- Like BTC ETFs, Ethereum ETFs also witnessed outflows in the past few days

- Statistics and market indicators suggested that Bitcoin’s bear rally could end soon

Despite the bearish market conditions Bitcoin [BTC] ETFs witnessed promising inflows a few days ago. However, the trend has changed in the past 24 hours.

That’s why it’s worth taking a closer look at what’s going on with ETFs, while drawing a comparison with the state of ETFs. Ethereum [ETH] ETFs.

How are Bitcoin ETFs doing?

According to recent data, Bitcoin ETFs saw inflows worth $200 million on August 8, which seemed optimistic. Unfortunately, this trend did not last as the numbers turned negative the very next day.

According to SoSoValue, BTC ETF net flows fell below -$90 million on August 9. Here it was interesting to note that while Blackrock expanded its holdings, Grayscale opted to sell, according to Dune’s facts.

Source: SoSoValue

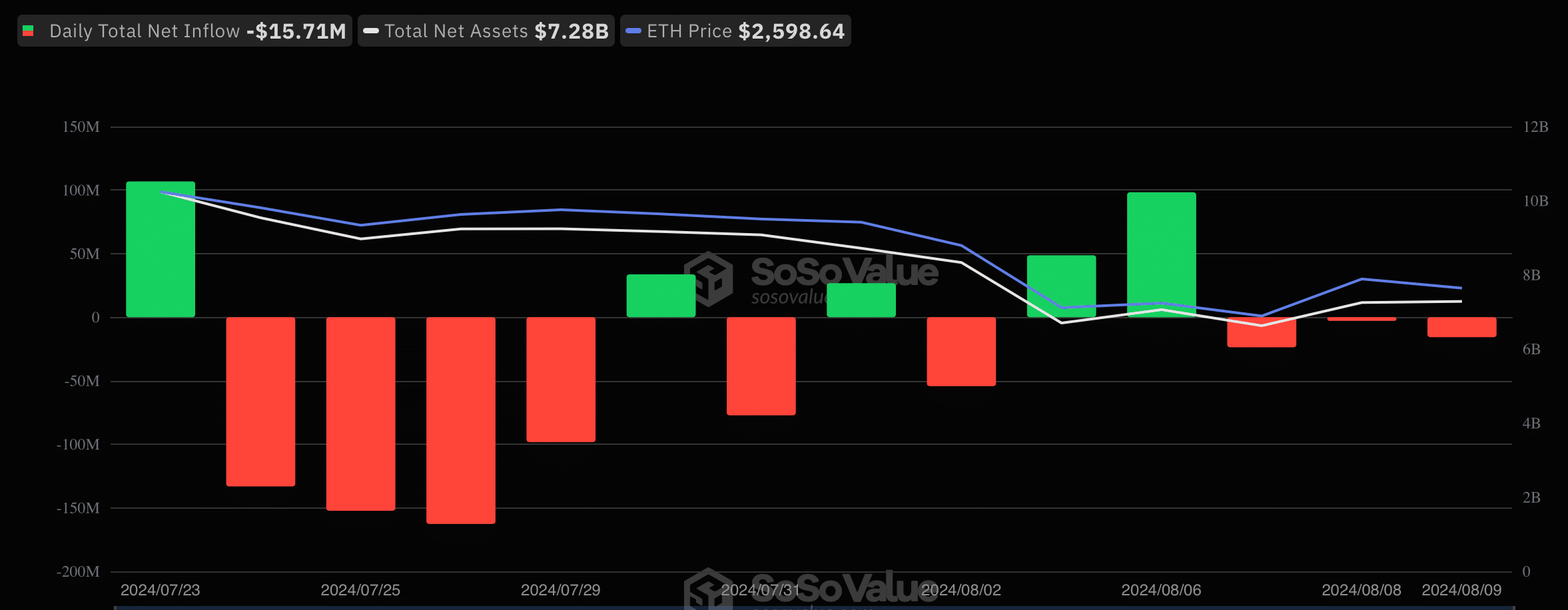

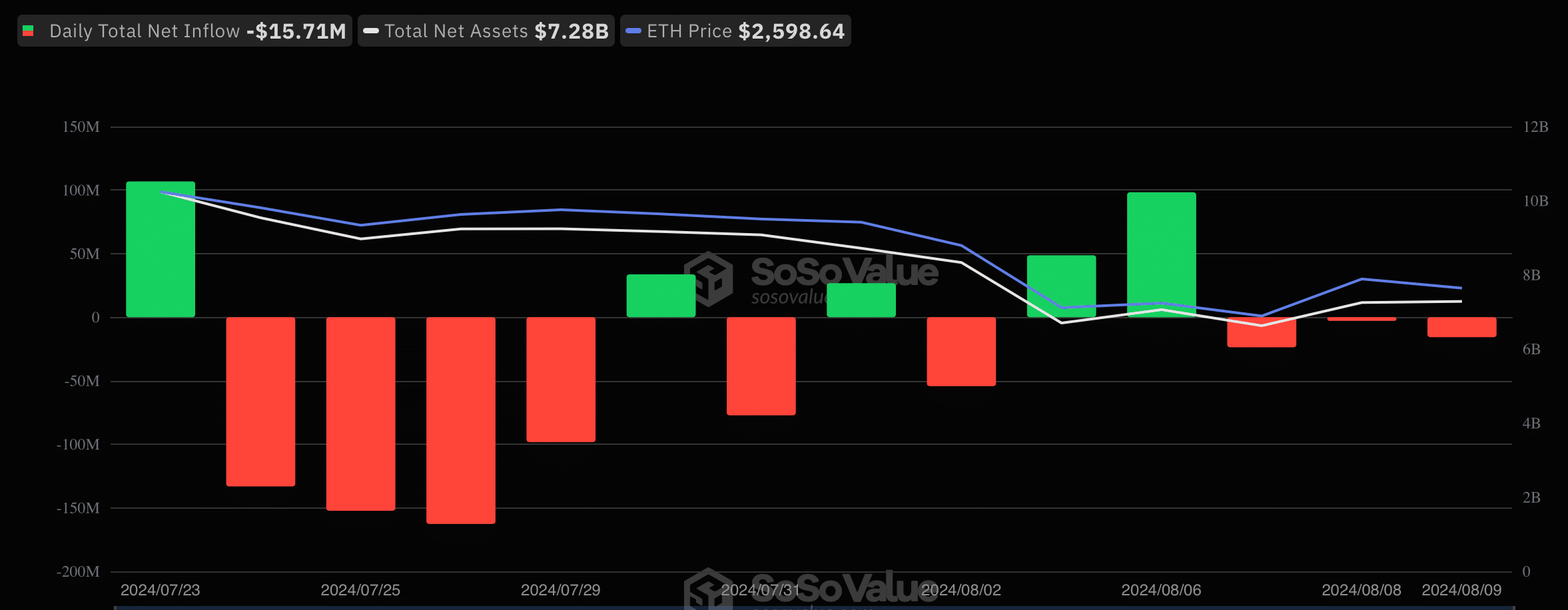

Like Bitcoin, Ethereum ETFs have also witnessed a similar situation in recent days. To be precise, the net flow of ETH ETFs on August 6 was $98 million. However, on August 9, the number dropped to -$15.7 million.

Source: SoSoValue

A possible reason for the decline in net flows could be the bearish market conditions, as both BTC and ETH saw price declines on the charts.

In fact, according to CoinMarketCapWhile the price of BTC fell by 1.2% last week, the value of ETH fell by more than 12% during the same period. At the time of writing, BTC was trading at $60.4k, while ETH was valued at $2.6k.

What can you expect from Bitcoin?

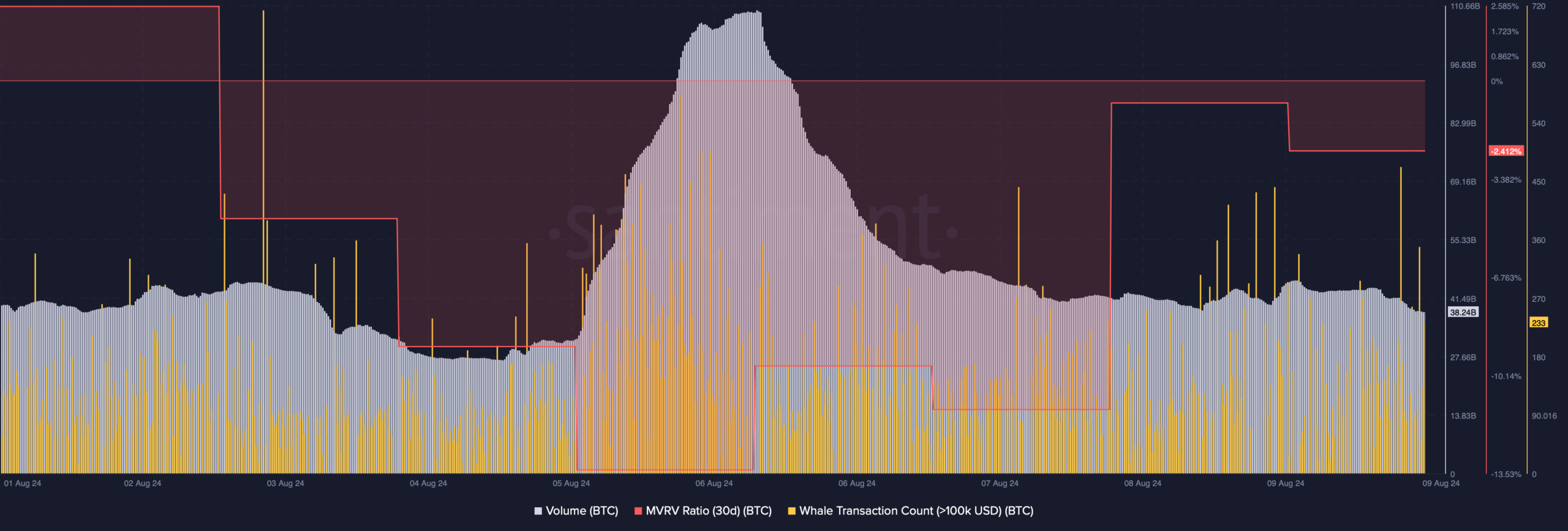

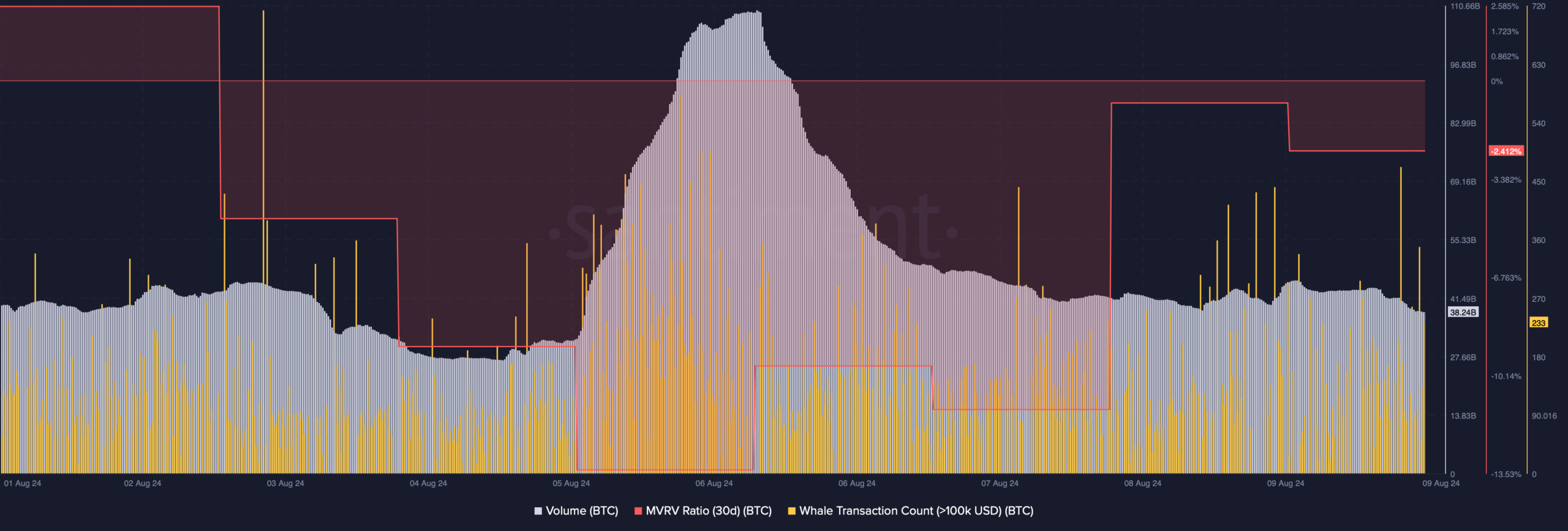

AMBCrypto then planned to take a closer look at the current state of BTC to see if it can stage a bullish comeback in the coming days. According to our analysis of Santiment’s data, BTC’s MVRV ratio improved – a bullish signal.

Another optimistic metric was volume, which fell. A decline in the measure during a bear market indicates that the bearish trend could end soon. Furthermore, the number of whale transactions in Bitcoin also remained high last week, meaning whales have been actively trading BTC.

Source: Santiment

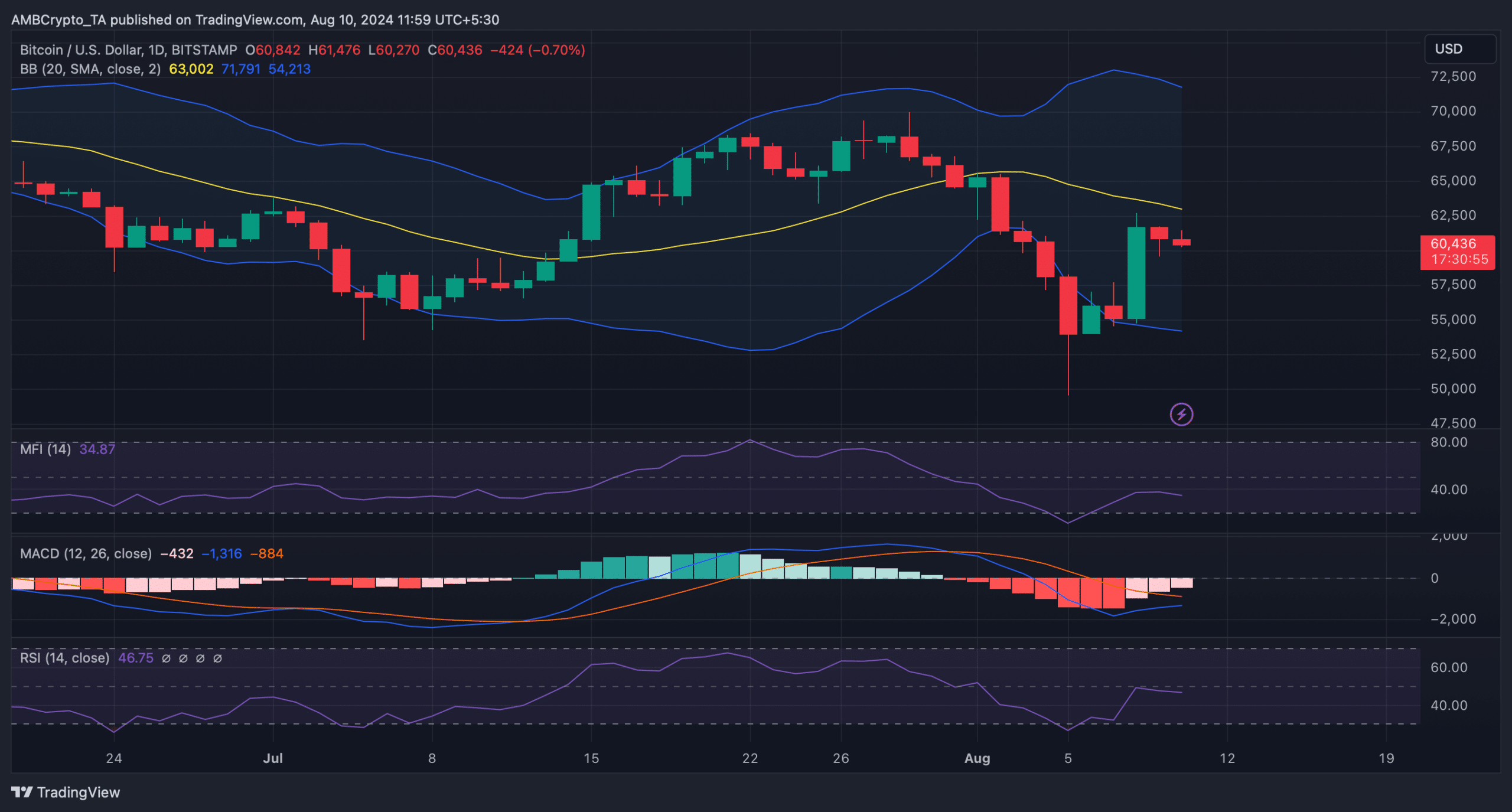

On the contrary, our look at Bitcoin’s daily chart showed that the Relative Strength Index (RSI) registered a decline. The Money Flow Index (MFI) also headed south – a sign that the price of BTC could fall further.

Is your portfolio green? View the BTC profit calculator

Still, the MACD showed the possibility of a bullish crossover. Furthermore, the Bollinger Bands revealed that they were about to test their resistance near the 20-day Simple Moving Average (SMA).

A successful breakout above that level would signal the start of a bull rally.

Source: TradingView