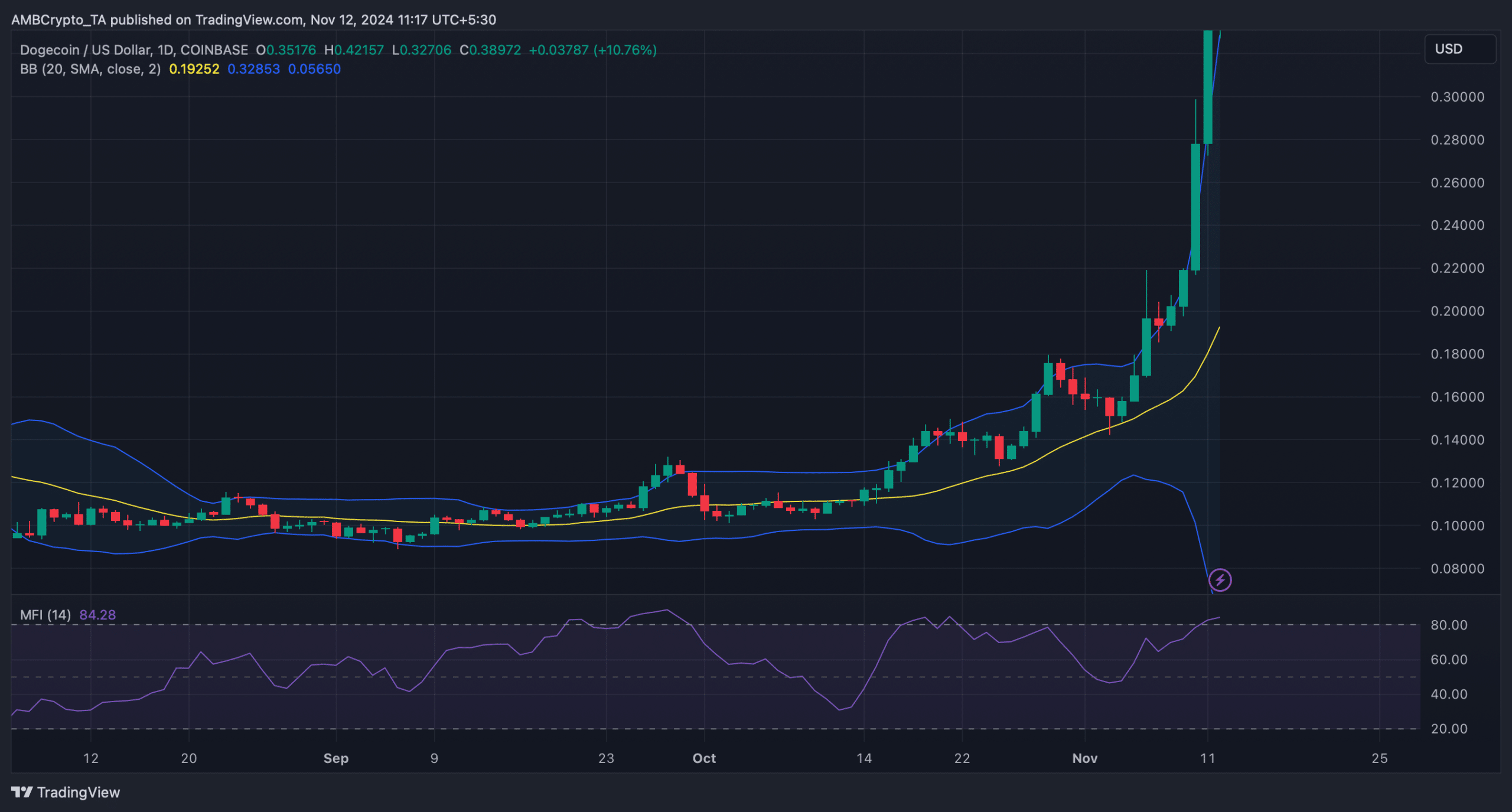

- DOGE’s price moved in an upward channel.

- The Bollinger Bands soon suggested a price correction.

Market conditions turned heavily in favor of investors, with most tokens registering massive growth Dogecoin [DOGE] was not omitted.

This latest pump boosted the price of the world’s largest memecoin by triple digits last week. Meanwhile, an important development took place, indicating a continued price increase for DOGE.

Dogecoin’s golden cross

Dogecoin bulls clearly dominated the market last week as the price rose over 140% in that time. In fact, the bull rally continued over the past 24 hours.

According to CoinMarketCap, DOGE’s value increased by more than 48%. At the time of writing, DOGE was trading at $0.4192.

This matched that of AMBCrypto analysiswhere we reported that there were chances of DOGE rising by 50%.

The latest price increase pushed 61.6 million Dogecoin addresses gained, accounting for 96% of the total number of DOGE addresses.

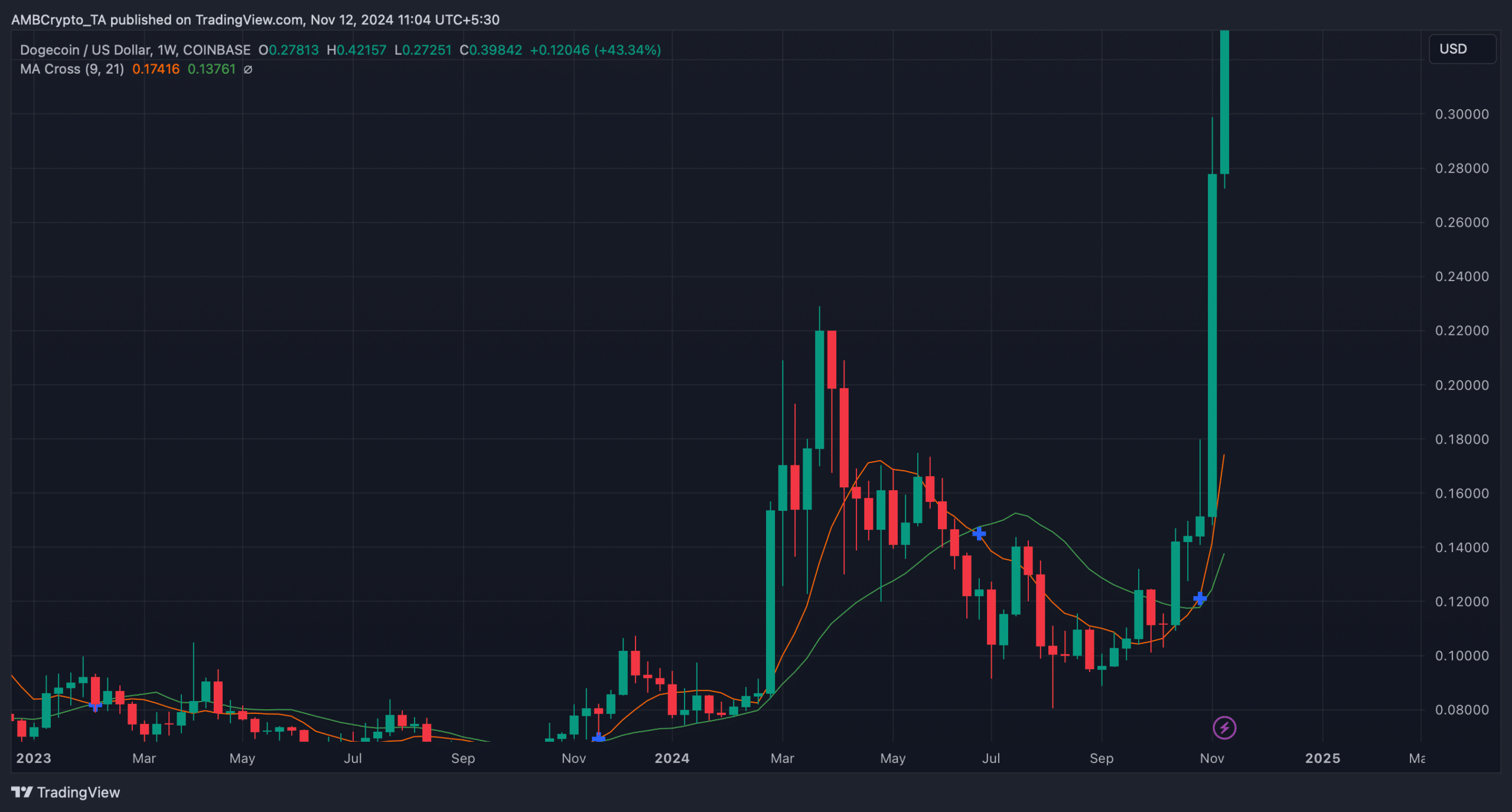

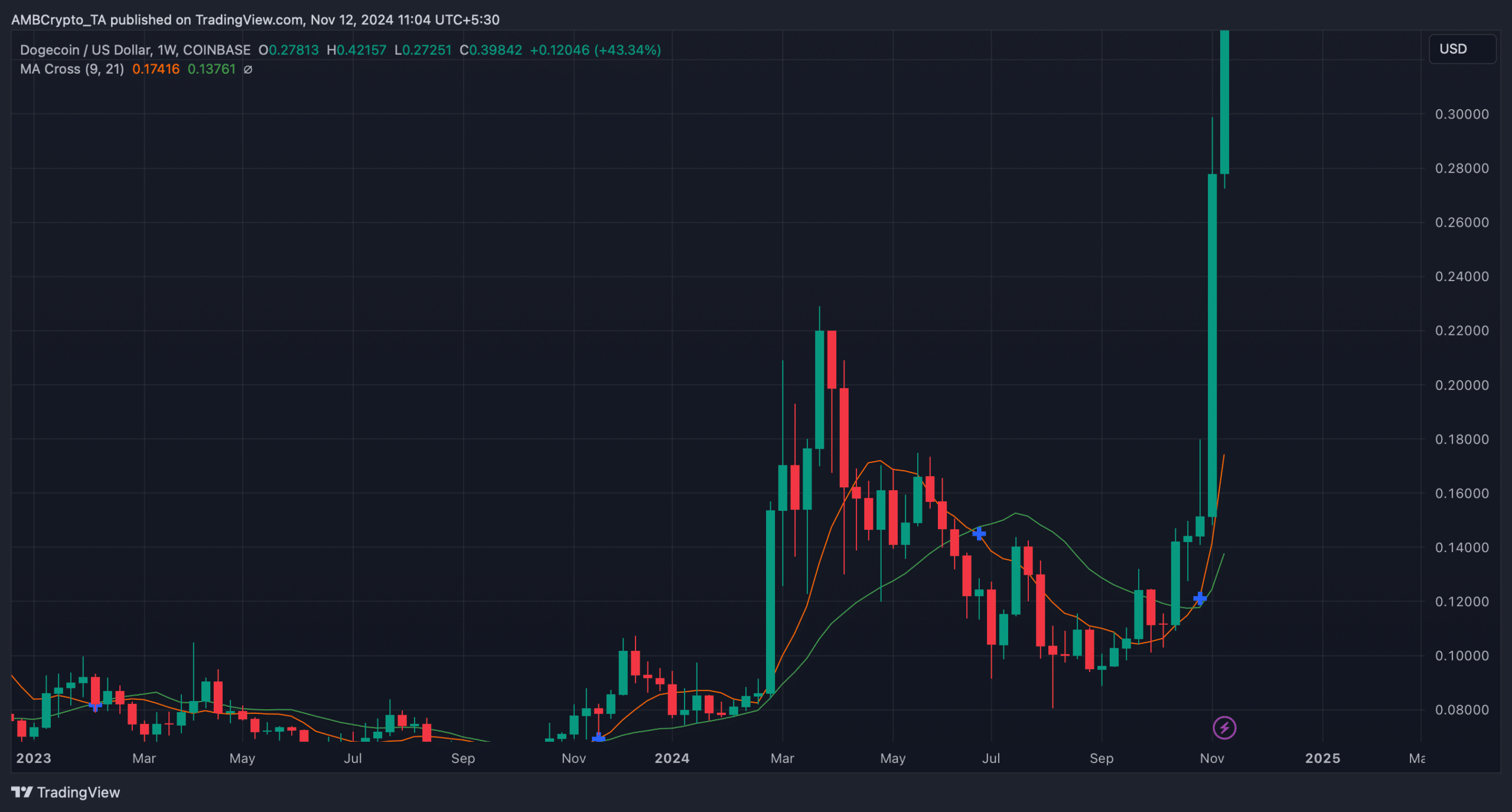

While that was happening, DOGE witnessed a gold cross on the weekly chart. To be precise, the memecoin’s 9-day MA has reversed the 21-day MA, indicating continued price appreciation.

Source: TradingView

The likelihood of DOGE’s bull run continuing

In the meantime, Ali, a popular crypto analyst, also posted one tweet reveal a remarkable update.

According to the tweet, DOGE was moving in an upward channel and at press time the coin was testing the middle resistance level of the pattern.

A successful test could fuel this ongoing rally, suggesting a possible rise to $1. That’s why we looked at DOGE’s on-chain data.

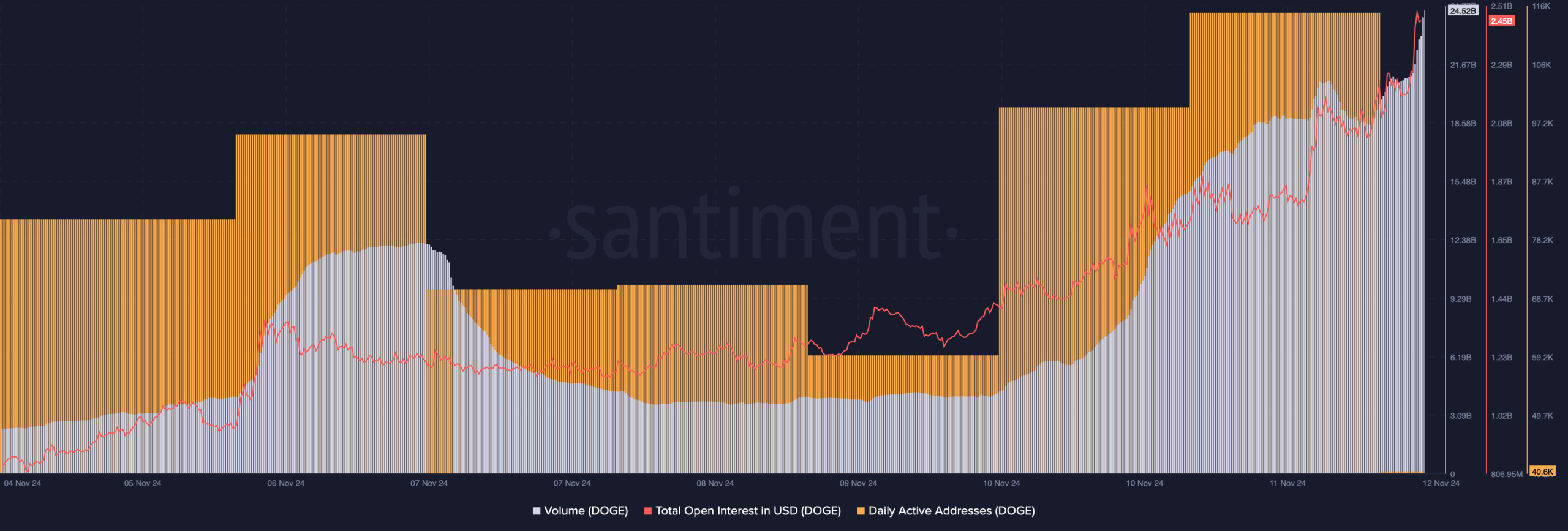

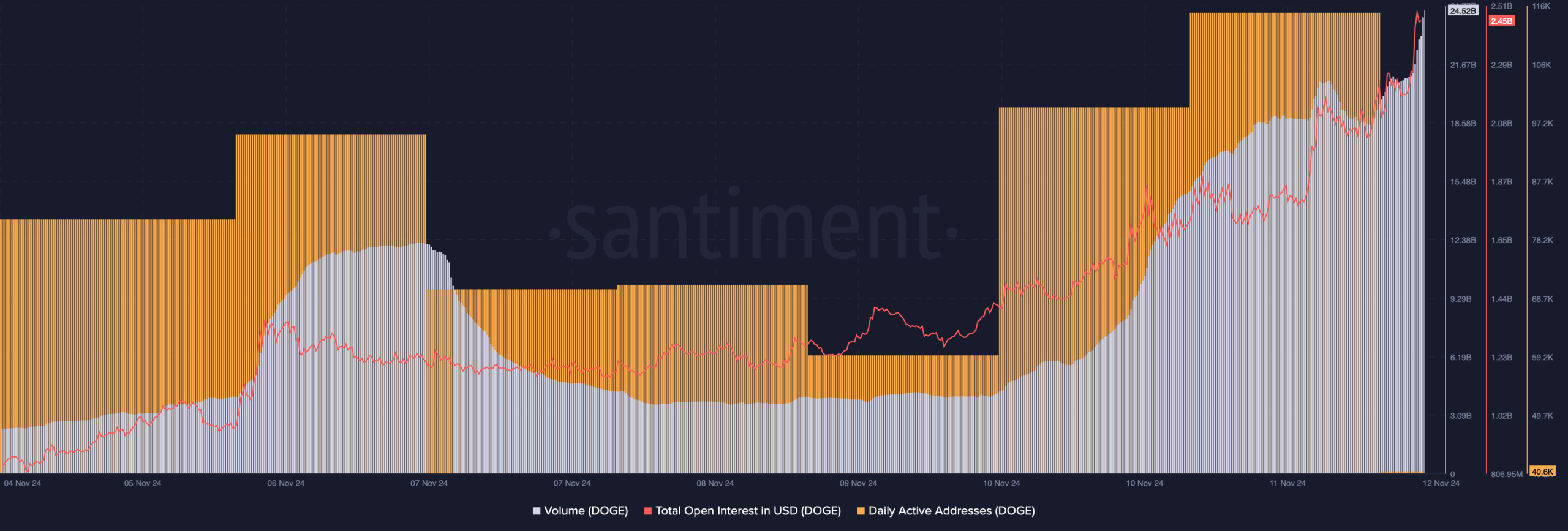

The memecoin’s trading volume rose sharply along with its price, which generally acts as a basis for a bull rally.

Open Interest also shot up, meaning there was a good chance the ongoing bullish trend would continue.

Apart from that, Dogecoin’s network activity also remained high. This was evident from the increase in the number of daily active addresses.

Source: Santiment

While these aforementioned metrics looked bullish, trouble could arise for Dogecoin. The price of the coin reached the upper limit of the Bollinger Bands, which often leads to price corrections.

Furthermore, the memecoin’s Money Flow Index (MFI) entered the overbought zone. This suggested that selling pressure on the memecoin could increase, which could negatively impact bullish momentum.

Source: TradingView

Read Dogecoins [DOGE] Price prediction 2024–2025

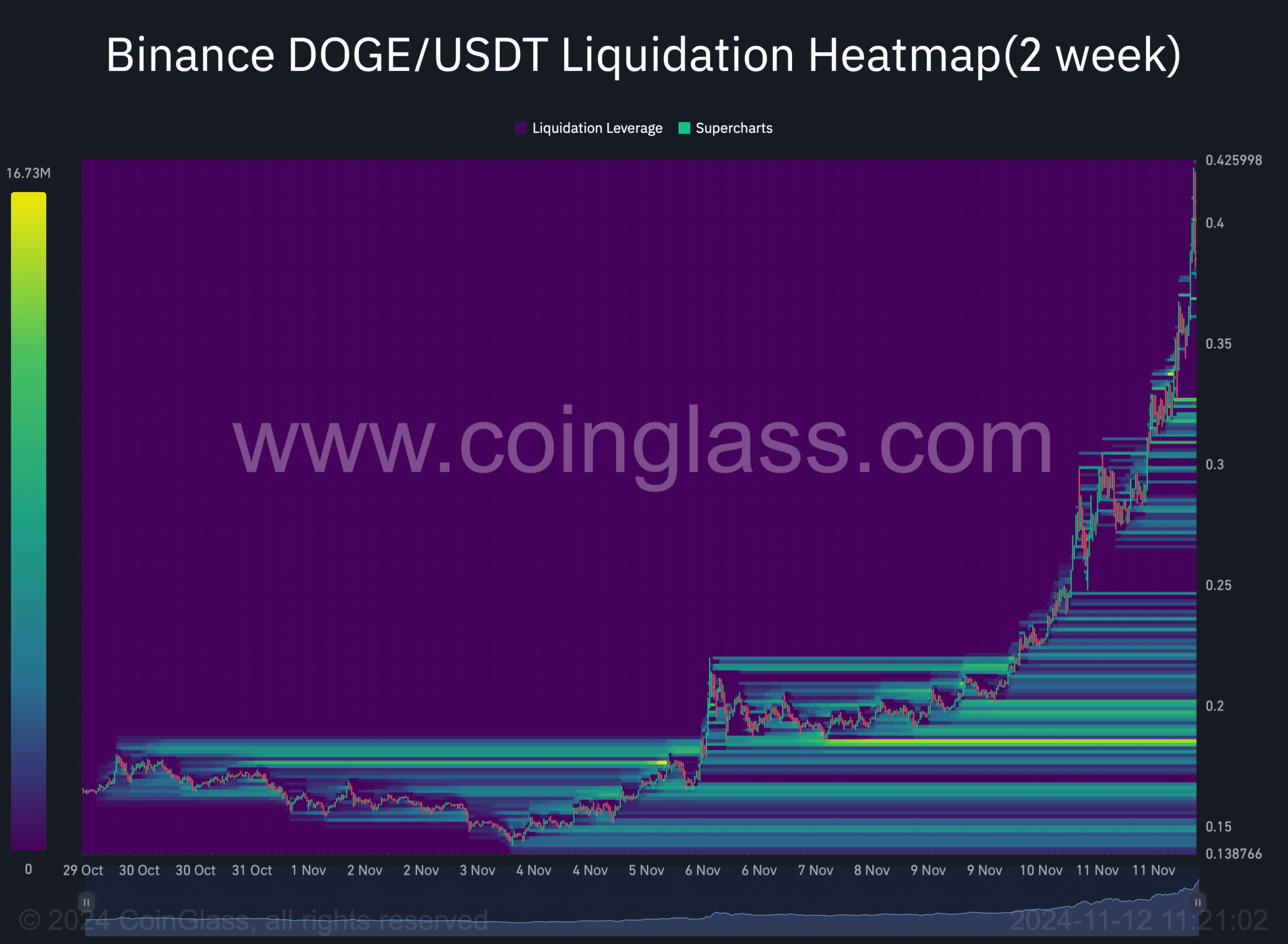

However, Dogecoin was not subject to major liquidations in the short term. This was the case because the heat map of the liquidation did not show that there would be significant liquidity in the coming days.

However, as suggested by the Bollinger Bands, if DOGE faces a correction, it could fall towards its support near $0.32.

Source: Coinglass