- DOGE could rise +43% after a bullish breakout.

- Overall, however, bearish market sentiment could delay the outlook.

Dogecoin [DOGE] saw a price cut in early July and has fallen more than 30% in the past two weeks amid a general recovery.

This week the recovery stuck and withdrew more than 11%, sending the memecoin down to $0.12. The press time level was similar to DOGE’s price consolidation in late June.

However, it could post a 44% gain after a bullish breakout. Renowned crypto analyst Ali Marinez tipped an upside potential for DOGE, citing a breakout pattern on the falling wedge pattern.

“Looks like Dogecoin has broken out of a wedge, suggesting a 44% upside target!”

Source: X/Ali M

For perspective, falling wedges are typical bullish patterns that tend to develop into front rallies in most cases after the breakout. The potential breakout is usually equal to the height of the wedge – in this case more than 43%.

Another user echoed the bullish long-term outlook, citing an initial weekly golden cross that could see DOGE gain 18,000%.

Does DOGE’s spot and derivatives market agree?

From a derivatives perspective, DOGE market sentiment was bearish at the time of writing indicated due to a drop of almost 10% in open interest (OI). Moreover, volume dropped significantly during the crypto market’s general collapse on Wednesday.

DOGE also saw a lot spotting outflow from mid-week, indicating a risk approach that could delay the 43% rebound projection.

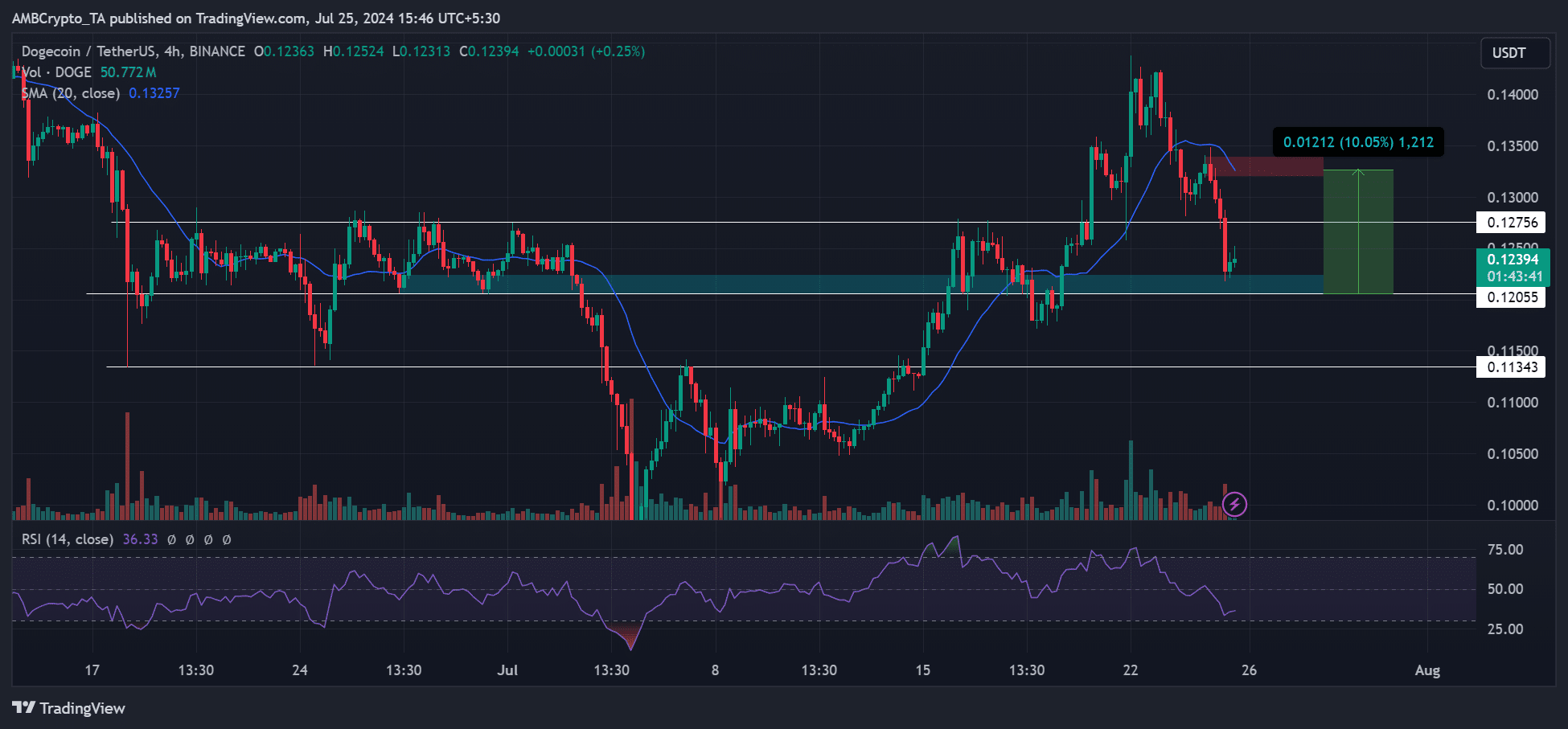

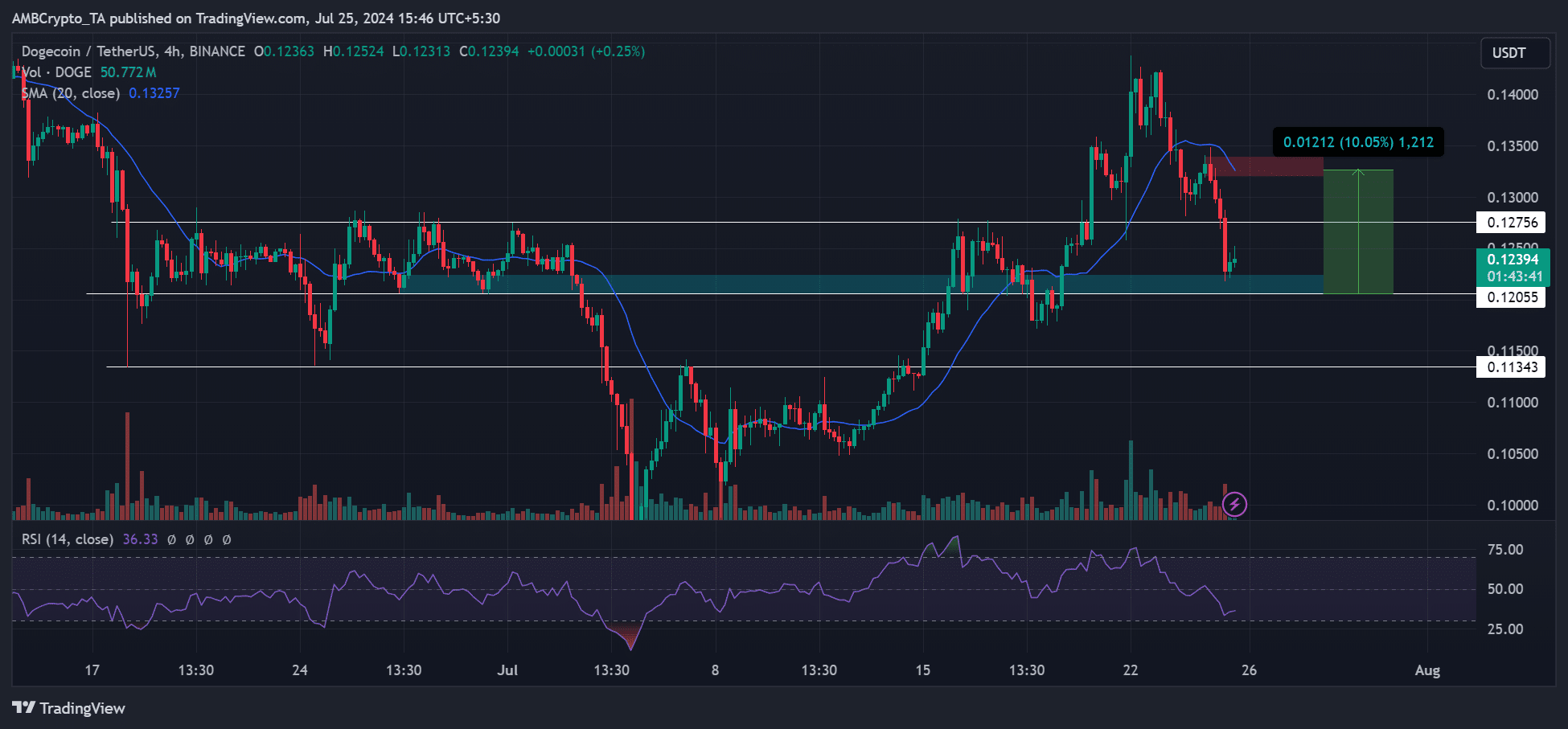

Nevertheless, a 10% rally was still possible in the short term, as shown by the 4-hour chart. Notably, the RSI (Relative Strength Index) had retreated near oversold territory, suggesting a bullish reversal could be likely.

If so, the immediate price targets could be $0.1275 and $0.1325. Hitting the latter translates into a 10% gain.

However, DOGE could slide towards $0.11 if it breaks through the $0.12 support in the near term.

Source: DOGE/USDT, TradingView

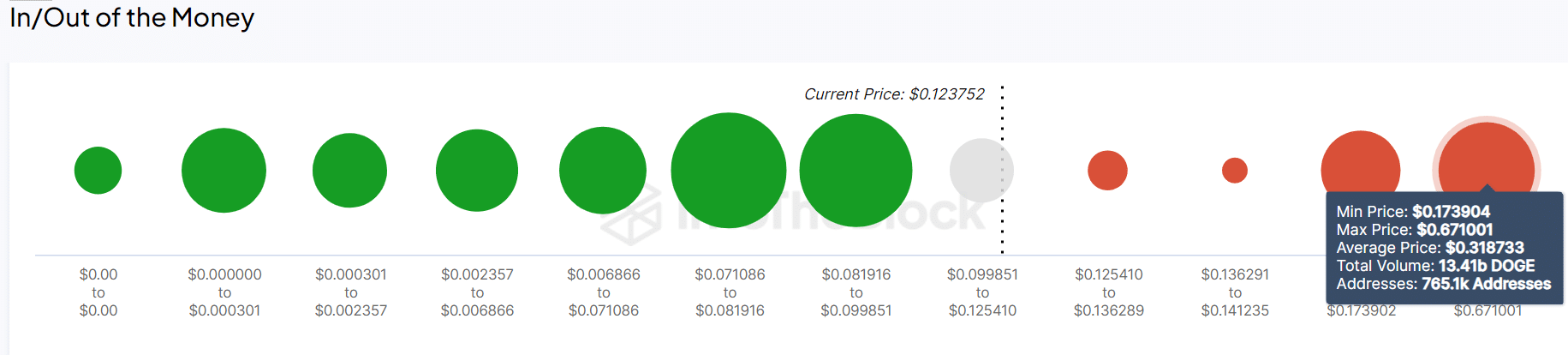

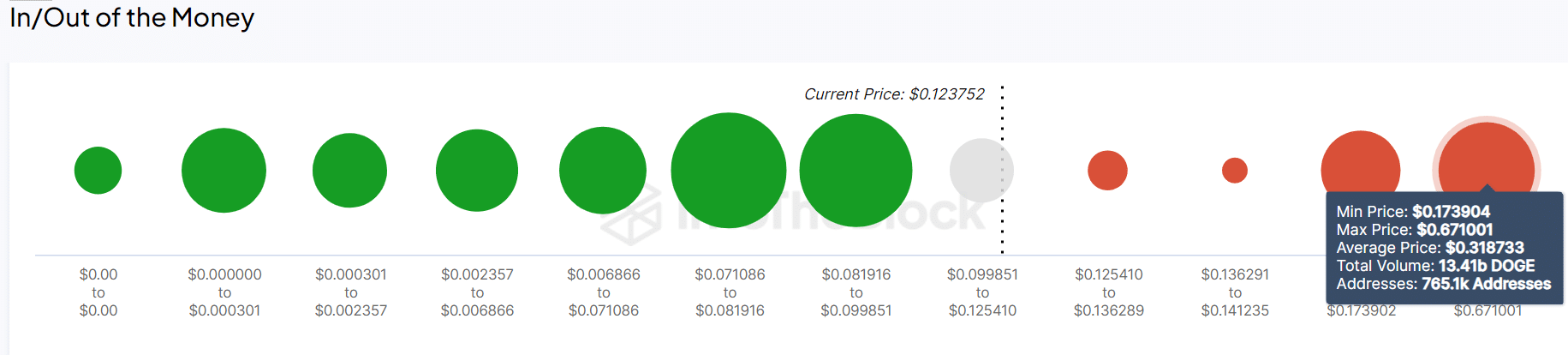

Interestingly, there wouldn’t be much resistance at levels of 0.14 or $0.13 as very few addresses bought the meme coin at those levels. This reduces the chance of profit taking if the recovery hits targets.

Source: IntoTheBlock