- The Fed is sucking $161 billion out of the market to influence Ethereum.

- ETH old whale on a silent sell-off.

Ethereum [ETH] remains a strong player in the cryptocurrency market despite recent challenges affecting the broader crypto sector.

Analysts are closely watching the Federal Reserve’s actions as the Fed has withdrawn $161 billion from the markets.

This was confirmed by the increase in the Treasury’s General Account from $714 billion to $875 billion, due to corporate tax payments.

As the Fed continues to liquidate positions in risky assets, market liquidity will be affected.

Source: Tomas/X

The Reverse Repo program will likely start reducing liquidity this week and continue until September 30.

These developments could impact the price of Ethereum and its ETFs as market conditions respond to changing liquidity levels.

Impact of liquidity shortage on the price of ETH and its ETFs

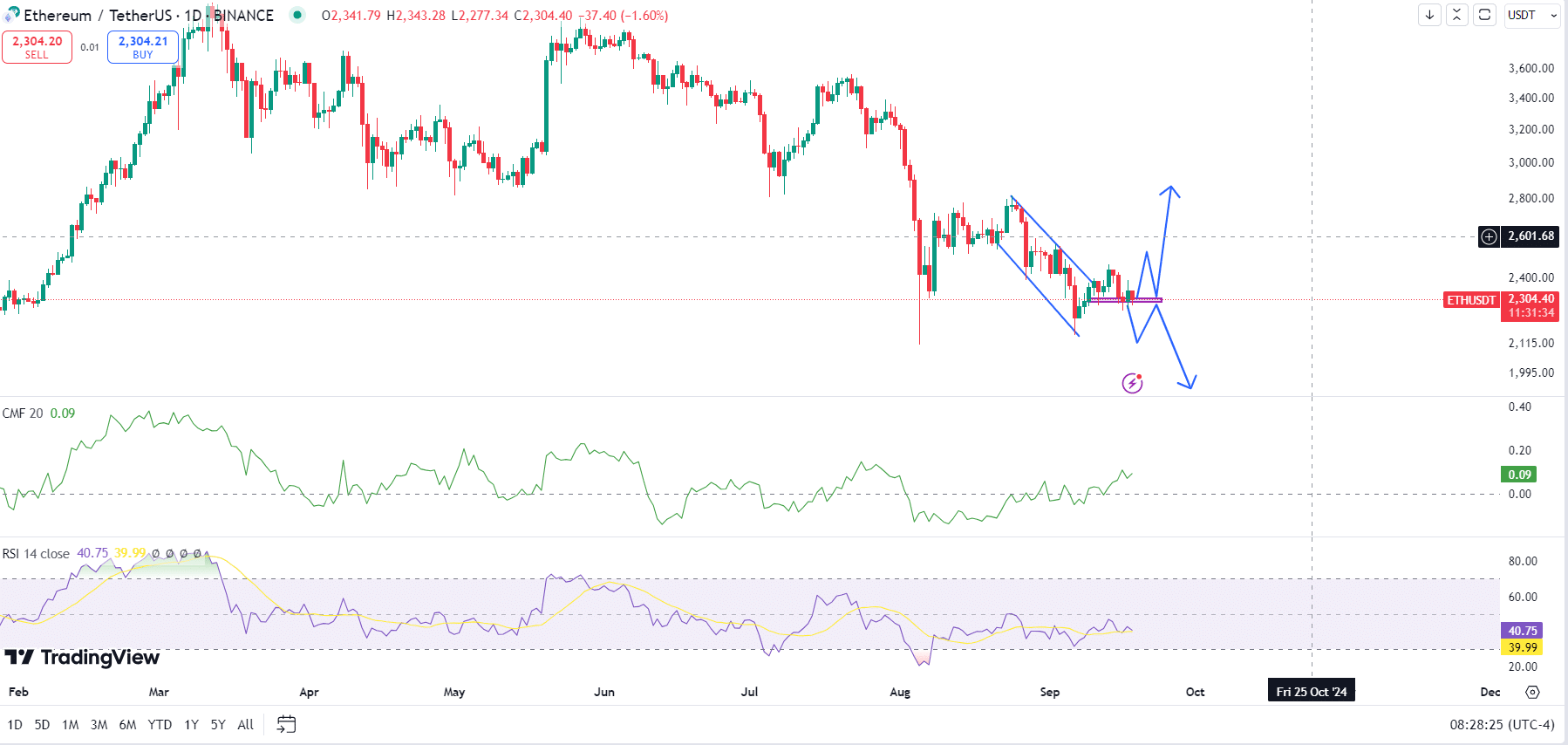

Ethereum’s price action is heavily influenced by the Federal Reserve’s liquidity measures, especially for the ETH/USDT pair.

ETH was trading at $2,298 at the time of writing and has been in a downtrend since March 2024, with significant price fluctuations in August.

ETH broke out of a downtrend channel and is now hovering around the $2,300 level.

If ETH can stay above this critical price zone, it could avoid the negative effects of the Fed’s liquidity reduction and even trigger a price reversal.

However, if ETH falls below $2,300 and stays there, the liquidity crisis could push prices lower.

Source: TradingView

On the plus side, the Chaikin Money Flow (CMF) indicator reads 0.09, indicating accumulation and buying pressure.

The Relative Strength Index (RSI) has also crossed above the 14-day moving average, indicating potential bullish momentum.

While these technical indicators point to a possible price recovery, the liquidity crisis could still push ETH lower before an upward move occurs.

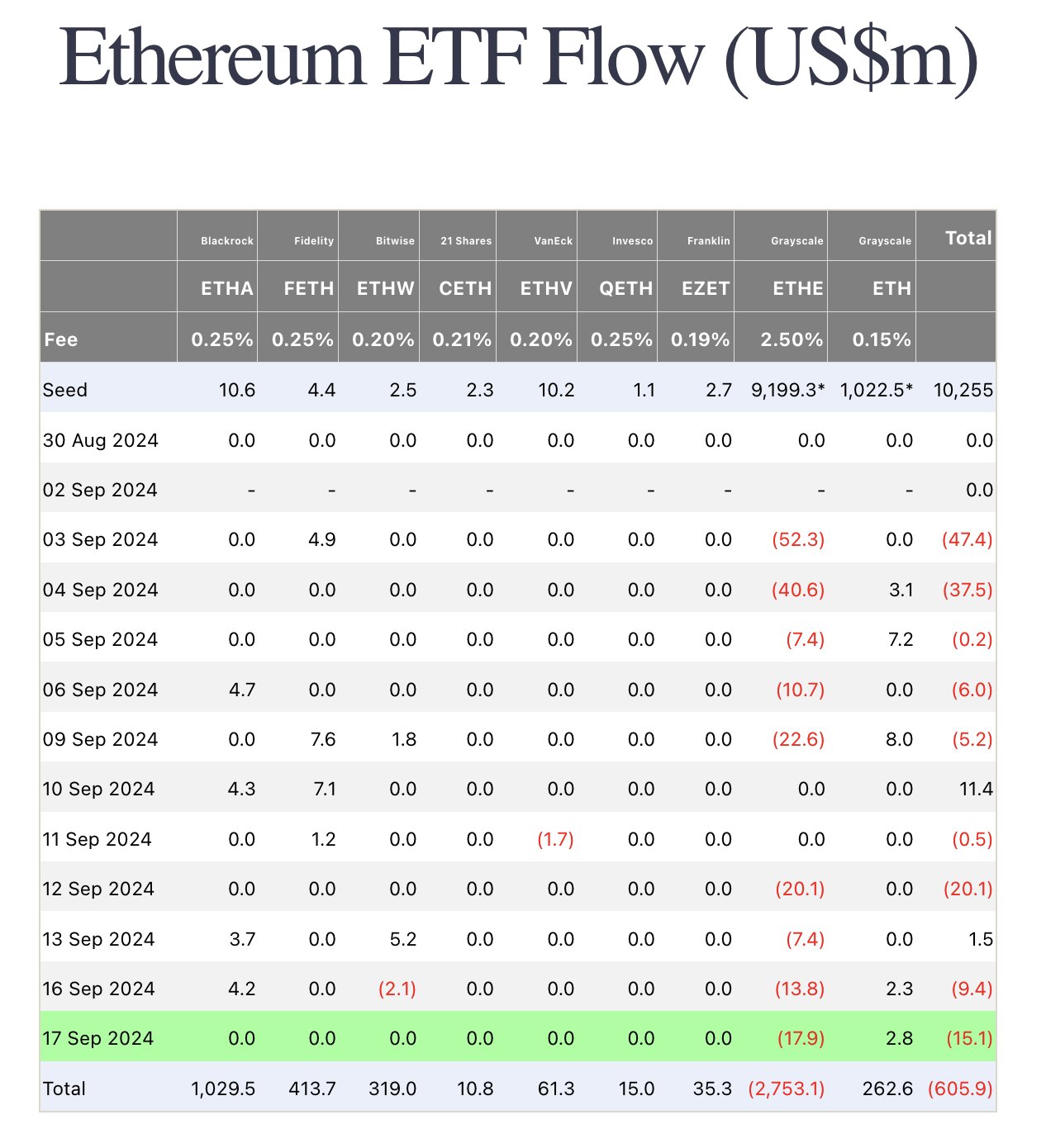

Furthermore, Ethereum-based ETFs have experienced notable outflows even as Ethereum spot ETFs were launched, allowing money to flow into ETH assets.

Source:

The Fed’s liquidity reduction could worsen this trend, leaving less money available for investing in risky assets like Ethereum ETFs. During this new week, ETH ETFs have seen net outflows of $25.5 million.

The Grayscale Mini ETF (ETH) attracted $2.8 million in inflows. However, the Grayscale ETF (ETHE) saw significant outflows, losing $17.9 million, due to a shift in market sentiment.

This contributed to the overall negative net flow of -$15.1 million, as shown in the most recently released data.

Sale of old whales

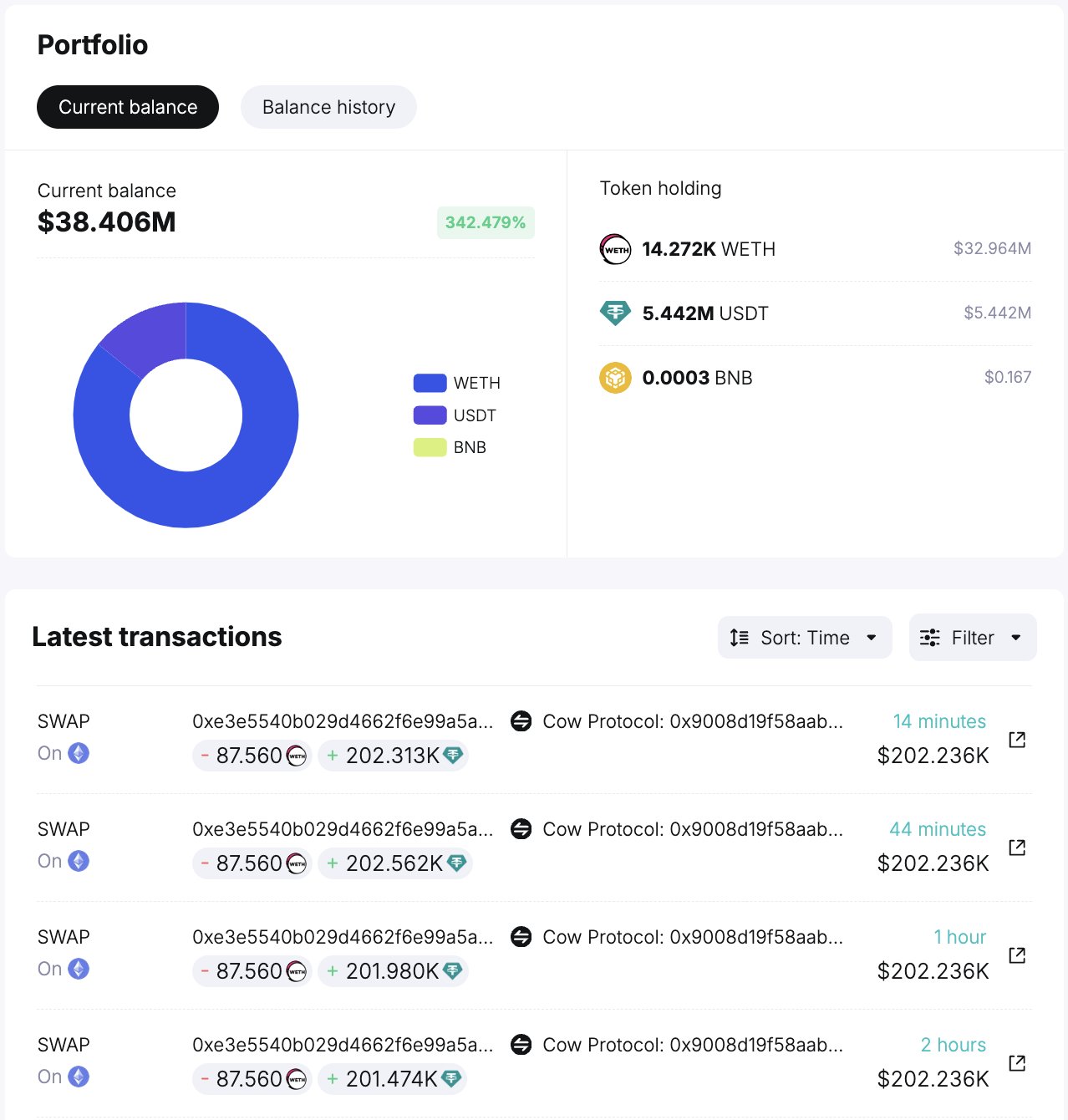

Finally, an old Ethereum whale has been quietly selling off significant amounts of ETH lately.

The whale sold 2,364 ETH, for a total of $5.44 million USDT at an average price of $2,302, across 27 transactions. Despite this recent sell-off, the whale still owns 14,272 WETH, worth approximately $33 million.

Source: SpotOnChain

The whale may be selling due to the bearish sentiment caused by the Fed’s liquidity reduction, but selling could slow if market conditions improve.

Read Ethereum’s [ETH] Price forecast 2024–2025

Ethereum’s price could fall further due to the Fed’s liquidity crisis, but technical indicators point to the potential for a reversal.

However, ETH ETFs and whale activity indicate caution, and the market may need more liquidity to support higher prices.