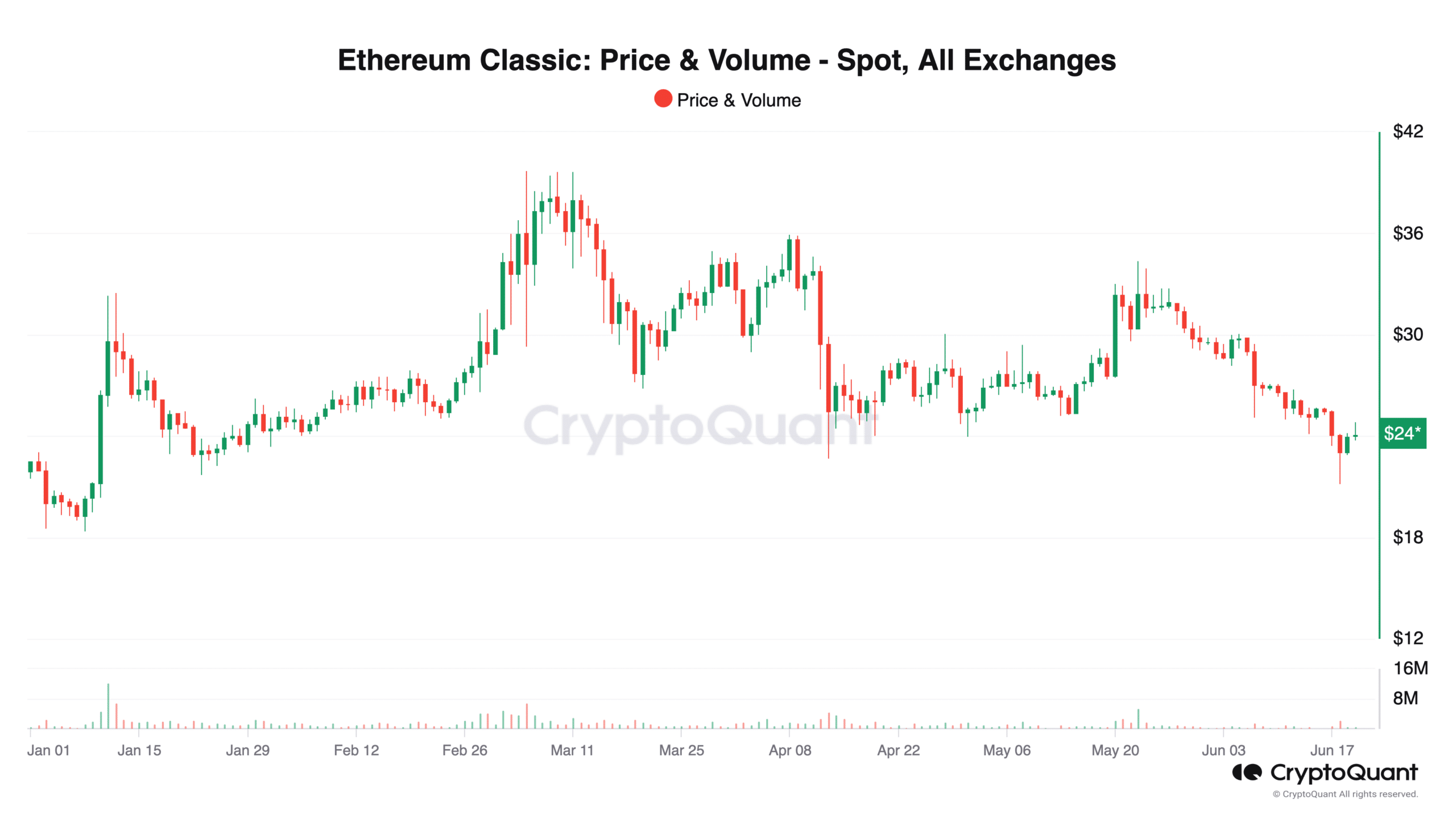

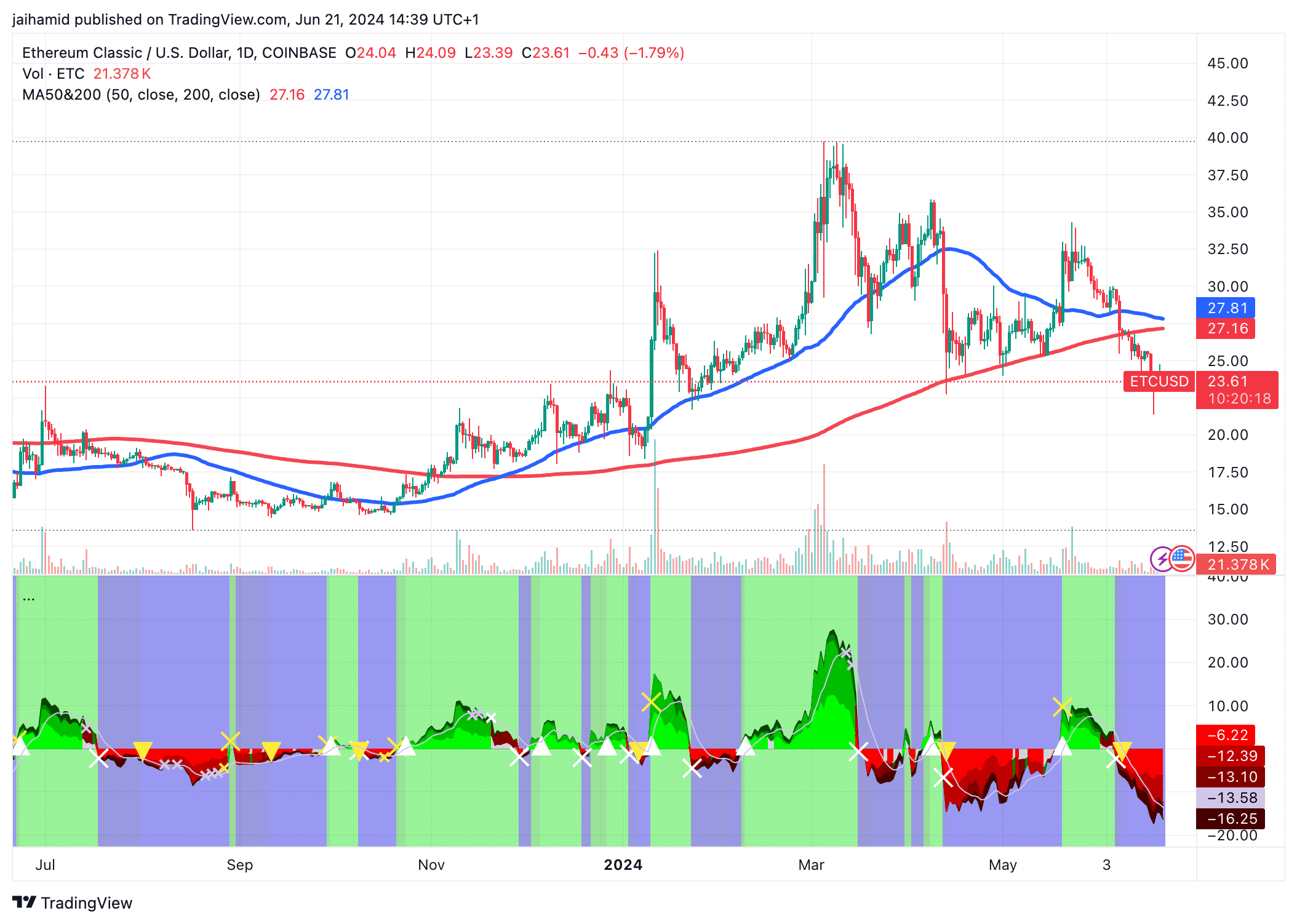

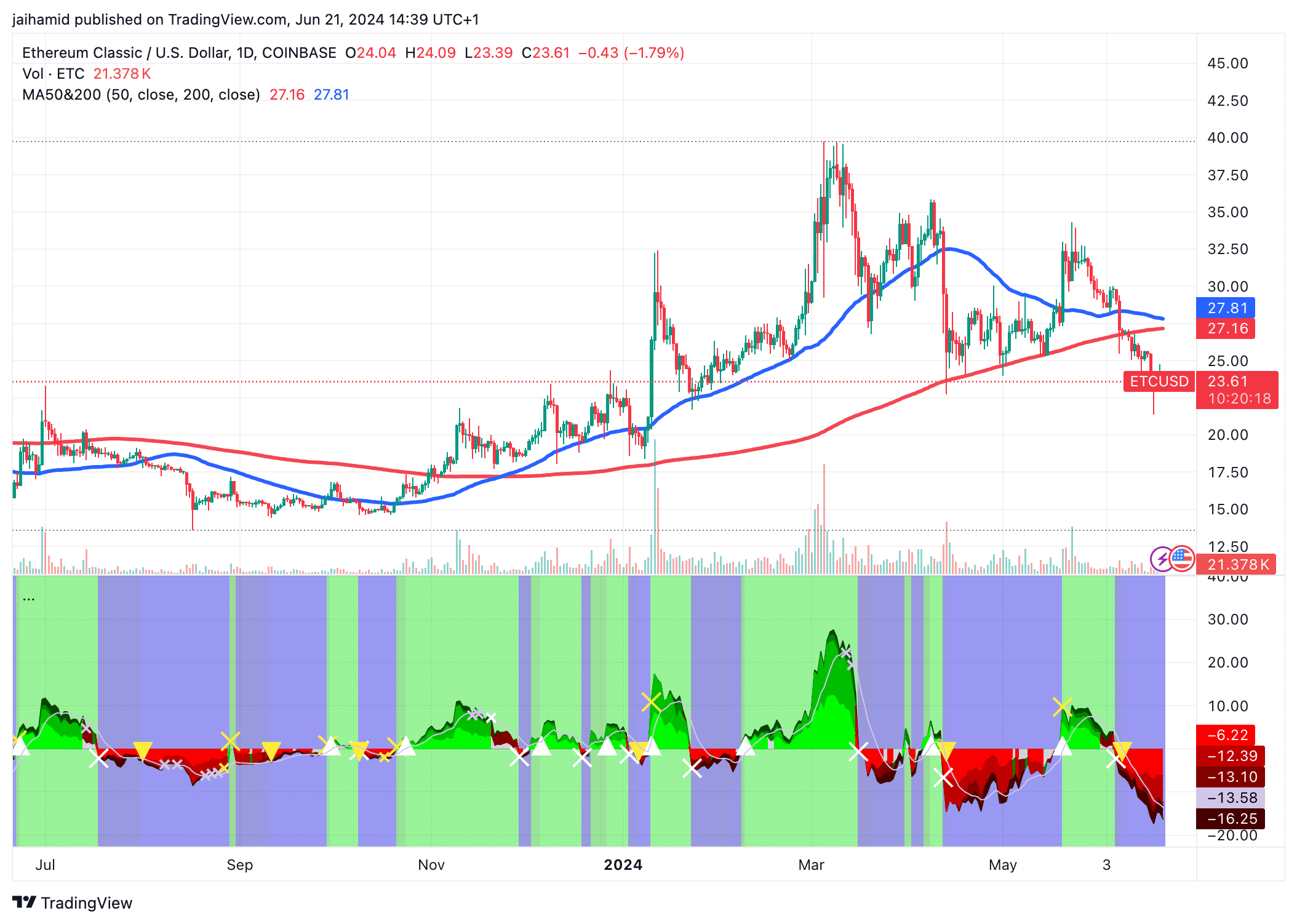

- Ethereum Classic (ETC) showed an overall downtrend with declining price highs and lows, coupled with declining trading volumes

- A bearish death cross suggested a potential long-term downtrend

Ethereum Classic (ETC) is a staple of the cryptocurrency market, but never expected it to go 100x. Still, 2024 is widely expected to be a very bullish year for the market, even more so than it already has been. Recently, however, things have slowed down and the markets have collapsed.

What about ETC? What is his fate for the rest of the year?

Source: CryptoQuant

Since late May and into June, the trend appeared generally bearish as the price of ETC reached lower highs and lower lows – a classic indication of a downtrend. This recent price drop may be accompanied by declining trading volume – a sign of reduced investor interest and market fatigue.

Typically, low volume during a downtrend can indicate a lack of conviction in the sell-off, but it can also mean there are fewer buyers available to push the price back up.

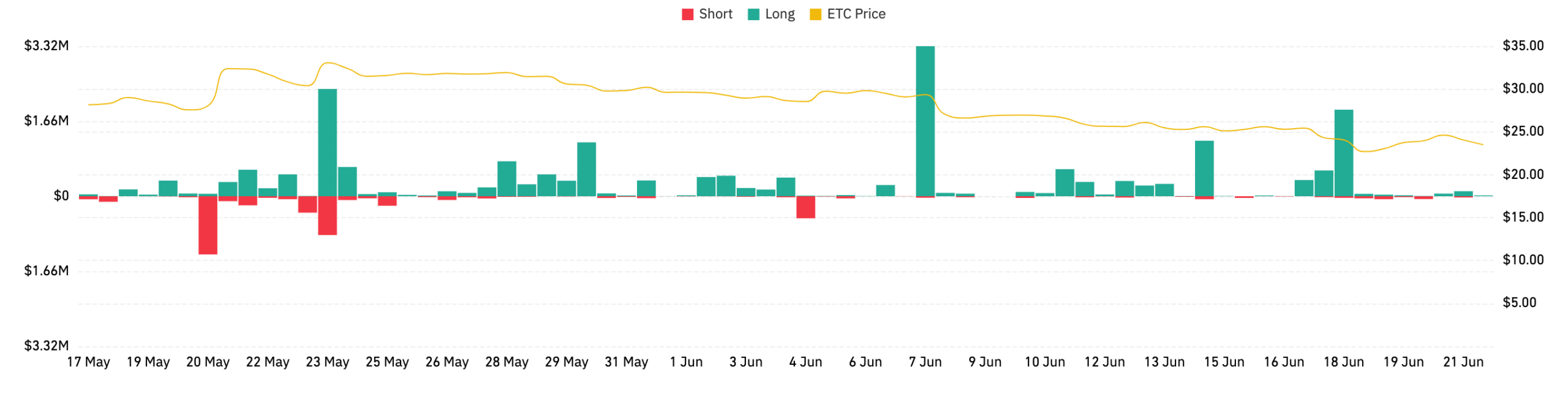

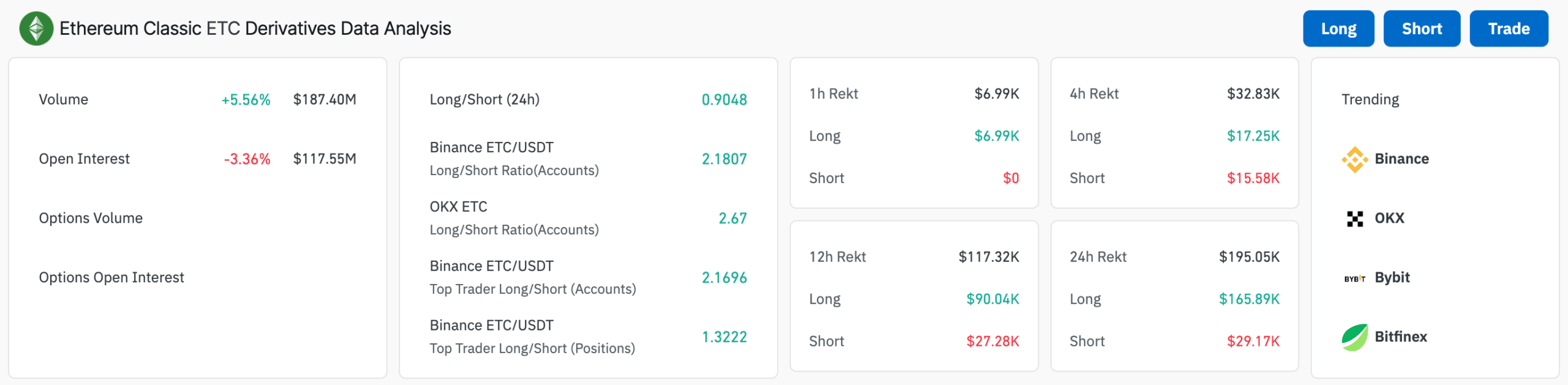

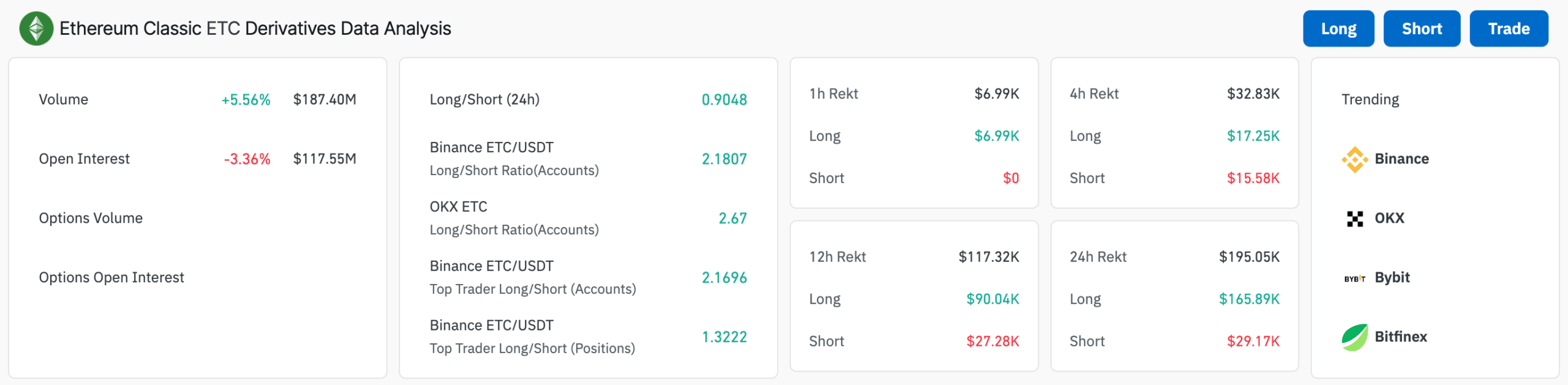

Source: Coinglass

An increase of +5.56% means increased trading activity in ETC derivatives, which can be speculative buying or selling. In fact, the notable spike appeared to align with a spike in ETC’s price line, possibly indicating a speculative rush that did not last and led to price pullback.

Source: Coinglass

Death Cross signals a long-term downward trend

The 50-day moving average recently dipped below the 200-day moving average, indicating a bearish death cross. This pattern is usually a sign of a long-term downtrend.

The price peaked around $35 in March, followed by a sharp decline. It then consolidated around $30 before falling below the 200-day moving average.

Source: TradingView

Previous support levels can be observed around the $25 level, but these have now been broken and could act as resistance if there is an attempted price recovery. The next major support is likely around the $20 level, which could be tested if the prevailing bearish trend continues.

In conclusion, the increase in selling volume plus the break from previous support levels tells us that the bears are here to stay.