- Ethereum reflects its breakout cycle in 2023 style, with smart money that further supports this possibility.

- Great headwind still has to be confronted.

Ethereum [ETH] shows aggressive dip-buzzing of deep-pocket investors.

Data on chains Showed that ETH portfolios of Top-Class 130,000+ ETH gained only up to $ 1,781 as a prize, which indicates smart money absorption in a critical demand zone.

However, with excessive supply that is still present on the market, the uncertainty remains. Is the current price promotion a real outbreak, or is ETH only a soil located at an important level of support before the next step?

Smart Money Flow – Drawing of a potential dip

A month ago Ethereum opened $ 2,147. On the press it had fallen by 15%, so that the critical $ 2K support was violated for the first time in two years.

In 2023, ETH underwent a six -month consolidation phase before he started an outbreak, with two significant accumulative phases in Q4, which eventually reached a peak at $ 4,012.

Some analysts are Predict a potential repeat rallyWith the poor Q1 performance of Ethereum, parallels draw as a precedent for a bull’s cycle. Given both micro and macro factors, this hypothesis seems plausible.

Firstly, the risky sentiment driven by the economic landfill of Trump could shift Bitcoin’s attention, making Ethereum possible for upward momentum.

In addition, large inflow at important support levels suggested the start of a battery phase, which strengthens the Bullish case for ETH.

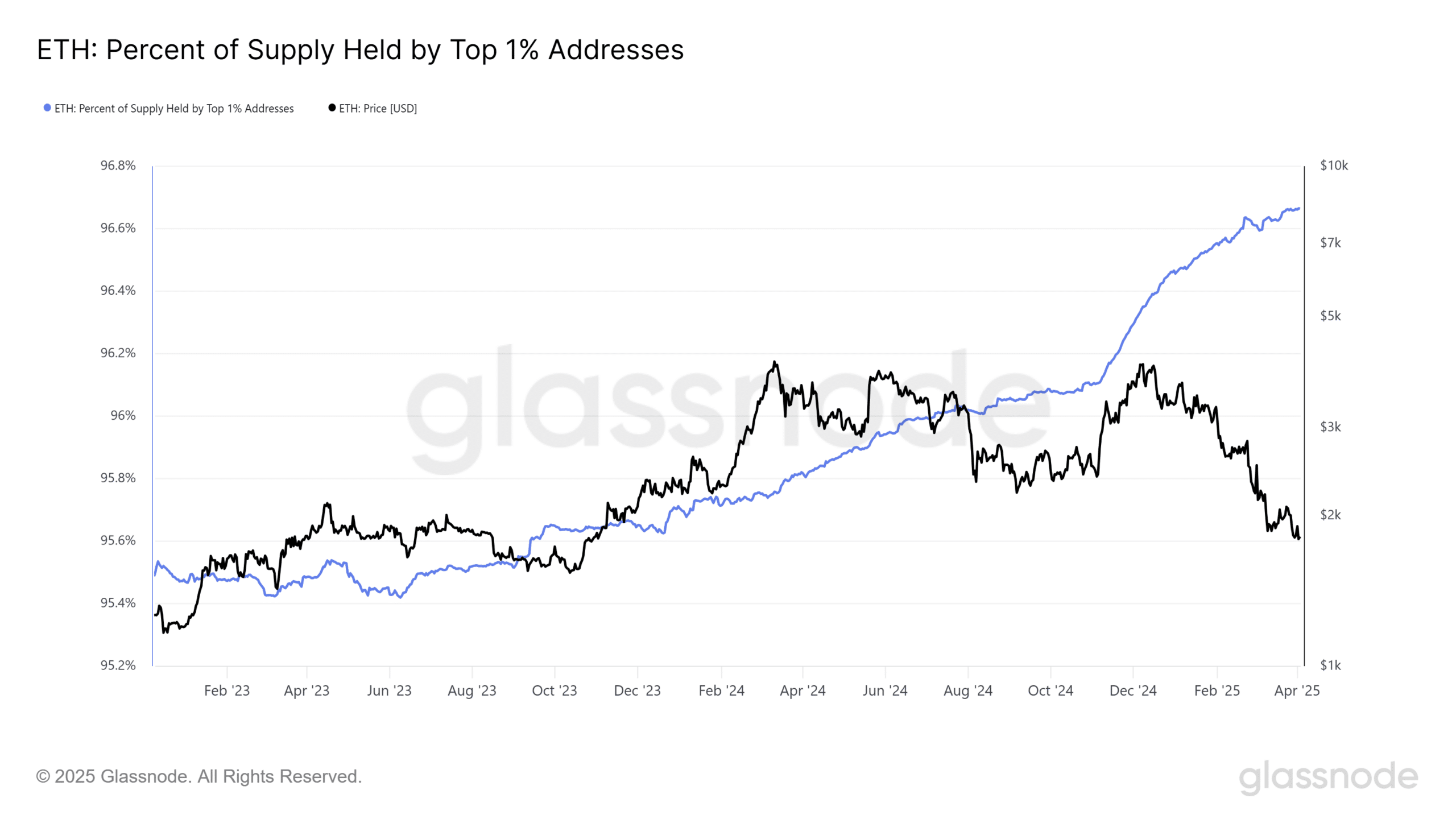

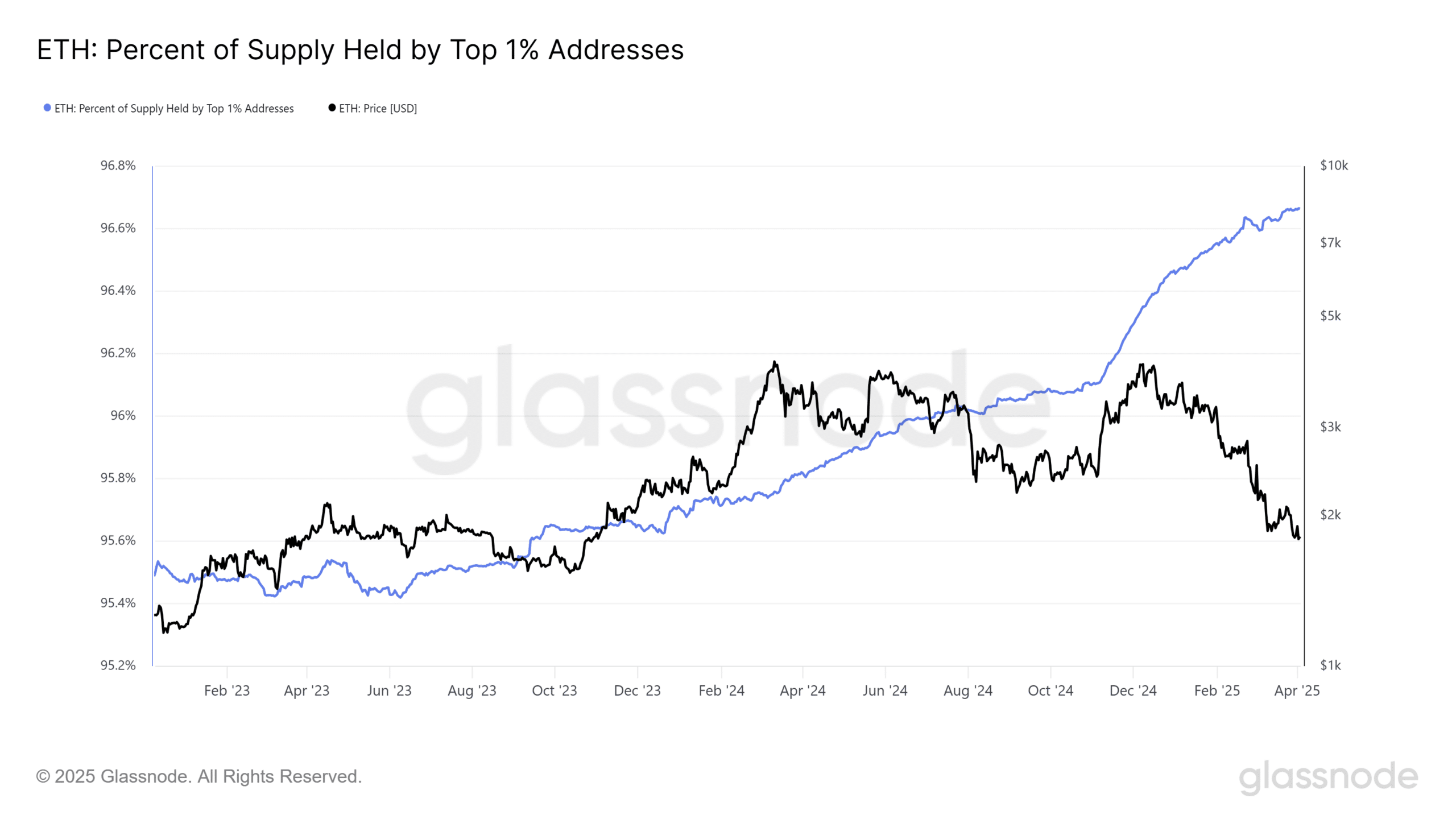

It is remarkable that the percentage of Ethereum of the supply of the top 1% addresses has risen to a record high, with a considerably 96.66% of the total stock concentrated in the hands of whales.

Source: Glassnode

This concentration peaked in the middle of Q4 last year, coinciding with a clear increase in whale recording, which helps the quarterly rally of the 71% of the ETH Beter than Bitcoin’s better than that of Bitcoin [BTC] 61% in the same period.

As the whale recording is resumed with ETH immersing to $ 1,780 and a bounce of 2% to $ 1,830 shows on the press, these historical patterns and accumulation trends strengthen the business for this as a potential market base.

Could Ethereum position itself for a potential market takeover if Q2 unfolds?

Ethereum’s opportunities for a repeated rally

In contrast to two years ago, the market conditions have become more volatile. This is illustrated by the ETH/BTC purple, which has fallen to a low-five-year low.

Bitcoin’s resilience in the midst of market turbulence has put down on Ethereum, which contributes to the weak Q1 performance.

The dominance of Ethereum, which kept stable in double digits in 2023 and in the first quarter of 2025, has now fallen sharply to a record layer of only 8%.

Source: Coinmarketcap

While whale activity played a crucial role in Eth’s breakout up to $ 4K earlier, the simultaneous peak in the ETH/BTC pair capital rotation as key factor emphasizes.

Investors, away from the risky/risky profile of Bitcoin, have led capital in Ethereum and added Bullish Momentum to its rally.

However, this dynamic is dramatically shifted. The dominance of Bitcoin has risen to a highest height of four years and breaks 61%, causing the relative outperformance of Ethereum to suffocate.

Unless this shift reverses, the chance of a repeated rally remains related to 2023.