- The development of Ethereum took important steps with the split of ERC and EIP.

- The Dencun upgrade was also discussed in the developments.

While ETH prices rose alongside the broader crypto market, Ethereum [ETH] development team continued to work on the network.

Is your portfolio green? Check out the ETH profit calculator

This continued development amid a bullish market was a notable indication of Ethereum’s commitment to staying at the forefront of the blockchain space.

The split is complete

One of the most important developments in the Ethereum ecosystem was the completion of the separation between Ethereum Request for Comment (ERC) and Ethereum Improvement Proposals (EIP). This split was an important milestone after years of discussions.

The purpose of this separation was to provide standardized and high-quality documentation for the Ethereum application layer. By distinguishing ERC from EIP, Ethereum could create a clear track record of both past and ongoing improvements to application standards.

Meanwhile, the core EIP played a major role in improving the Ethereum consensus protocol.

Insights from the ACDC call

Recently, Ethereum developers gathered for their regular bi-weekly meeting known as ACDC Call. These meetings serve as a crucial platform for discussing a wide range of topics related to Ethereum’s technical development.

A number of important topics were on the agenda during this special meeting. This included discussion of the recent launch of Devnet-10, a key part of Ethereum’s development process.

Devnet-10 is designed to enable testing of the Dencun upgrade. A major highlight was the involvement of 330,000 active validators in this test network, making it an important milestone for Ethereum’s technical growth.

However, as with any complex technological undertaking, Devnet-10 was not without initial challenges. Notably, both Prysm and Teku customers encountered challenges, but the development team successfully resolved these issues.

The meeting also included critical testing of the Miner Extractable Value (MEV) workflows with the Lodestar customer, identifying and addressing certain issues.

One of the highlights of the meeting was the discussion on blob latency analysis in Devnet-10. Developers carefully examined how data blobs were processed and transmitted within this test network.

While the analysis confirmed the trends observed in previous tests, it was clear that further research and testing was needed before these changes could be implemented in public Ethereum test networks.

In addition, there was an extensive discussion about stabilizing client releases and intensifying testing of the MEV builder and relay components. The goal was to ensure these elements were robust before moving on to public testnet launches for Dencun.

In light of the shutdown of Devnet-10, developers planned to launch Devnet-11, which would require fewer validators.

Dencun upgrade and activation

The Dencun upgrade, an important step in Ethereum’s continued evolution, received major attention during the ACDC Call #173 meeting. The development team outlined their plans for preparing and activating this upgrade.

In preparation for Dencun, developers decided to launch Devnet-11, a test network designed to facilitate testing of various features. These include testing the MEV workflow and a rollup implementation.

To ensure these features worked seamlessly, it was important to have stable client releases on Devnet-11.

The timing of these steps was discussed and an activation date for Dencun on the Goerli testnet was proposed.

However, it became clear that due to ongoing changes to the Prysm client software and an upcoming developer conference, the earliest possible activation of Dencun would take place in late November.

There was also the possibility that Dencun’s mainnet activation could be delayed until early 2024.

Market impact and Ethereum performance

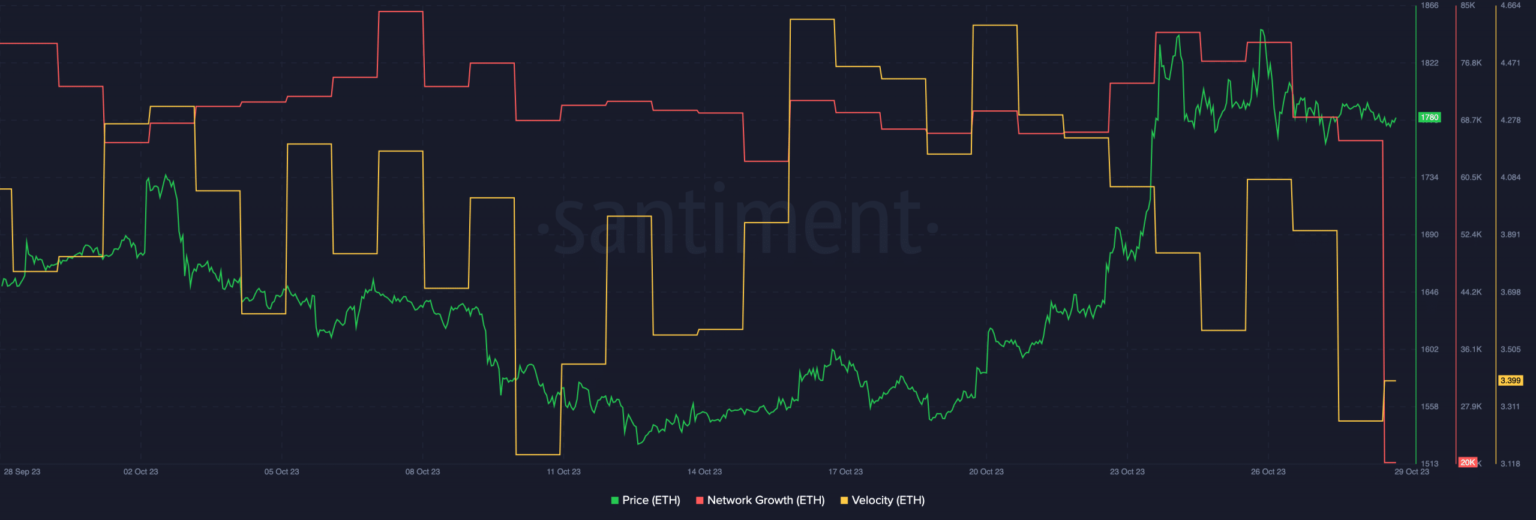

Despite these important technical developments, the impact on Ethereum’s market performance remained uncertain. At the time of writing, Ethereum was trading at $1780, after rising significantly in recent days.

Realistic or not, here is the market cap of ETH in terms of BTC

However, a large decrease in network growth was observed over a few days. This suggested that new addresses may lose interest in ETH as its price rises.

Furthermore, ETH’s rate declined during this period. This suggested that the number of times ETH was traded had decreased.

Source: Santiment