- Etheruem’s witnessed an 82% increase in its quarterly costs.

- ETH’s RSI and MACD indicators indicated some continued bullish relief for the altcoin

The start of Q3 2023 came with good news for the altcoin market. This was because most altcoins entered the third quarter with some strong bullish moves. According to data from CoinMarketCap, Ethereum [ETH] also switched hands 3.93% higher in the past 24 hours.

To add to the rising price of ETH, also a tweet from IntoTheBlock highlighted an important update from K2. According to the tweet, ETH’s quarterly fees experienced an 83% growth over Q2 2023. Moreover, the tweet also highlighted that speculation around meme tokens could be the driving factor for ETH fees growth.

Read Ethereum’s [ETH] Price Forecast 2023-24

New hope for a new quarter

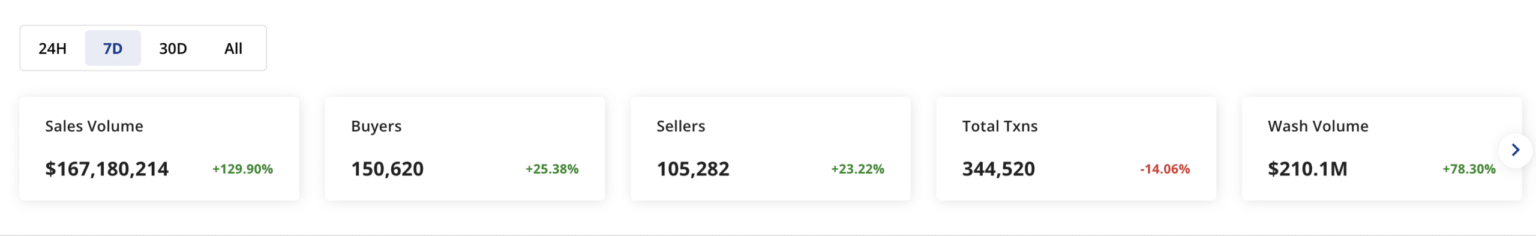

A look at Ethereum’s performance on the NFT front painted a rather positive picture. According to data from CRYPTOSLAM, ETH’s NFT sales volume is up 129.90% in the past seven days. In addition, the network also saw a 25% increase in buyers and a 23% increase in sellers, while washing volume increased by almost 79%.

Source: CRYPTOSLAM

In addition, data from intelligence platform Santiment showed that development activity metrics could use some effort on the developer’s part. This was because ETH’s development activity was at 39.32 at the time of writing, which was noticeably lower considering the trend over the past few days.

However, the volume of ETH witnessed a peak from June 30. An increase in volume along with a price move in the positive direction could be a sign that the investor was accumulating the altcoin. In addition, weighted sentiment towards ETH has also shown a slow but steady improvement since bottoming out on June 9.

Source: Sentiment

Who will side with ETH?

A tweet posted by the Ethereum fear and greed index stated that investor sentiment in the market was that of greed as the number stood at 55. Does ETH’s Daily Chart Reflect the Same?

At the time of writing, ETH was trading 4.22% higher than its opening price for the day. Additionally, looking at the position of ETH’s Relative Strength Index (RSI), it could be argued that there was significant buying pressure in the market. This was because ETH’s RSI stood at 60.25 and was seen moving towards the overbought zone.

How much are 1,10,100 ETHs worth today

In addition, ETH’s Moving Average Convergence Divergence (MACD) line (blue) was above the signal line (red) above the zero line. This indicated a strong bullish move for ETH. However, despite the bulls supporting ETH from June 30, traders should remain cautious.

This was due to ETH’s Awesome Oscillator (AO) flashing red bars above the zero line. A slight decrease in buying pressure could lead to changes in the position of the indicators and a price correction for ETH.

Source: TradingView