- Whale Activity Surges 400%, Indicating Accumulation and Fueling Dogecoin’s Recent 18% Price Surge

- Analysts predict Dogecoin could surpass resistance by $0.40 on its way to the coveted $1 target

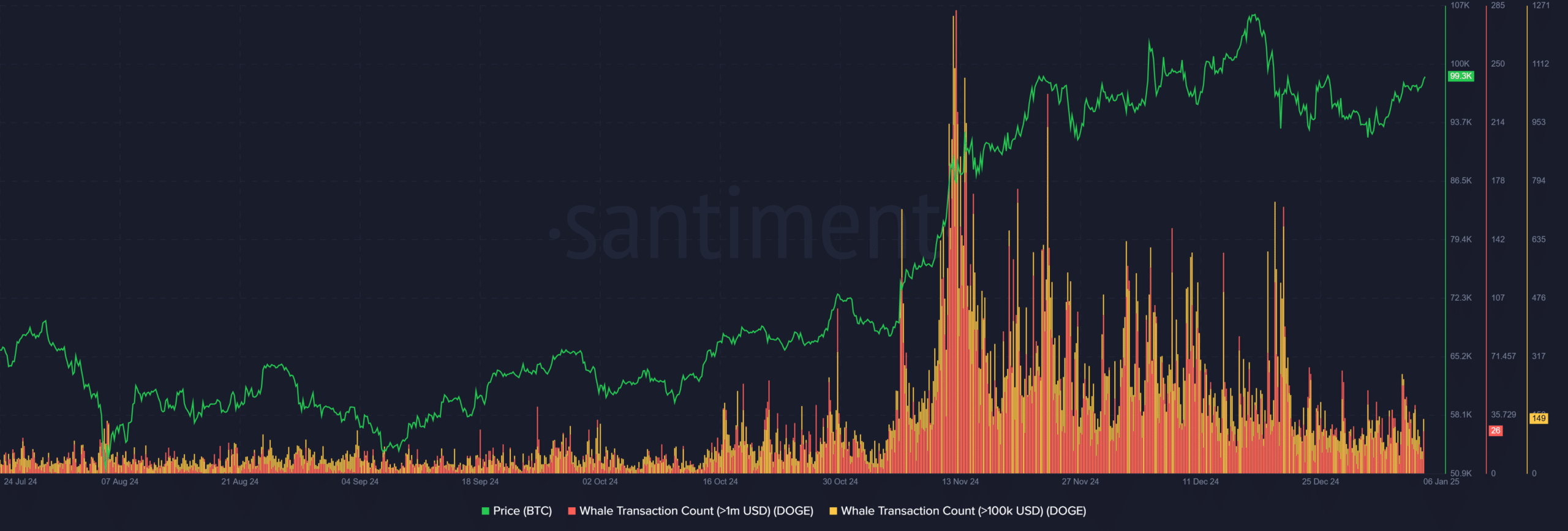

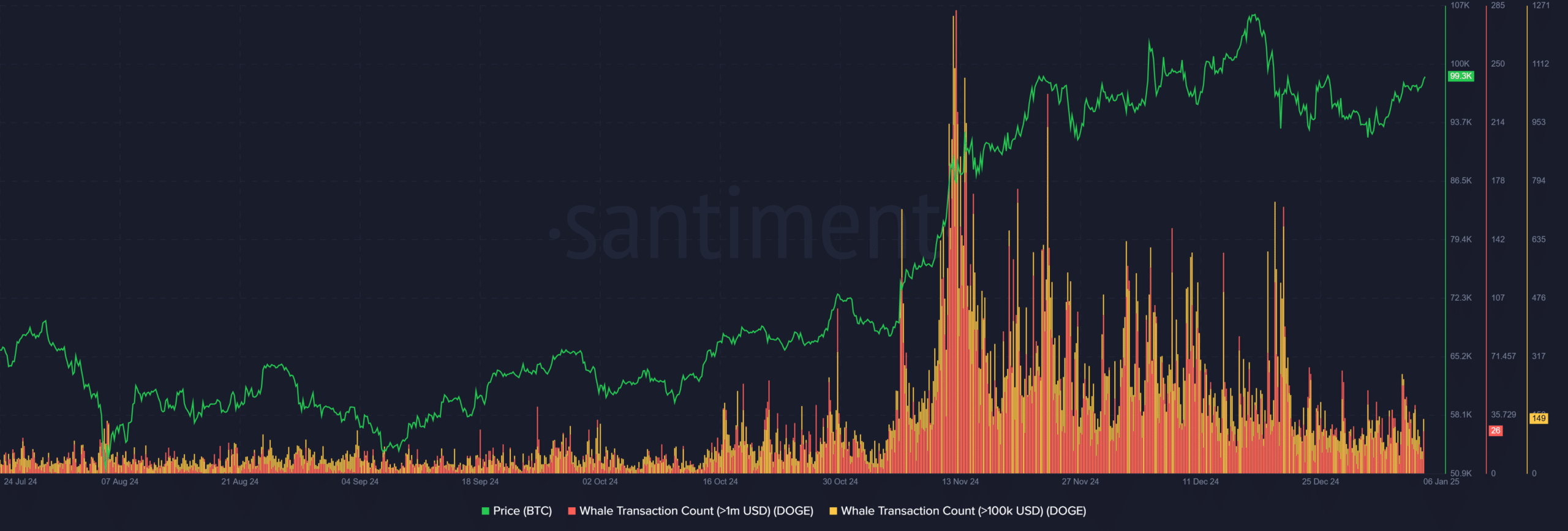

Over the past 24 hours, Dogecoin [DOGE] has experienced a dramatic 400% increase in whale transactions, coinciding with a remarkable 18% price increase in the past week.

The sudden increase in whale activity has led to speculation about a possible bullish run for DOGE. Whale trades are often significant market movements, with large trades causing price swings.

As whales continue to accumulate Dogecoin, many analysts predict that the token could reach the coveted $1 target.

Whale activity indicates bullish momentum

Dogecoin’s recent price increase appears to be caused by intensified whale activity. Data from Santiment shows a notable 400% increase in large trades over $100,000 in the past 24 hours, indicating increased interest from deep-pocketed investors.

Source: Santiment

Historically, an increase in whale trades has been a harbinger of bullish trends. These large trades often reflect accumulation phases or strategic positioning for further upside potential.

Rising trading volumes and growing market optimism indicate whales are betting on a continued rally. With robust institutional interest, analysts speculate that Dogecoin could retest its all-time high. It could potentially reach the coveted $1 milestone in the coming months.

Read Dogecoins [DOGE] Price forecast 2025–2026

Short-term price predictions

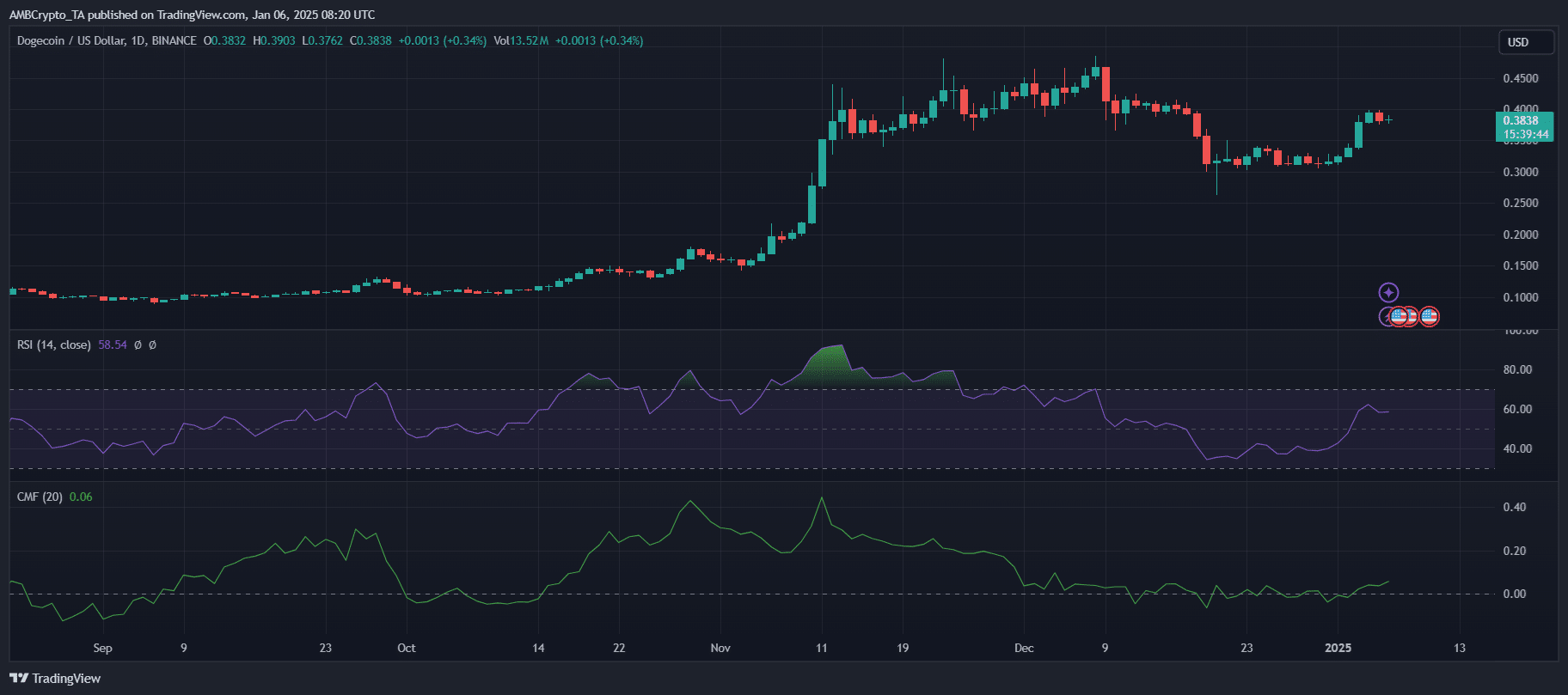

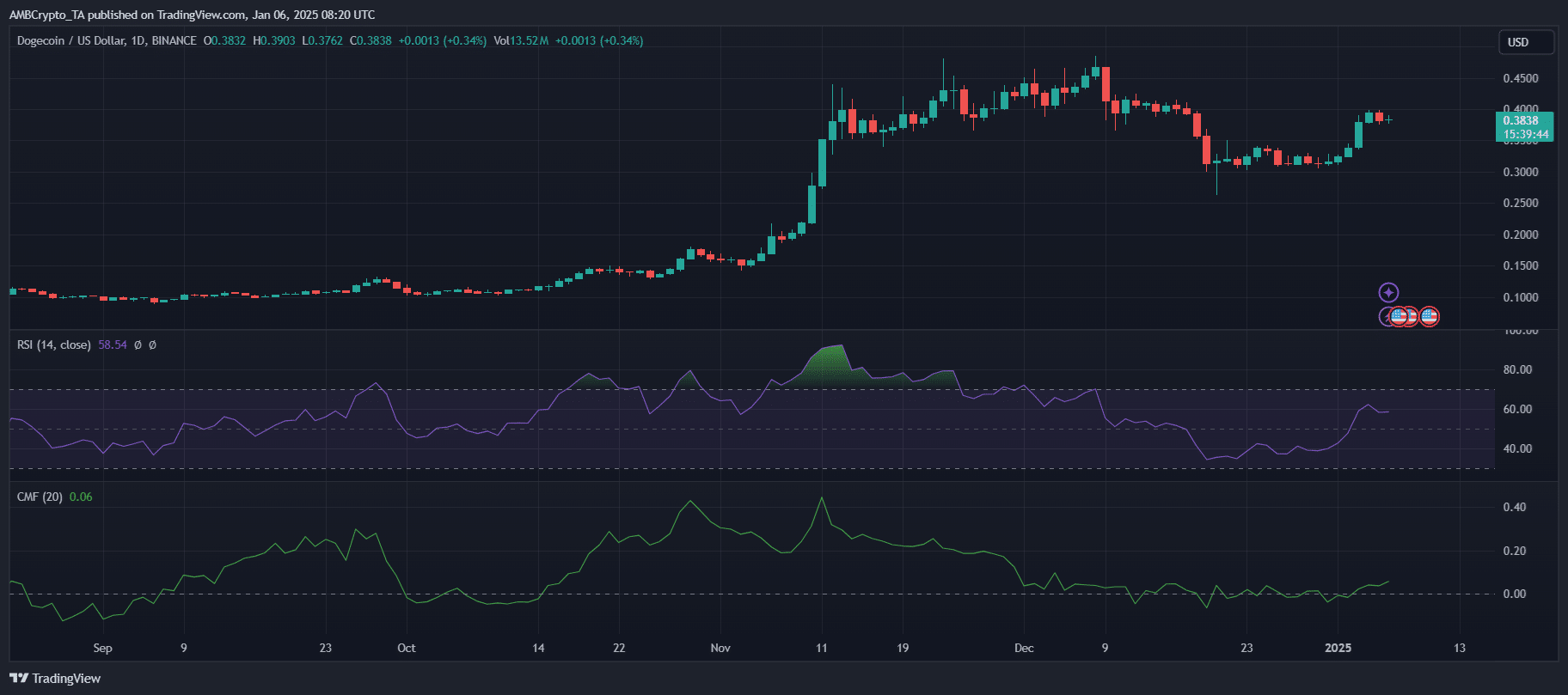

Dogecoin’s price action has positioned it as a strong candidate for further bullish momentum in the near term. The data illustrates a clear breakout from the consolidation phase, supported by a steady increase in trading volumes and liquidity.

With the CMF indicator hovering in the positive territory at 0.06, capital inflows indicate continued buying pressure and robust demand in the market.

Moreover, the RSI remains below the overbought level, indicating that there is room for further upside without immediate risk of a correction. This technical alignment, coupled with strong whale activity, reinforces bullish sentiment in the short term.

Source: TradingView

Market liquidity appears to be more than sufficient to support further upward moves. The recent increase in transaction volumes implies growing confidence among private and institutional participants.

However, Dogecoin is facing psychological resistance near $0.40. Crossing this level could pave the way to $0.50, a crucial level on the way to $1.

While the current situation favors bullish scenarios, traders should remain cautious about potential volatility. This could be caused by macroeconomic factors or profit taking by whales. Near-term price action will likely depend on continued volume growth and broader market sentiment.