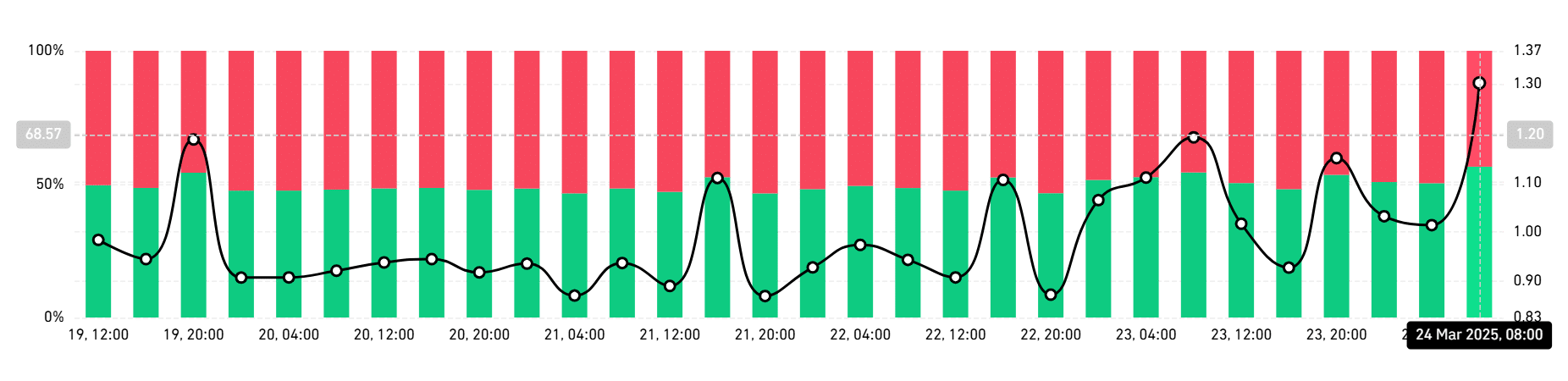

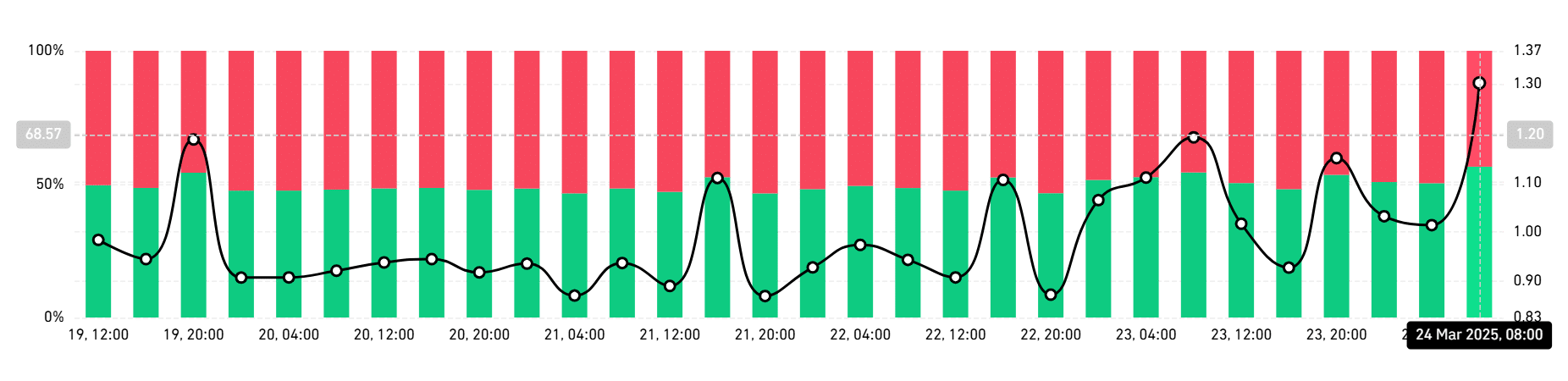

- The long/short ratio rose from Doge rose to 1.20 and showed a possible bullish breakout.

- Price keeps important support from around $ 0.17, with goals near $ 0.22 when the momentum builds.

Dogecoin [DOGE] Can prepare itself for a directional shift, because the long/short ratio has taken a bullish turn. This peak in trader sentiment and potential support levels that form in the charts can shape the next stage of Doge’s journey.

Long/short ratio signals increased doge optimism

In the last 24 hours, Dogecoin’s Long/short ratio jump from 0.85 to 1.20, the highest level that was seen last week. This statistics suggests that more traders place long bets than shorts, which indicates a growing confidence in a potential upward movement.

Source: Coinglass

Historically, the price of doge reacts to such shifts in the positioning of the traders, especially when the ratio exceeds the 1.00 threshold.

A rising long/short ratio can be a sign of speculative appetite -return, which often precedes outbreak attempts in memecoins such as Doge.

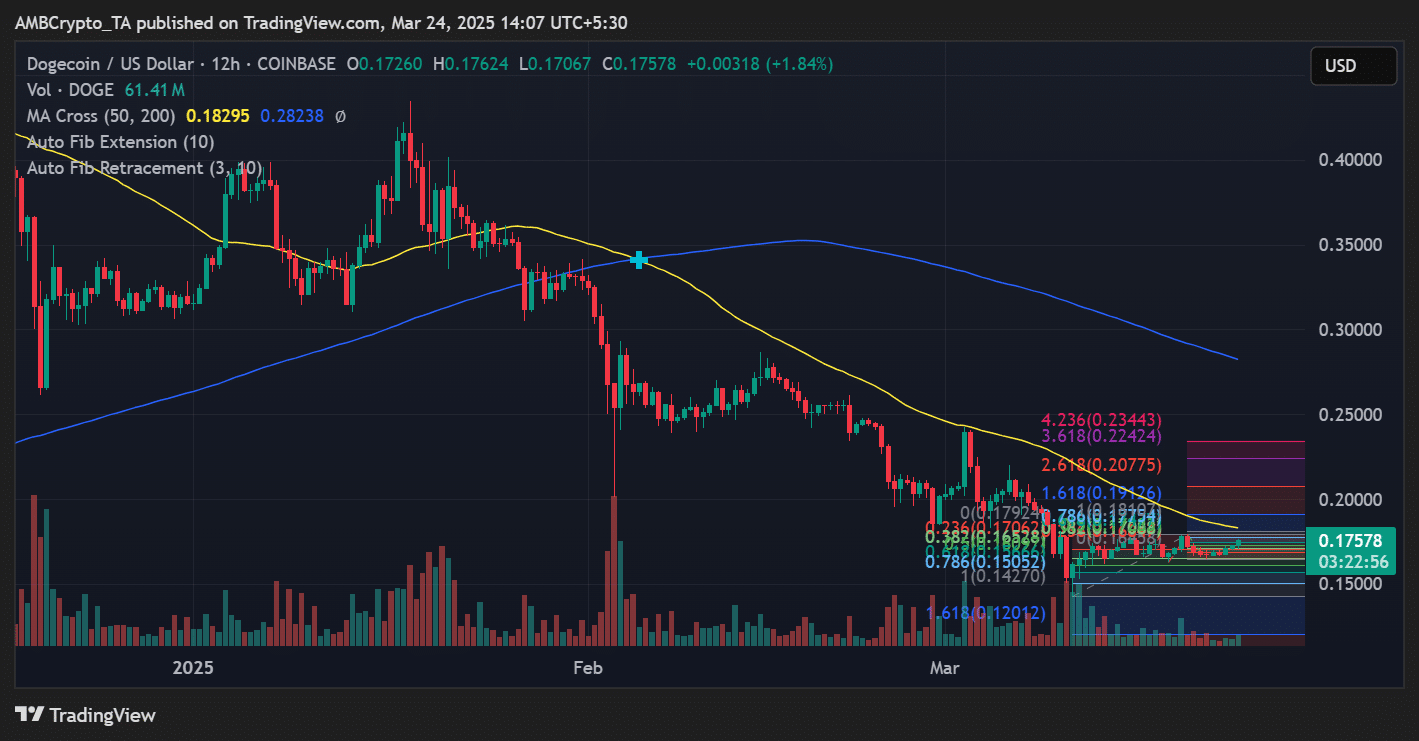

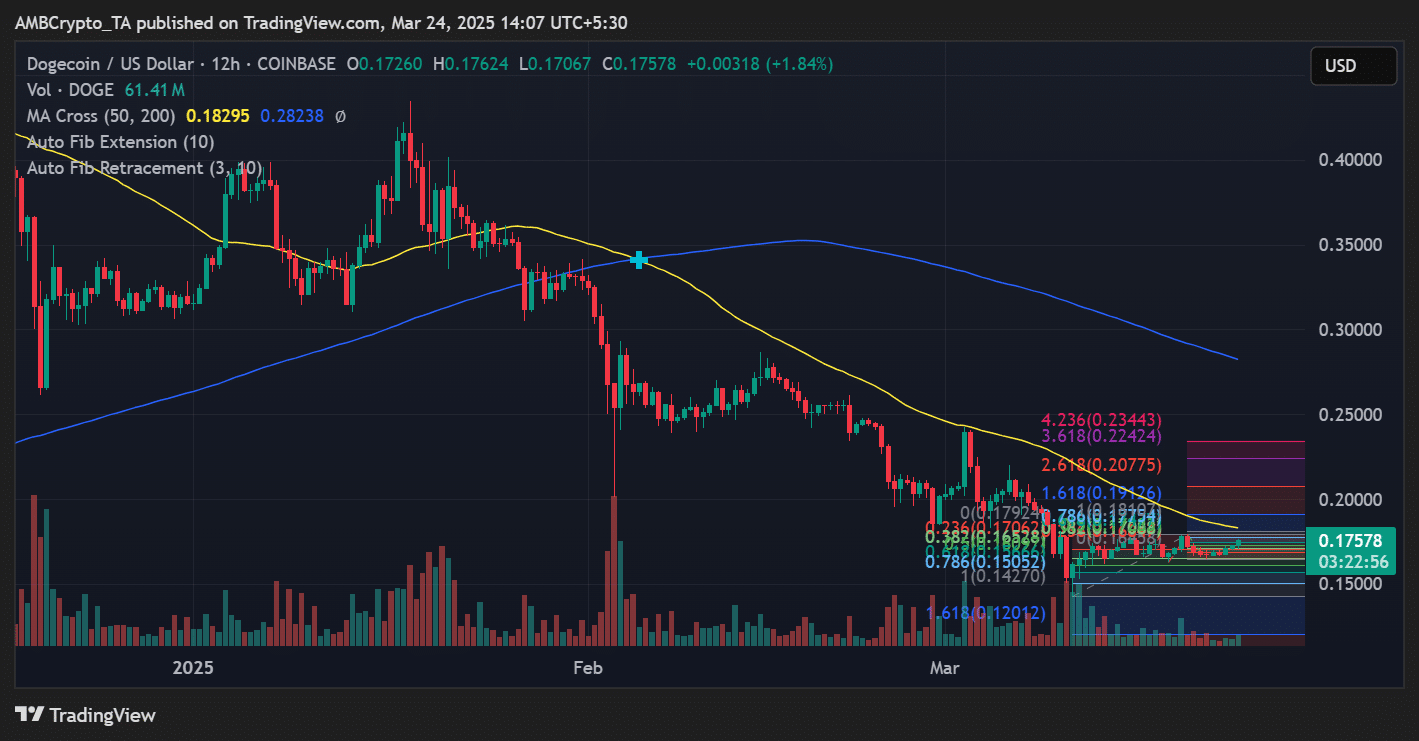

Dogecoin’s Macro Channel keeps bulls in the game

Looking at the macructure from a weekly perspective, Dogecoin acts within a long -term rising channel. Based on Fibonacci extensions and trendline alignment, it acted actively just above crucial diagonal support near the $ 0.17 region, a per time.

If Doge maintains this channel and picks up the volume, the following resistance zones are between $ 0.22 and $ 0.23, tailored to the FIB extension levels of 2,618 and 3.618. A violation of these levels could open a path to $ 0.30 and beyond.

On the other hand, the failure of $ 0.16 can expose to a retest of $ 0.15, characterized by the 0.786 FIB racement on the 12-hour graph.

At the time of writing, the 50 EMA (yellow line) were at $ 0.182, as a resistance in the short term.

Doge technical indicators point to …

From a momentum position, Doge’s RSI floated around 50, which reflects a neutral setup. The stable lateral price action around $ 0.175, however, is accompanied by a stable volume, often a prelude to a volatility expansion.

Source: TradingView

Moreover, the narrowing of Bollinger tires and a flat-lining MacD suggested that Dogecoin could rinse for a larger movement in the coming days, especially because traders take signals of rising long positions.

What for doo

The rising long/short ratio of Dogecoin shows an increasing bullish sentiment among traders. As long as the price applies above the most important support levels and avoids a sharp correction, DOGE can test higher resistance levels in the short term.

With Memecoin volatility that still in the game, traders must follow sentiment and volume closely for confirmation.