- The largest ETH ETF, Grayscale, had outflows of $210 million in one day.

- ETH also turned bearish and most metrics pointed to a continued price decline.

Exchange Traded Funds (ETFs) have gained a lot of ground since the beginning of this year with the launch of Bitcoin [BTC] ETFs. Things have gotten even better this past week Ethereum [ETH] ETFs started trading.

So let’s see how these two ETFs stack up against each other.

BTC ETFs vs. ETH ETFs

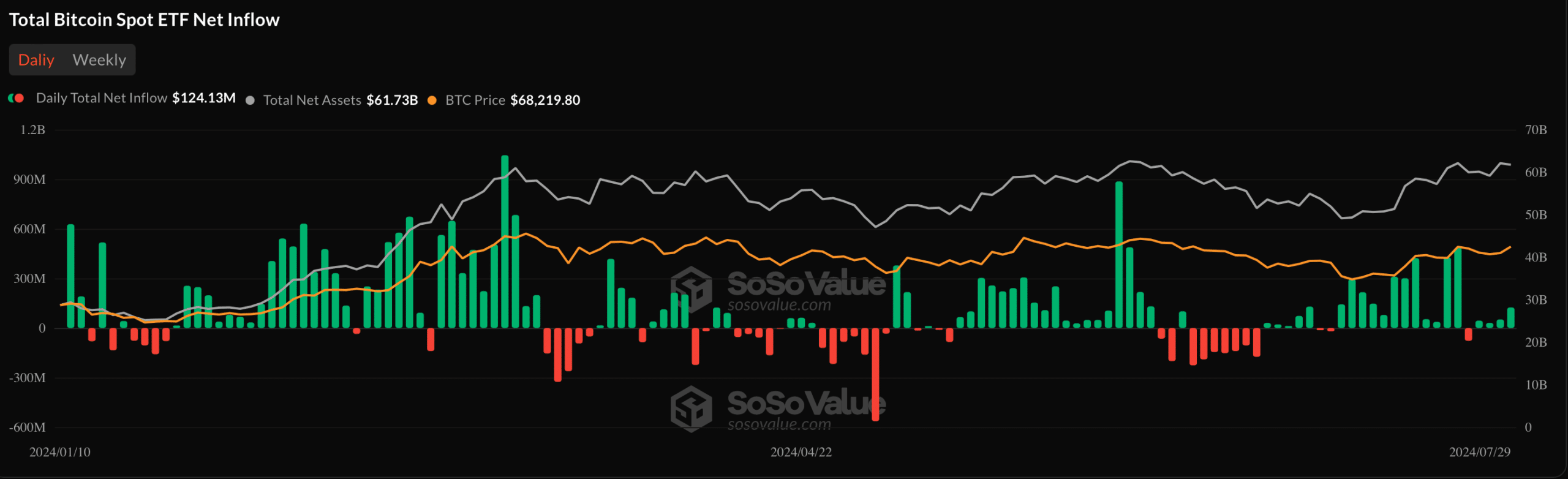

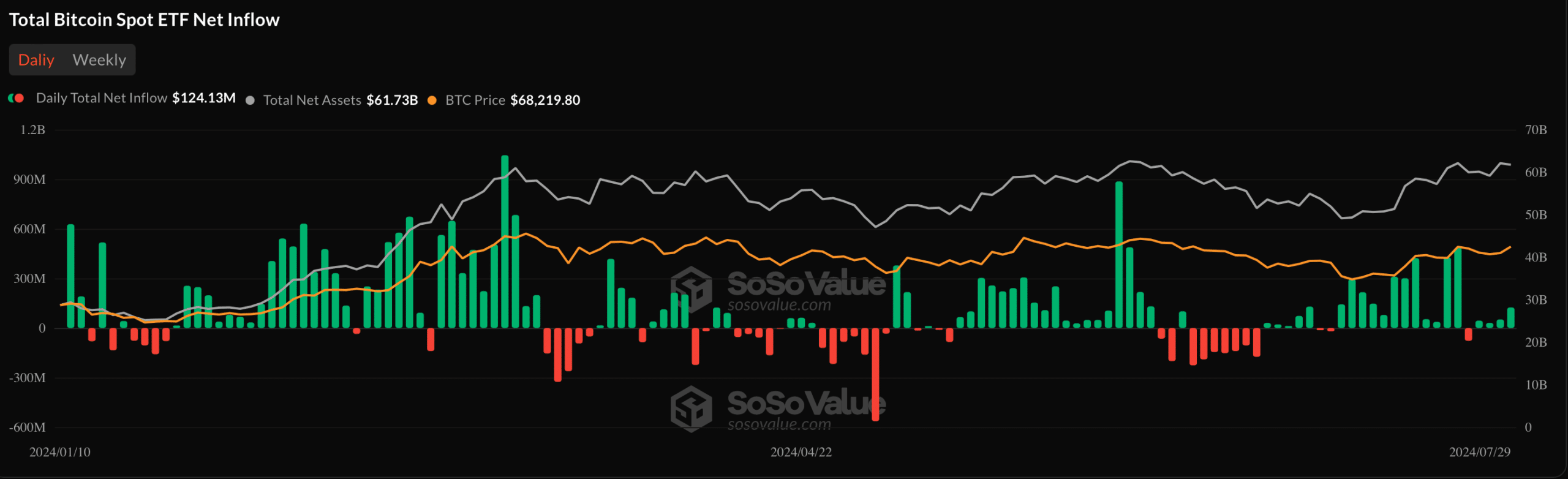

Since its launch, Bitcoin ETFs have witnessed high inflows and relatively much lower outflows. The Bitcoin spot ETF had total net inflows of $124 million on July 29 and continued to have net inflows for four consecutive days.

BlackRock ETF IBIT had inflows of $206 million. However, the size of the influx has decreased in recent weeks.

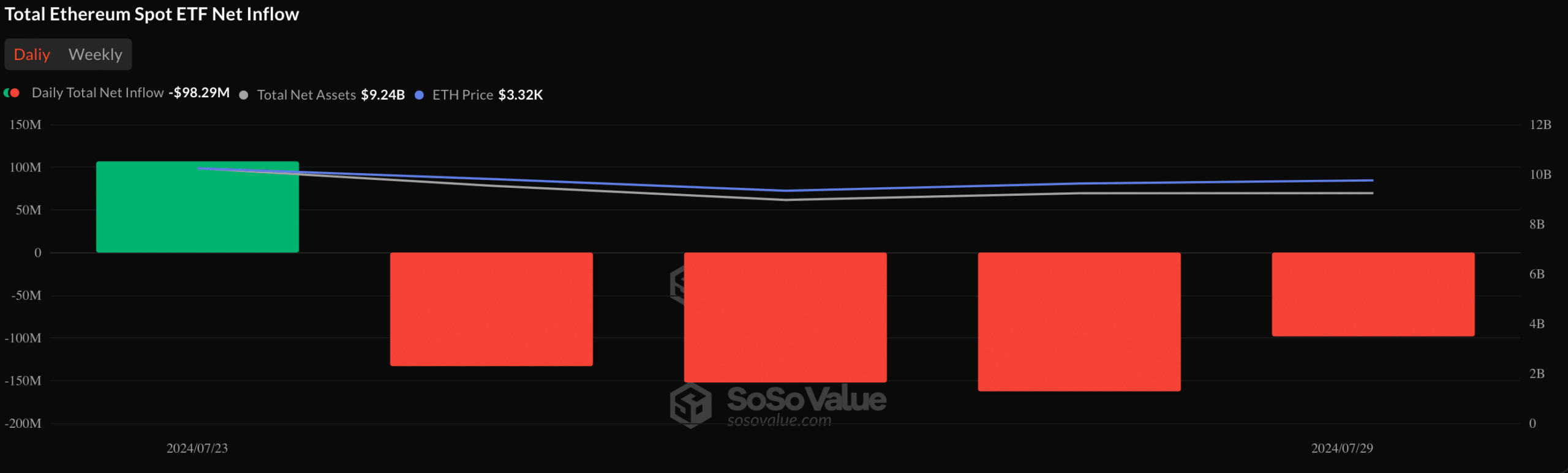

Source: SoSoValue

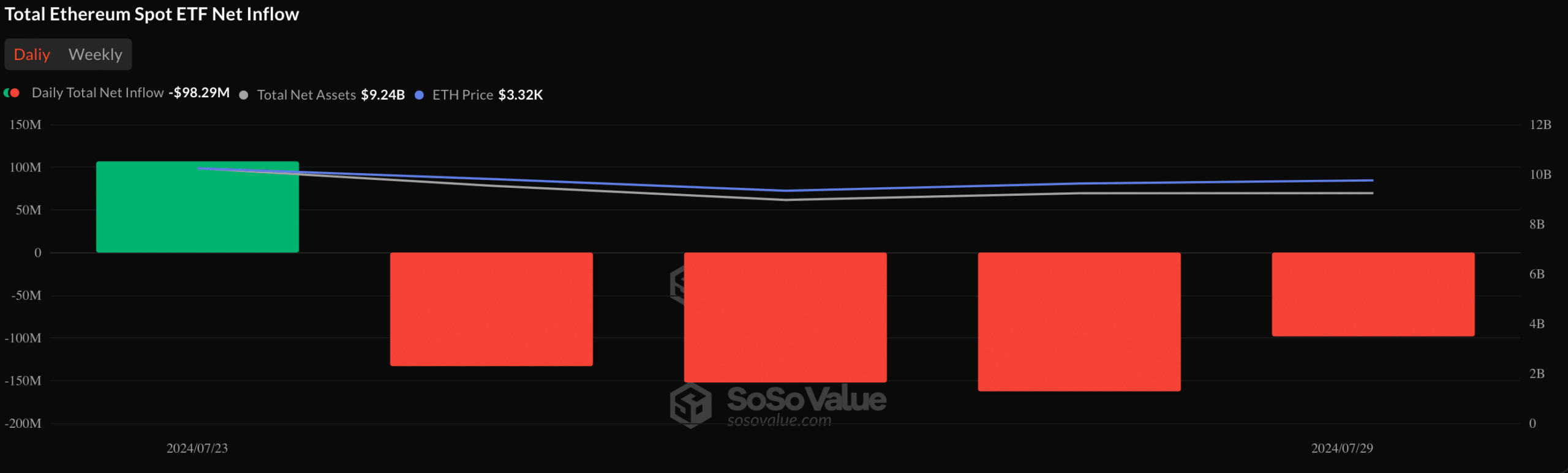

While BTC’s average net flow remained positive, Ethereum ETFs had a different fate.

Ethereum spot ETF had total net outflows of $98.2856 million on July 29 and continued to experience net outflows for four consecutive days.

Grayscale ETF ETHE, the largest ETH ETF, had an outflow of $210 million in one day. Nevertheless, the second largest ETH ETF recorded inflows of $4.8967 million.

Source: SoSoValue

Impact of ETFs on Ethereum

The outflows of the last four consecutive days negatively impacted the chart of the king of cryptos. According to CoinMarketCapThe price of ETH fell by more than 3% last week.

The bearish price trend continued over the past 24 hours, with the token’s value plummeting by more than 1%. At the time of writing, ETH was trading at $3,322.91 with a market cap of over $399 billion.

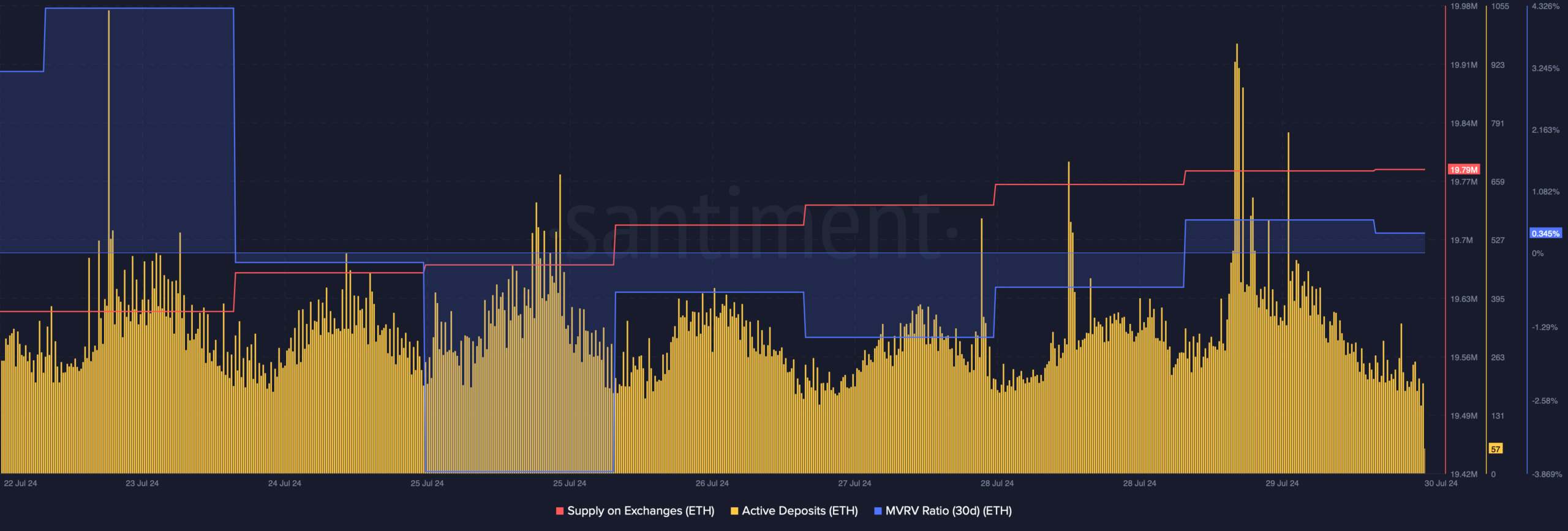

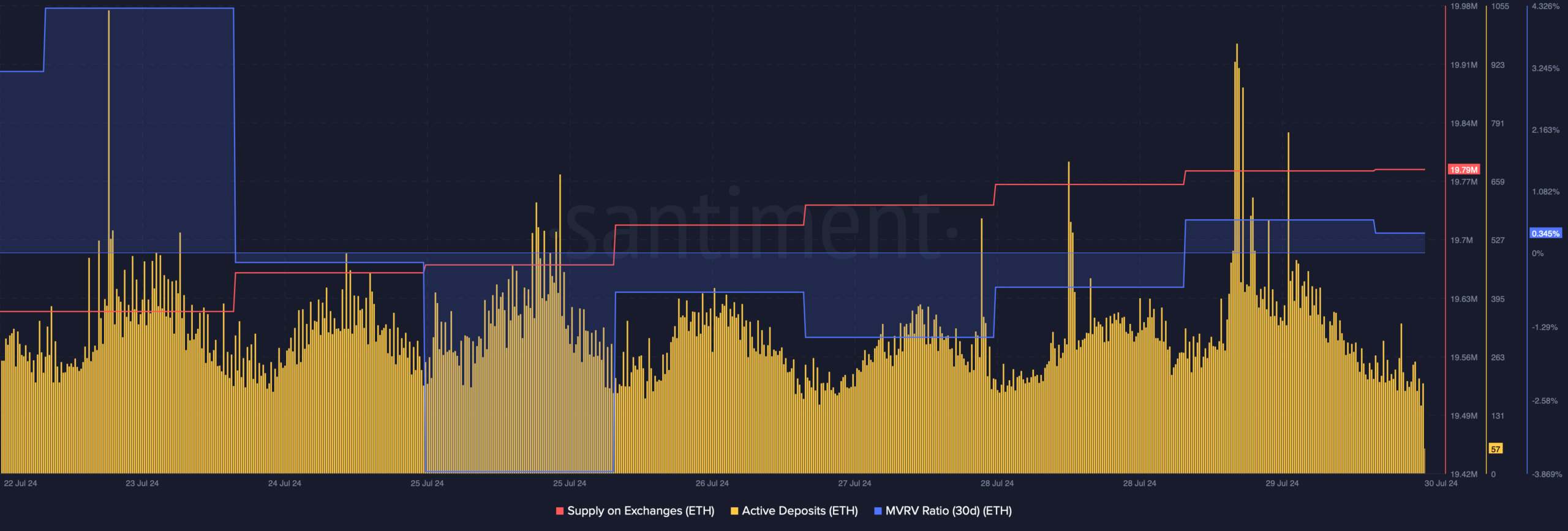

AMBCrypto then checked Santiment’s data to better understand what’s going on with the token. We found that selling pressure on the company increased as active deposits increased.

The fact that investors were selling ETH was further evidenced by the increase in supply on exchanges over the past seven days.

Nevertheless, after a major dip, Ethereum’s MVRV ratio improved on July 29, which can be inferred as a bullish signal.

Source: Santiment

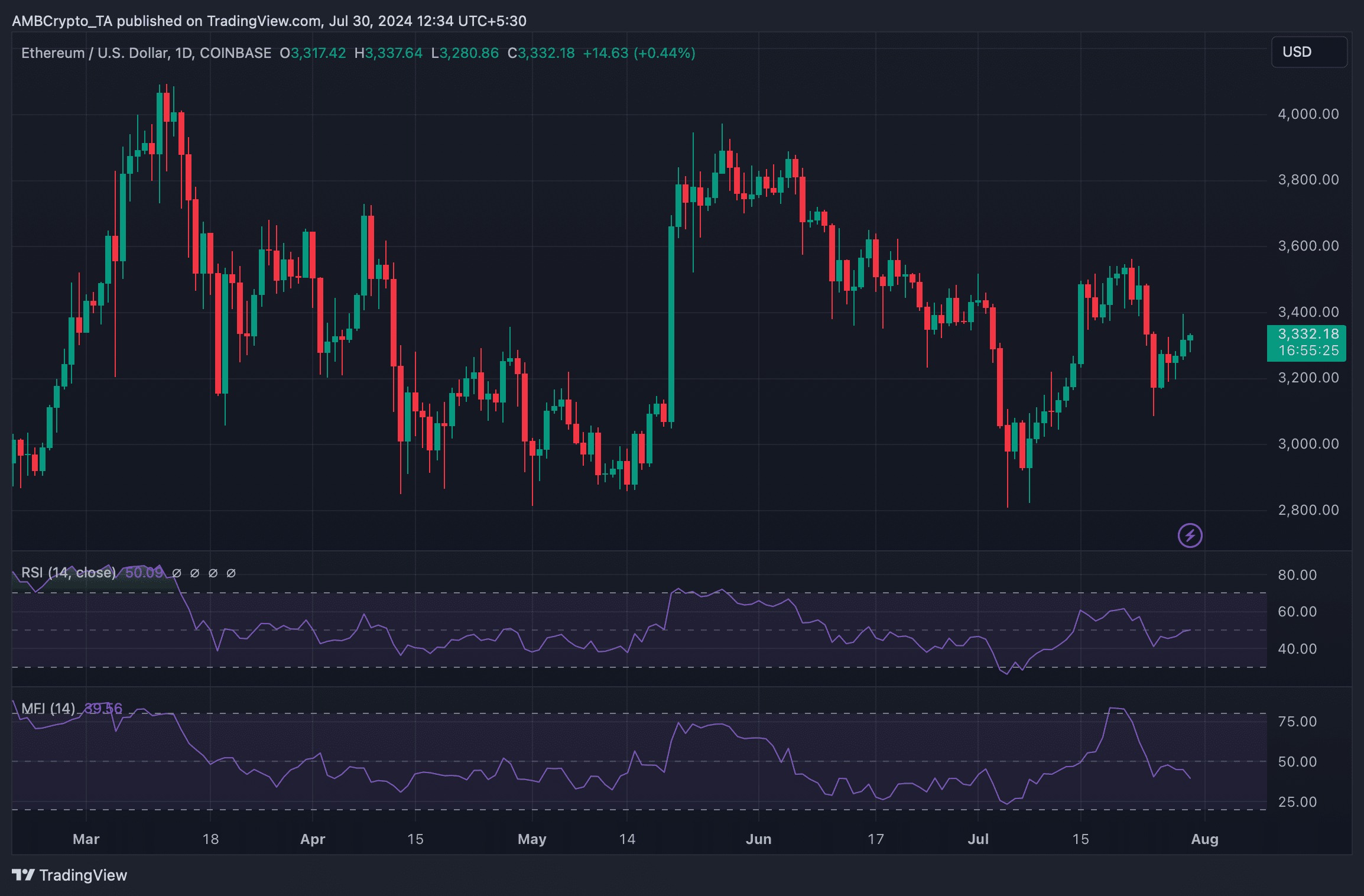

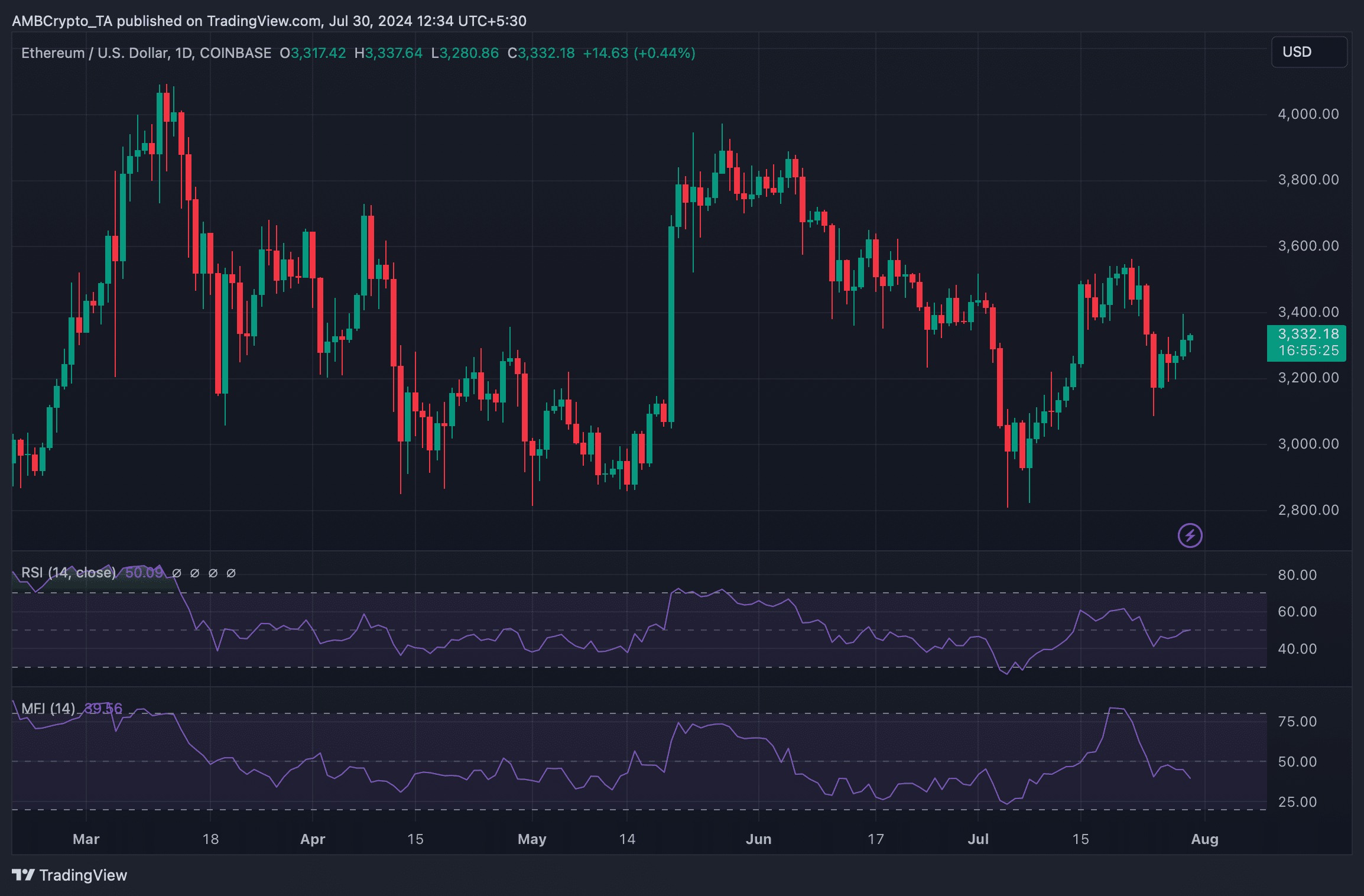

The technical indicator Relative Strength Index (RSI) recorded a sharp increase. This indicated that there was a good chance that the price of ETH would turn bullish again.

Nevertheless, the Money Flow Index (MFI) remained bearish as it headed south.

Source: TradingView

Read Bitcoins [BTC] Price prediction 2024-25

While the price of ETH fell, Bitcoin also followed a similar trend. According to CoinMarketCap, BTC has fallen by almost 4% in the past 24 hours.

At the time of writing, it was trading at $66,829 with a market cap of $1.31 trillion.