- ENA’s outbreak of a falling channel tested its critical support, with key levels on $ 0.35 and $ 0.47

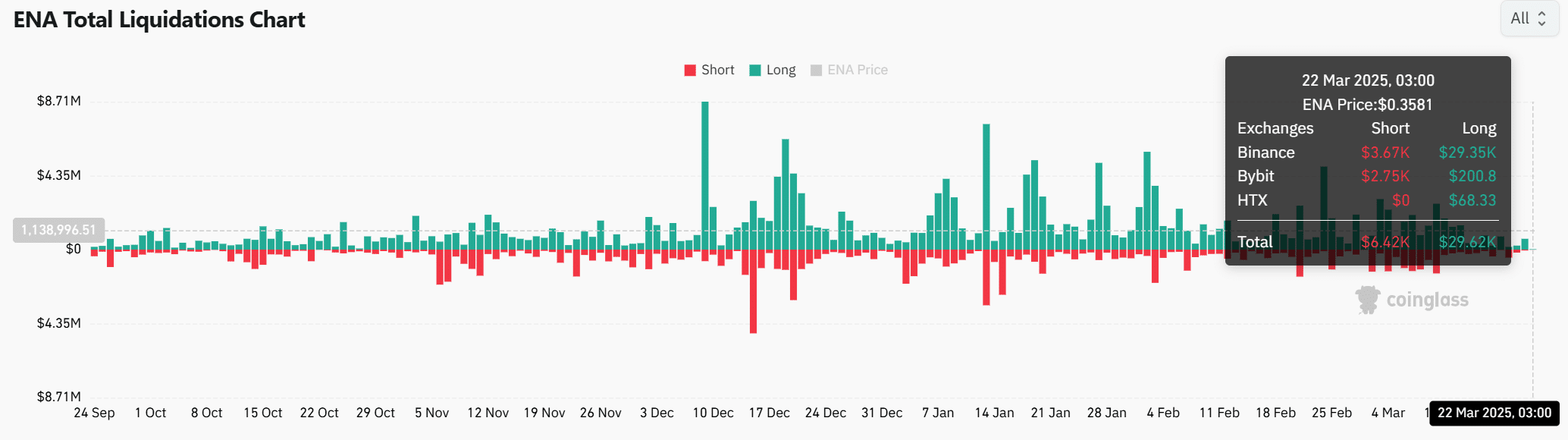

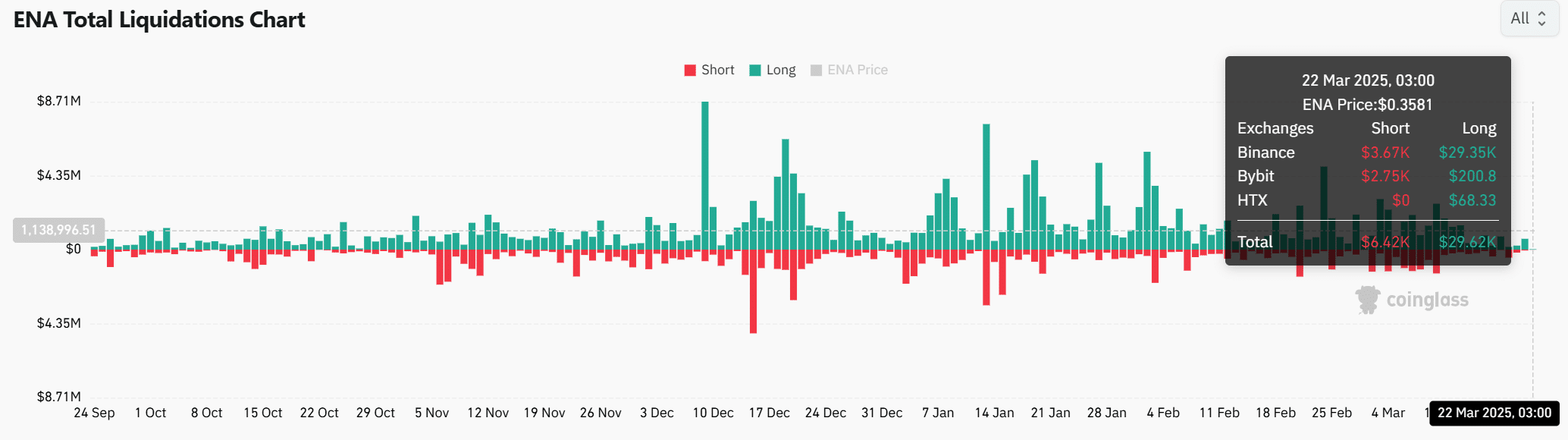

- Signals on chains were Beerarish, with long liquidations that exceed shorts

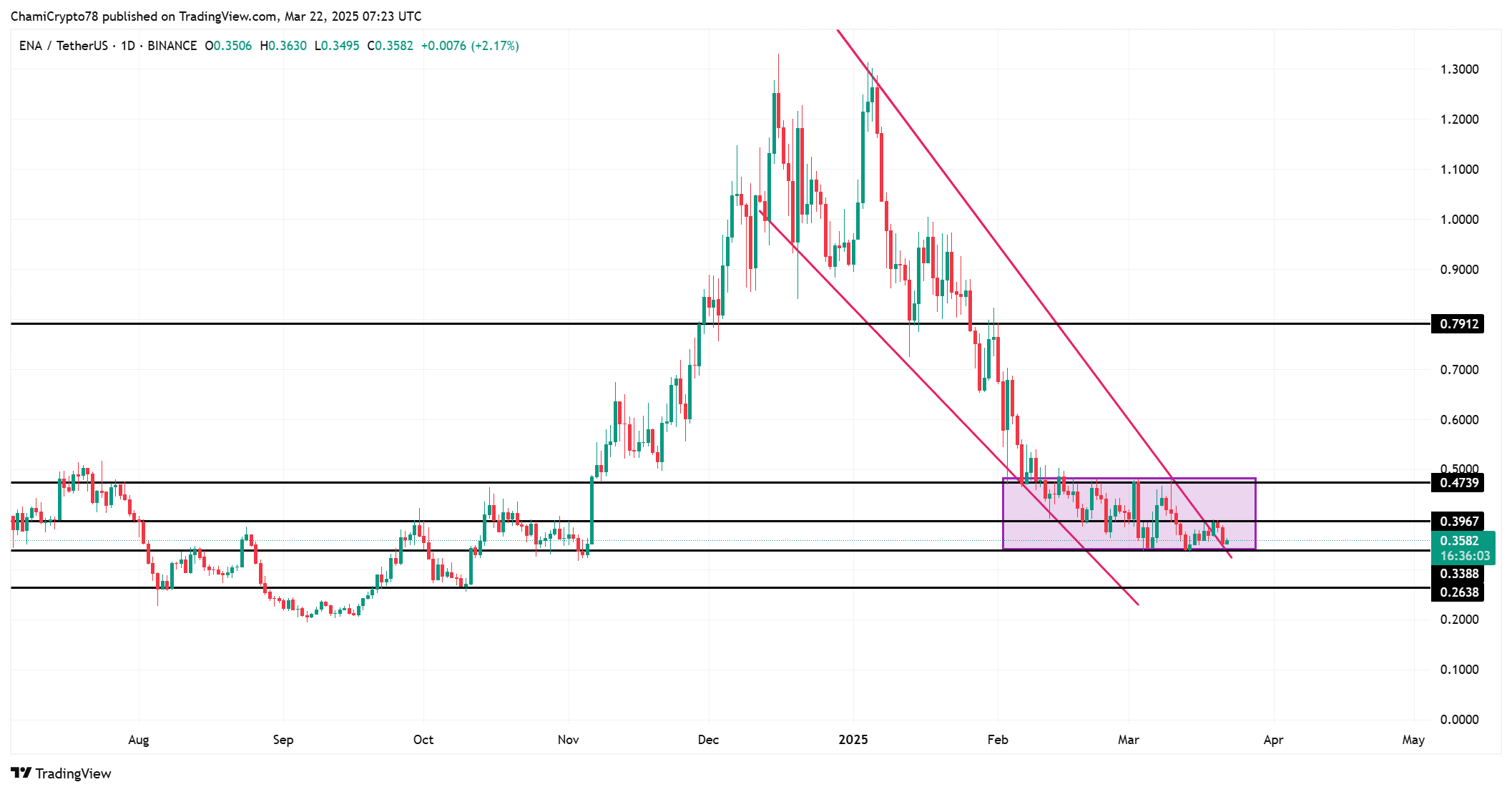

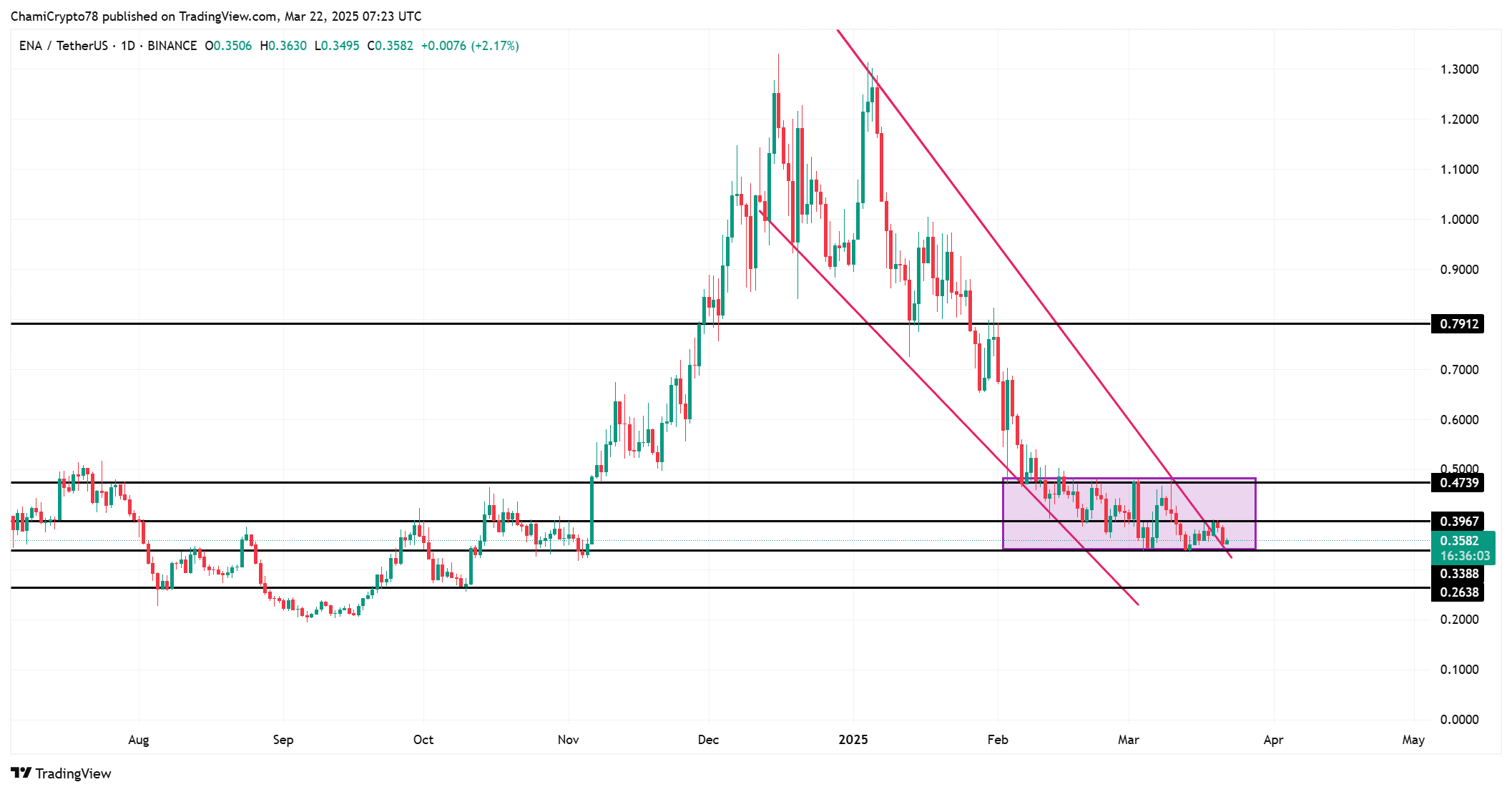

Ethena [ENA] Token recently broke from a falling channel pattern that caused optimism among investors. At the time of writing, the Altcoin was appreciated at $ 0.3583, after a decrease of 3.44% on the charts. The market capitalization of ENA was $ 1.89 billion, with a 24-hour trade volume of $ 135.5 million.

Despite the outbreak, however, the price of the Altcoin is still testing of crucial levels, so that the market remains uncertain. Can Ena retain this breakout momentum, or will it have difficulty maintaining upward pressure?

Price promotion – analysis – is Ena ready for a rally or a retreat?

The ENA prize had previously been in a phase of consolidation, before an outbreak of the falling channel. This breakout created a new price action structure for the Altcoin. With the price that now floats almost $ 0.3583, the support levels can be about $ 0.35 of crucial importance for the sustainability of the price.

If ENA succeeds in retaining above this level, this can focus on resistance zones near $ 0.47 and possibly, challenging higher levels, such as $ 0.48, $ 0.68 and even $ 1.00.

On the other hand, if the price does not support $ 0.35, ENA could test lower support levels at $ 0.26 – which indicates a potential price retreat.

Source: TradingView

Signals on the chain-silencing the data stimulate the price up or down?

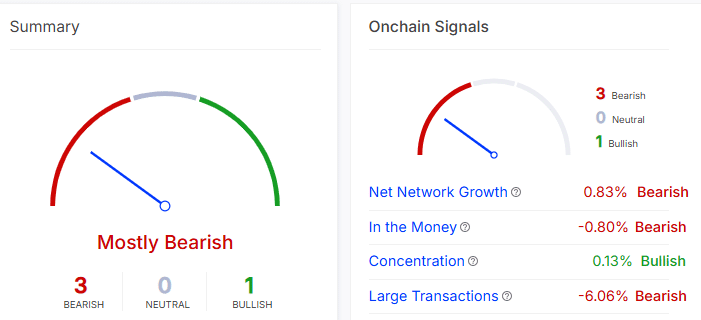

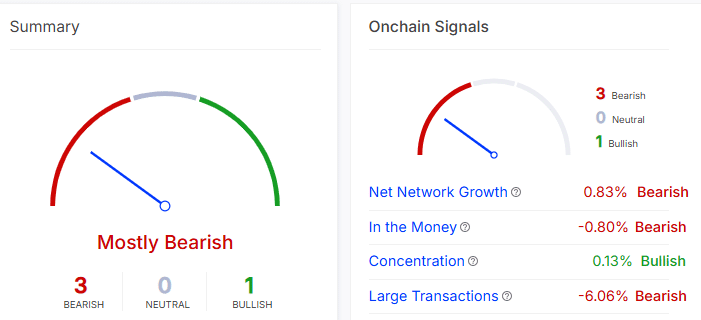

Analysis on the chain painted a rather bearish photo for Ena. Despite the outbreak, net network growth emphasized a decrease of 0.83% – pointing to a decrease in activity. Moreover, the “in the money” metriek flashed a change of -0.80%. This suggested that a significant part of the holders is currently a loss.

Although the concentration was somewhat positive with 0.13%, large transactions were largely bearish, with a significant decrease of -6.06% that points to more sales pressure in the market.

All in all, these signals in chains imply that Token could get considerable obstacles despite his latest technical outbreak.

Source: Intotheblock

Ena open interest and liquidations

Open interest in ENA rose by 3.38%and climbed to $ 345.78 million to underline higher market participation, according to Coinglass. Liquidation data, however, showed that long positions are more liquidated than shorts – $ 29.62k in long liquidations versus $ 6.42k in shorts.

This feeds down, but as soon as these liquidations have been erased, the market can rebuild.

For a long -term rally, ENA has to break resistance levels of around $ 0.47 and $ 0.48.

Source: Coinglass

Can Ena support his outbreak?

Although the newest outbreak of ENA from the falling channel the hope for a price die increased, Beerarish on-chain signals and support levels indicate that token can be confronted with challenges. If ENA can retain more than $ 0.35 and push the resistance at $ 0.47, it can see a persistent rally to higher price goals.

Without breaking through these critical levels, however, Ena might have difficulty retaining every up momentum. Although there is potential for a further meeting, ENA must therefore prove its ability to maintain important support levels to confirm any benefit.