- Ethereum shows potential for a bullish reversal, with a rare daily bullish divergence and narrowing Bollinger Bands.

- Macroeconomic shifts and on-chain data could push Ethereum’s price higher despite recent bearish momentum.

Ethereum [ETH] was showing signs of a price reversal at press time, with a bullish divergence emerging on the daily time frame. This marks the first bullish divergence for ETH in over two years.

Michaël van de Poppe, crypto analyst, recently noted,

“These are great signals in the markets as $ETH has made its first bullish divergence in daily time in over two years.”

However, he also asked the critical question:

“Will this be the actual reversal signal?”

Source:

Technical indicators signal possible price movements

Ethereum was trading at $2,514.53 at the time of writing, reflecting a decline of 0.89% in the past 24 hours and a decline of 4.94% in the past week. Despite this recent downturn, technical indicators point to a possible shift.

The Bollinger Bands are narrowing, which often indicates that there could be significant price movement on the horizon.

ETH was trading below the middle Bollinger Band at the time of writing, indicating the asset is still experiencing bearish momentum.

The Moving Average Convergence Divergence (MACD) indicator showed the MACD line staying below the signal line, with both trends in negative territory.

While this indicated continued bearish pressure, the histogram showed slight weakening, which could indicate the early stages of a possible reversal or consolidation.

Source: TradingView

At the time of writing, the Relative Strength Index (RSI) stood at 39.7, putting it in oversold territory.

So as long as selling pressure remains, there may be an opportunity for buyers to re-enter the market, potentially leading to a near-term rebound.

Macroeconomic influences

Macroeconomic factors could also play a crucial role in Ethereum’s potential price appreciation.

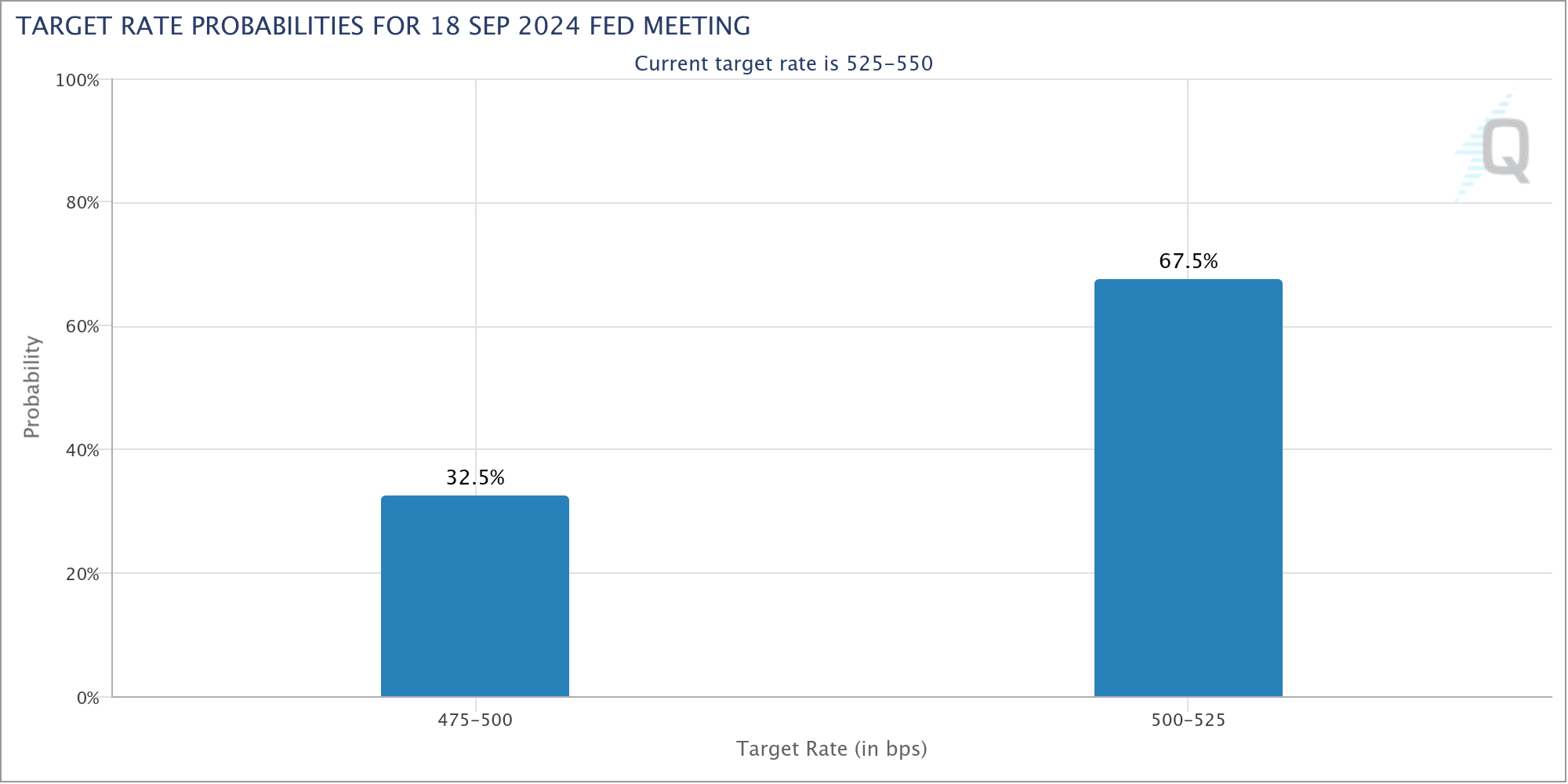

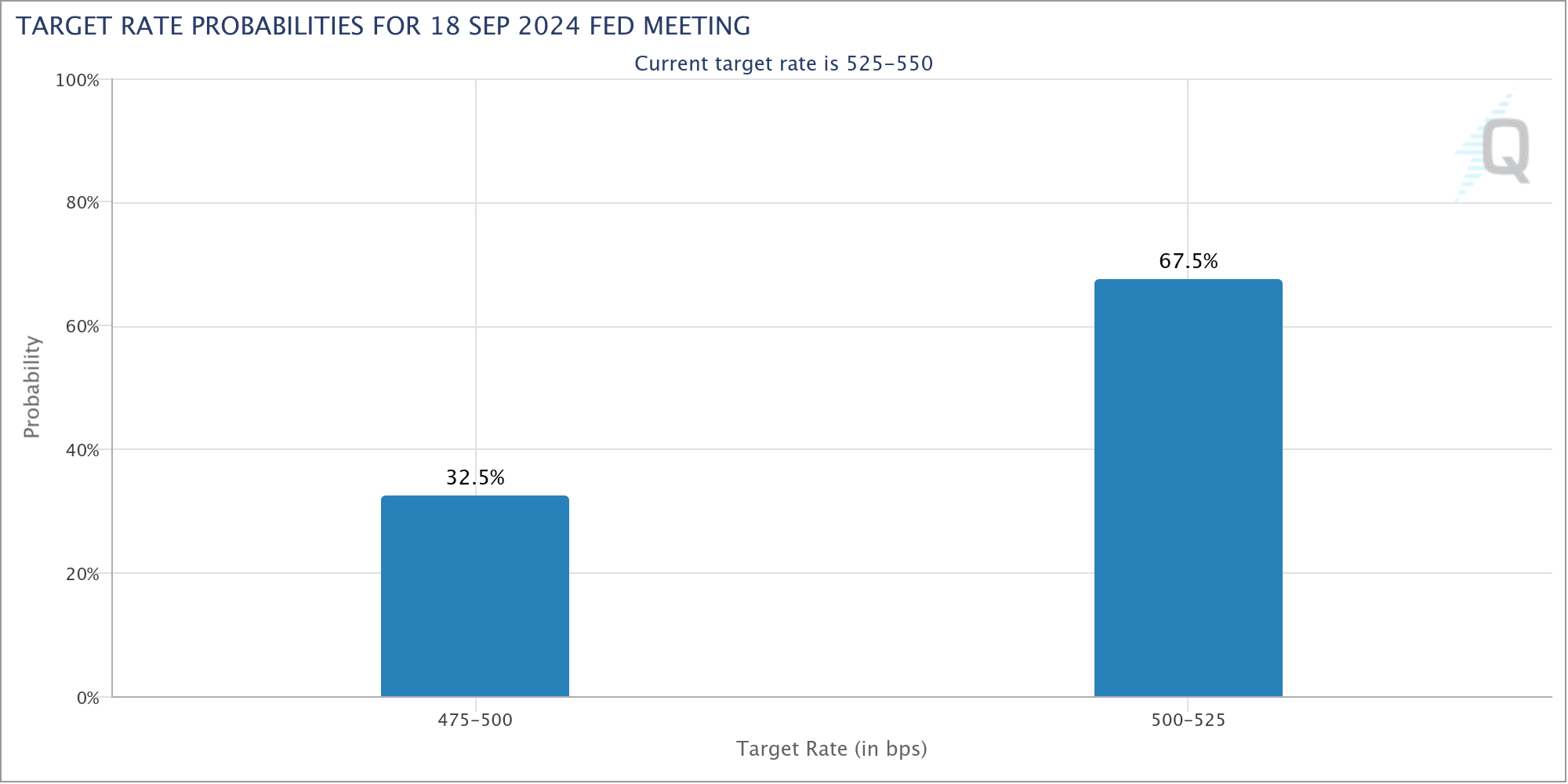

The Federal Reserve is expected to cut rates in September and may continue with further cuts, driven by slowing inflation and economic uncertainty.

A reduction in interest rates tends to make riskier assets such as cryptocurrencies more attractive, as the appeal of safe havens such as the US dollar diminishes.

Source: CME

Historically, interest rate cuts have led to greater capital inflows into the crypto market as investors seek higher returns in alternative assets.

Given Ethereum’s established ecosystem and its growing adoption, the crypto could be one of the primary beneficiaries of this shift in investor sentiment.

A dovish stance from the Federal Reserve could weaken the US dollar, which could put further upward pressure on the price of ETH.

Ethereum’s growth prospects

On-chain data also supported a positive outlook for Ethereum. According to DefiLlamaThe Total Value Locked (TVL) in Ethereum-based decentralized finance (DeFi) protocols stood at $46.966 billion at the time of writing.

Additionally, the network saw a 24-hour transaction volume of $1.13 billion, with inflows of $2.44 million.

Read Ethereum’s [ETH] Price forecast 2024–2025

The number of active addresses in the last 24 hours reached 390,291, in addition to 64,793 new addresses, highlighting continued user engagement and network activity.

So there is continued interest in the Ethereum network, which could support the asset’s price in the coming months.