After a prolonged period of downward momentum, Dogwihat (WIF), a popular Solana-based meme coin, is poised for a massive upward move. This positive outlook can be attributed to the formation of bullish price action and traders’ rising interest over the past 24 hours.

Dogwifhat (WIF) technical analysis and upcoming levels

According to experts’ technical analysis, WIF appears bullish as it has formed a bullish divergence on its daily time frame. When an asset forms a bullish divergence, it indicates that the asset is likely to skyrocket soon. Furthermore, WIF appears to be consolidating near a crucial support level at $1.30.

Historically, this level has provided strong support for the meme coin. Since August 2024, WIF has reached this level almost four times, and each time it has experienced significant upward momentum.

Looking at the historical price momentum, experts and analysts expect a similar kind of upward movement. Based on the recent price action, if WIF breaks out of the consolidation and closes a daily candle above the $1.50 level, there is a strong possibility that it could rise 40% to reach the $2 level in the future reaches.

The Relative Strength Index (RSI), currently near 35, indicates that WIF could soon experience a strong price reversal and significant upside momentum.

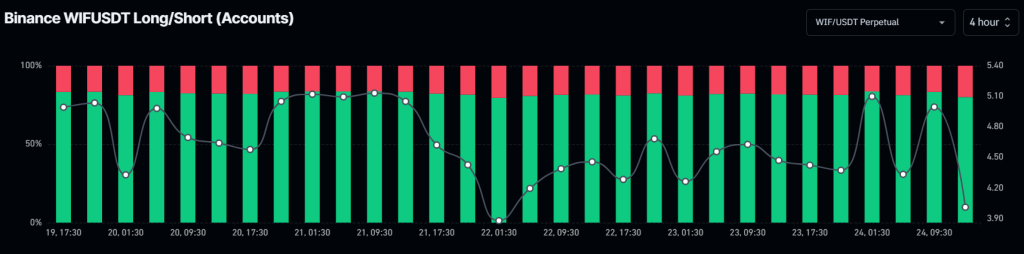

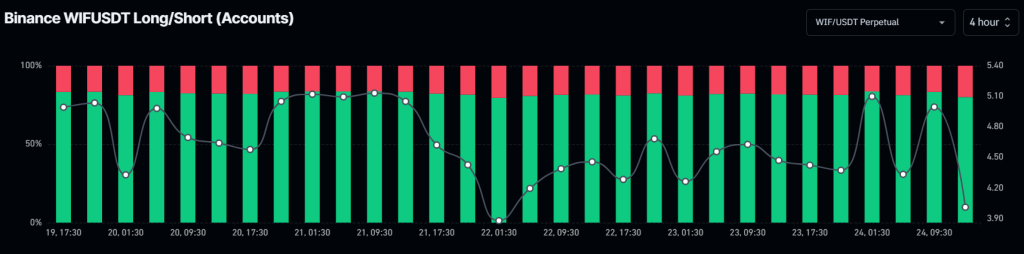

80% of Binance traders go long to WIF

Looking at the bullish outlook, Binance traders have shown strong interest and confidence in the meme coin over the past 24 hours, according to the on-chain analytics firm Coinglass.

Binance’s WIFUSDT Long/Short Ratio currently stands at 4.01, indicating strong bullish sentiment among traders. Furthermore, the data shows that 80.10% of the top WIF traders on Binance hold long positions, while 19.90% hold short positions.

Current price momentum

With rising rates and a bullish outlook, WIF is currently trading near $1.44 and has experienced upward momentum of over 3.5% over the past 24 hours. Furthermore, trader and investor participation appears to have increased over the same period, resulting in a 20% increase in trading volume.