- The adoption of Ethereum ETF coincided with a shift in investor sentiment Bitcoin ETFs saw outflows after weeks of consistent inflows.

- The net exchange flows and long/short ratios indicated market uncertainty.

The cryptocurrency market has witnessed a significant shift in recent times. After weeks of consistent inflows, Bitcoin [BTC] ETFs have experienced their first outflows.

This change comes on the heels of Ethereum [ETH] ETF endorsement, suggesting a possible correlation between the two events.

Ethereum steals the spotlight

The adoption of Ethereum ETFs has seemingly diverted investor attention from Bitcoin. It has also led to renewed interest in Ethereum, possibly at the expense of Bitcoin’s recent momentum.

The timing of these events has led to increased speculation about a possible rotation of funds between the two leading currencies.

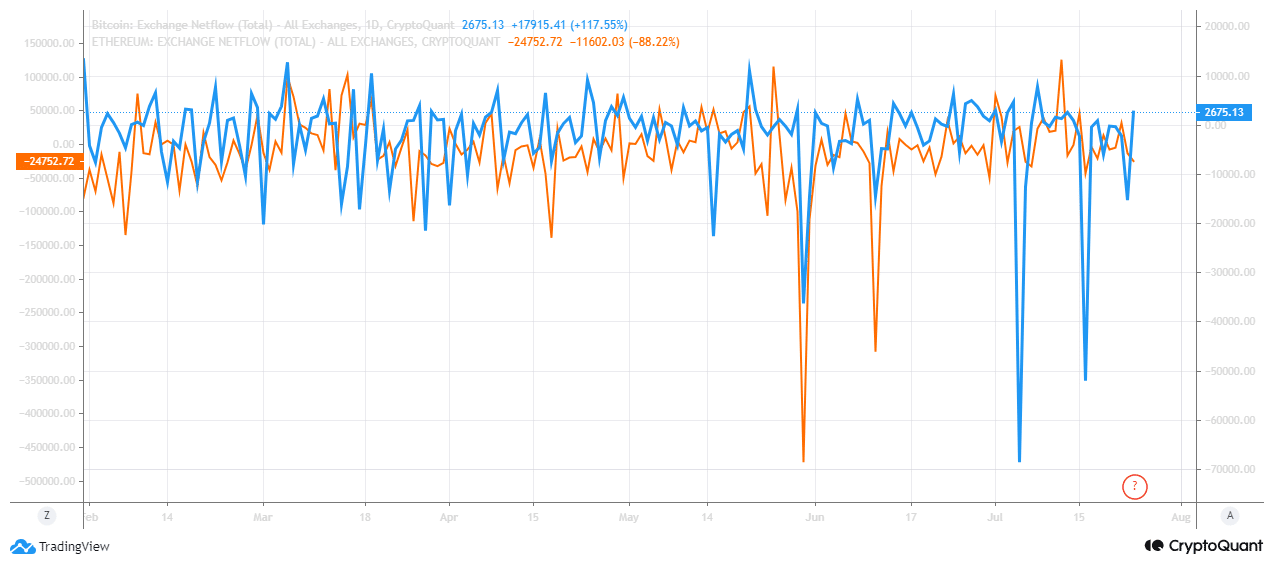

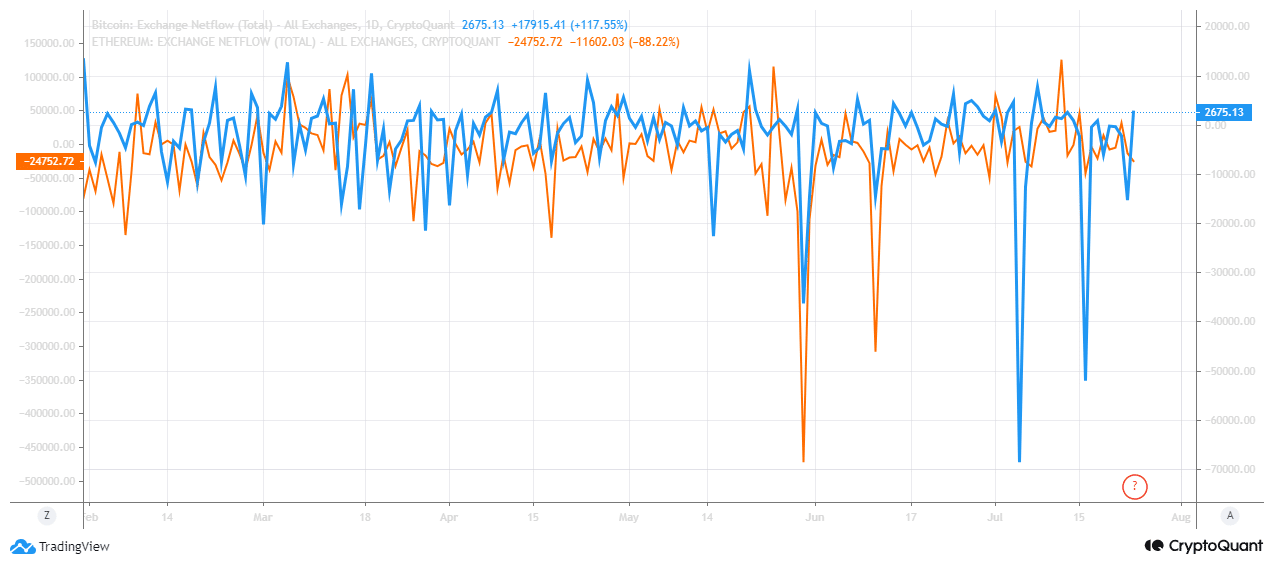

Data from CryptoQuant indicated a trend in net exchange flows. Bitcoin has seen a positive net flow of 2675.13 BTC. This means more coins are entering the exchanges instead of leaving.

Source: CryptoQuant

On the other hand, Ethereum experienced a negative net flow of -24752.72 ETH, indicating a higher volume of withdrawals from exchanges.

Furthermore, Ali Martinez tweeted that BTC was shows signs of a breakout, possibly heading to $67,000.

The RSI had already broken its descending trendline at the time of writing and now needed to cross $66,450 to confirm the bullish breakout.

Source:

BTC drops hints about market sentiment

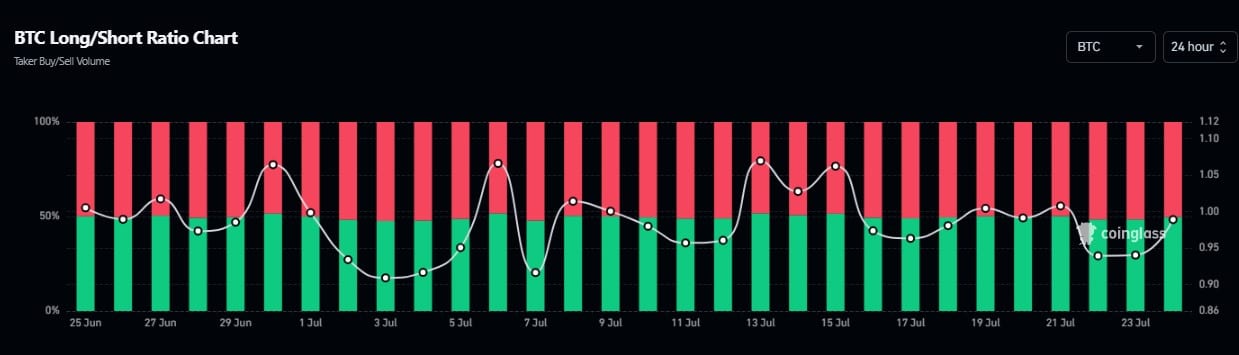

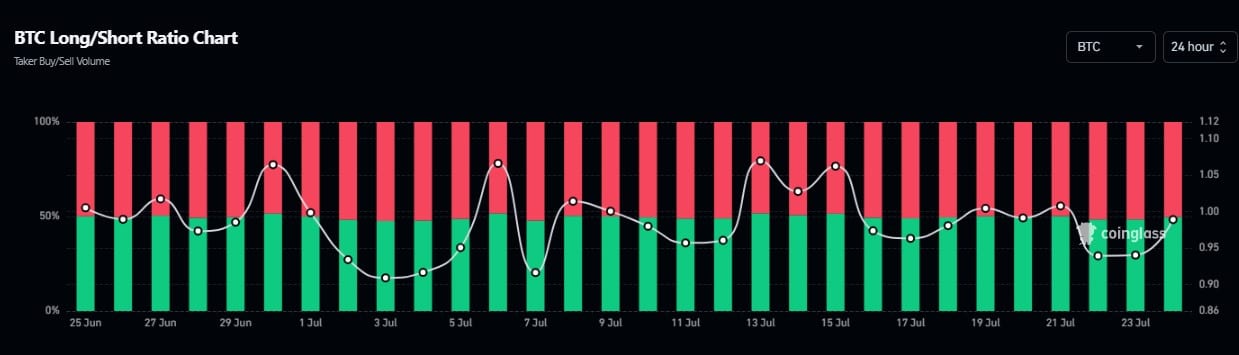

AMBCrypto’s analysis of BTC’s Long/Short Ratio Chart via Coinglass provided further insight into market sentiment.

Over the past 24 hours, the ratio has seen fluctuations, with recent data showing a slight increase in long positions. This suggested that despite ETF outflows, investors remained optimistic about Bitcoin’s prospects.

Source: Coinglass

Read Bitcoin’s [BTC] Price forecast 2024-25

Is Volatility on the Horizon?

The combination of ETF outflows, shifting net exchange flows and fluctuating Long/Short ratios painted a picture of market uncertainty.

These factors could potentially lead to greater volatility in the coming weeks as investors reassess their positions in light of the Ethereum ETF approval.