Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

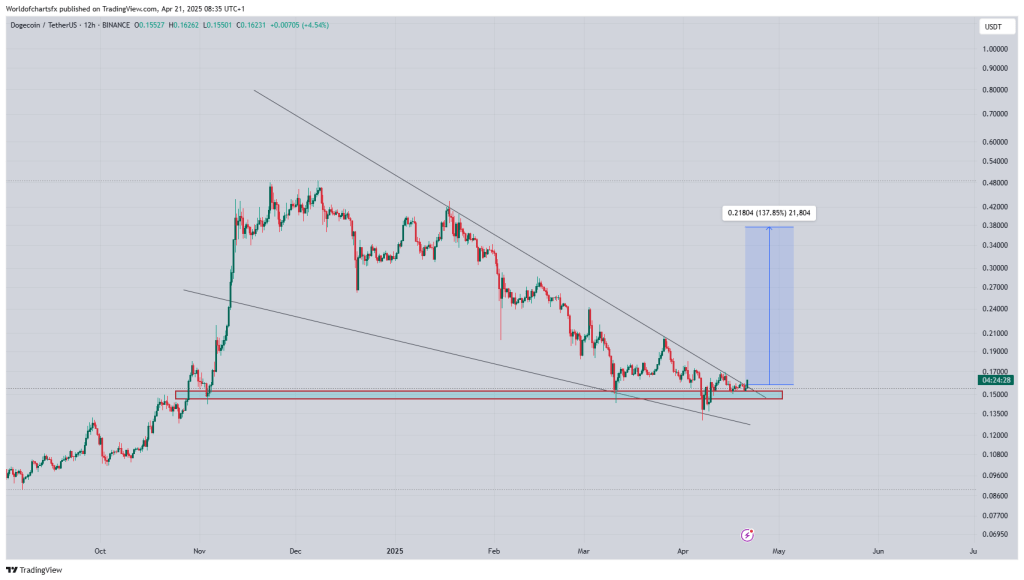

Dogecoin (Doge) breaks again from a textbook that falls the formation of the Val’s covers, and the analyst who anticipated the last triple explosion of Memecoin thinks the stage has been set for an encore. “Break crucial area and expect a solid bullish golf in the medium term,” said World of Charts (@worldofcarts1) his X followers while he shared a 12 -hour Binance card.

Major Dogecoin Upswing Income?

He referred to A post of April 13, where he predicted: “Doge: we caught this big move in October 2024, Dogecoin went more than 3 ×. Now doge again [is] on [the] Stretch of massive outbreak … expected from here 3 ×. “

The graph shows five months of compression that started when DOGE was slightly less than $ 0.48 at the beginning of December.

Since then, every rally has stalled under a falling resistance trend line, which now cuts through the zone of the middle of $ 0.155; Parallel support currently follows the $ 0.14 area after dampening a few capitulation wicks in March and April. The price now broke out of the upper limit for the first time in almost two weeks.

Related lecture

World of Charts’ Measured -Move -Overlay starts with the fictional outbreak above $ 0.17 and projects a vertical ramp of $ 0.21804, which implies a primary objective, just shy of $ 0.39 -a win of 138% of the trigger and within a striking distance. If the set -up delivers the same size as last year’s wedge, it could eventually test $ 0.65, which completes a new triple rally.

The time symmetry behind the call is difficult to ignore: the current WIG has been compressed for almost six months and reflects the consolidation that preceded the eruption of October -December 2024 from $ 0.11 to $ 0.48. The volume is diluted with every contracting cycle, a classic pre -breakout signature, while momentumoscillators start to tilt positively at lower time frames if Spot recalls his 50 – – -alle.

Related lecture

Other analysts remain focused on the Bitcoin’s grip over the beta of the market. “If BTC breaks above $ 89k and shows conviction upwards, I think Dogecoin returns relatively quickly to $ 0.26,” warnings Kevin (@kev_capital_ta). “BTC holds the cards as always, especially with BTC -Dominance that pushes higher and still tight the monetary policy.” In his analysis, $ 0.26 represents the 0.618 Fibonacci racement of the November -Maart DIA, which marks the first substantive obstacle, even if Doge knew the wedge resistance.

From a purely card -based perspective, the combat lines are now sharply drawn. A decisive daily close to trendline and a successful retest would confirm the outbreak, shift the red demand band in a springboard and expose successive goals. Not piercing would hold the price in the pattern, with every slip below $ 0.15 that risks a slide to structural support for $ 0.13 and, in extremis, the $ 0.11 pivot that launched last year’s parabolic climb.

At the time of the press, Doge acted at $ 0.1641.

Featured image made with dall.e, graph of tradingview.com