase in the outflow gives credibility to a possible price increase.

According to Santiment, ETH inflows amounted to 26,500, while outflows amounted to 37,500. Given the difference, there is a good chance that the price of ETH could increase several days or weeks after the start of official trading in the ETFs.

Source: Santiment

Sooner or later a rally will begin

Following the development, Benjamin Cowen, founder of Into The Cryptoverse, said: commented about the possible price action.

According to Cowen, ETH could outperform Bitcoin (BTC) in the fourth quarter of the year. He said,

‘If it follows the last cycle, this means ALT /BTC pairs begin their final decline in August, ETH/BTC begin their final decline in late September, and then BTC dominance peaks sometime in the fourth quarter.”

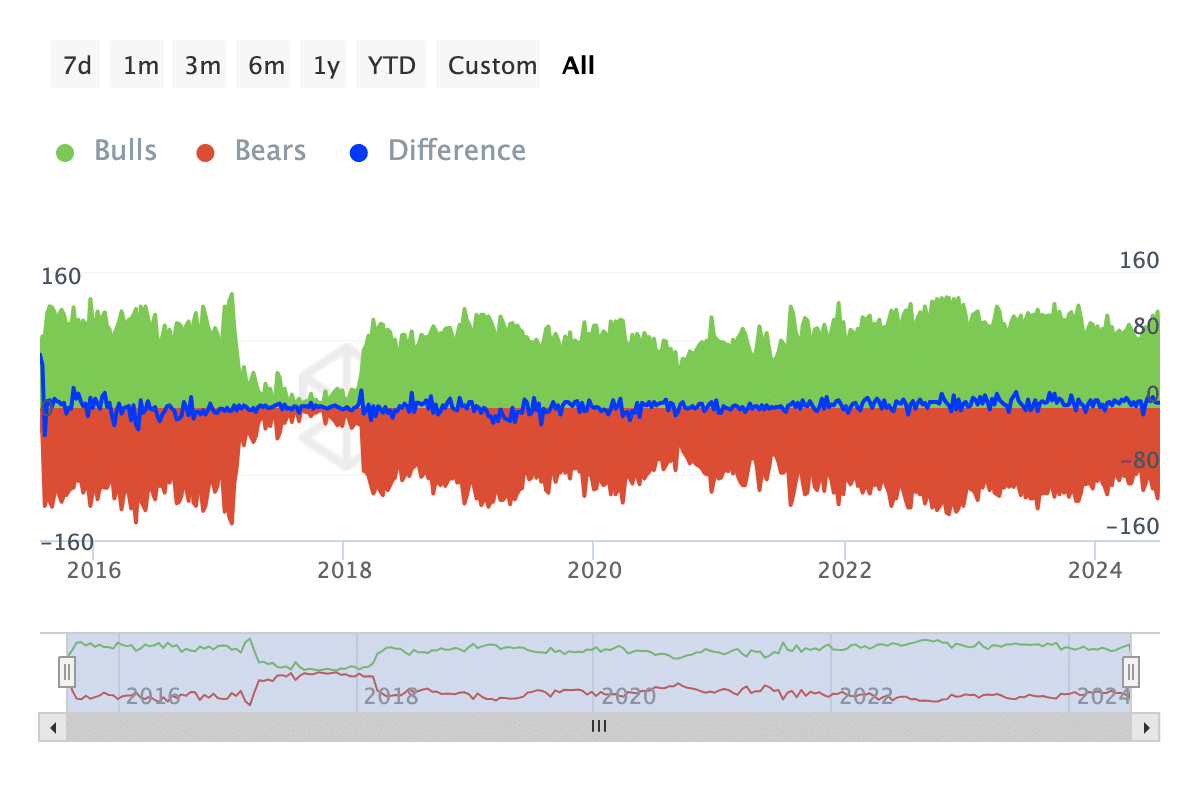

Meanwhile, data from IntoTheBlock showed that Ethereum may not wait until then to start performing well. This was because of the stands of the Bulls and Bears indicator.

Read Ethereum’s [ETH] Price forecast 2024-2025

Bulls refer to those who have purchased approximately 1% of the total trading volume. Bears are those who have sold the same ratio of volume.

Source: IntoTheBlock

At the time of writing, bulls dominated the ETH bears, indicating that buying pressure was greater. If this continues in the future, the price of ETH could reach $3,300 and approach $3,500.