The winds of change could be blowing for Polkadot (DOT), a popular blockchain network for connecting different blockchains. After a difficult few months, marked by a price drop of almost 50% from the April peak, DOT is showing signs of a potential revival.

This positive outlook comes from a confluence of three key factors: rumors of a DOT-focused exchange-traded fund (ETF) on Coinbase, a bullish technical chart pattern, and healthy levels of liquidity in the market.

Related reading

ETF buzz is fueling investor interest

Earlier this week, news broke that crypto researcher 0xNoble revealed on a social media platform that Coinbase may be harboring secret plans for a DOT ETF. The rumor suggests that the cryptocurrency exchange is in the early stages of applying for the ETF, with the first approval hurdle expected on July 15.

This news follows Coinbase’s important move on June 28 when they filed for DOT Futures Contracts, a Futures ETF, and a Spot ETF.

Coinbase secretly asks for it $POINT ETF🔥

The first approval phase is already scheduled for July 15!

Polkadot ETF will be incredibly bullish for the entire ecosystem👇🧵 pic.twitter.com/OF8CrJxp2m

— 0xNobler (@CryptoNobler) July 4, 2024

The prospect of a DOT ETF has created excitement within the Polkadot community. Exchange-traded funds, which trade like stocks on traditional exchanges, could introduce a new wave of investors to the cryptocurrency space.

This broader exposure often translates into greater buying pressure and potentially higher prices for the underlying asset. Notably, the ETF announcement has already led to an increase in activity on Coinbase Derivatives, evidence of pent-up investor interest.

Polkadot: Technical analysis points to price breakout

Adding fuel to the DOT rally fire is a recent technical analysis from ZAYK Charts, a respected cryptocurrency research firm. Their analysis of DOT’s one-day chart revealed a compelling pattern known as a falling wedge.

This pattern is characterized by converging trend lines that slope downward and encapsulate lower highs and lower lows. Although traditionally seen as a bearish pattern, falling wedges can also indicate a potential bullish reversal.

According to ZAYK Charts, the falling wedge suggests that while sellers have been in control lately, their influence is waning. This is further evidenced by the fact that Polkadot has been fluctuating within this pattern since February. The lower trendline has consistently provided support, while the upper trendline has acted as resistance.

ZAYK expects a breakout from this wedge, which typically leads to significant upward price movement. Their breakout target is around $9.60, which represents a potential upside of more than 50% from the current price level.

$POINT Still moving within the falling wedge, in 1D timeframe✅

Outbreak expected📈#POINT #DOTUSDT #Dot #Crypto pic.twitter.com/19eQ0cPBwR

— ZAYK Charts (@ZAYKCharts) July 7, 2024

The analyst marks this target zone as a green box on the map. The timing of this outbreak is critical. As DOT continues to trade within the narrowing wedge, pressure increases, making a breakout more likely in the near future.

Related reading

Sufficient liquidity could enhance a potential rise

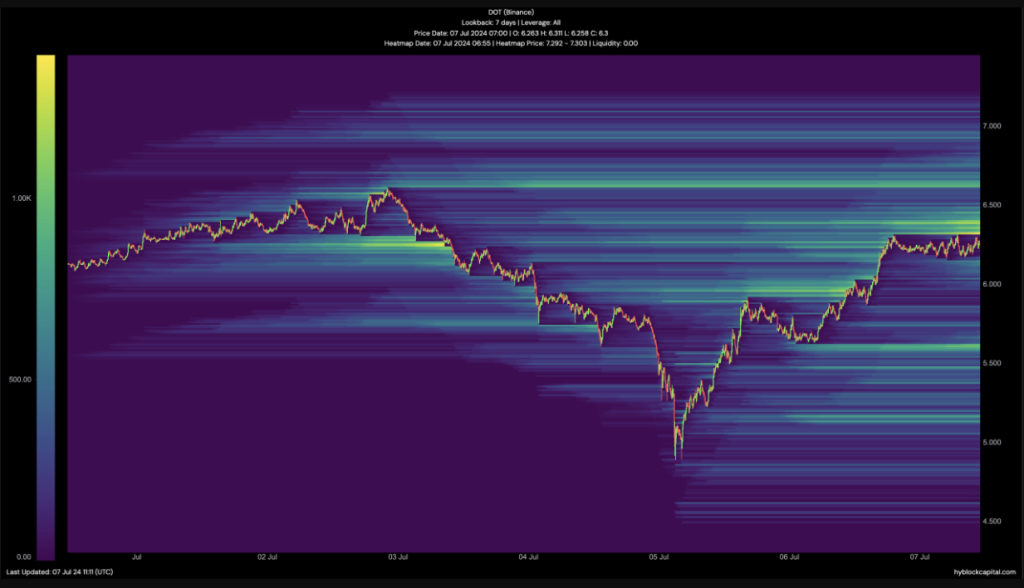

An added layer of intrigue to the DOT rally story is the presence of significant liquidity. A heatmap analysis by NewsBTC revealed concentrated liquidity zones for DOT between $6.45 and $6.96. Liquidity refers to the ease with which an asset can be bought or sold.

High liquidity translates into smoother price movements, as large buy or sell orders are less likely to cause significant price swings.

The presence of high liquidity between $6.45 and $6.96 creates a more favorable environment for a potential breakout. This abundance of buy and sell orders can act as a buffer, absorbing selling pressure and preventing sharp price drops.

If a breakout from the falling wedge occurs, this liquidity could help propel DOT’s price towards the $9.60 target zone identified by ZAYK Charts.

Featured image from Shutterstock, chart from TradingView