- Market trends favor Ethereum as ETF launches approach.

- The report showed a changing landscape in spot trading volume, options, futures and perpetual contracts.

Cryptocurrency markets have experienced high volatility over the past two months. Market preferences are changing, especially since the SEC approved Ethereum [ETH] spot ETFs in May.

With the expected launch of ETH spot ETFs, investors are becoming increasingly optimistic.

While ETH ETFs have yet to start trading, a report from Kaiko and a joint report from Block Scholes and Bybit showed changing market preferences.

A change in trends

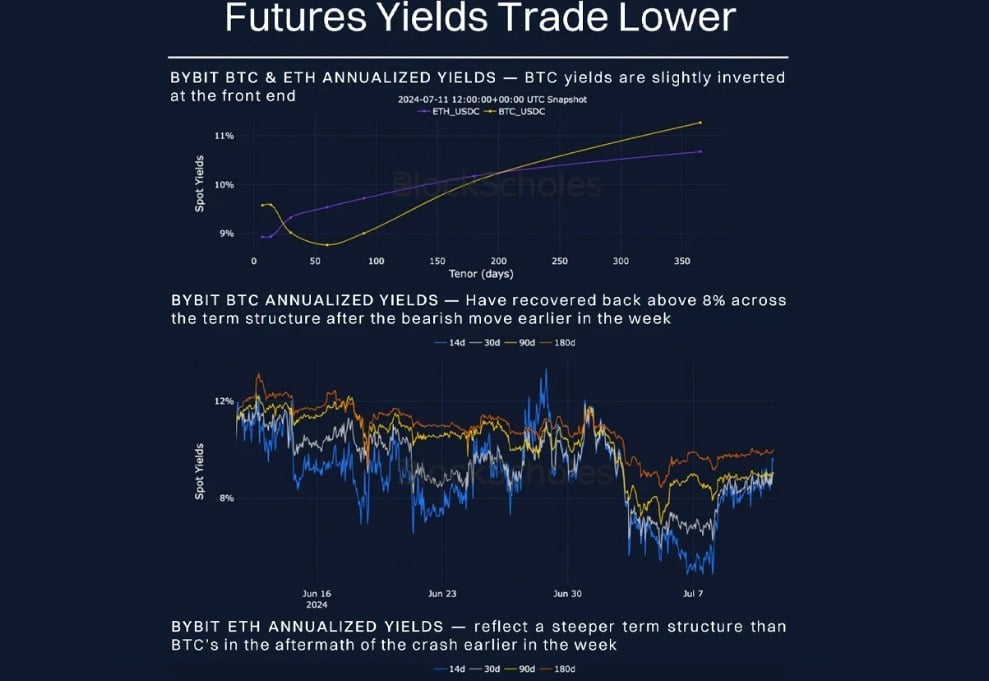

According to the recently released report from Block Scholes and Bybit, there has been a massive landscape shift in spot trading volumes, futures, options and perpetual contracts.

The report stated that Ethereum enjoyed a better volatility premium than Bitcoin [BTC]. This was mainly due to increased address activity and a positive shift in market sentiment towards ETH.

Source: Blockscholes & Bybit

Ethereum is gaining ground against Bitcoin

The ETH/BTC ratio has maintained a positive value of 0.05 since the adoption of spot ETFs. This ratio is significantly higher than pre-approval levels of approximately 0.045.

The higher ratio shows that when the ETH spot ETFs start trading, they will continue to outperform BTC.

Source: Kaiko

The general market sentiment

ETH has seen more gains than BTC in multiple areas since the approval of ETH spot ETFs in May.

Although the crypto market has seen high volatility over the past two months, ETH Futures have shown more resilience and a faster recovery than Bitcoin Open Interest.

ETH’s faster recovery for its future indicated rising positive sentiment, with many investors confident about the future.

Source: Blockscholes & Bybit

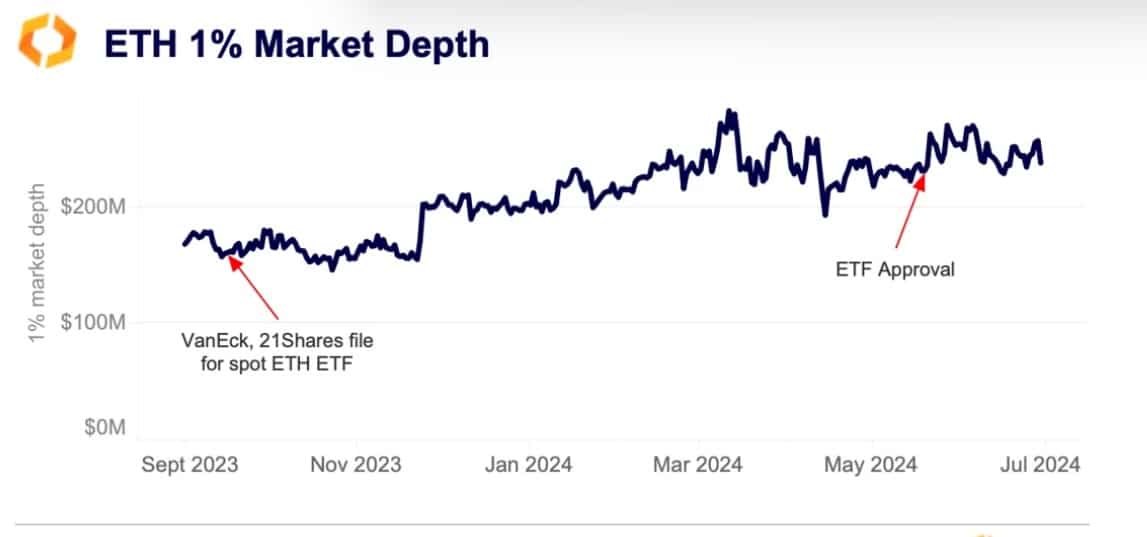

ETH trading volume has been in the same range since May. According to Kaiko, ETH’s liquidity has been maintained at a depth of 1% and a consistent range of $250 million.

The ETF approval appears to have changed the trend after it fell below $200 million, and reversed the trend after the SEC’s approval. Therefore, ETF anticipation has played a crucial role in improving liquidity.

Source: Kaiko

Additionally, ETH perpetual contracts have seen increased trading volume. The rise showed that investors were willing to pay a premium to hold long positions, showing confidence in crypto’s future potential.

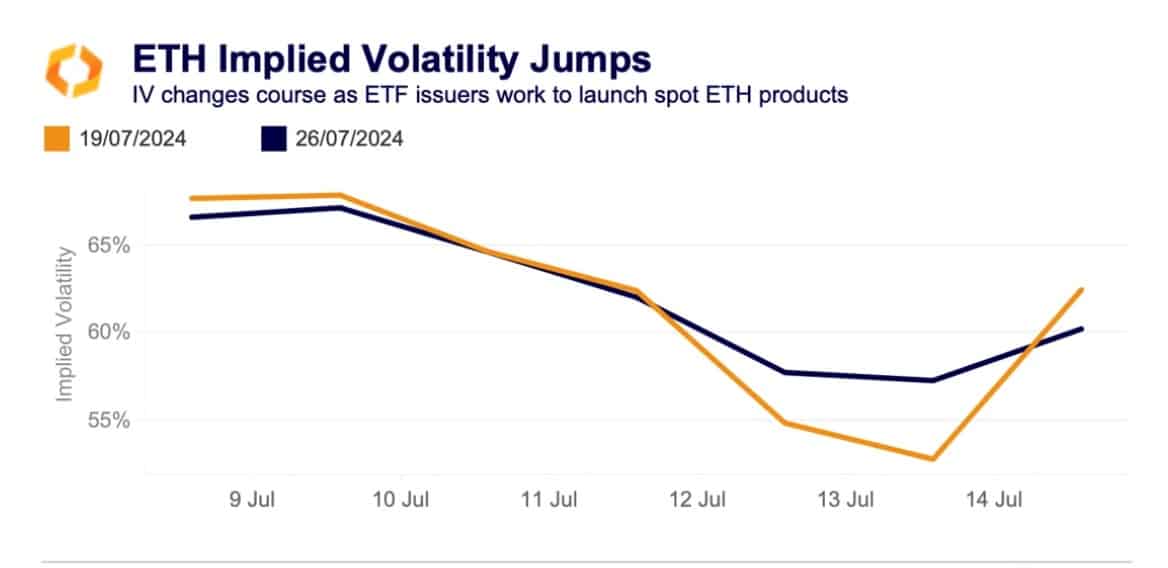

As Kaiko reported, implied volatility has soared over the past seven days. For example, ETH options expiring this Friday have risen from 53% on July 13 to 62% at the time of writing.

Read Ethereum’s [ETH] Price forecast 2024-25

The rise in these contracts implied that investors were paying short positions to protect themselves from short-term price increases.

This market sentiment shows significant optimism about ETH’s future, especially with the upcoming ETFs this week.

Source: Kaiko