- Bitcoin ETFs are outperforming Ethereum, with BTC inflows rising, while ETH ETFs are struggling with outflows.

- Bitcoin’s dominance and first-mover advantage strengthen its lead over Ethereum in the ETF market.

Bitcoin [BTC] Exchange Traded Funds (ETFs) have had a significant impact on the crypto market and have demonstrated strong performance since their launch.

Bitcoin and Ethereum ETF Analysis

According to the latest update of Farside InvestorsBTC ETFs recorded net inflows of $252 million.

Leading the way was BlackRock’s IBIT, with $86.8 million in inflows, followed by Fidelity’s FBTC, which recorded $64 million.

However, amid this inflow race, Grayscale’s GBTC faced challenges, recording $35.6 million in outflows on August 23.

On the other hand, Ethereum [ETH] ETFs have been struggling and have mainly experienced outflows since their inception. As of August 23, ETH ETFs recorded outflows of $5.7 million.

Notably, BlackRock’s ETHA saw no inflows, while Fidelity’s FETH, Bitwise’s ETHW and VanEck managed to register some inflows.

However, Grayscale’s ETHE suffered significant outflows, recording a record $9.8 million, surpassing all other countries’ outflows. Ethereum ETFs combined.

Note about this: an X handle with the username – Crypto cradle noted,

“Last week, $ETH spot ETFs had net outflows of $44 million. $BTC spot ETFs had net inflows of $506 million.”

Not so surprising!

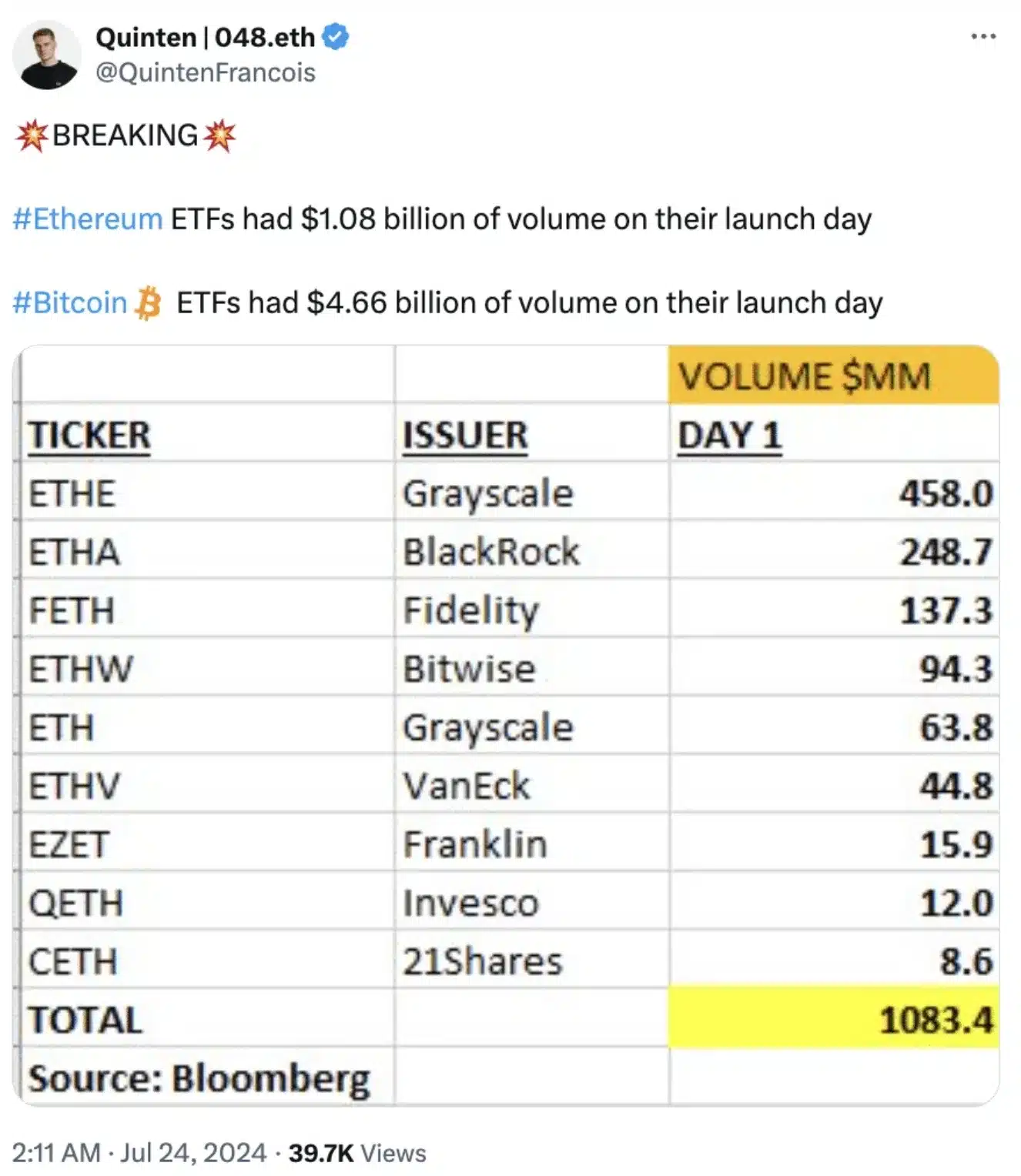

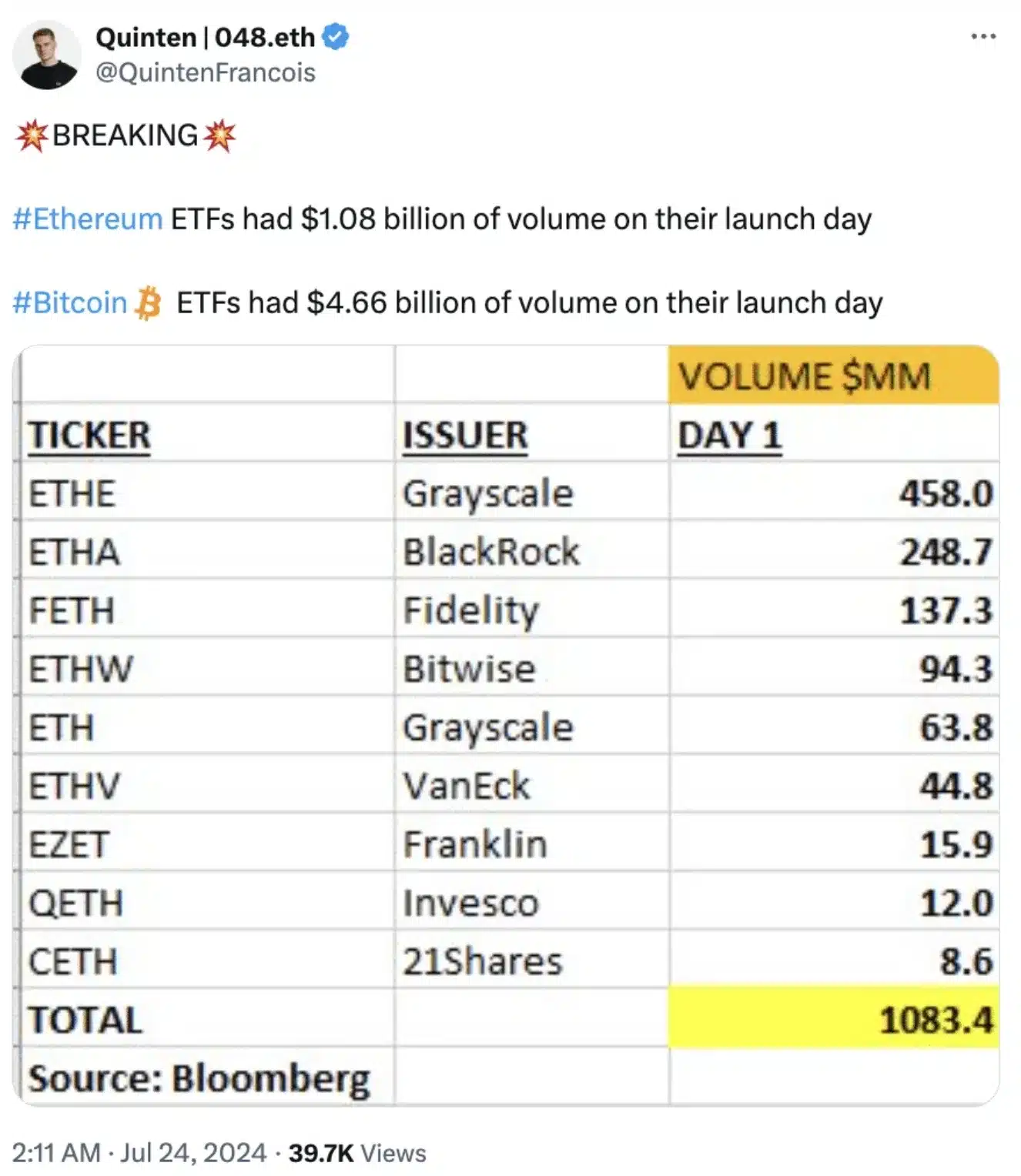

This should come as no surprise, however, as Ethereum ETFs’ trading volumes on their first day were only a quarter of what Bitcoin ETFs achieved on their debut.

Source: Quinten/X

The launch of Spot Bitcoin ETFs created a lot of excitement in the market and set a high standard that Ethereum ETFs have yet to match.

While Bitcoin ETFs have seen impressive trading volumes since their inception, Ethereum ETFs have struggled to generate similar interest, reflecting a more muted market response and indicating that they have not been able to generate the same enthusiasm.

Impact on token prices

That said, following the launch of Bitcoin ETFs in March, BTC rose to a new all-time high of $73,000.

Ethereum, on the other hand, has faced challenges and has struggled to cross the $3,000 mark.

According to the latter CoinMarketCap At the update, ETH was trading at $2,735, which remained below the previously expected $4K level.

What’s behind this?

This difference can also be attributed to Bitcoin’s established dominance and its first mover advantage, which has cemented its position as the preferred choice for many traders.

Furthermore, Bitcoin’s robust proof-of-work system, often hailed as the pinnacle of decentralization, further strengthens its appeal compared to alternatives such as Ethereum.