- ETH is more sensitive to US elections than BTC, according to Bitwise’s CIO.

- The altcoin has been underperforming against BTC since 2022; will the trend change?

According to Bitwise’s CIO Matt Hougan, Ethereum [ETH] has greater exposure to US election results than Bitcoin [BTC].

The director noted that ETH has doubled BTC’s losses since Kamala Harris replaced Biden as the Democratic presidential candidate on July 21. He said,

“Since Harris replaced Biden. BTC: -8.68%, ETH: -26.19%. In my opinion, Ethereum has more influence on the election outcome than Bitcoin.”

Since Harris replaced Biden, ETH has fallen from $3.3K to less than $2.5K. On the other hand, BTC fell from above $68,000 to below $60,000 during the same period.

As such, ETH’s perceived high sensitivity to the changes could indicate that the outcome of the US elections in November could impact the altcoin more than BTC.

ETH is ‘still great’

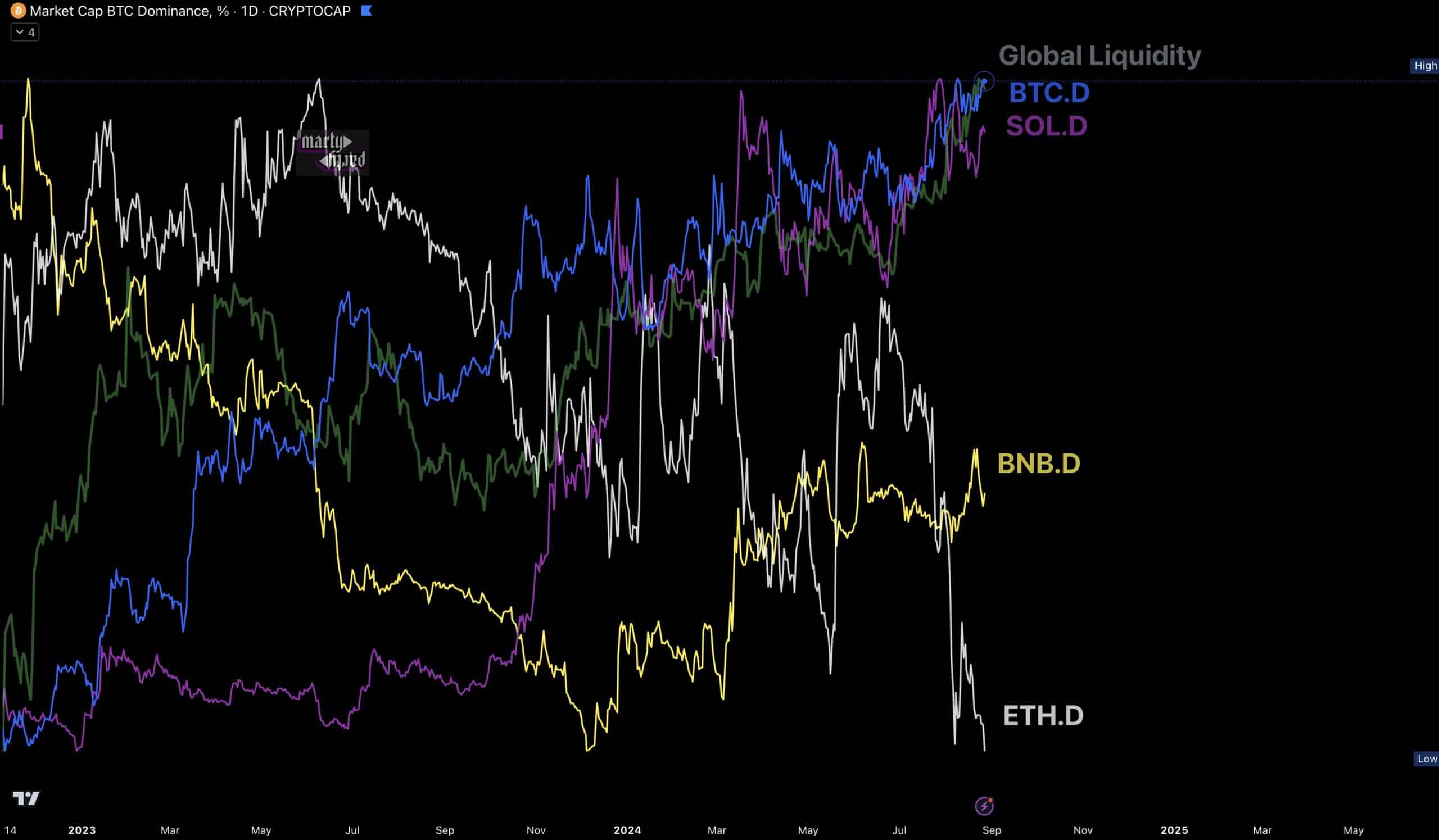

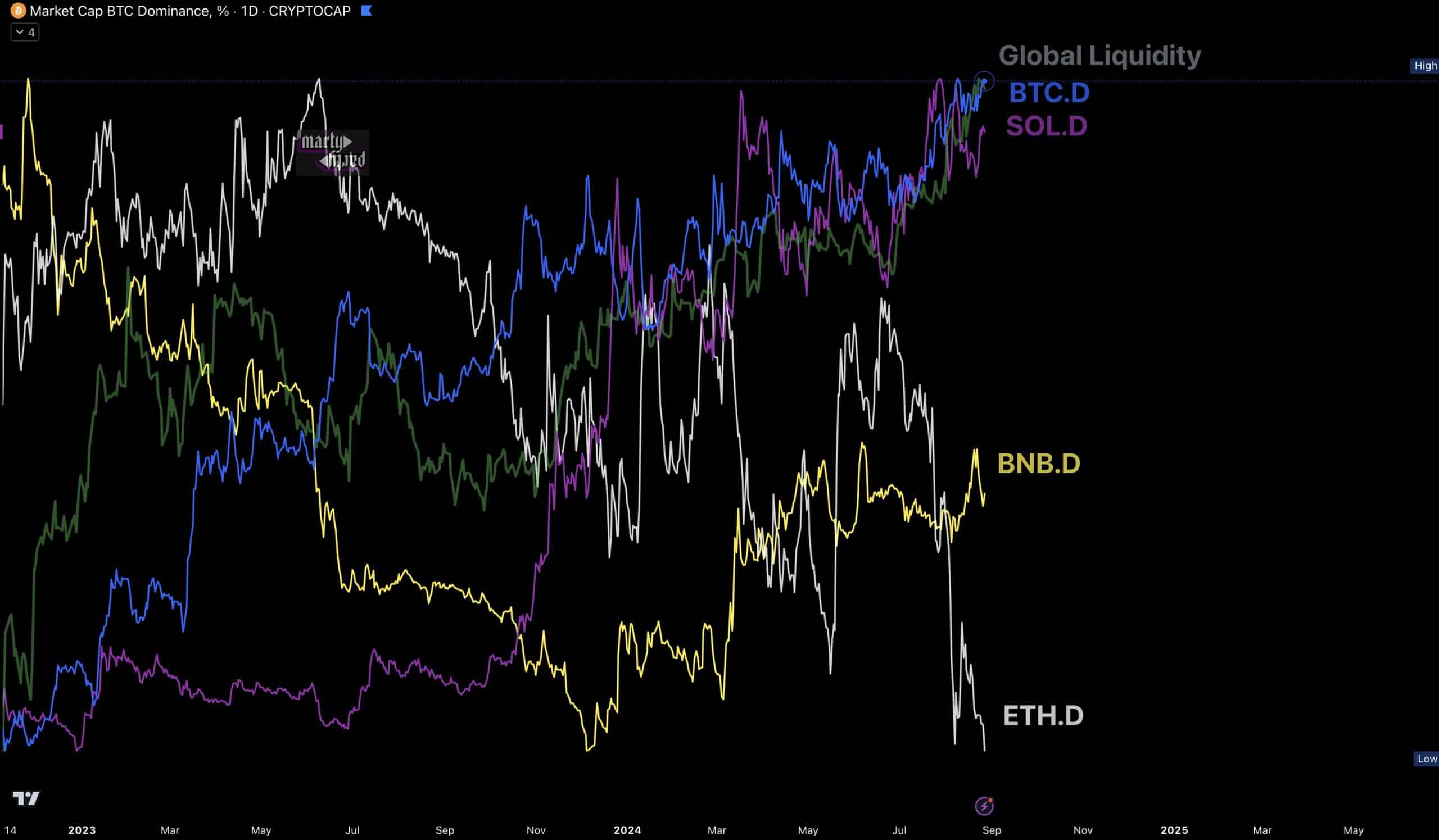

Furthermore, ETH lost significant market dominance between July and August as liquidity flowed to other competing assets such as BTC and Solana. [SOL].

According to market commentator Marty partythis did not bode well for the largest altcoin.

Source:

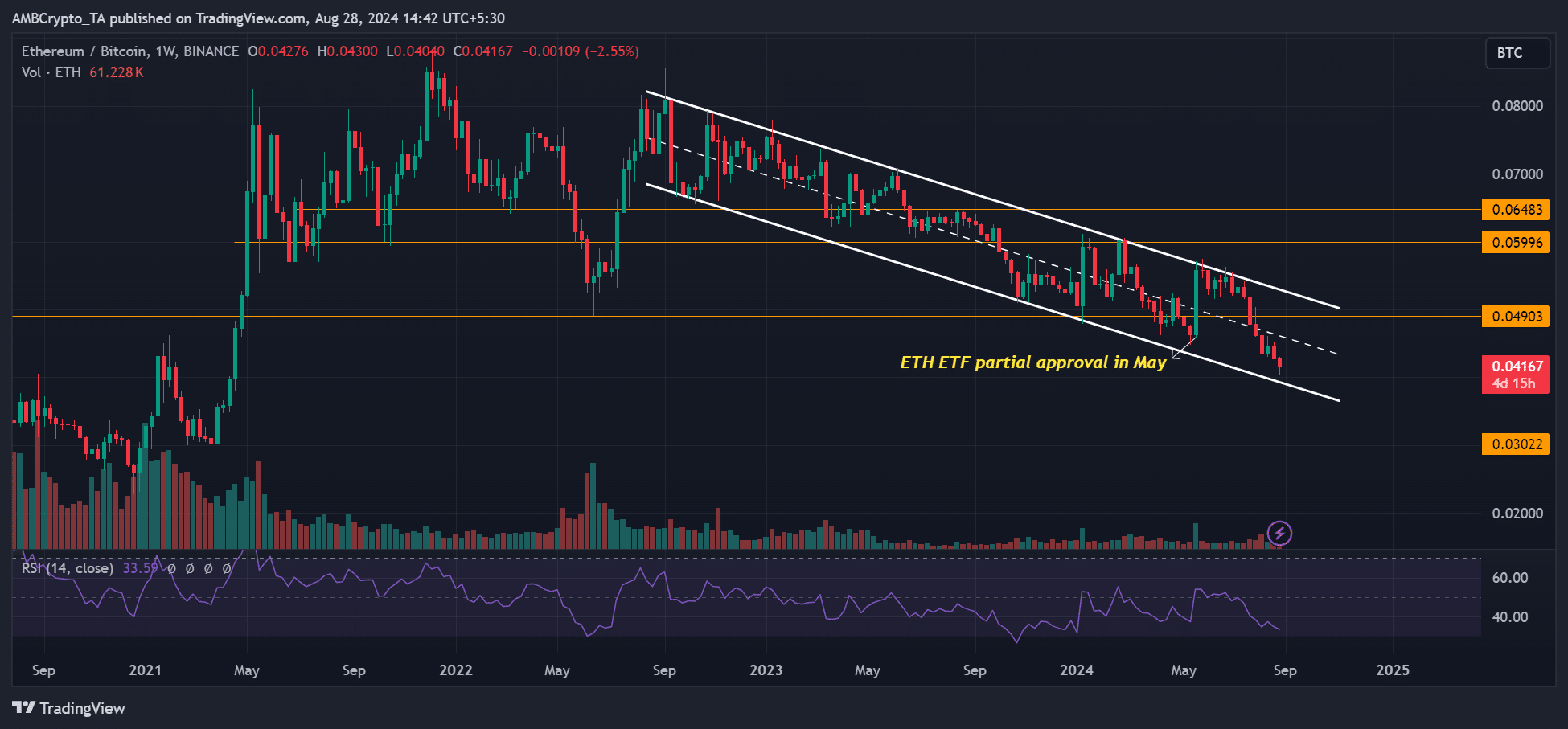

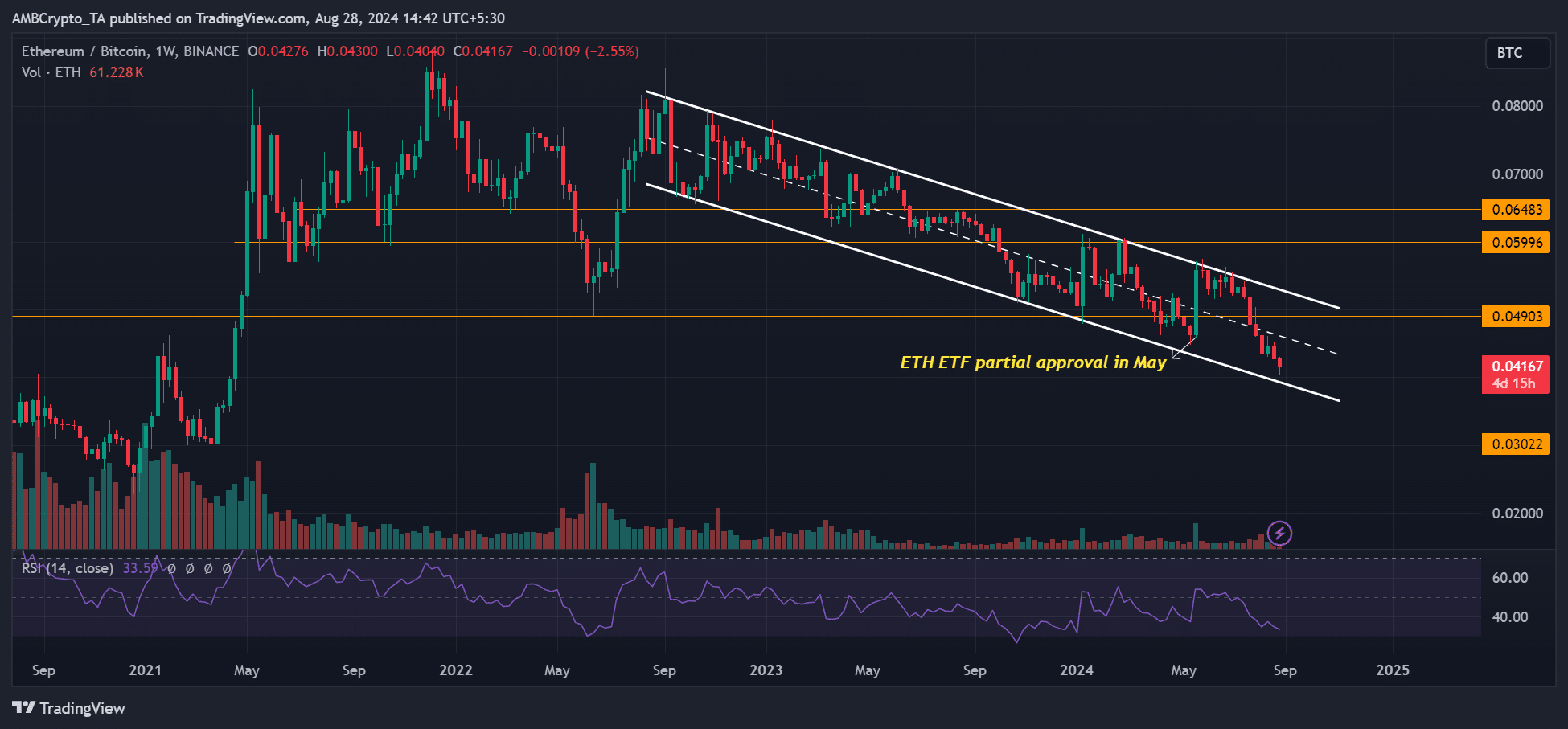

An evaluation of the ETHBTC ratio, which tracks the price performance of ETH against BTC, has been in a downward trend since late 2022. In short, ETH has been underperforming BTC for two years.

Unless the descending channel is broken, ETH’s underperformance could spread.

Source: ETHBTC ratio, TradingView

However, Vitalik Buterin, co-founder of Ethereum, claimed that ETH was still great despite overwhelmingly weak market sentiment.

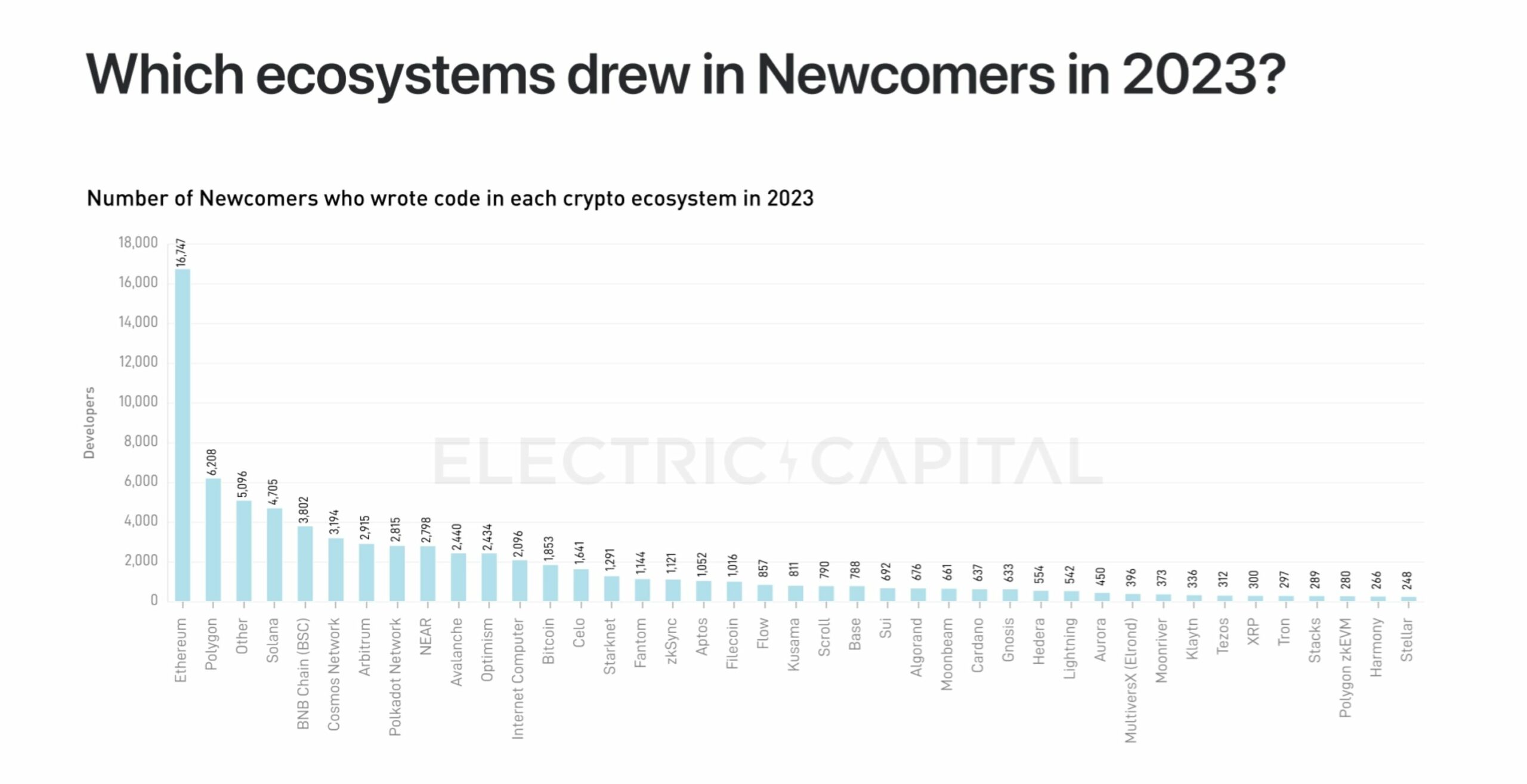

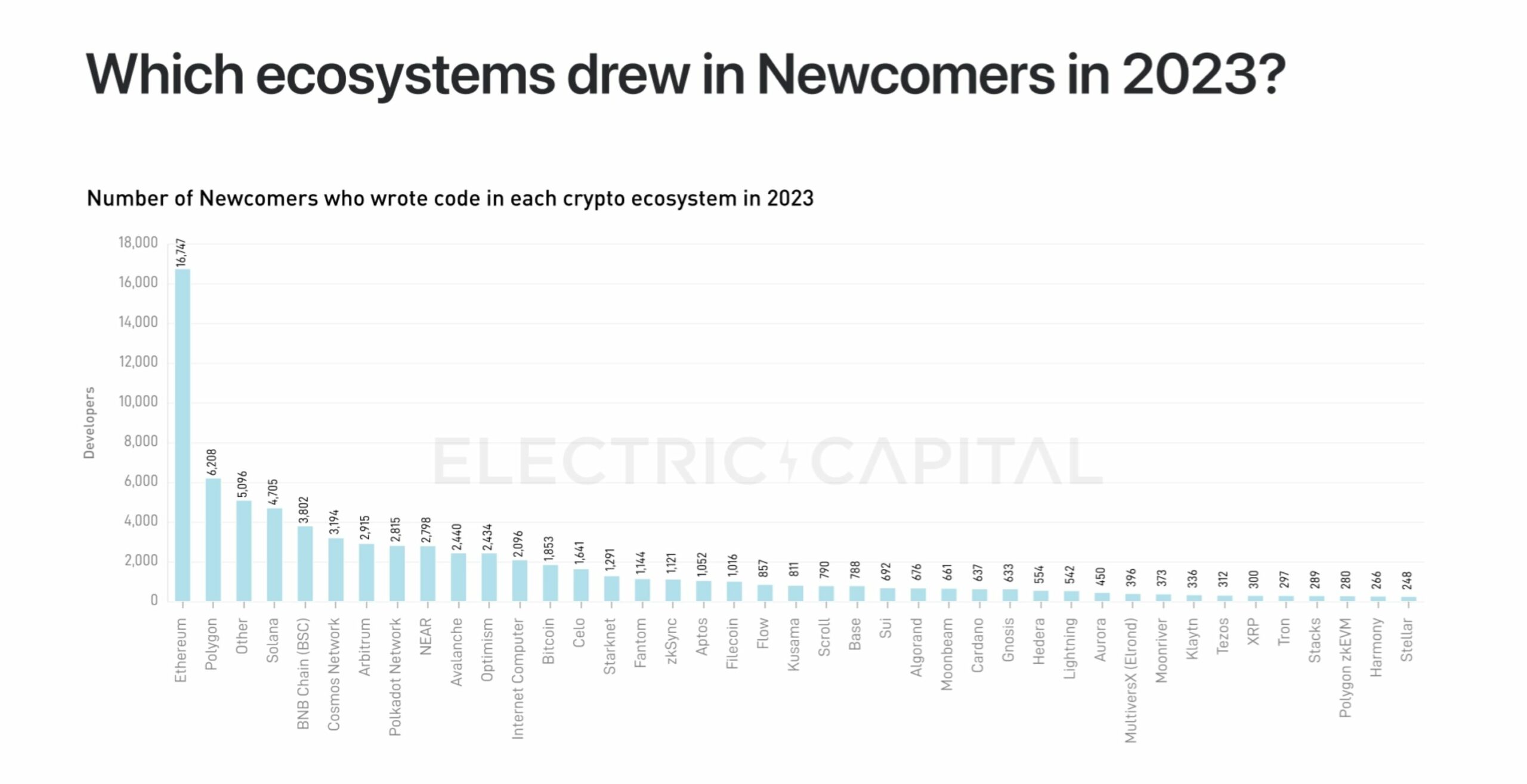

Rebutting the idea that Solana has more developers than ETH and would be the most preferred over the next five years, Buterin says said,

“I like how the chart understates ethereum’s success by listing the L2s as separate categories, but even with that handicap, ethereum still looks great 😂😂”

Source:

Meanwhile, ETH lost 8% of its value on Wednesday and fell below $2.5K, wiping out most of August’s recovery gains. The altcoin needed to reclaim the $2.5K for any potential recovery trend.