- Grayscale’s has a hefty 2.5% fee, 10x higher than the competition.

- BlackRock fees are set at 0.25% as the market expects outrage from Grayscale.

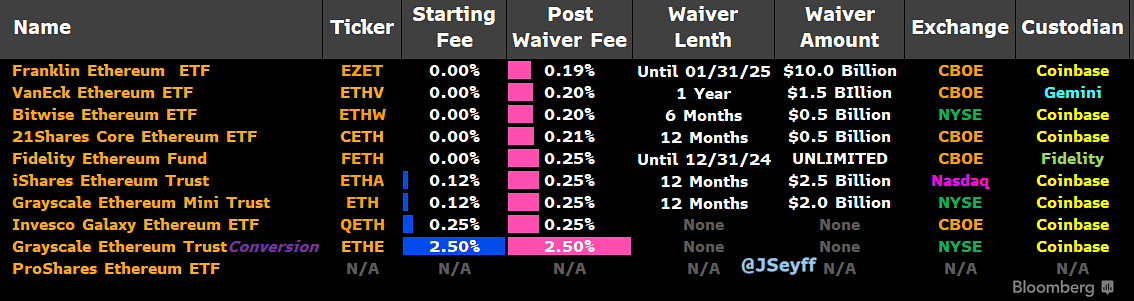

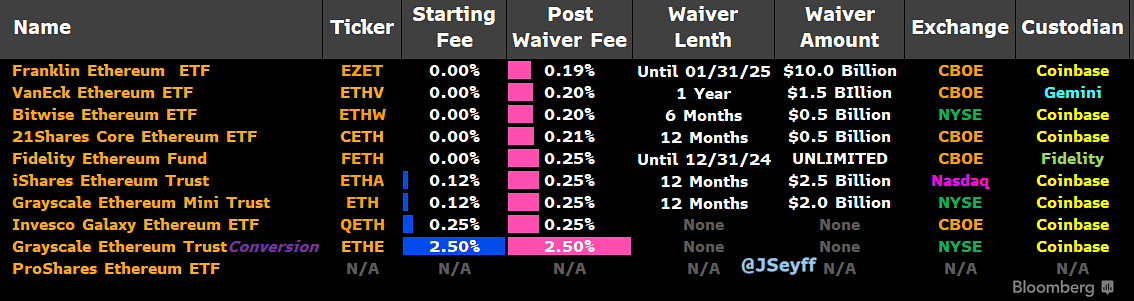

Potential Ethereum [ETH] ETF issuers updated their fee structures on Wednesday as the market prepares for possible S-1 approvals and the products’ July 23 launch.

So says Bloomberg ETF analyst James Seyffartapproximately seven issuers have waivers based on the period or assets held.

However, Grayscale’s ETHE had the highest fees at 2.5%, while BlackRock’s iShares Ethereum Trust pegged fees at 0.25% post-waiver.

Source: X/James Seyffart

Unlike BlackRock’s initial fee of 0.12% for 12 months, if net assets are less than $2.5 billion, Grayscale’s ETHE will maintain 2.5% for the entire period after converting its trust to ETF on 23 July.

Ethereum ETF fee wars

This has angered market commentators. One observer, Nate Geraci of ETF Store, called Grayscale’s move a “huge miss‘ and that it was disappointing.

Bloomberg ETF analyst Eric Balchunas, for his part, warned that Grayscale’s fees were “10x higher than the competition” and “outrage flowswere likely.

“Shades of gray do not decrease at all. This means they are 10x higher than the competition. Wow. There will probably be some outrage. I suspect the Mini ETF will be dirt cheap, perhaps 15 basis points. There’s an interesting dynamic at play.”

For perspective, the Grayscale Ethereum Mini Trust (ETH) did indeed have a similar fee structure to BlackRock: 0.25% with 0.12% as a starting fee. The Mini Trust will do that Reportedly be split off after the conversion of ETHE.

“10% of $ETHE will automatically be converted into $ETH. $ETHE currently has $10 billion in assets. So $ETH would essentially have to start life with $1 billion in assets.”

However, despite the Mini Trust’s lower fees, some market observers predicted massive outflows from ETHE.

According to HODL15 Capital estimatesETHE outflows could reach 50%-60% due to high fees.

“Will Grayscale Replicate $GBTC’s Mistake with $ETHE? If so, expect 50%-60% outflows 👇 Just over $10 billion under management.”

Source: HODL15Capital

Meanwhile, SEC Commissioner Hester Peirce has done just that declared that ETH ETF stake could be open to reconsideration amid looming political changes in the US

On the price front, ETH’s recent recovery has hit resistance at $3.5K. The second largest digital asset was trading at $3.4K at the time of writing and could only target $4K if it were to reach $3.5K.