- The percentage of BTC supply in earnings fell from 71% to 61%.

- BTC was still below $26,000, but a few metrics were bullish.

Over the past few days, the crypto market witnessed a sudden downtrend, causing top coins such as Bitcoin [BTC] And Ethereum [ETH] price plummet. Not only was the effect limited to the market leaders, altcoins with lower market caps also felt the heat.

Read Bitcoin [BTC] Price Forecast 2023-24

Why did the price of Bitcoin fall?

The past weeks, BTC remained comfortably below the $30,000 mark. However, investors were shocked on August 17 when the king coin witnessed a major drop, pushing the price below $26,000.

According to CoinMarketCap, BTC fell more than 11% in the past seven days. At the time of writing, it was trading at $25,897.22 with a market cap of over $503 billion. In addition, the trading volume fell by more than 38% in the last 24 hours.

While there may have been multiple factors at play that caused the entire market to turn red, Lookonchain pointed out what could be the most powerful trigger. Unsurprisingly, it was Elon Musk who kicked off this episode.

Musk’s aerospace engineering company, SpaceX, had sold $373 million worth of Bitcoin. This SpaceX dump may have sparked fear among investors, resulting in a price drop.

What happened to the market in the last 24 hours?

Eleven hours ago, the Wall Street Journal reported that SpaceX had sold for $373 million $BTC.

Then, $BTC dropped to $25,166.

9 hours ago, #Bloomberg reported that #SEC will clear the Ether futures ETFs and the decline stopped. pic.twitter.com/QO2Bvy2HHb

— Lookonchain (@lookonchain) August 18, 2023

The price drop had a greater impact on BTC’s on-chain metrics. Glassnode is recent analysis showed that the percentage of BTC supply in profit just dropped from 71% to 61%. This reflects the ‘top-heavy’ market, which has become increasingly price sensitive.

Additionally, Bitcoin’s lost UTXOs just hit a one-month high of 41,944,655,958. Not only that, but whale activity around the coin dropped as whale numbers just hit a 1-month low of 1,599.

📉 #Bitcoin $BTC Whale numbers just hit a 1-month low of 1,599

The previous 1-month low of 1,602 was observed on August 16, 2023

View statistics:https://t.co/k1K8OK2tl3 pic.twitter.com/HHRKRCczqg

— glassnode alerts (@glassnodealerts) August 19, 2023

Bitcoin is showing signs of recovery

However, the market decline came to a halt thanks to the Securities and Exchange Commission (SEC). This happened after the regulatory body announced its plans to approve Ethereum futures ETFs.

According to an Aug. 17 Bloomberg report, the SEC is unlikely to block the product, which has seen many applications from numerous companies. Since then, BTC’s on-chain stats have shown signs of recovery, lending hope that the value of the king of crytpos could witness an uptick.

Is your wallet green? Check the Bitcoin Profit Calculator

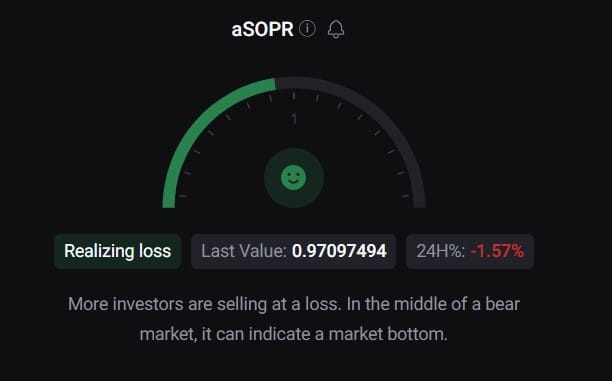

In particular according to CryptoQuant, Bitcoin’s foreign exchange reserve declined, suggesting that the coin was not under selling pressure. The coin’s aSORP was green, meaning more investors were selling at a loss, signaling a possible market bottom.

In addition, BTC’s Relative Strength Index (RSI) was in an oversold position. This could increase buying pressure on the coin and in turn raise its price.

Source: CryptoQuant