- Ethereum falls under the realized price and signal potential capitulation and possible market base.

- Whale accumulation during the dip of Ethereum suggests a chance for long -term buyers despite market panic.

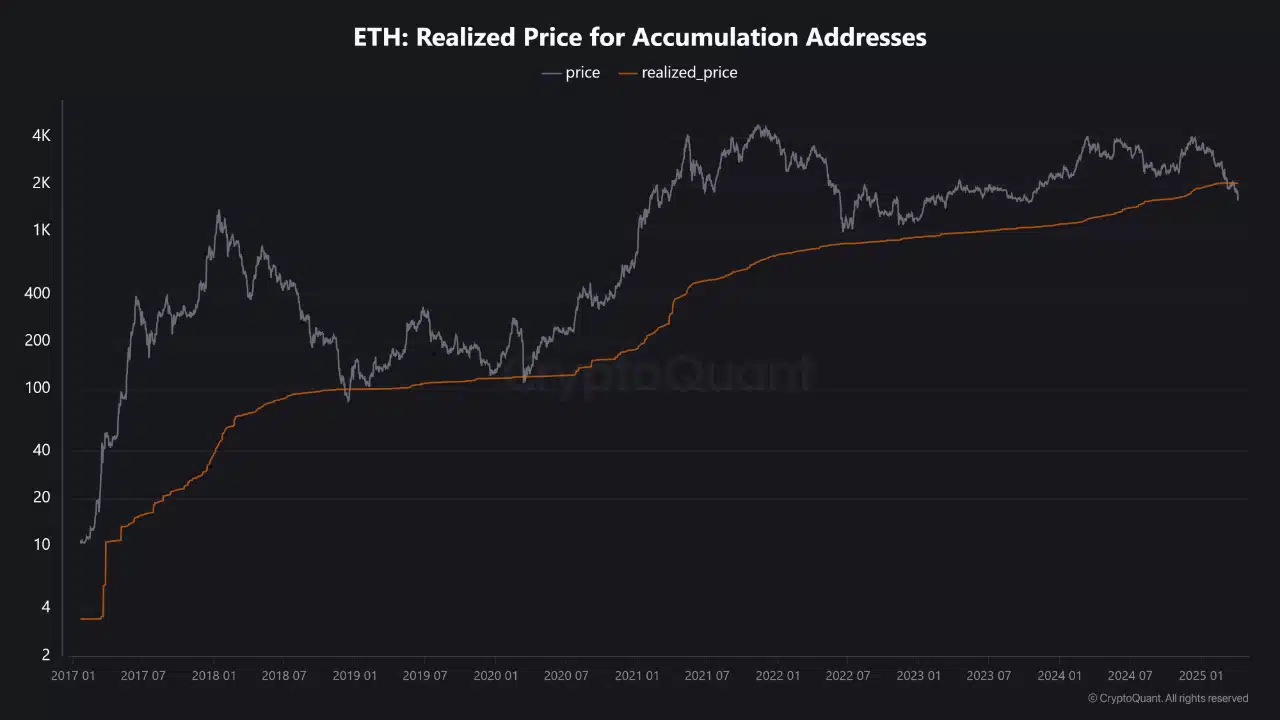

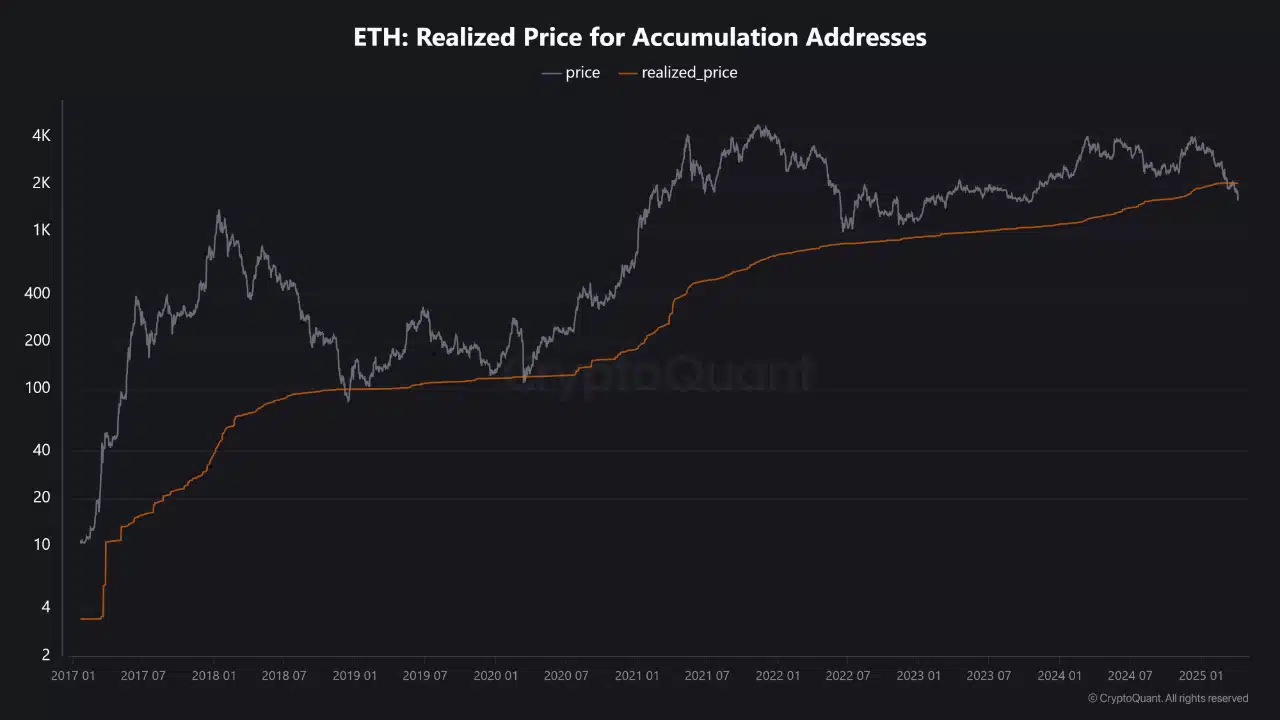

Ethereum [ETH] Has slid under the realized price for the first time since March 2023 – a level that historically indicates the capitulation of investors and potential market bases.

This drop comes in the midst of a wave of Altcoin sale, caused by the fading of optimism of the mutual rate of President Trump.

With the ETH/BTC ratio at a low-five-year low and market sentiment that Tilts Bearish, the fears spread. But while retail investors flee, data on chains reveal whales that quietly accumulate.

Is the collapse of Ethereum a final dip before recovery – or the start of a deeper demolition in Altcoin’s confidence?

Ethereum: A sign of capitulation

For the first time in more than a year, the market price of Ethereum has fallen Under the realized price For accumulation addresses – a level that usually indicates a deep market stress.

This statistics reflects the average cost basis of long -term holders who are known for buying and keeping ETH through volatility.

Source: Cryptuquant

Such cross-overs have traditionally been crucial moments in the price cycle of Ethereum, often coincide with capitulation zones and long-term soils.

The data shows that ETH is immersing below this important level of support, a development that could either cause further loss-driven sales or if a stealth buy signal for optimists in the long term can serve.

Where panic

Every time Ethereum has fallen under the realized price-as can be seen in 2018, mid-2020 and at the end of 2022-it will be marked the tail end of brutal down rends and the start of powerful recovery.

These dips often signal capitulation, in which weaker hands go out and long -term believers come in quietly.

Although today’s price action can feel like a crisis, patterns suggest in the past that it can be a disguised chance. Smart Money has treated these moments historically as access points with a lot of conviction and not.

If history repeats itself, Ethereum approaches one of those rare accumulation windows before the next upward trend unfolds.

Whales step in

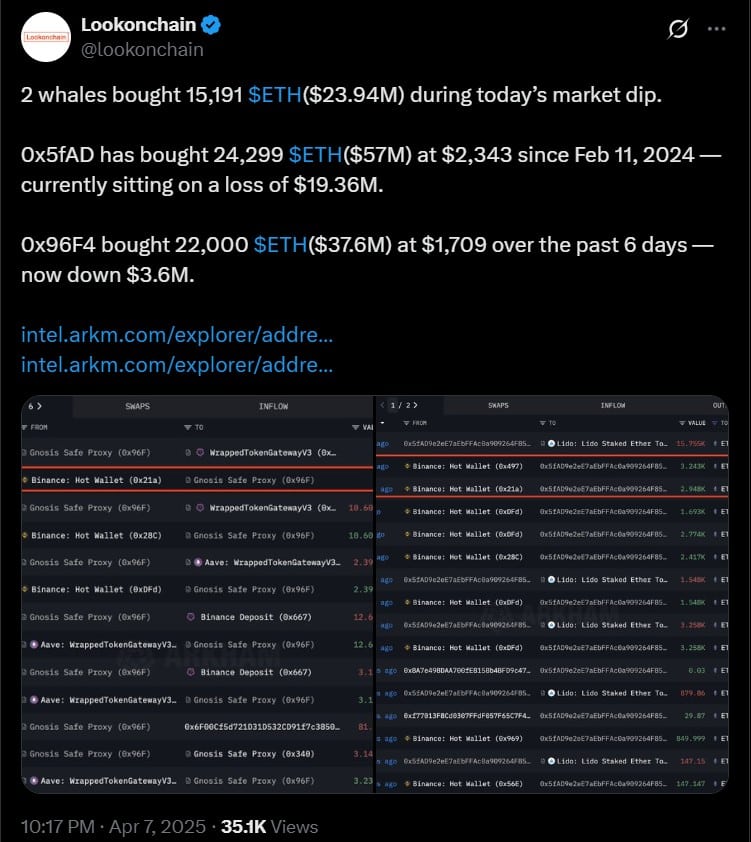

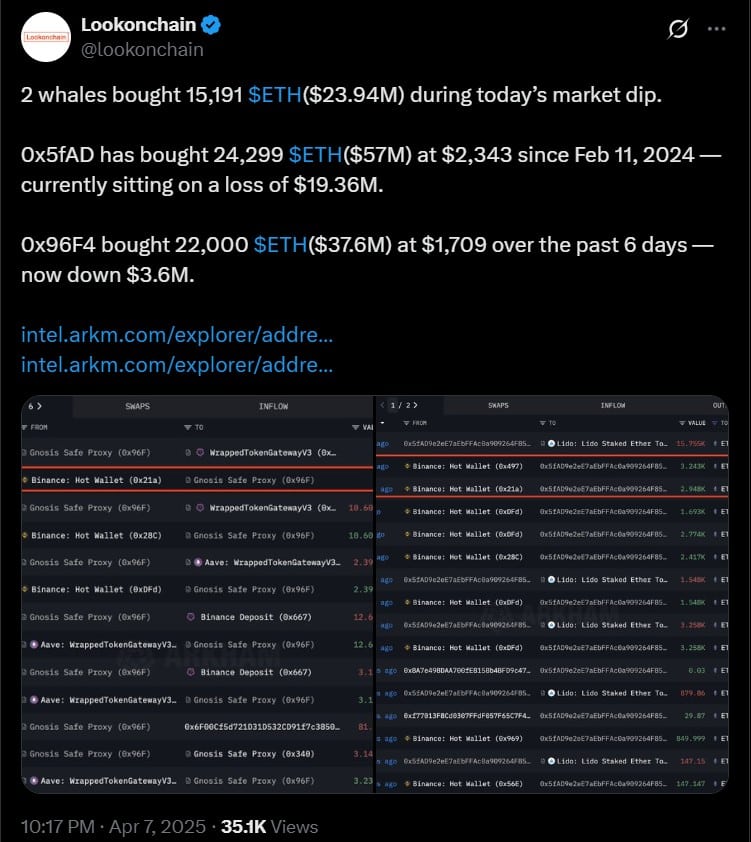

While Ethereum fell below $ 1,600 on 7 April, whale activity rose dramatically. Data on chains Shows two large entities collected 15,191 ETH – worth around $ 23.94 million – in the midst of the dip.

Source: X

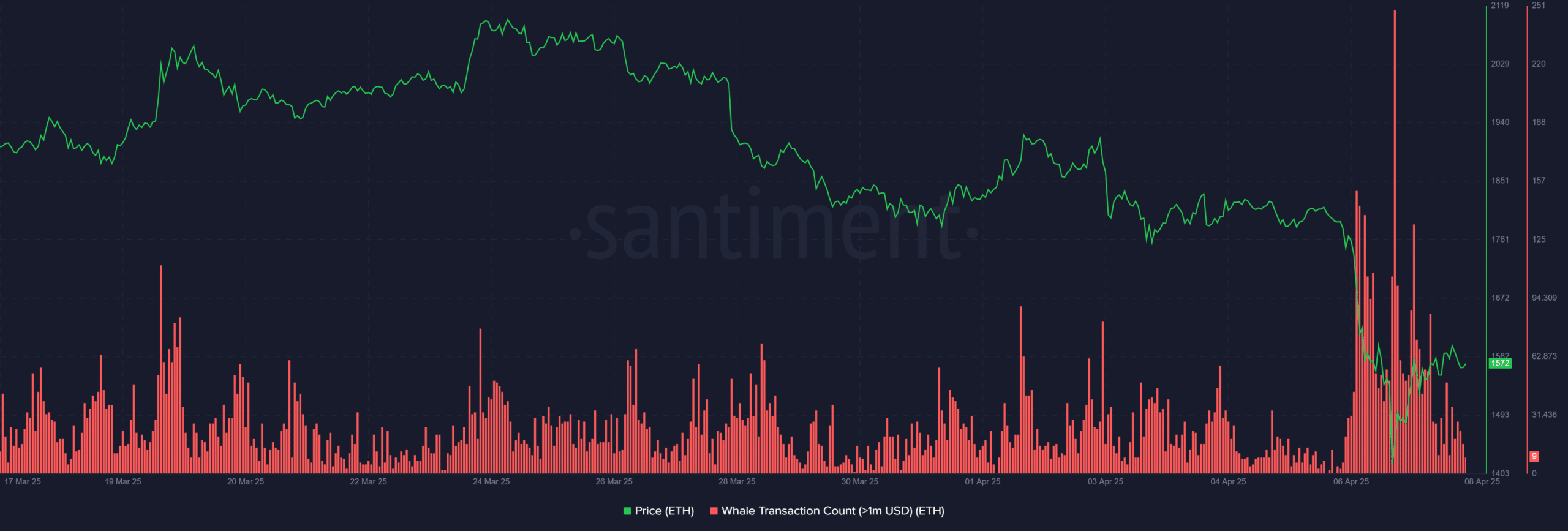

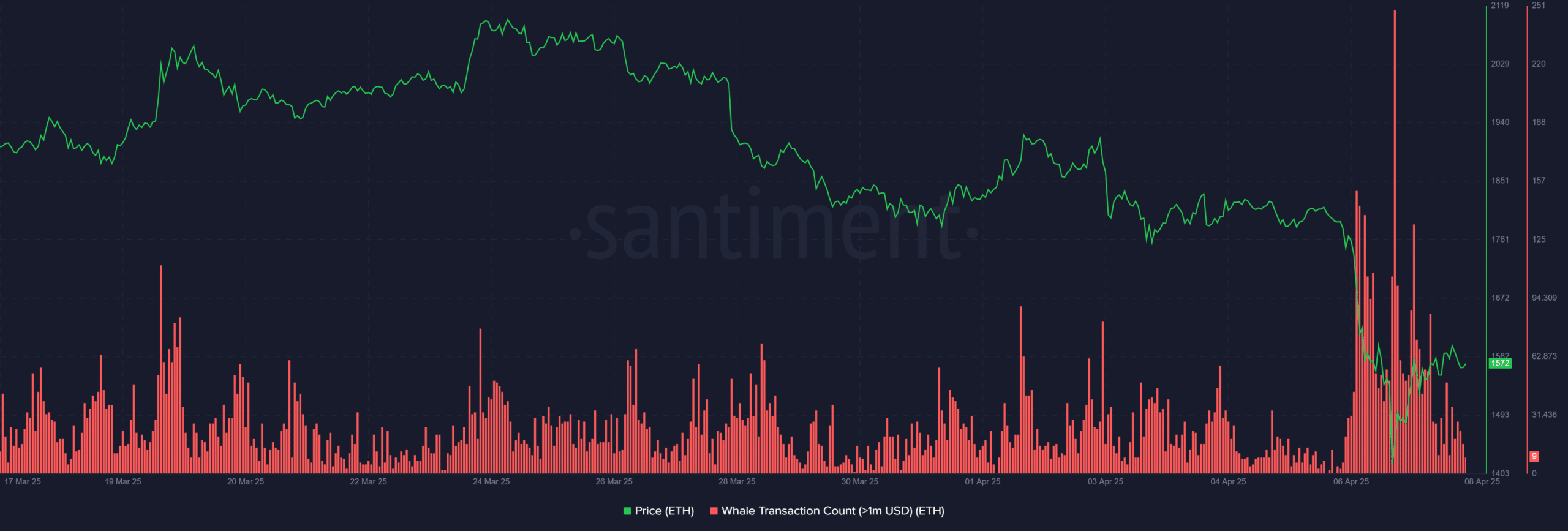

Santiment data unveiled a remarkable peak in whale chanties of more than $ 1 million, in accordance with the price base.

Source: Santiment

Historically, such large -scale purchases during times of fear often precede market stabilization or reversal.

Although the retail sentiment remains shaky, this kind of conviction of players with a high cap can show that the current levels of Ethereum are considered undervalued and potentially opportunistic.

Market lose trust in Ethereum?

The weekly ratio of Ethereum against Bitcoin has fallen to 0.12 levels that have not been seen since the beginning of 2020. The persistent downward trend, which is eager for two years, indicates a deep erosion of relative strength.

Once praised as the primary rival of Bitcoin, ETH now performs chased in the middle of the shifting from investor preference to BTC and newer L1S.

Source: TradingView

The breakdown suggests a structural loss of trust in the story and the usefulness of Ethereum, without clear reversal in sight.

Unless ETH will soon be back on important historical levels, the market can continue to run the capital – a sobering signal for Ethereum Bulls.