- The project’s development activity declined; however, participants remain optimistic about DOT.

- Indicators showed that the price of DOT was in danger of falling below $6.

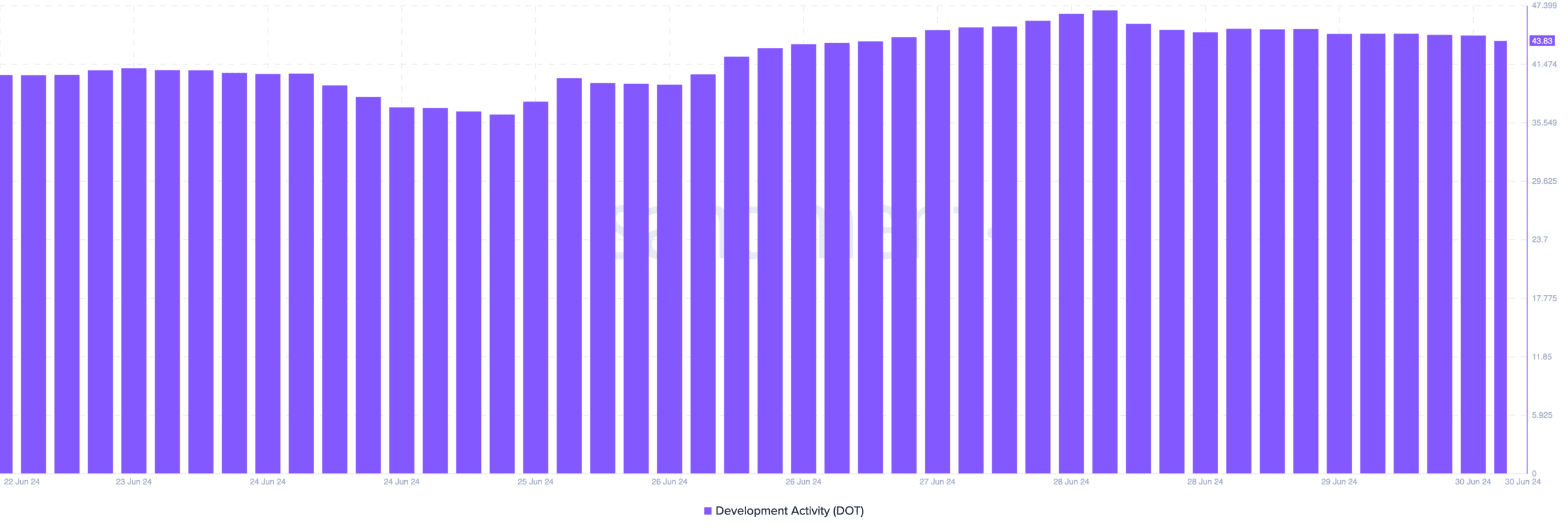

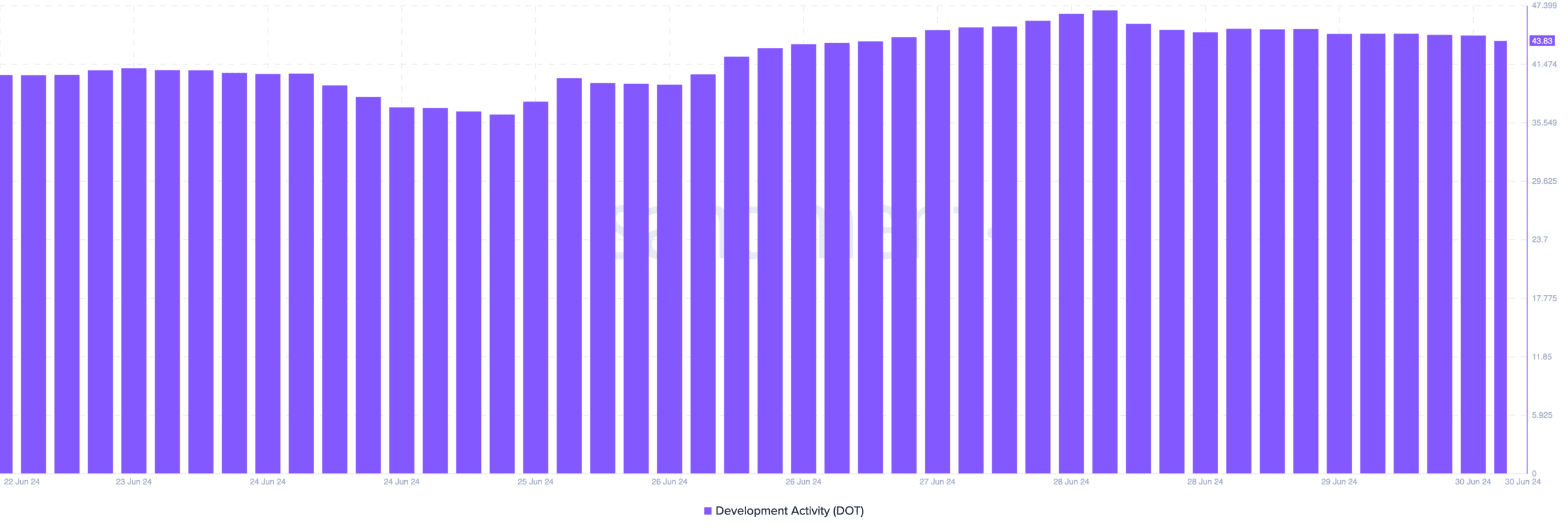

Development activities have always been an important part of Polkadot’s [DOT] grow. On several occasions, AMBCrypto reported how the blockchain was leading the way on this front.

Something similar happened last week when the development activity metric reached 46.93. But on June 28, the reading began to decline. When development activity increases, it means a project is shipping new features on its network.

However, a decrease occurs when the commitment to polishing the network is not at its highest. At the time of writing, this was the case with Polkadot. But it is necessary to point out that the protocol has made significant progress in the said week.

Shipping is stagnating due to optimism

Thus, Snowbridge was launched, a reliable cross-chain project, developed on the network. There were too remarkable developments Apart from this. Some involved non-fungible tokens (NFTs), and others involved asset security.

Source: Santiment

Should this continue into the new week, the project’s development activity could see an upward trend again. As for price, DOT changed hands for $6.11.

Surprisingly, it was one of the biggest winners out of the top twenty projects on the market. Moreover, several analysts in the market shared their views on the cryptocurrency, saying that it was undervalued.

One of them is Michaël van de Poppe. According to van de Poppe, DOT could follow suit in Ethereum [ETH] steps. He gave his reasons on X, noticing That,

“DOT will likely follow Ethereum in its upward expansion. This means that Polkadot’s current valuations are extremely low. I expect a lot from the Polkadot ecosystem with all the new segments.”

ETF rumors pop up, but DOT doesn’t care

Another reason for the speculation What’s going around is that Polkadot is another project that qualifies for an ETF. For context, ETF stands for Exchange-Traded Fund. If this happens, the traditional financial sector would be exposed to DOT, following the example of Bitcoin [BTC] and the path of Ethereum.

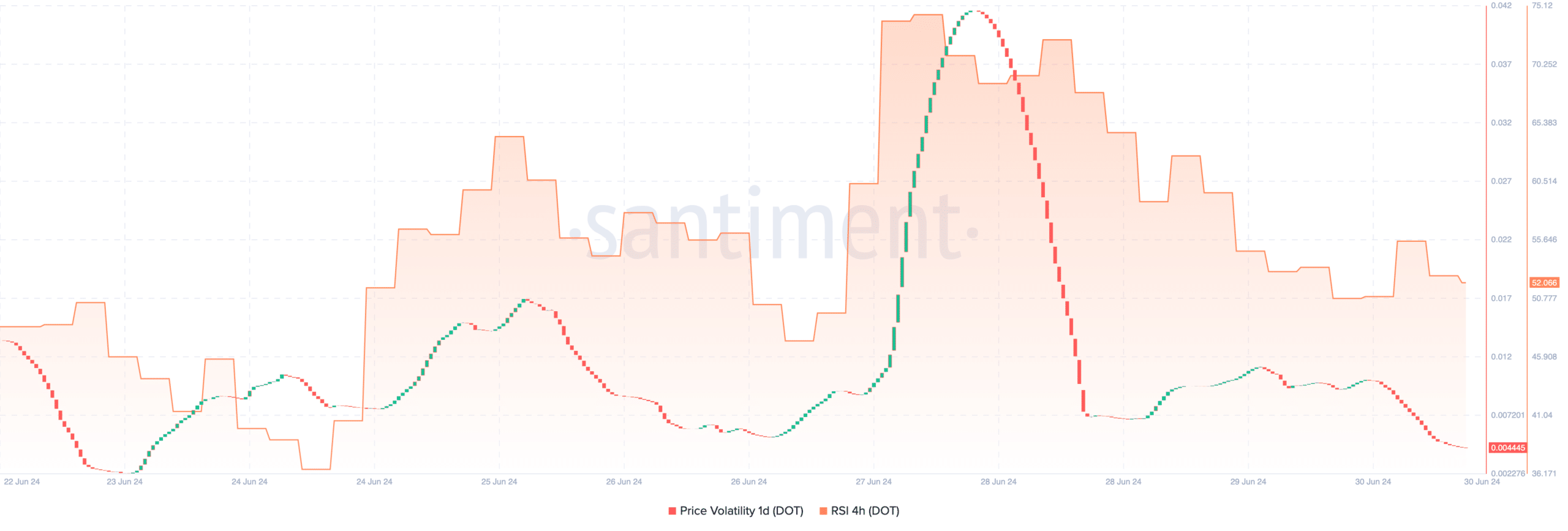

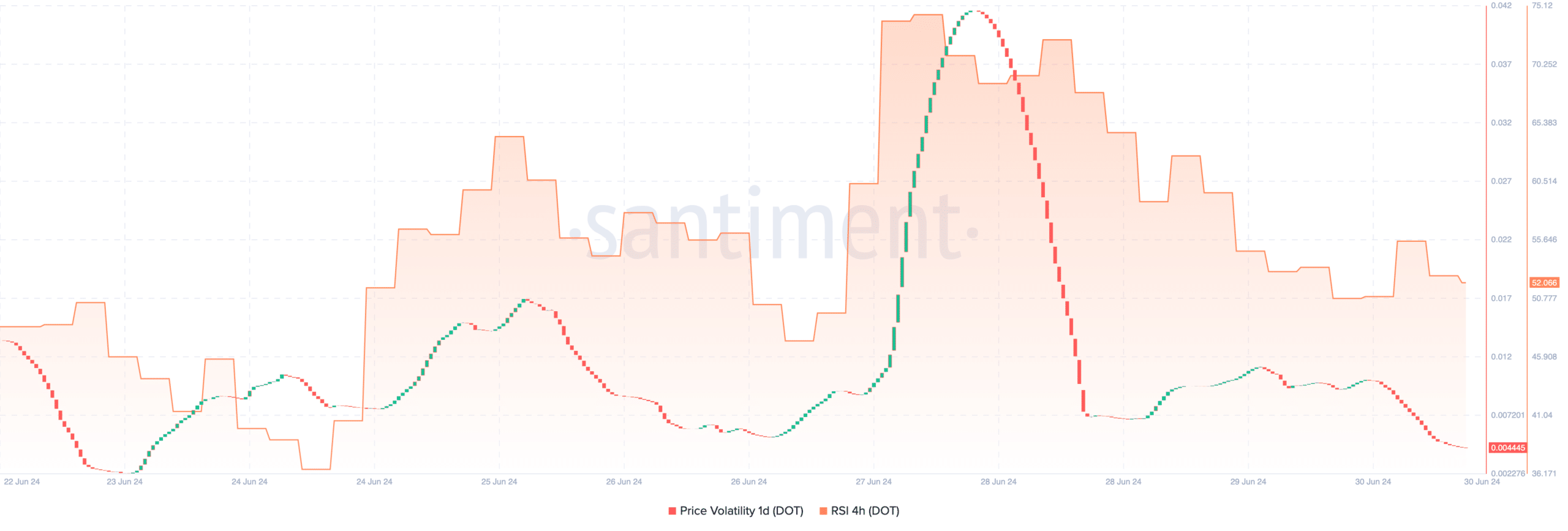

Despite the optimism surrounding the token, AMBCrypto found that the previous bullish momentum was waning. After evaluation, we discovered the Relative Strength Index (RSI) on the 4-hour chart.

The RSI measures momentum. If it rises, it means the momentum is bullish. But when it decreases, it means the momentum is bearish.

At the time of printing the indicator value had changed down to 52.06, indicating sellers are taking profit from recent gains. In addition, one-day volatility decreased.

Source: Santiment

Read Polkadots [DOT] Price forecast 2024-2025

The drop in volatility implies that the price may not experience rapid swings in the short term. If selling pressure increases, DOT’s price could fall below $6.

However, if bulls enter the picture, the price could remain above $6 or move towards $7.

![Dot [DOT] Sees a slowdown in development amid market gains](https://bitcoinplatform.com/wp-content/uploads/2024/07/polkadot-dot-network-price-1000x600.webp)