This article is available in Spanish.

It appears that Bitcoin price will see a bullish reversal in January next year after maintaining tepid price action to close this year. This bullish outlook for the flagship crypto came as a crypto analyst Tony Severino revealed a potential Doji formation, suggesting BTC could enjoy this uptrend in the new year.

Related reading

Doji formation could lead to a Bitcoin price surge in the new year

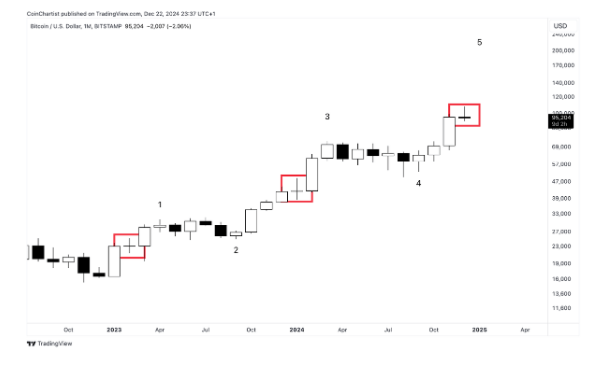

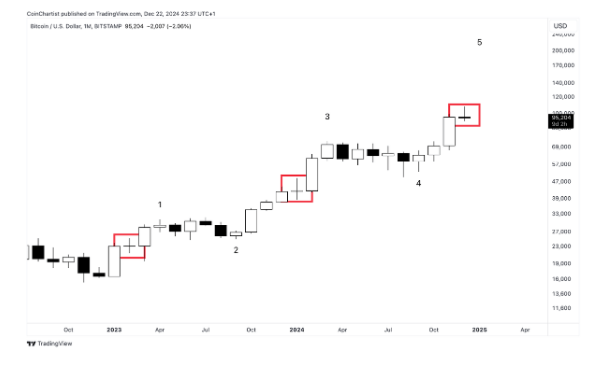

In one X message, Severino suggested that a Doji formation could lead to a Bitcoin price rally in the first two months of the new year. The analyst said he suspects BTC will end December with the Doji and then January will end with a strong continuation for the flagship crypto. His accompanying chart showed that this strong continuation could continue into February.

The crypto analyst explained that a Doji represents a pause in the market due to indecision from buyers and sellers. He added that the next candlestick will show market participants the decision the market has made through a strong continuation or a reversal. In this case, Severino expects the next candlestick to be a strong continuation for the Bitcoin price.

Severino noted that a similar Doji on similar subwaves each resulted in another two months of upside before one local winner was in for the Bitcoin price. Therefore, the crypto could enjoy two months of upside potential between January and February 2025 if history repeats itself. From a fundamental perspective, the inauguration of Donald Trump is a factor that could cause this strong continuation.

The BTC price rose above $100,000 following Trump’s victory in the US presidential elections in November. As such, flagship crypto could continue this rally as Trump becomes the first pro-crypto US president. Moreover, the new American president can… Strategic Bitcoin Reserve when he takes office, which would create more bullish momentum for BTC.

BTC should remain above $92,730

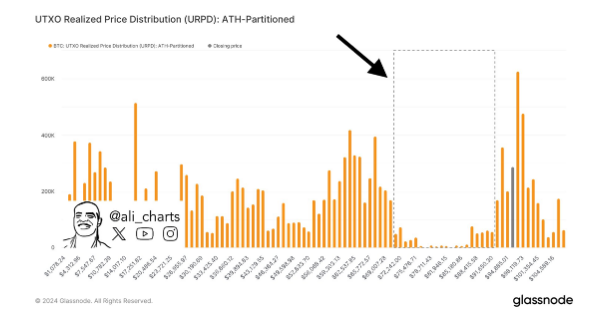

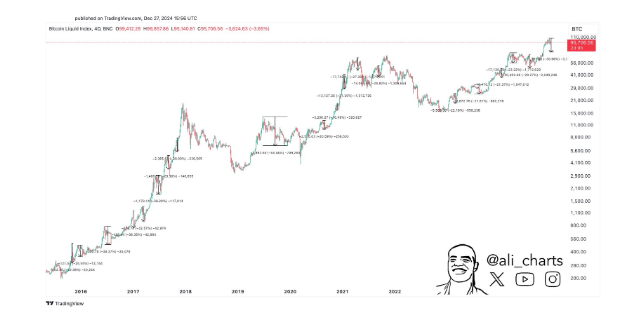

In an X-post, crypto analyst Ali Martinez noted that the Bitcoin price must avoid falling below $92,730, as if it breaks that level, it is in free fall. The analyst’s accompanying chart showed that Bitcoin could fall to the $70,000 range if it were to break this $92,730 price level.

Related reading

However, in another X post, Martinez suggested that such a Bitcoin price drop may not necessarily be a bad thing. This came when he stated that a 20% to 30% price correction is the most bullish thing that can happen to Bitcoin. Meanwhile, Martinez stated that the void levels for his bearish Bitcoin outlook are a sustained close above $97,300 and a daily close above $100,000.

At the time of writing, the Bitcoin price is trading around $94,400, down almost 2% in the past 24 hours. facts from CoinMarketCap.

Featured image from Reuters, chart from TradingView