- Demand for ETH retail is increasing, but the whales are countering with selling pressure.

- ETH’s price action indicates accumulation, but buying pressure is low.

Where does ETH currently stand in the big picture in terms of adoption? We recently saw it struggle to maintain value above $2,000, but something interesting is happening this week.

Is your wallet green? Check out the ETH Profit Calculator

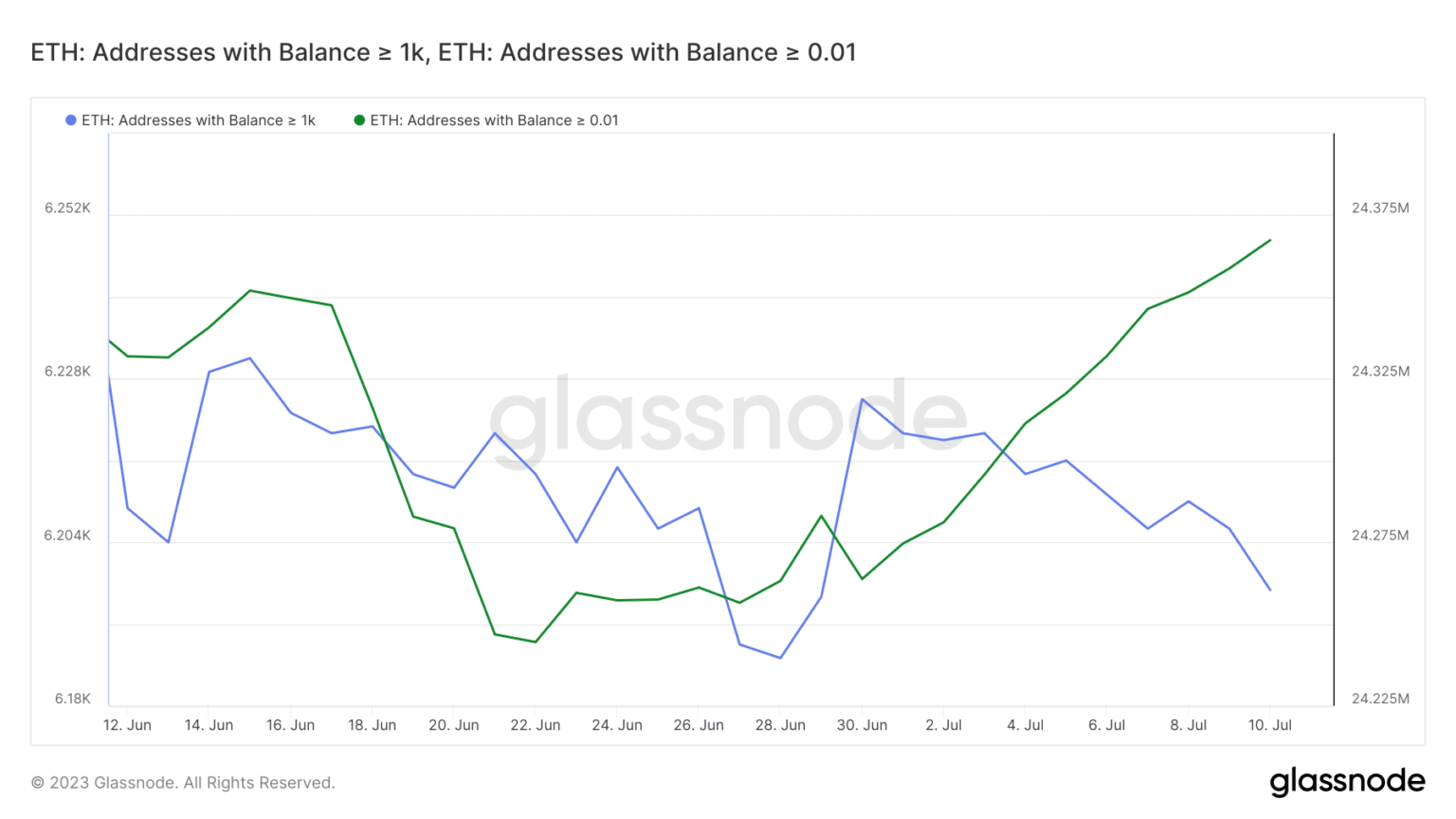

Glassnode’s latest on-chain data revealed that the number of addresses with 0.01 ETH or more reached a new ATH on July 10. In other words, ETH managed to maintain a healthy level of demand and the new milestone confirmed that this demand is growing.

📈 #Ethereum $ETH Number of addresses with 0.01+ coins just reached an ATH of 24,365,581

View statistics:https://t.co/XXb0u19ouH pic.twitter.com/71jV5mnXu3

— glassnode alerts (@glassnodealerts) July 10, 2023

While the above may be true, the dynamics of address activity and demand may determine whether or not it is enough for a major move. For example, many shopping activities can increase the number of addresses. It’s not a powerful sighting if whales aren’t involved, though.

Addresses with at least 1,000 ETH have their balance reduced. This meant that the whales contributed to the selling pressure.

Source: Glassnode

Whale games hold back ETH’s potential upside

The data above means that private buyers are contributing liquidity for whales. As such, this has limited ETH’s potential rally. We have seen an increase in demand in the last 24 hours, but this is likely due to the price fluctuating at a remarkable price level.

ETH recently retested a major Fibonacci support at the 0.786 level as shown below. It has been hovering above this level for some time, which may be due to heavy accumulation within this zone. However, continued whale sales pressure could limit the impact of rising demand.

Source: TradingView

A closer look at ETH’s price chart revealed that the cryptocurrency has also attempted to bounce off the 50% Relative Strength Index (RSI) level. The Money Flow Index (MFI) also confirmed that there was some accumulation. Basically, retail demand was in a tug of war with the whales at the time of writing. But which group will win?

Glassnode data on ETH flows shows that the number of receiving addresses recently dropped to a 5-month low.

📉 #Ethereum $ETH The number of receiving addresses (7d MA) just hit a 5-month low of 8,529,363

The previous 5-month low of 8,536,357 was observed on July 9, 2023

View statistics:https://t.co/Vm6VJY2z37 pic.twitter.com/aNLrxgfaqb

— glassnode alerts (@glassnodealerts) July 10, 2023

Read about the ETH price prediction for 2023/2024

This finding reinforces the idea that current buying pressure is low. ETH could give in to the bears if it prevails along with the aforementioned selling pressure from whales. But just like any tug-of-war, ETH bulls can regain control if market dynamics turn in their favor.