- Volatility Shares joins other eager companies in the ETF race.

- Institutional interest in ETH is growing, but whale interest in Ethereum is declining.

Because all eyes remain on Bitcoin’s [BTC] possible ETF approval by the SEC, Ethereum [ETH] saw itself positioned to reap the benefits of this fast-growing investment avenue.

Read Ethereum’s [ETH] Price forecast 2023-2024

In the increasingly crowded landscape of ETF applications, Ethereum has become a major contender alongside Bitcoin. Volatility Shares, in particular, has recently thrown its hat into the Ethereum ETF arena.

More players join

Eric Balchunas, a prominent ETF analyst at Bloomberg, revealed that Volatility Shares had scheduled the launch of an Ethereum futures ETF for October 12. This strategic move was revealed via an SEC filing on July 28.

The proposed ETF, called Ether Strategy ETF (Ticker: ETHU), will invest in cash-settled Ethereum futures contracts. This way we avoid direct investments in the cryptocurrency itself.

VolatilityShares announced that they plan to list their Ether Futures ETF on October 12 (which would be a day or two ahead of the rest of the pack (if the 75 days are adhered to).. they did the same with $BITX pic.twitter.com/hhFtk32f4X

— Eric Balchunas (@Eric Balchunas) August 15, 2023

While this may seem like a unique approach, Volatility Shares made waves earlier with the launch of the first 2x bitcoin-linked ETF (BITX) in July. This foray solidified the company’s presence in the landscape of crypto-related ETFs.

However, Volatility Shares is far from alone in this Ethereum ETF race. Other prominent financial players, including Bitwise, VanEck, Roubhill, ProShares and Grayscale, have also thrown their hats in the ring by filing their own filings with the US SEC.

This wave of institutional interest in Ethereum could significantly affect its trajectory. The introduction of Ethereum-focused ETFs could increase its appeal to a wider range of investors, potentially boosting demand and boosting its value.

Whales swim away

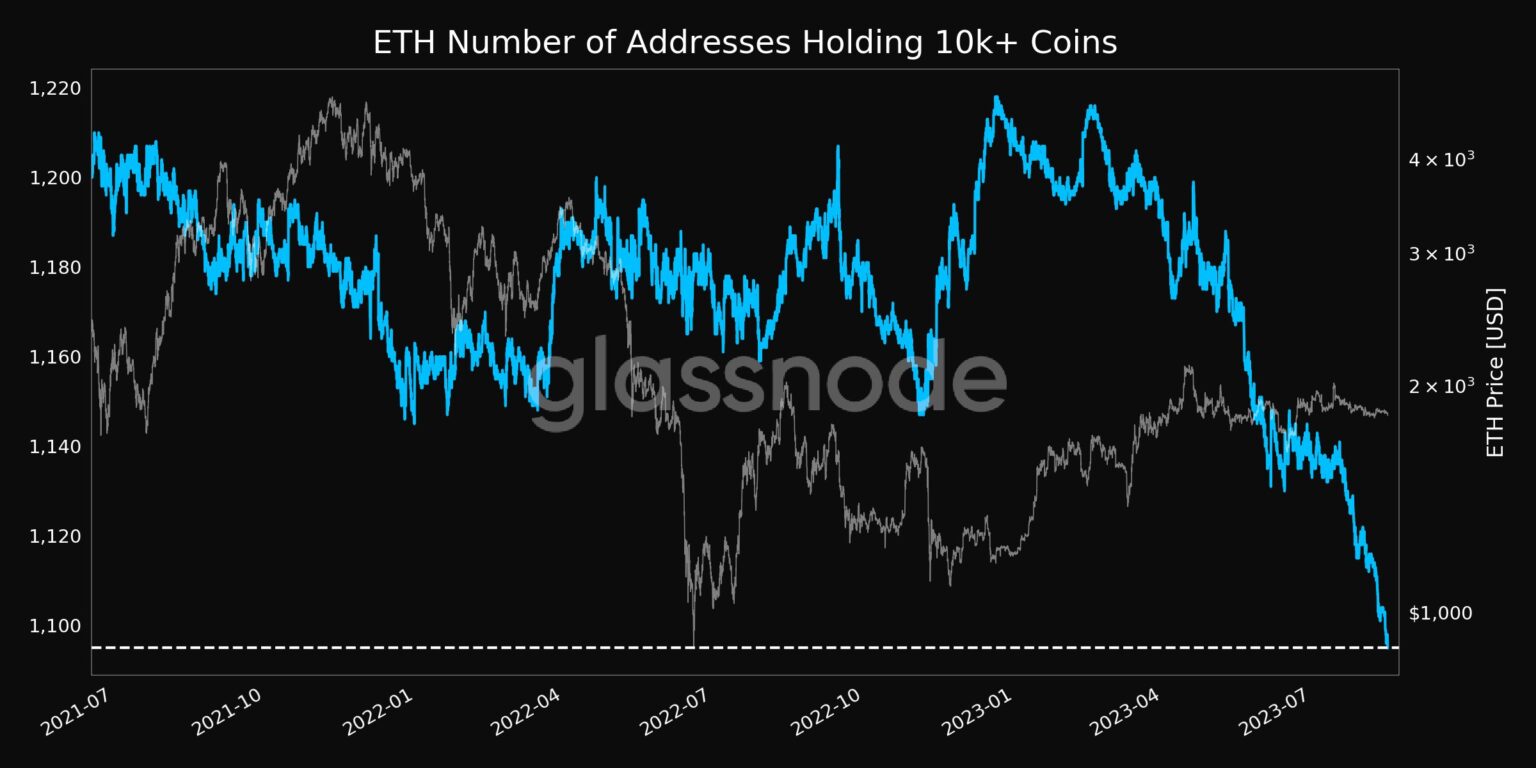

Despite this promising institutional interest, an intriguing contrast emerged. Glassnode’s data revealed a decline in whale interest in Ethereum, with the number of addresses holding more than 10,000 ETH hitting a two-year low of 1,095.

Source: glasnode

At the time of writing, Ethereum’s trading price stood at $1830.8 and has been moving relatively sideways over the past week. The market value to realized value (MVRV) ratio, a key indicator of address profitability, tended largely to negative. This indicated a reduced incentive for most holders to sell.

Realistic or not, here is the market cap of ETH in terms of BTC

The long/short ratio for Ethereum increased over the same period, indicating a growth in the number of long-term holders. This could potentially translate into less impulsive sell-off by short-term holders, fostering greater price stability.

Source: Sentiment