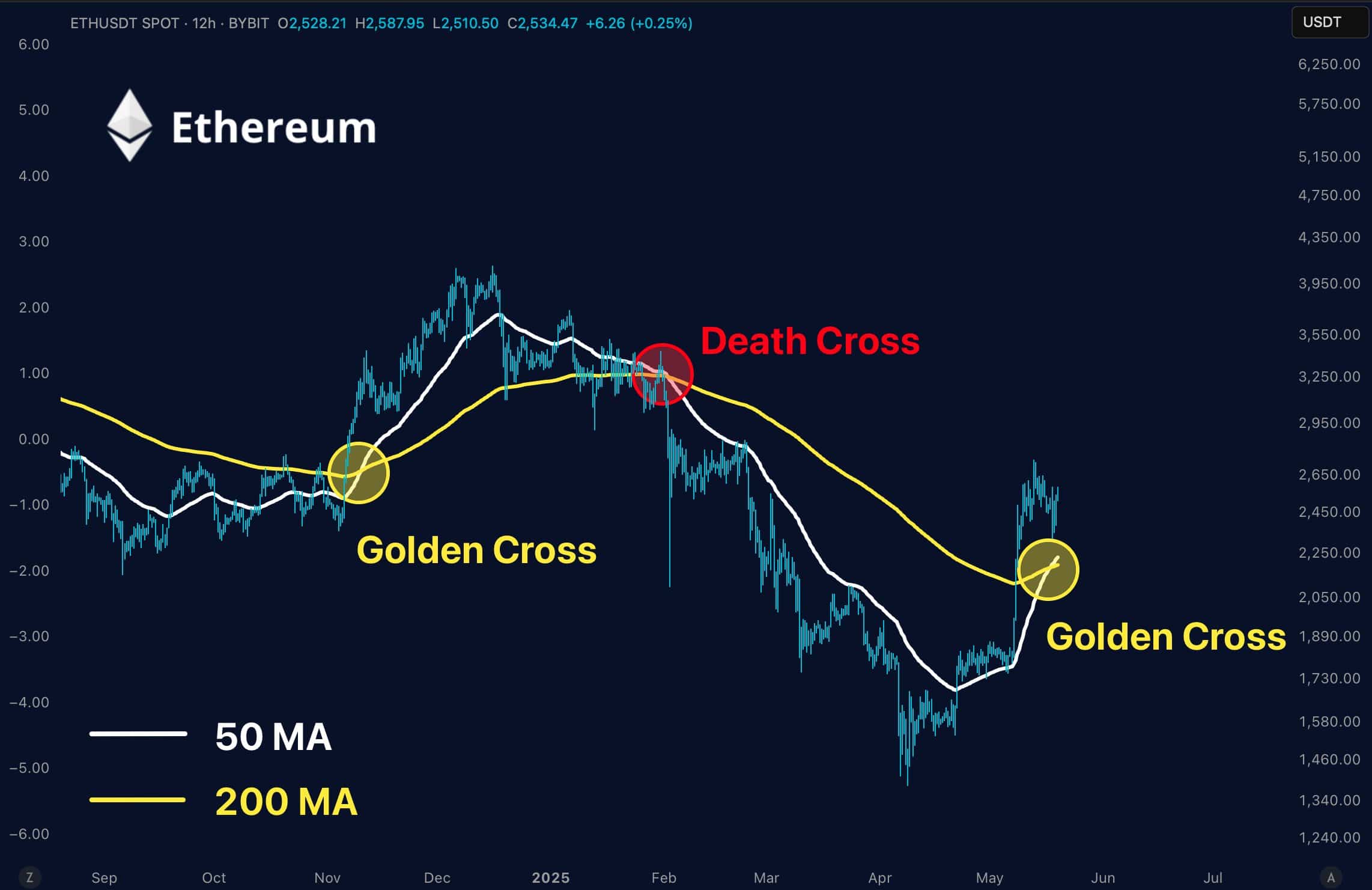

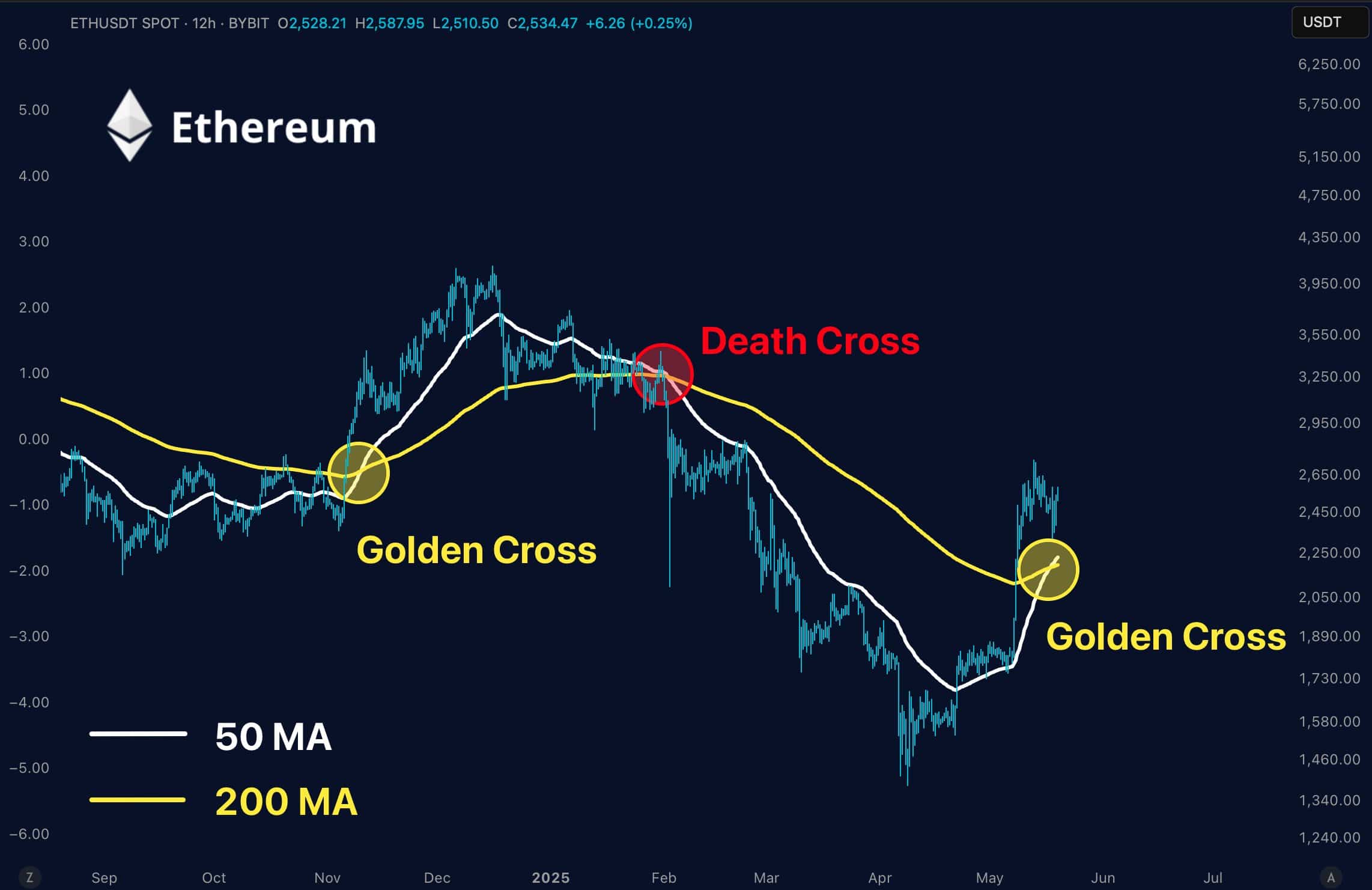

Ethereum has just printed a fresh gold cross, as marked in a graph shared By @MerlijnTrader on X (formerly Twitter).

The 50-day advancing average is above the 200-day advancing average crossed-a pattern that previously preceded a rally of almost 90% in the end of 2024.

Source: X

After a Bearish Death Cross had caused a long -term downward trend earlier this year, this renewed signal attracts the attention of the traders.

Because ETH is now being held above $ 2,500, market participants are closely watching to see if the history is about to repeat.

What happened the last time?

The previous Golden Cross took place at the beginning of November 2024.

After the signal, Ethereum rose from around $ 1,800 to a peak almost $ 3,400 at the end of December – which marked a profit of around 89% in just under two months.

The move was not only driven by technicalities. This rally coincided with increasing anticipation around Spot Bitcoin ETF approvals in the US, which fed wide optimism in crypto markets.

Increased institutional importance, in combination with rising Ethereum -using deposits, added to the bullish pressure and helped to support the rally at the end of the year.

Back to Bull?

Source: Cryptuquant

Ethereum Exchange Reserves have fallen to 18.7 million ETH, the lowest in more than a year – a sign of persistent outlets and potential accumulation.

Source: Coinglass

At the same time, financing percentages just somewhat negative, which suggests that the current rally is not powered by aggressive long speculation.

This healthy background of decreasing delivery and neutral leverage adds credibility to the Golden Cross signal and reduces the probability of a sharp correction.