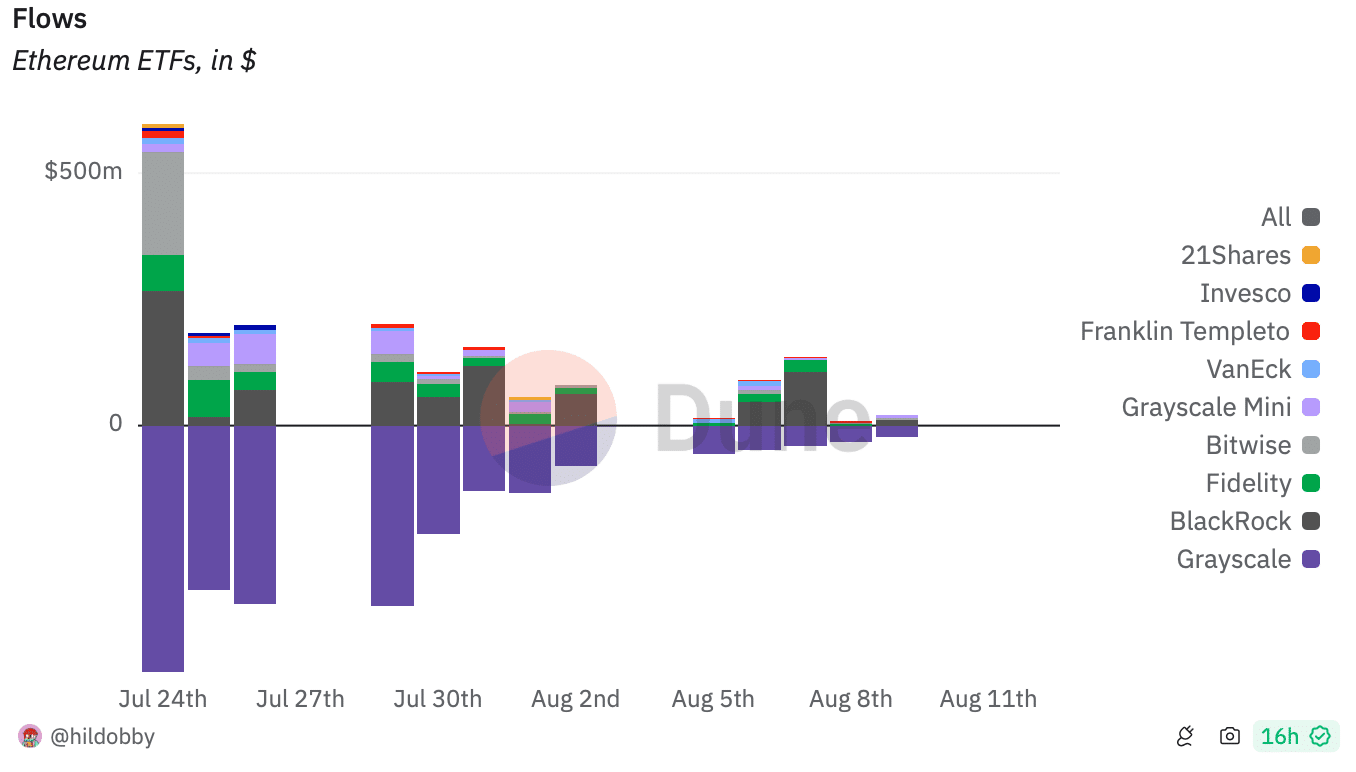

- While BlackRock’s ETF inflows increased, GreyScale’s outflows increased.

- A recent analysis found that the price of Ethereum could fall to $2k.

Ethereum [ETH] ETFs have received a lot of interest in recent months from one of the top institutional investors, BlackRock. While that was happening, the deep-pocketed players in the crypto space were also showing interest in the king of altcoins while stockpiling ETH.

Let’s take a closer look at what’s going on.

How are Ethereum ETFs doing?

BlackRock’s spot Ethereum (ETH-USD) ETF showed huge interest in ETFs as it recorded inflows worth nearly $900 million in just eleven days.

On August 6 alone, the iChare Ethereum Trust saw an inflow of over $100 million.

Interestingly, while BlackRock was accumulating, GrayScale, the largest ETH ETF, was selling. For example, BalckRock’s inflows were over $12 million on August 9, and GrayScale’s outflows were $20 million.

Source: Dune

Last week, net flows of ETH ETFs were +31.5k. On the other hand, the total net flow since launch is -124.2k, according to Dune’s facts.

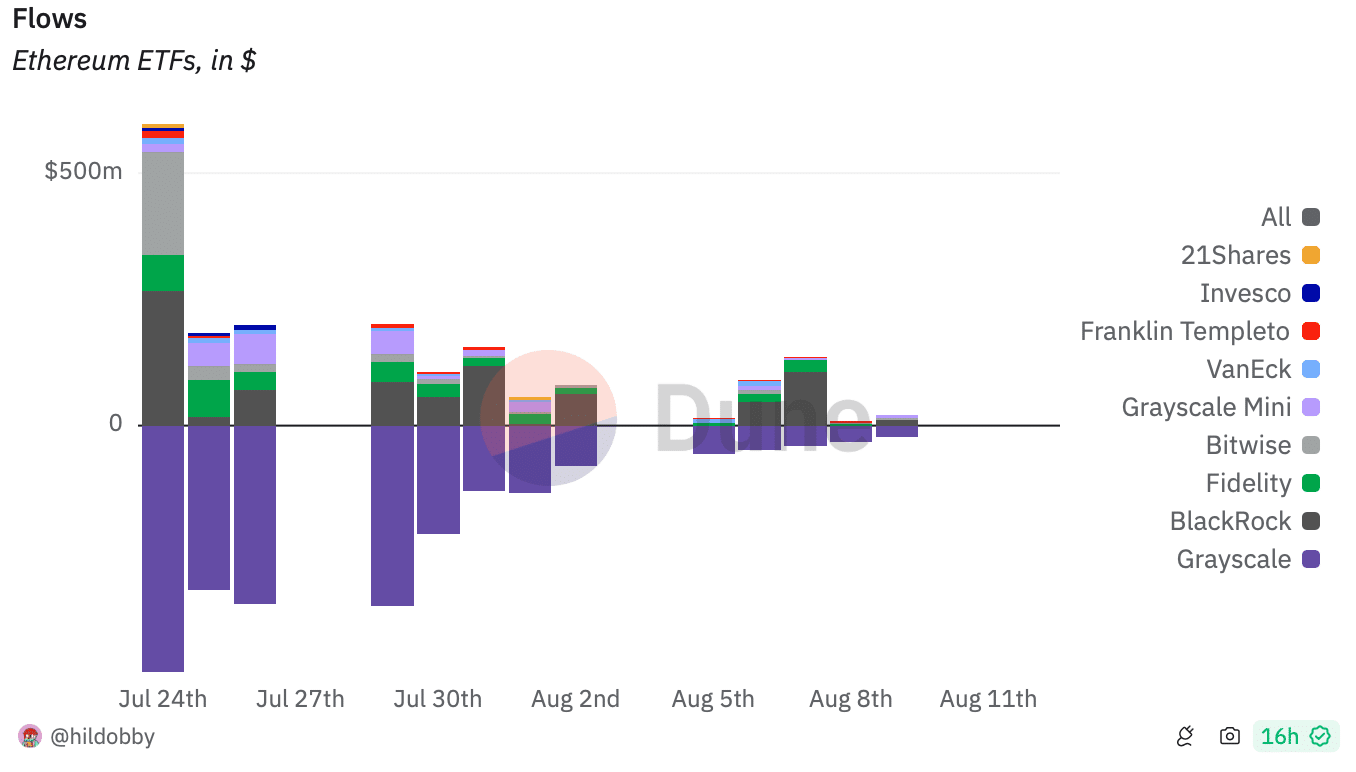

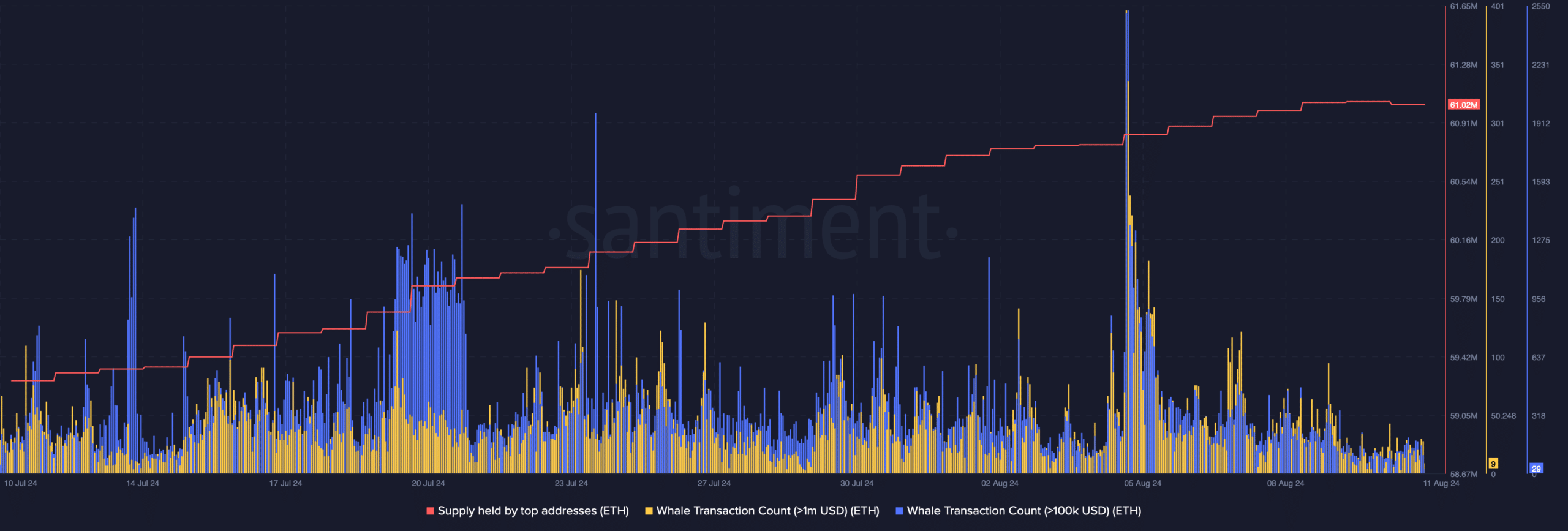

While all this was happening, ETH whales increased their accumulation. AMBCrypto’s analysis of Santiment’s data showed that the supply of ETH at top addresses increased sharply over the past month.

At the time of writing, the metric had a value of 61.2 million ETH. The number of whale transactions also increased during the same period.

Source: Santiment

A look at the state of ETH

AMBCrypto then checked the current status of ETH to see how the token has performed price-wise. According to CoinMarketCapThe price of ETH has fallen by more than 4% in the past 24 hours.

At the time of writing, it was trading at $2,543.14 with a market cap of over $305 billion.

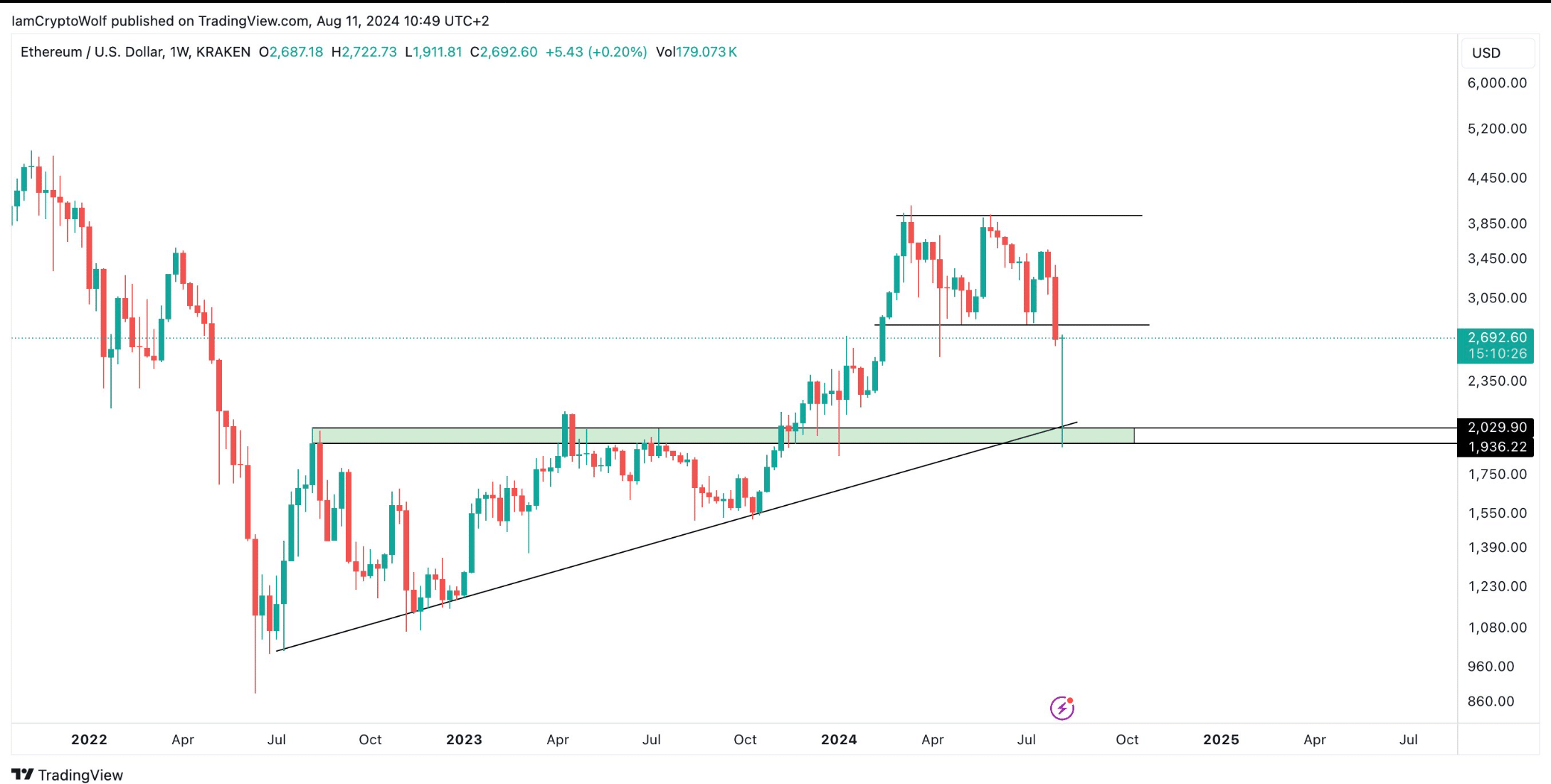

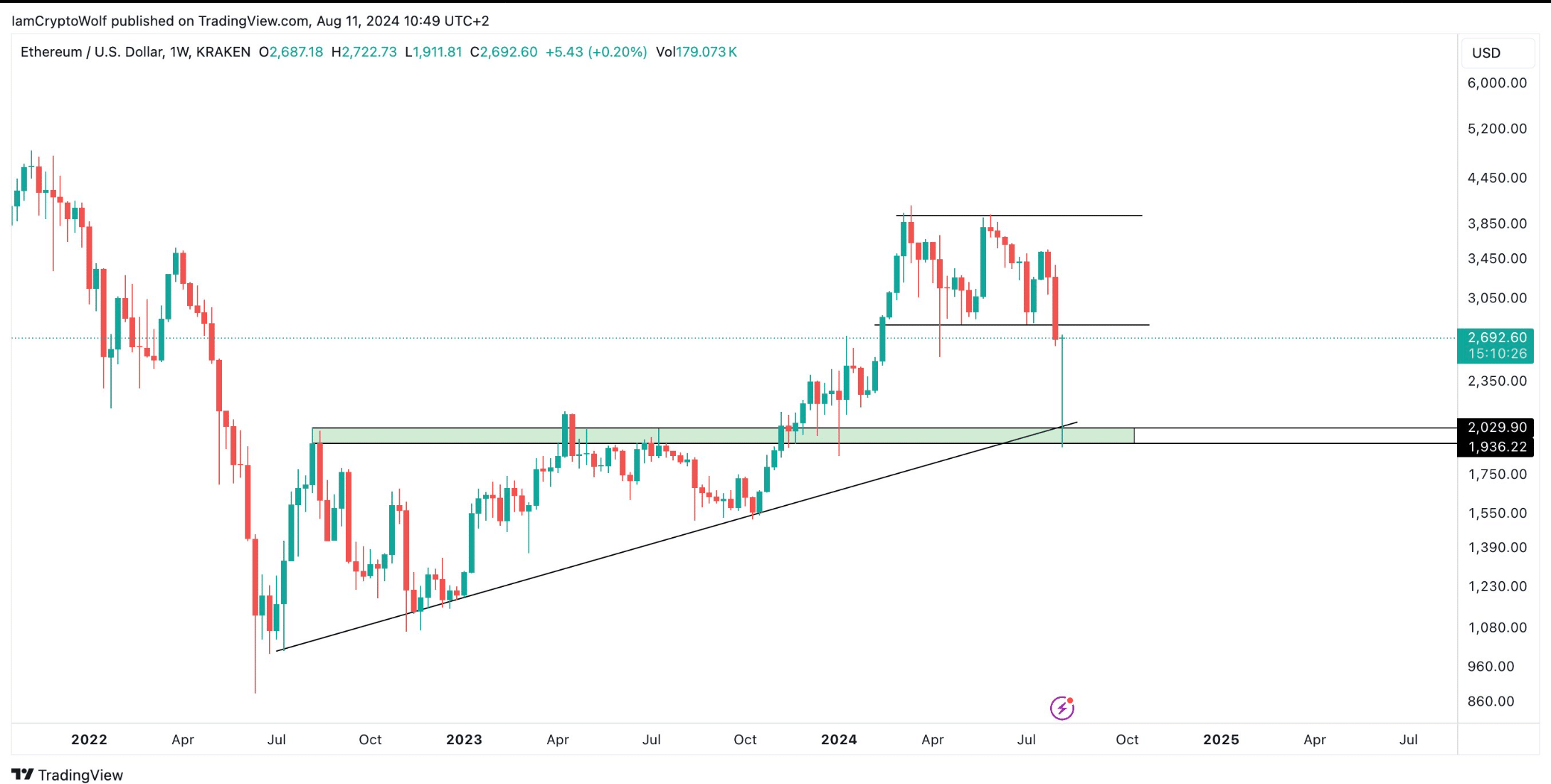

Meanwhile, Wolf, a popular crypto analyst, posted one tweet point to an important development. There were chances of a hard redound after ETH retested its ascending triangle pattern.

This meant that ETH might as well drop to $2k in the coming days or weeks before embarking on a prolonged bull rally.

Source:

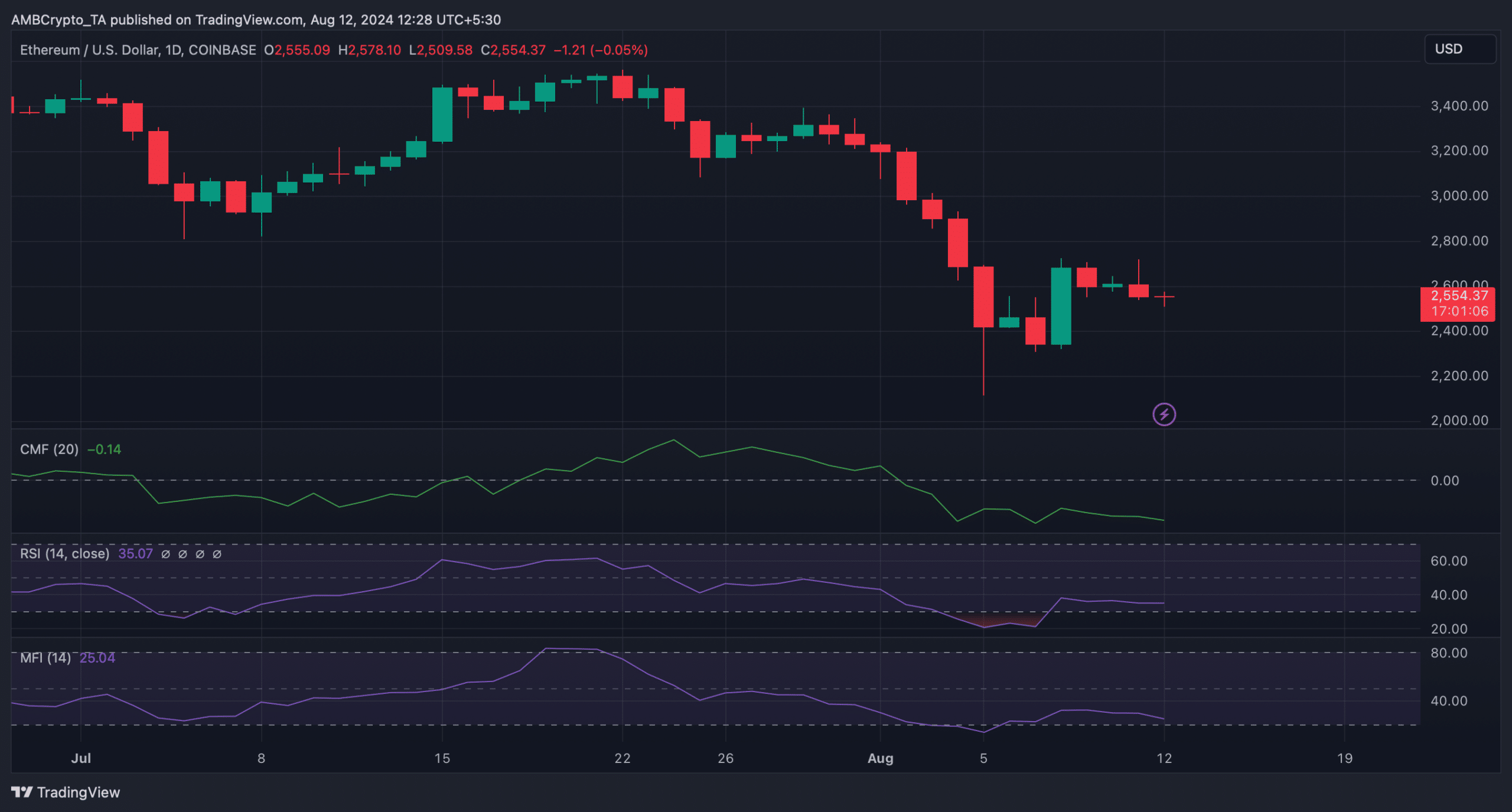

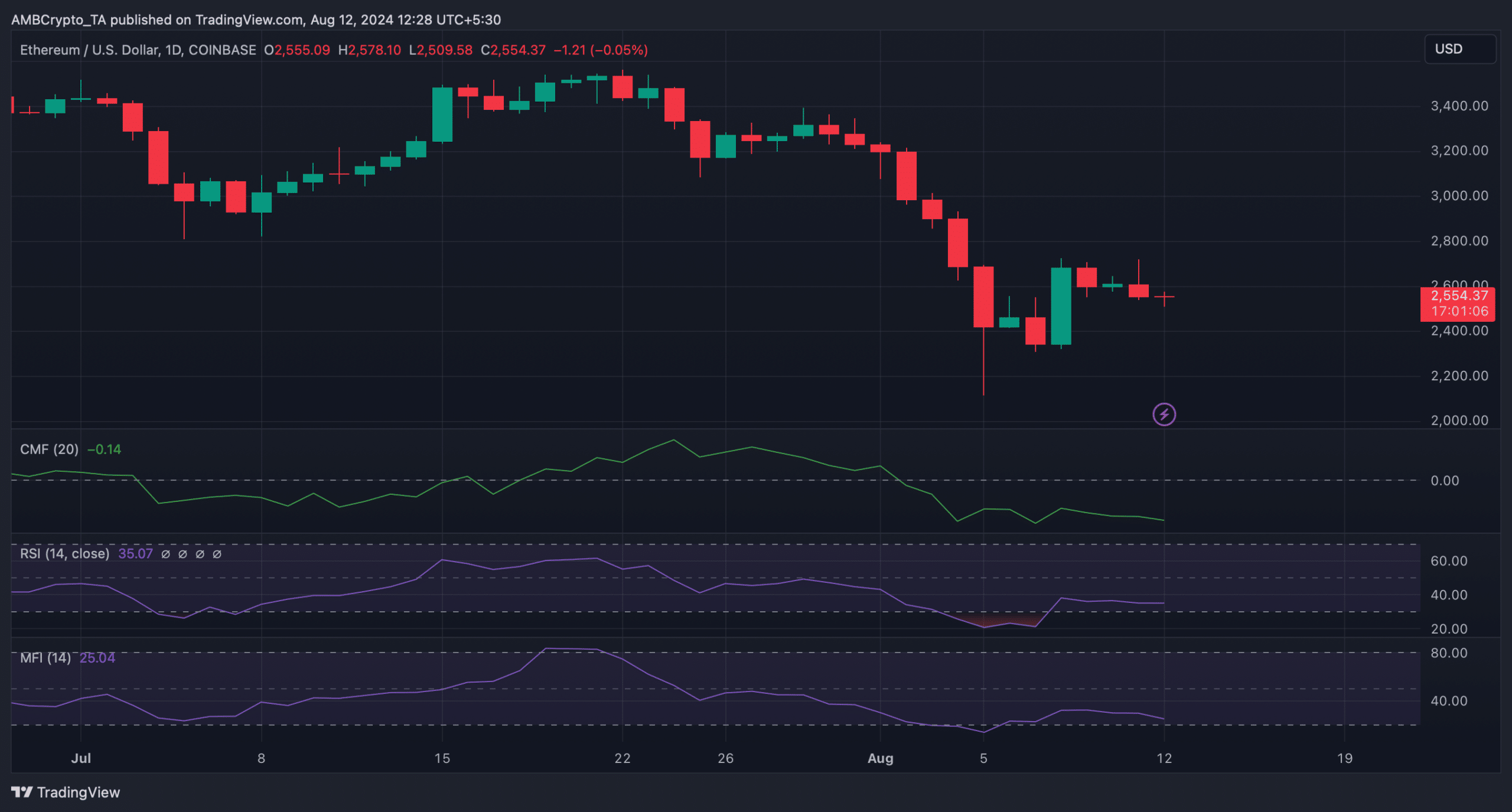

Therefore, AMBCrypto planned to take a closer look at the token’s daily chart to see if market indicators also pointed to a further price decline towards $2k.

At the time of writing, the Relative Strength Index (RSI) had a value of 35, meaning it was well below the neutral limit of 50.

Read Ethereum (ETH) Price Prediction 2024-25

Moreover, the Chaikin Money Flow (CMF) also moved south, further indicating a continued decline in prices.

Nevertheless, the Money Flow Index (MFI) was on the verge of entering the oversold zone. This could increase buying pressure and in turn increase the price of ETH.

Source: TradingView