- ETH ETF’s first-day results exceeded analyst expectations of 15-15% of BTC ETFs.

- BlackRock’s ETHA led the way, but Grayscale caused an outflow of almost half a billion euros.

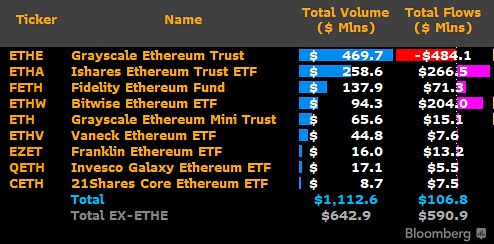

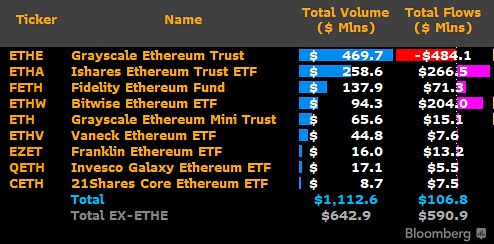

American place Ethereum [ETH] ETFs had a notable debut, with trading volume exceeding $1 billion. Grayscale’s ETHE, along with BlackRock and Fidelity ETH ETFs, recorded more than $100 million in trading volumes on Day 1.

The rest, including Vaneck, Franklin and Invesco Galaxy, saw their ETFs reach daily trading volume above $10 million, excluding 21Shares.

From a flow perspective, Bloomberg facts revealed that the products generated $107 million in net inflows, with $266.5 million from BlackRock’s ETHA and $204 million from Bitwise’s ETHW.

Source: Bloomberg

However, Grayscale’s ETHE was the only one with outflows totaling $484.1 million, while the mini version recorded inflows of $15.1 million.

ETH ETF’s first-day results beat analyst estimates

Despite Grayscale’s outflows, trading volume of more than $1 billion and net flows of more than $100 million exceed analyst estimates.

Bloomberg analyst Eric Balchunas had already said this earlier projected that the products would outperform their “20% of BTC ETF” estimates if BlockRock exceeded $200 million in volume.

“Using BlackRock’s ETF as a proxy, $ETHA volume will be approximately $50 million after the first hour. If it can cross $200 million per EOD, it will outperform our ‘20% of BTC’ estimate (since $IBIT did $1 billion in its first day).”

Interestingly, ETHA reached $258 million in volume at the end of Tuesday’s trading session. That translates to about 26% of BlackRock’s first-day IBIT volume, beating estimates.

Commenting on the great results: Zaheer Ebtikar from crypto hedge fund Split Capital also reiterated that its Day 1 results outperformed analyst estimates.

“The final numbers from our side show total volume of approximately $1.3 billion for ETH ETFs. About 28% of BTC’s debut and substantially higher than most estimates, between 15 and 20%.”

Some products, like Vaneck Ethereum ETF (ETHV), even eclipsed their BTC ETF based on Day 1 performance. Commenting on the explosive results, VanEck’s head of digital asset research Mathew Sigel said he’prideof the party.

“And proud to see $45 million worth of $ETHV traded, surpassing our $HODL volumes of $26 million on Day 1!”

However, Grayscale’s ETHEs fears of outflow appear justified after an outflow of $484.1 million on the first day. This far exceeded GBTC’s $95.1 million outflow in its January 11 debut.

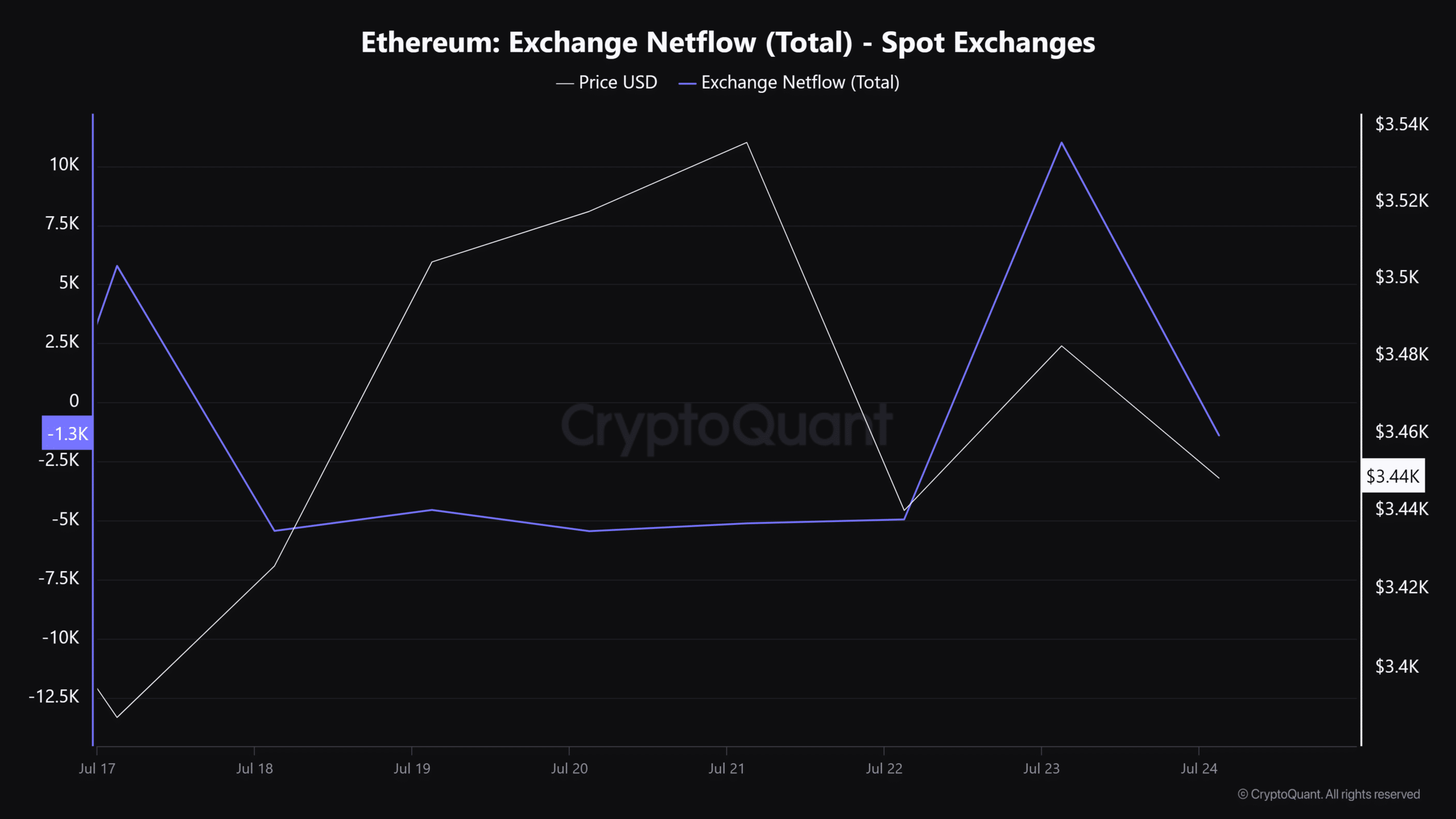

Meanwhile, ETH price rose negligibly on the ETF debut day. It rose 1.25% to reach $3.54k, but fell slightly below $3.5k at the time of writing.

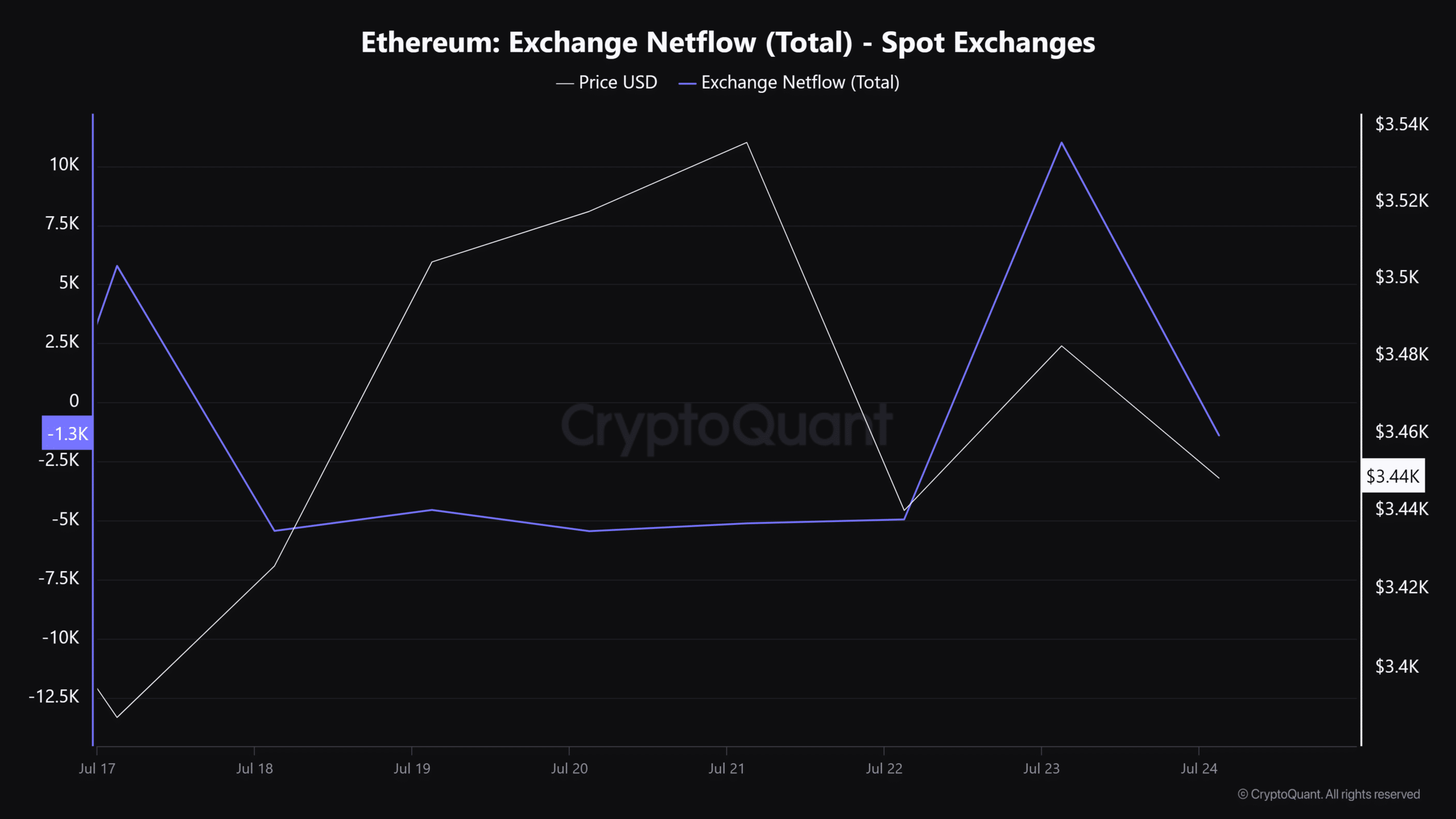

However, the ETH spot market did not experience significant selling pressure after the ETF debut, as evidenced by a decline in Exchange Netflow.

This meant that more ETH was being taken off the exchanges than put in, underscoring the increased accumulation of ETH into personal wallets.

Source: CryptoQuant