- ETH has fallen by 19% in the past month.

- Although Ethereum experienced a strong downward pressure, an analyst looks at a historic rally.

Since he hit a local highlight of $ 3.4ka week ago, Ethereum [ETH] has experienced a strong downward pressure. After the market crash that the Altcoin Dip saw up to $ 2.1k, it did not reclaim a higher level of resistance.

At the time of writing, Ethereum traded at $ 2,695, which marked a decrease of 5.05% in daily cards. The Altcoin has also fallen on weekly and monthly charts with 16.51% and 19.11% respectively.

With the recent fall in price, important stakeholders have divided both optimistic and pessimistic views of ETH in equal measures.

One of the most optimistic individuals is popular crypto analyst Ali Martinez, who has presented a big step for ETH.

Market sentiment analysis

In his analysis, Martinez Assuming that Ethereum is currently preparing for a large switch to the benefit. According to him, the prevailing conditions position ETH for a possible outbreak above $ 4,000.

Source: X

This analysis notes that if the Altcoin succeeds in violating this resistance, it will pave the way for a parabolic rally.

That is why ETH would rake to $ 7.4k, $ 10k, and hit a historic $ 14k. However, it is vital to note that these levels will take place in the long term in the short term in the long term.

Could Ethereum see a strong rally?

Although the analysis of Martinez provided above offers a promising prospect, the analysis of Ambcrypto tells a different story.

According to the analysis of Ambcrypto, Ethereum experienced a strong downward pressure, especially in the short term.

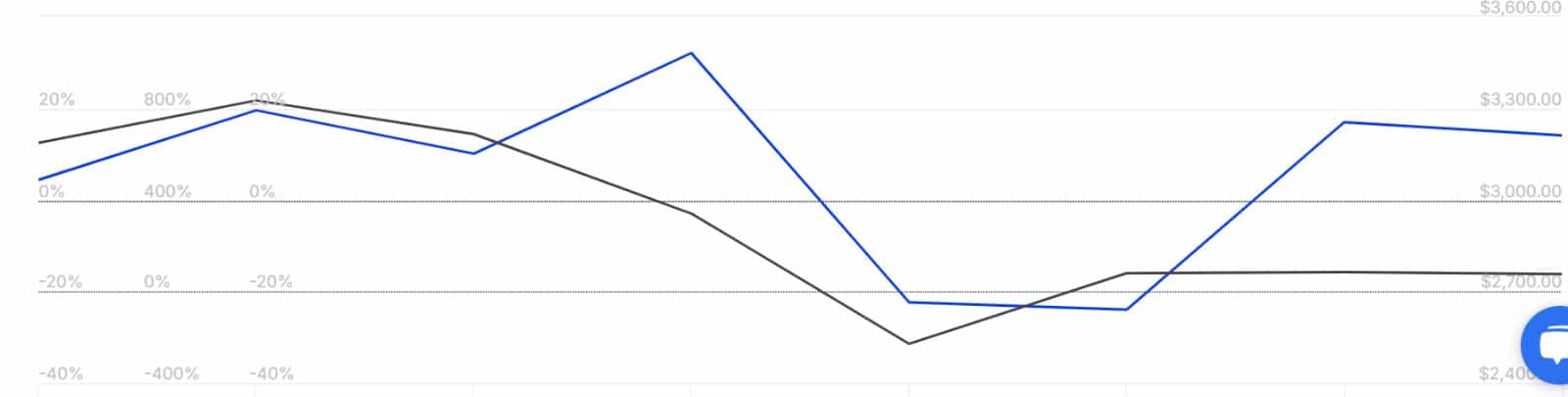

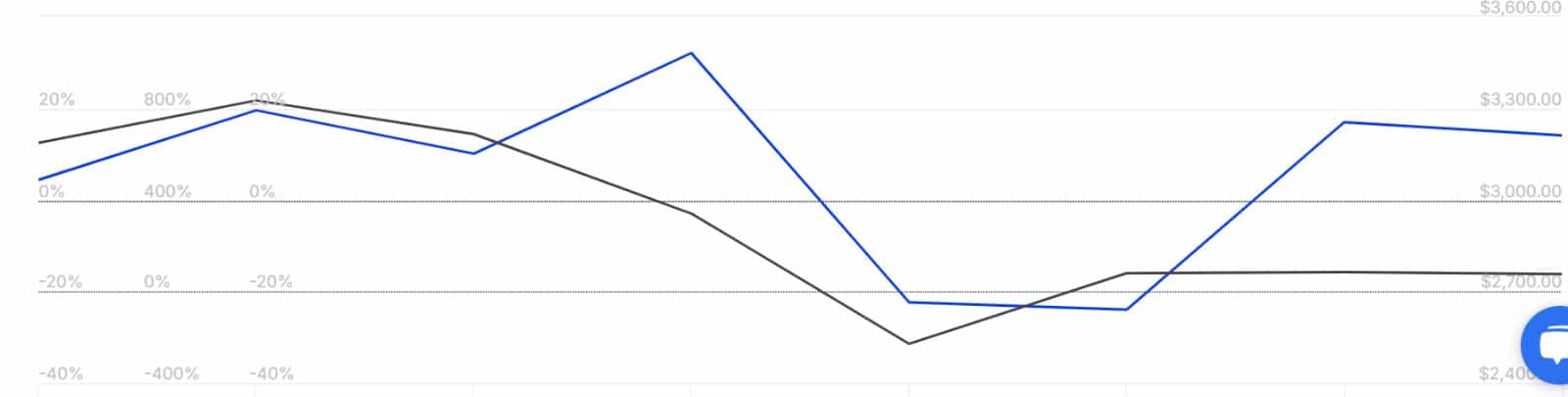

Source: Messari

For example, the Sharpe ratio of Ethereum (90 days) has decreased that the negative territory has been hit.

At the time of the press, this metric was at -0.266. Such a persistent decline means that a risk-corrected return has been worse than a risk-free active in the last 90 days.

That is why ETH fails to compensate traders for the risks they take, making the crypto less attractive for investors.

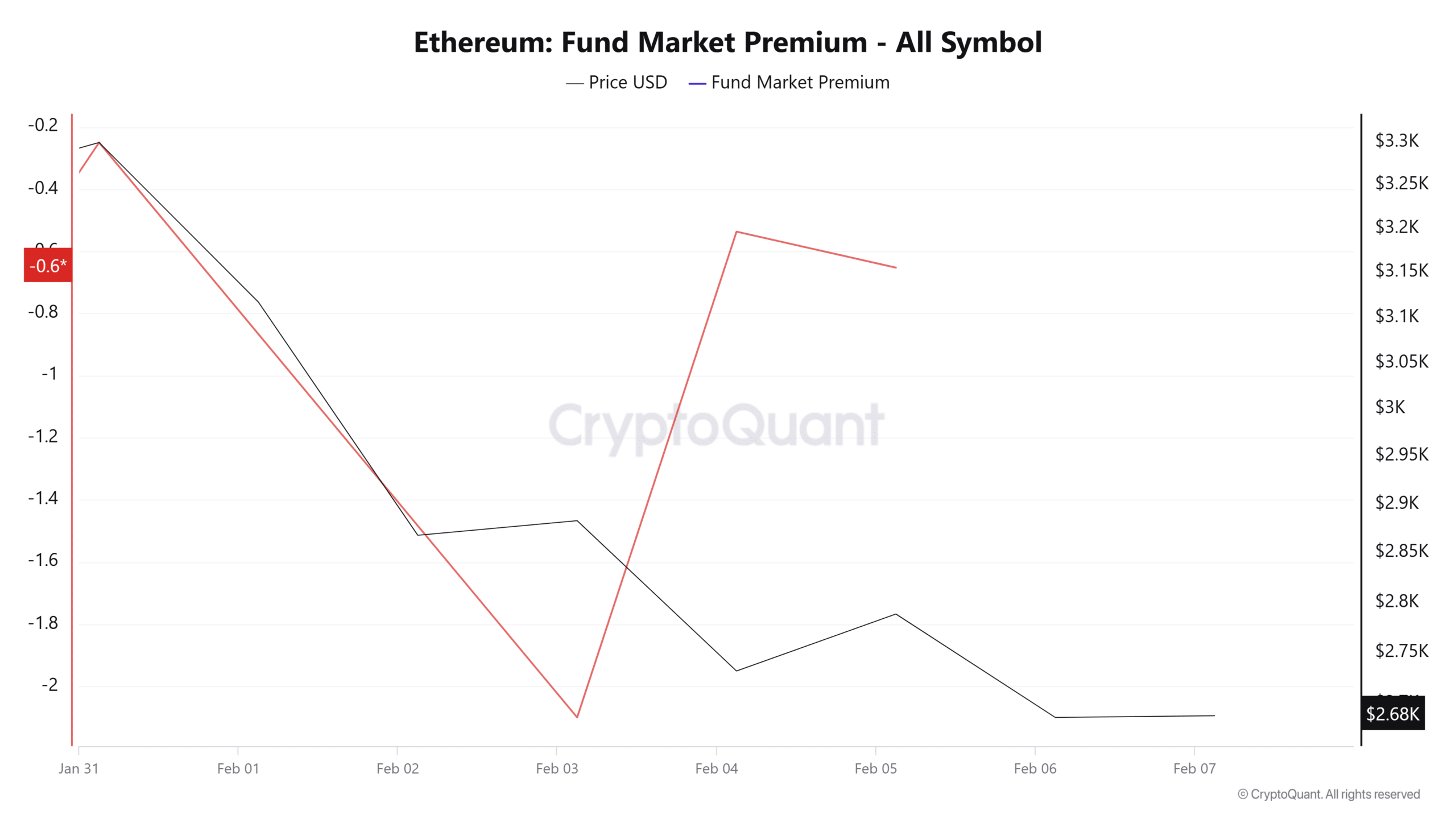

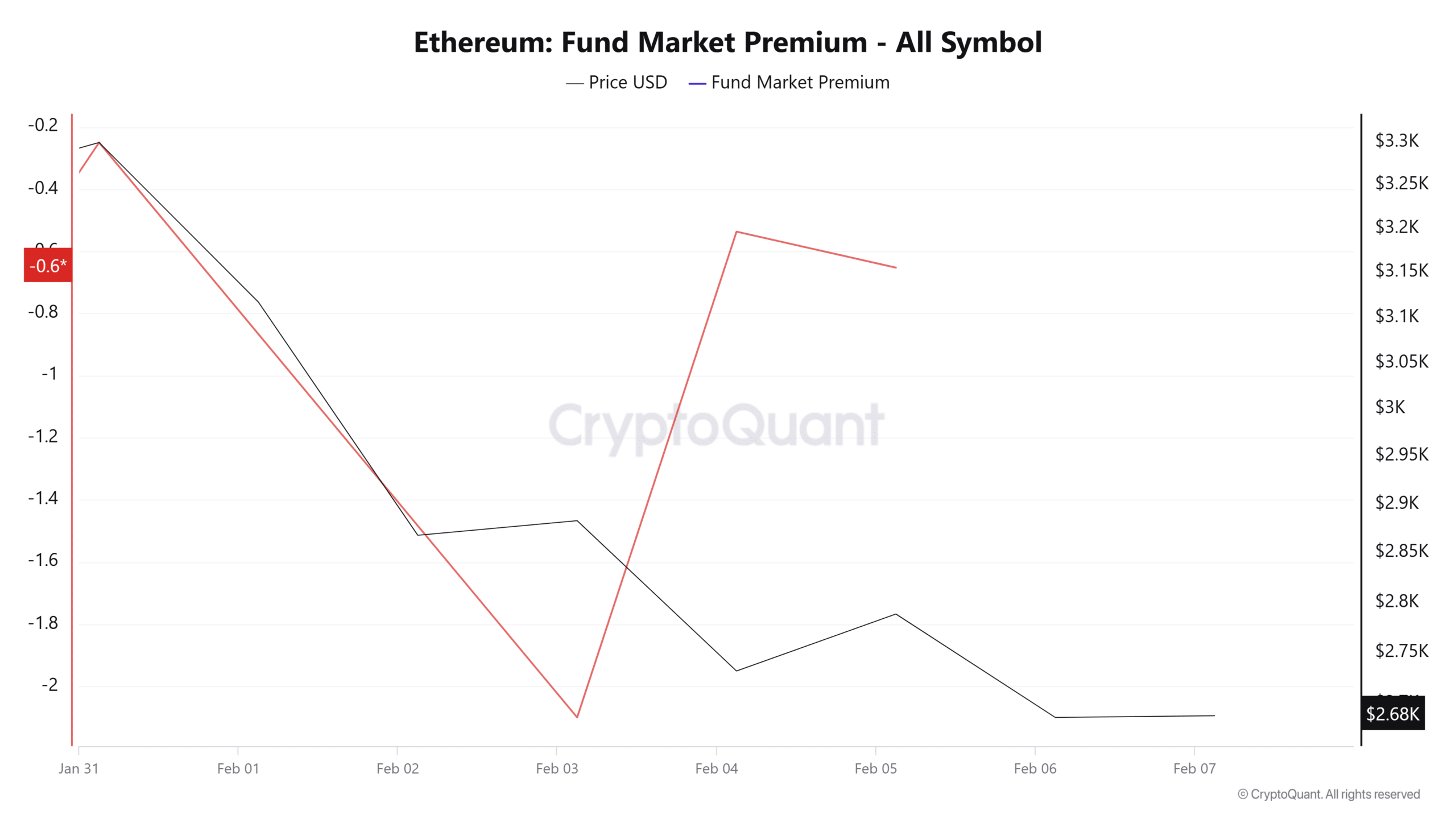

Source: Cryptuquant

Moreover, Ethereum experiences a strong bearish sentiment, as evidenced by a negative market premium.

This has remained negative during the week, which implies that most investors take short positions and anticipate prices.

Source: Intotheblock

Finally, whales became bearish when they increase their deposits to fairs. The large holders Netflow to change Netflow -Ratio has risen to 14.09% of -23.91.

With more large holders who transfer their assets to exchanges, this causes the sales pressure, causing the prices to push further.

What’s ETH?

Simply put, Ethereum experiences downward pressure in the short term and can see more losses before a rebound.

Is your portfolio green? Check the Ethereum winning calculator

If the current conditions continue and ETH are critical support of $ 2.7k infringing, this can fall further to $ 2500.

Due to a trend removal, however, the Altcoin will reclaim $ 2710 and try a run to $ 3000. The rally predicted by Martinez is unlikely in the short term, but ETH will reach these levels in the long term.