- The asset is in danger of losing its current support level within the bullish pattern it is trading in, potentially leading to a deeper correction.

- Statistics show active participation from both long and short traders, but with a clear direction.

dog hat [WIF] was mostly bearish, with a monthly market performance of -43.11%. However, there are signs that the downtrend could pause in the coming trading sessions.

Before a rally occurs, WIF is likely to experience an additional price decline from current levels. The recent drop of 14.69% in the past 24 hours could extend further.

WIF remains bullish, but risks a short-term decline

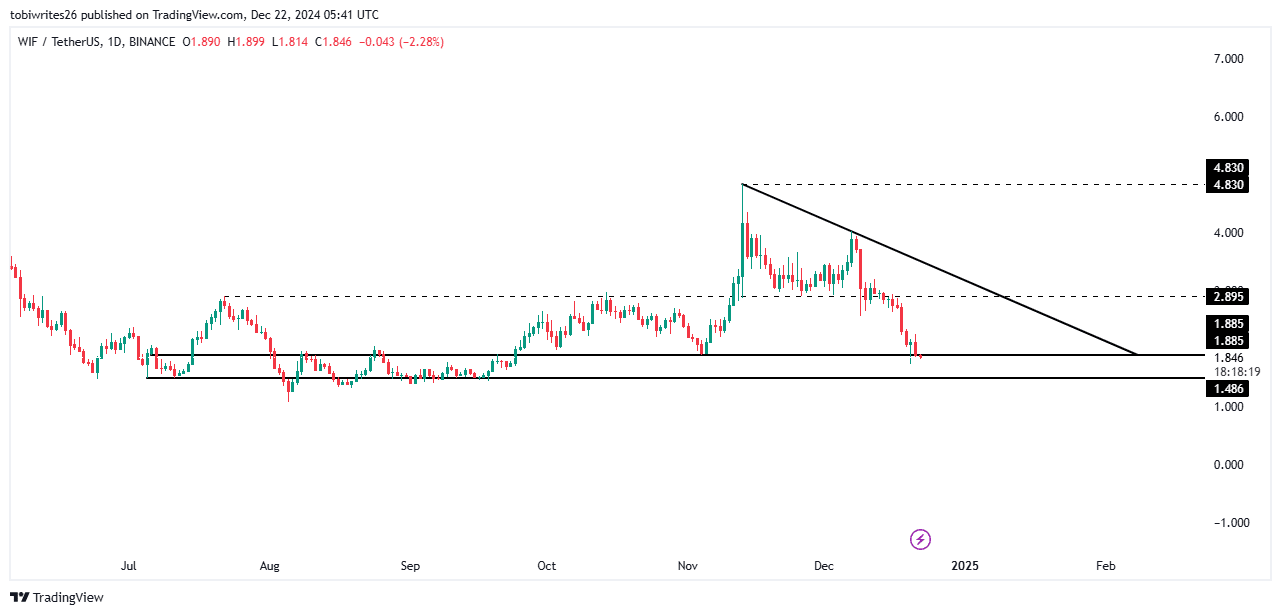

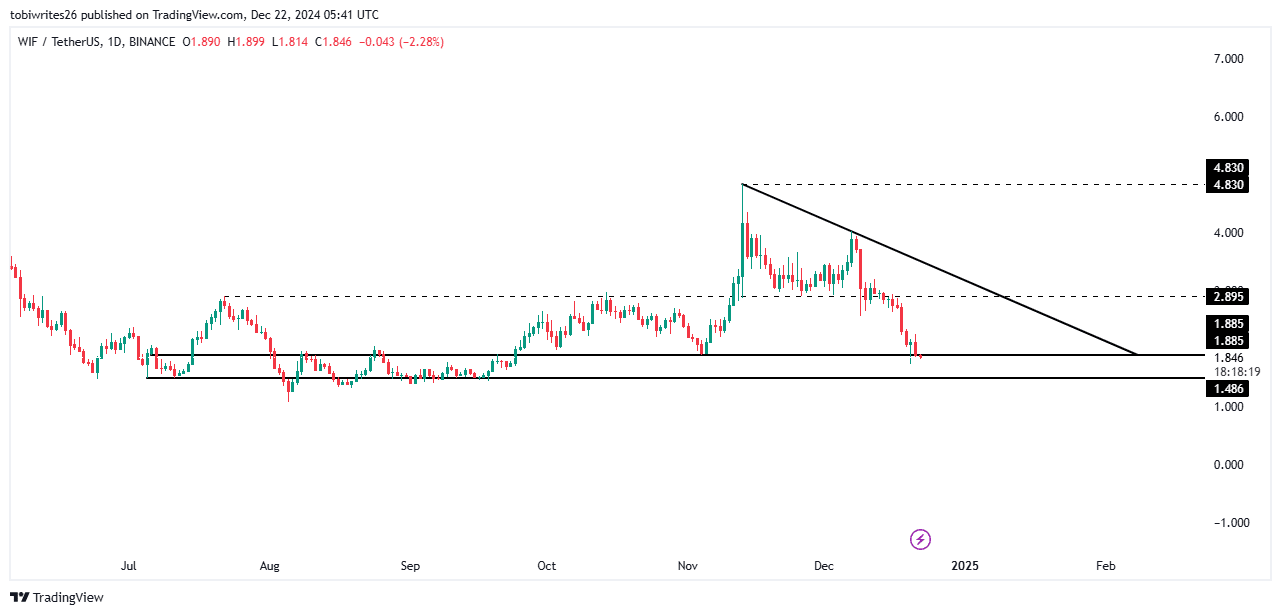

On the chart, WIF has formed a bullish pattern. It has now fallen to the support level of this structure at 1,885, which would typically trigger an upswing. However, there has yet to be significant buying activity at this level.

If the 1,885 support does not hold, WIF is likely to lose strength and fall within a range. The next potential support is at 1,486, where the asset could find the necessary momentum for a rebound.

Source: trading view

Once a rebound is initiated, WIF will face two key resistance levels on the way to a rally. The first is at 2,895, followed by the upper limit of the bullish pattern. If these hurdles are overcome, WIF could reach its next high at $4,830.

A decline in the price of WIF is imminent

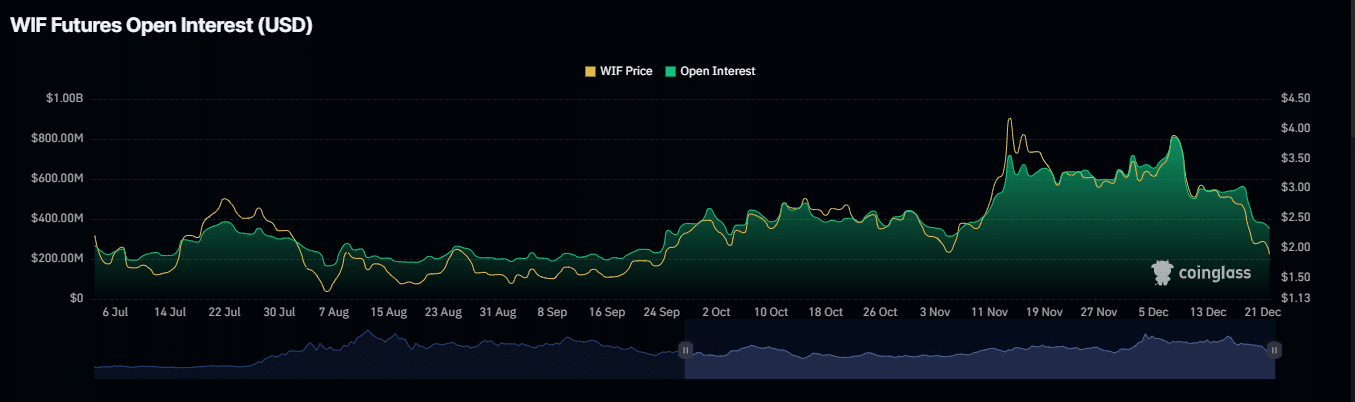

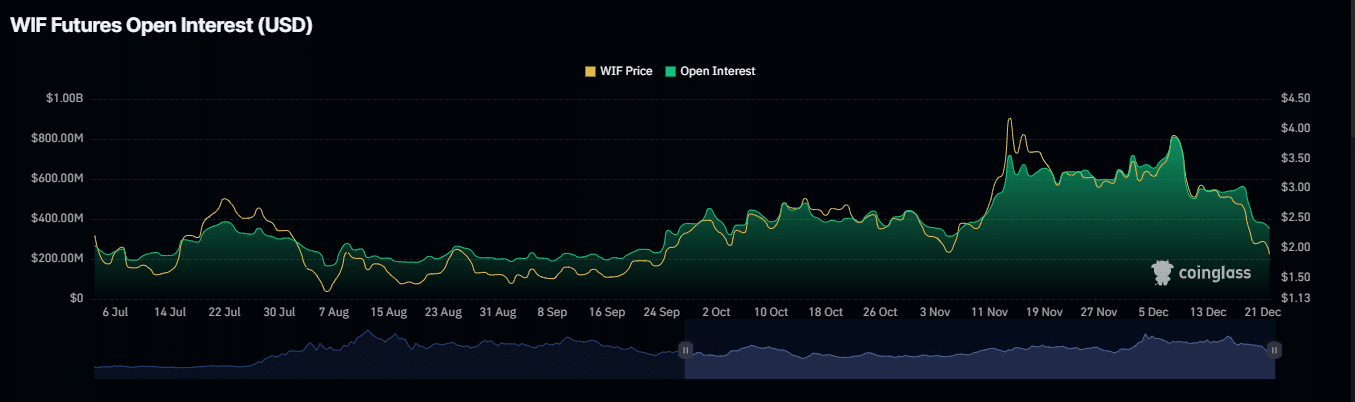

WIF’s Open Interest (OI) has steadily declined. At the time of writing, OI is down to $360.94 million, down 11.25%.

This decline in OI is caused by derivatives traders actively closing their positions while the price of the asset continues to decline. As a result, WIF’s market capitalization fell 14.29% to $1.88 billion, while trading volume fell 44.16% to $496.58 million.

Source: Coinglass

Furthermore, there has been a shift in market sentiment, with short contracts outweighing long contracts. The current long-short ratio is 0.89, which indicates that there are more short positions than long positions.

When this ratio remains below 1, it indicates bearish dominance in the market.

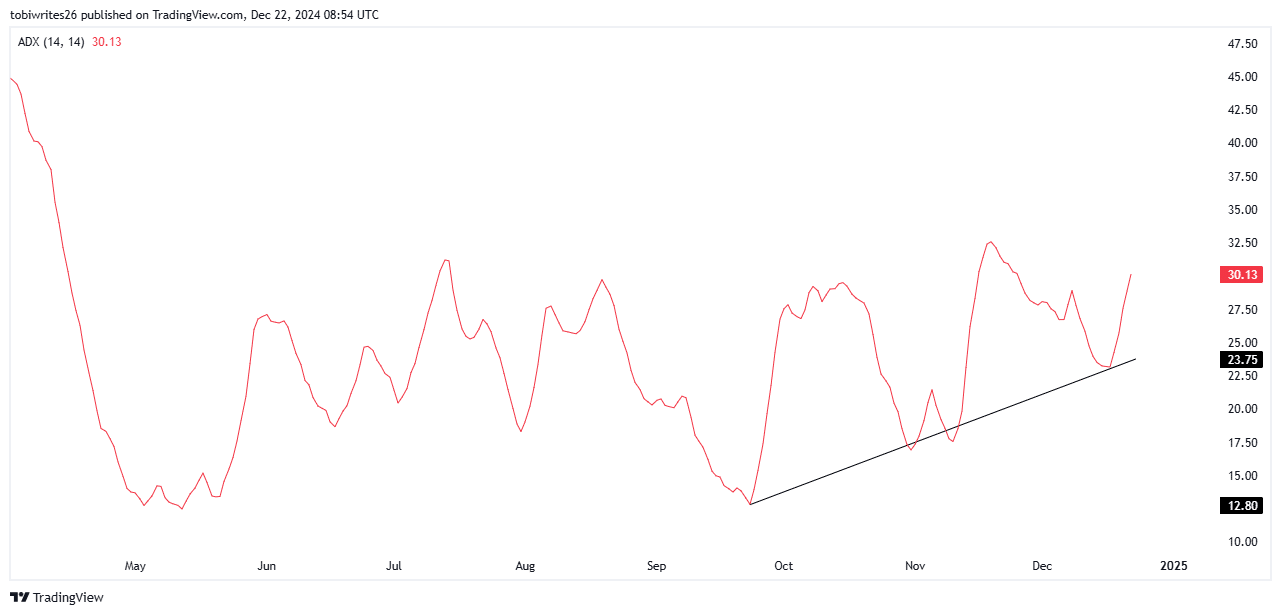

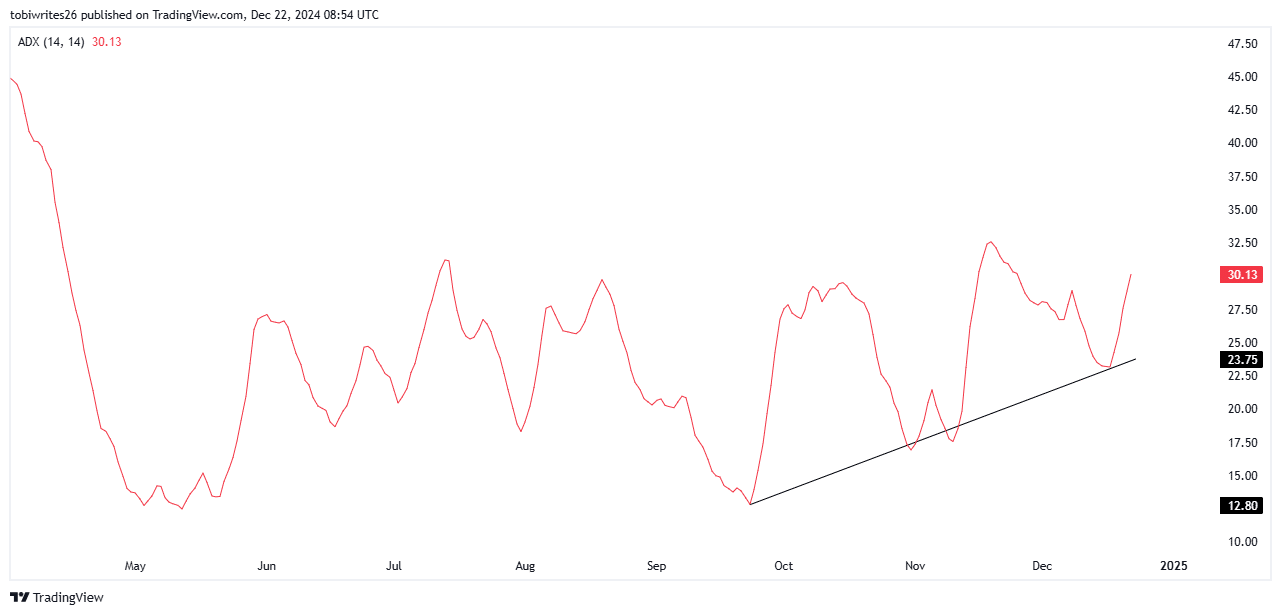

Further supporting the likelihood of a price drop is the Average Directional Index (ADX), which currently reads 30.19, a sign of a strong bearish trend. A rising ADX during a price decline indicates that bearish momentum is increasing.

Source: trading view

Now that these numbers are in line, the price of the asset is expected to fall below the current support level.

Bullish strength remains high despite a small decline in prospect

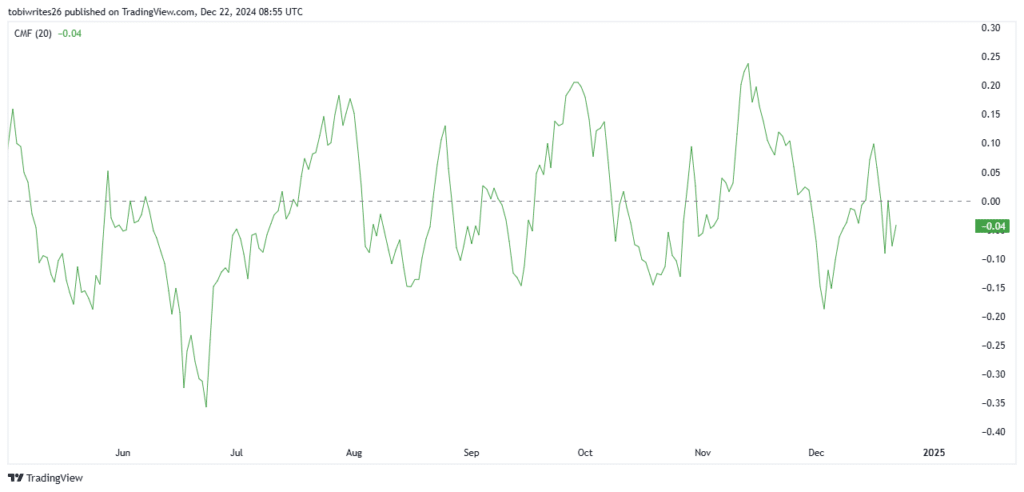

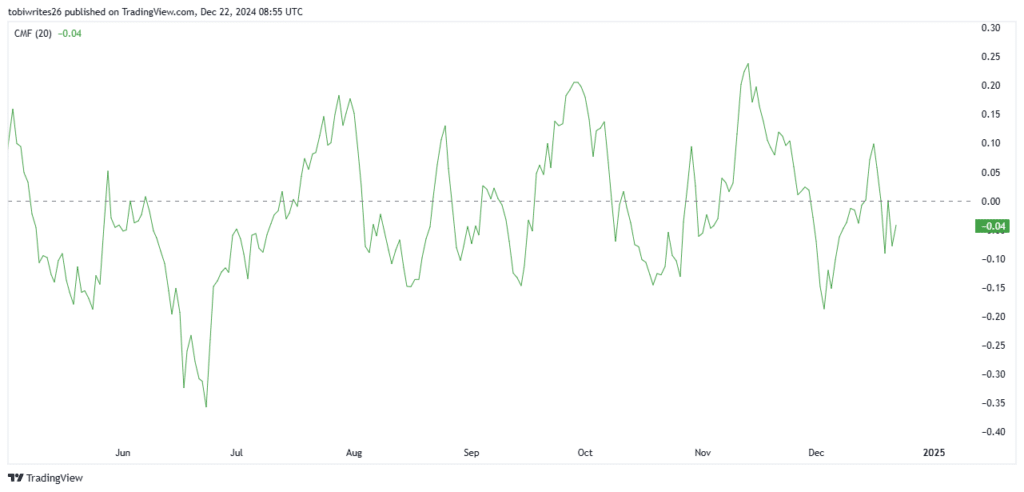

The bullish sentiment in the market remains, supported by the Chaikin Money Flow (CMF), which is trending upwards and approaching the zero limit.

When the CMF is trending higher, it indicates that buying volume is greater than selling volume, with a potential reversal to the upside close. If the CMF moves above the neutral zero line, it could cause the price to rise.

Source: trading view

The current movement of the CMF indicates continued accumulation at support levels. However, this accumulation can temporarily weigh on the price, causing a small dip before the bullish momentum strengthens.

Read dogwifhat’s [WIF] Price forecast 2024–2025

In addition, spot traders are increasingly transferring their WIF balances to private wallets for long-term storage. Currently, approximately $5.50 million worth of WIF has been moved this way.

While WIF maintains its overall bullish outlook, a slight price decline remains likely in the near term.