- Dogecoin has struggled to fully recover after a fall two weeks ago.

- The total supply has decreased further as a result of the price battle.

Recently Dogecoin [DOGE] has experienced a less favorable price trend, which has led to a decrease in the number of tokens in a profitable state. Nevertheless, despite the downward trend, the derived measure indicates buyer aggression.

Dogecoin’s profits are falling

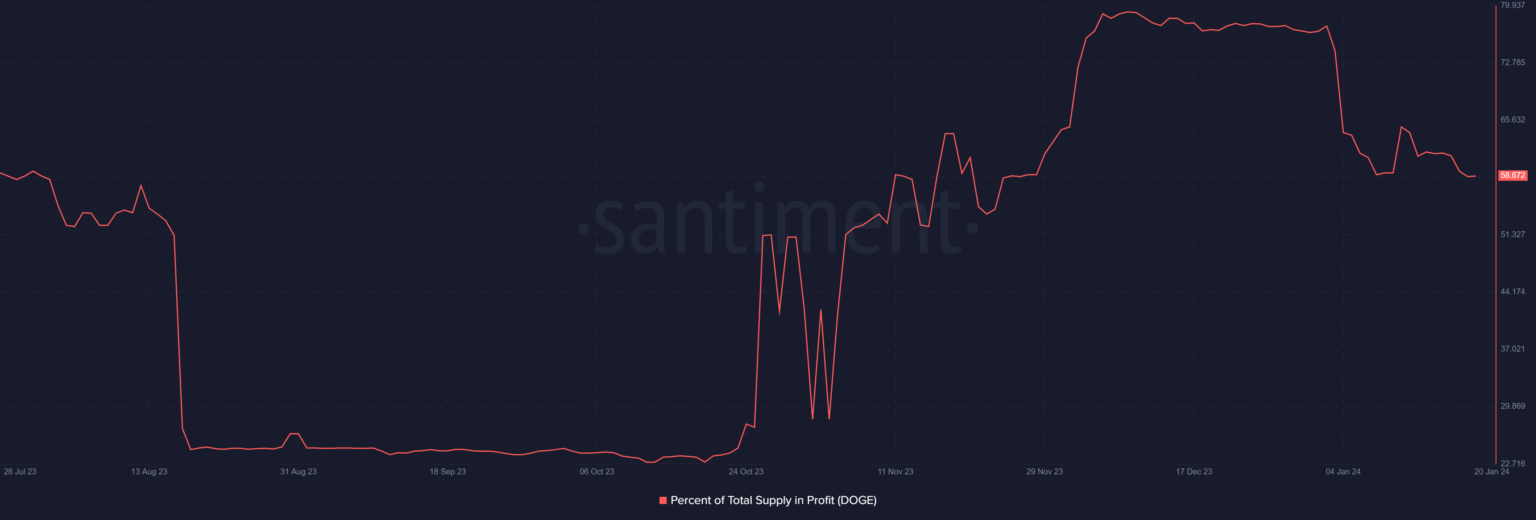

An analysis of Dogecoin’s supply shows that profits fell at the start of the year, after a relatively stable trend in December.

Profits remained largely constant, with a gain of approximately 103 billion tokens. However, according to figures, it fell to around 79 billion earlier this year Santiment.

Although attempts were made to recover, the number could not cross the 100 billion mark.

There is currently a slight decline, bringing DOGE’s profit to approximately 78 billion according to the latest update. Given the current supply, this translates into a profit percentage of approximately 59% of the total supply.

DOGE remains rooted in bear zone

Examination of Dogecoin’s daily timeframe chart showed a series of swings between gains and losses since the significant drop on January 12.

It is striking that the losses are greater than the gains. At the close of trading on January 19, DOGE was valued at approximately $0.078, representing a slight increase of approximately 0.6%.

At the time of this update, it posted a slight gain of around 0.2%, maintaining the $0.078 price range.

The trend shown by the short-term moving average (yellow line) indicates a bearish trajectory. The yellow line was above the price, indicating a less favorable trend.

Moreover, the Relative Strength Index (RSI) has remained below the neutral line and is struggling to surpass it. According to the latest data, the RSI line barely reached 40, which shows the prevailing strong bearish trend.

Dogecoin buyers are becoming more aggressive

While the overall price trends may not be particularly impressive, an intriguing development is emerging among traders on the derivatives side.

Research of the Mint glass The funding rates chart has shown a consistent rate of around 0.01% since about January 4th.

Is your portfolio green? Check out the Dogecoin profit calculator

However, at the time of this update, there had been a notable increase in the funding rate, to approximately 0.05%. This uptick indicates increased aggression among buyers.

Such an escalation often indicates a bet by traders anticipating a possible price increase.