- The ETH/BTC pair floated close to cycle lows, but important support for approximately 0.05 BTC could offer a launch platform.

- If BTC -Dominance decreases, capital can rotate in ETH, causing a rebound in the pair.

The US Dollar Index (DXY) has been deposited into new lows, refueling speculation About capital that runs in risk provisions, in particular crypto. Historically, a weakening dollar has supported the liquidity inflow in Bitcoin [BTC] and Ethereum [ETH].

Trump’s import tax increase intensified the pressure on the US dollar and pushes it back to levels before the elections. The analysis of Ambcrypto, however, emphasized a crucial shift – BTC and DXY have been disconnected, reducing the reliability of the dollar if a leading crypto market indicator is reduced.

Yet macro -economic catalysts remain in the game. As soon as US President Donald Trump announced A tariff break, Bitcoin has recovered $ 86k after the actions of below this level for seventeen days, while Ethereum rose past $ 2k.

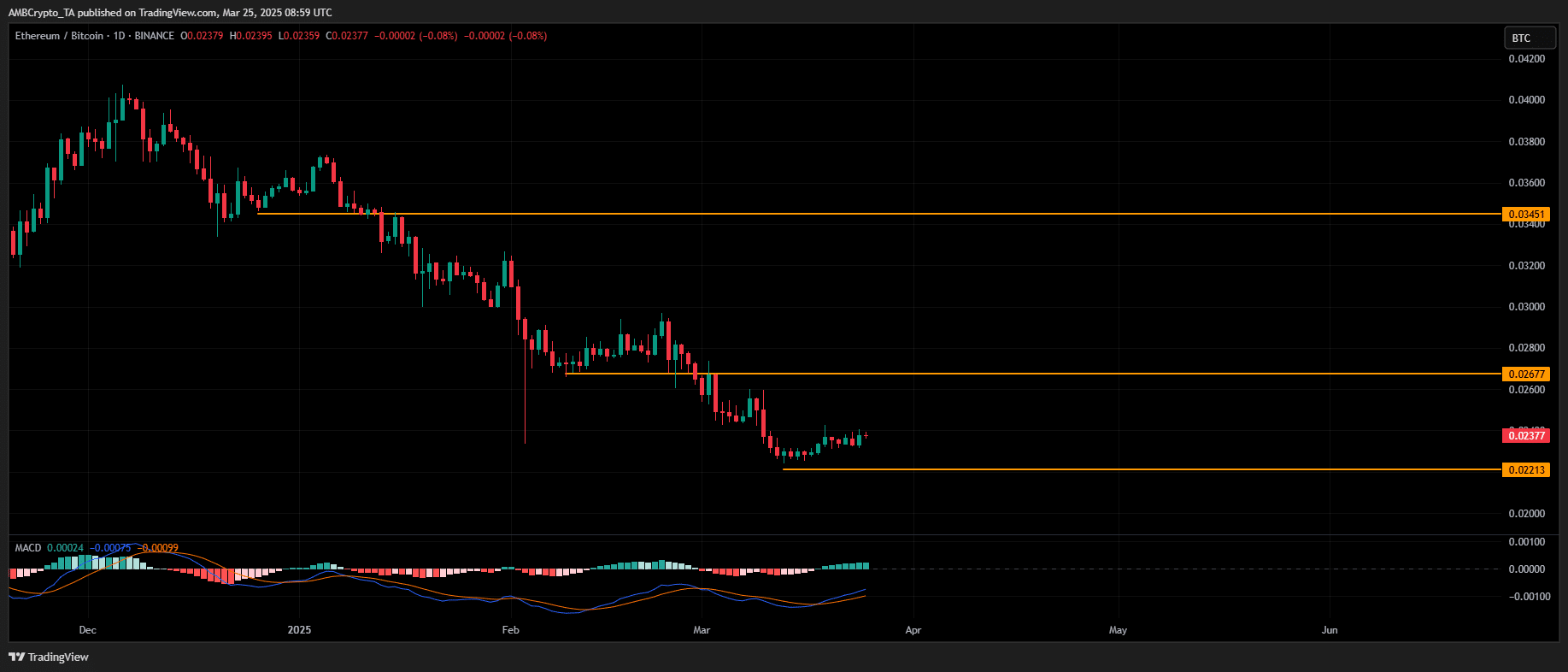

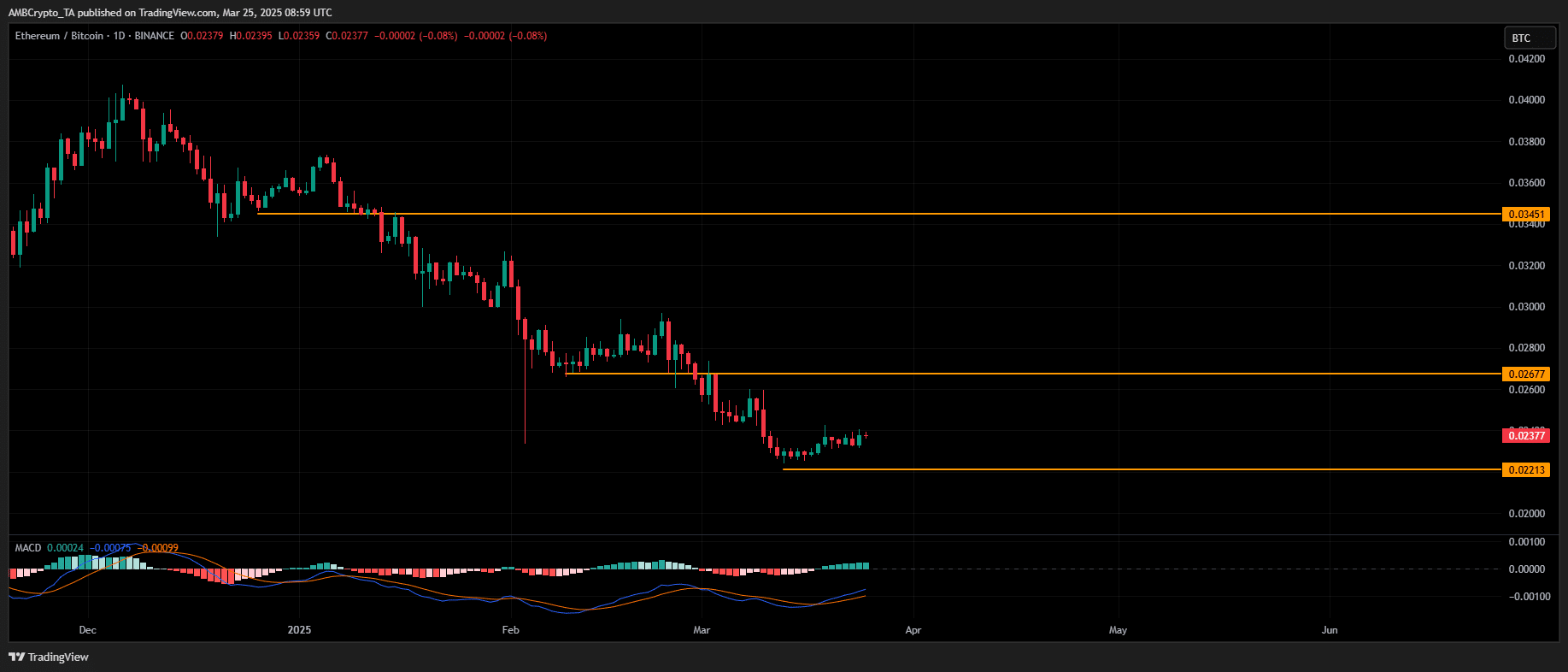

The current non-linear price promotion of BTC presents ETH with a window to attract capital. The ETH/BTC pair indicates that the momentum is growing while the MACD is bulling bullish for the first time in almost a month.

A well-defined support cluster has been formed, which marks the third compression phase in three months-a indication of a potential outbreak and trend domination in favor of ETH.

Source: TradingView (ETH/BTC)

If the breakout structure is confirmed, analysts are analysts project A movement to 0.0019 BTC per ETH, with the couple currently floating around 0.002 BTC.

Only tech social alone are not. In earlier demand zones, buyers could not retain accumulation, which led to liquidity exhaustion and a breakdown into a low of five years.

If history repeats itself, the chance of further liquidity sweeping remains increased. In such a scenario, ETH/BTC could expand the disadvantage, which further weakens the relative power of Ethereum against Bitcoin.

ETH/BTC: Breakdown -front or trend removal?

A BTC retracement remains a critical trigger for a confirmed ETH/BTC.

Current market structure identify $ 89k as an important resistance zone for Bitcoin, in which an earlier outbreak attempt failed on 24 March, to strengthen the overhead facility.

If BTC is confronted with persistent rejection at this level, a corrective movement can unlock ETH/BTC rotation, allowing a potential bid for Ethereum -Dominance.

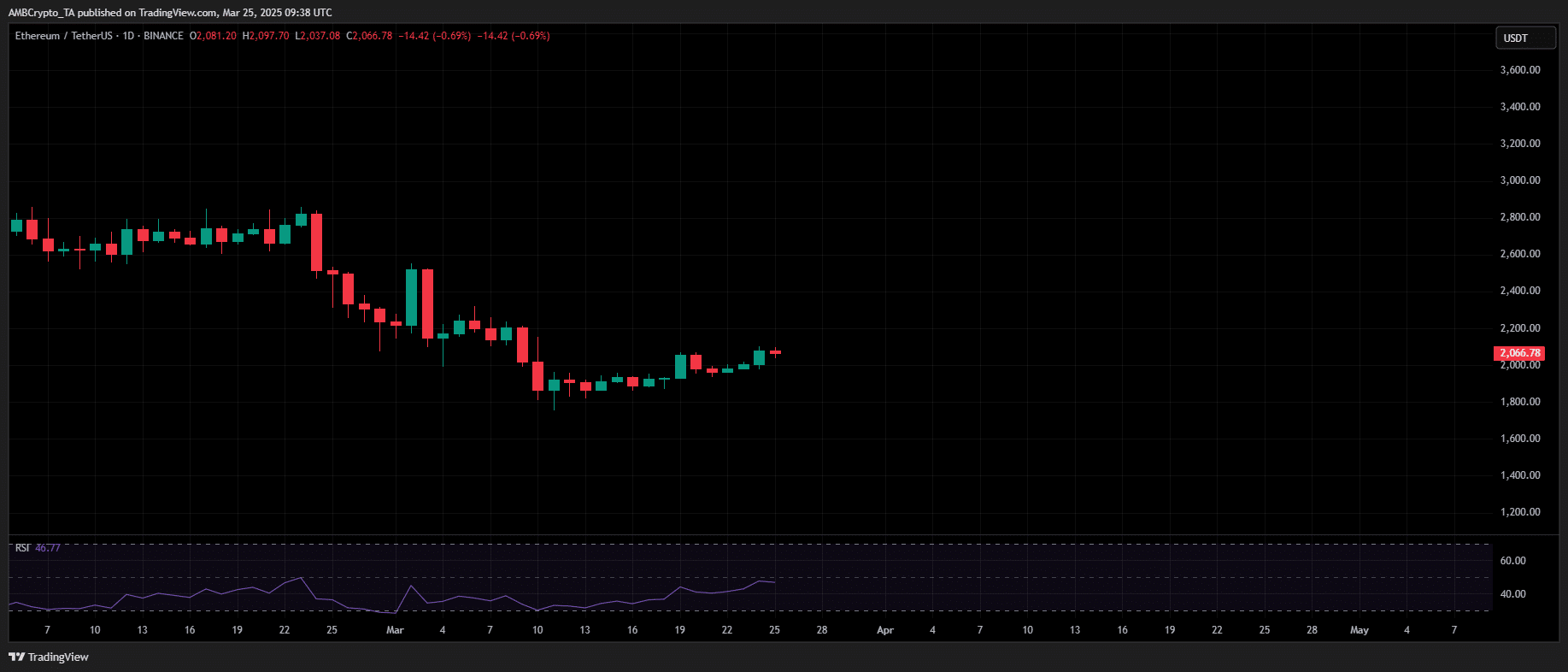

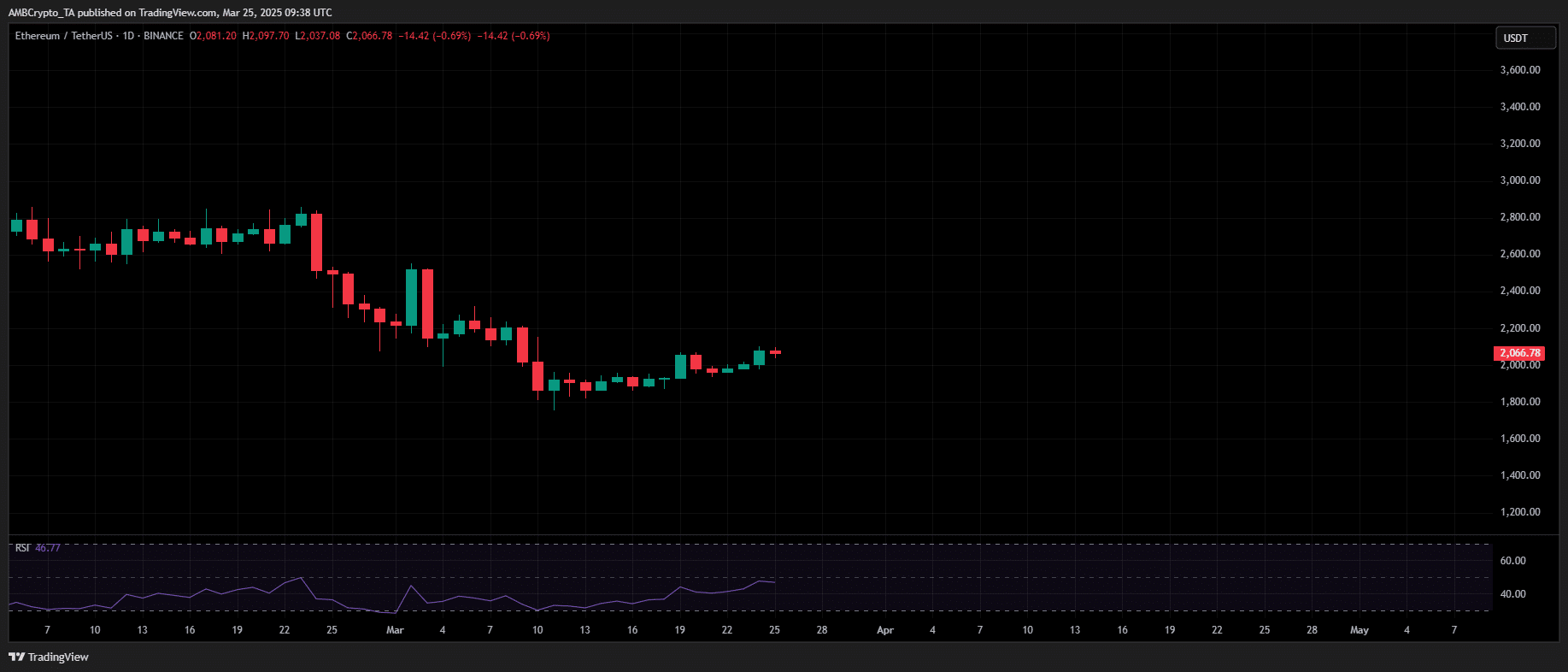

Bullish conviction, however, seems weak. Since the rally after the elections, ETH has demonstrated an increased correlation with the disadvantage of BTC, which is consistently lower highlights.

On March 3, BTCs led 8.54% Single-Day drawing to an ETH decrease of 14.66%.

Source: TradingView (ETH/USDT)

This structural shift suggests that Ethereum is becoming increasingly reactive to the drawings of Bitcoin instead of benefiting from capital rotation.

If BTC picks up sharply, ETH risks to lose the $ 2K liquidity zone, which means that ETH/BTC may float to fresh cycle Lows.