Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

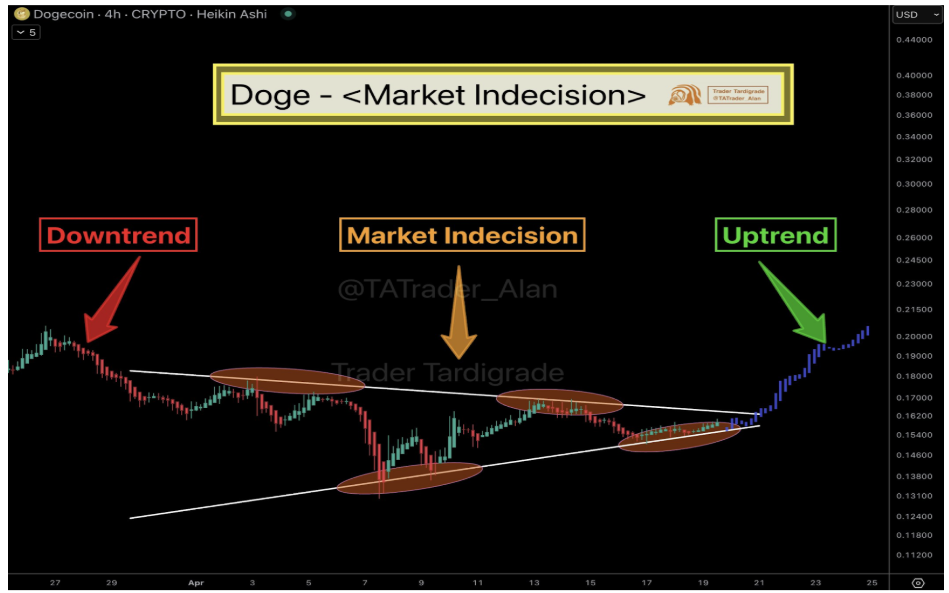

Dogecoin has been Have been acting in a tight reach lately, With its price movement that increasingly limits between $ 0.15 and $ 0.16 in recent days. This always messing up assortment has come from a wider downward consolidation movement since the beginning of April, which has led to the creation of a triangular pattern on the 4-hour candle-time frame graph.

Related lecture

As it looks now, Dogecoin tries to recover from previous losses in April, and a recent higher layer points for the growing bullish activity that it could be pushed above the upper trend line of the triangle pattern in the coming week.

Analysts notes the classic market decision in the Dogecoin structure

Crypto -analyst dealer Tardigrade recently paid attention To the current price structure of Dogecoin in a message shared on the social media platform X, where a converging triangle formation is noticed that reflects the growing indecision in the market.

According to his analysis, the Dogecoin price action has been transferred to a clear decrease (visibly during the end of March and extends until the first week of April) in a state of consolidation that has existed for the past two weeks.

Looking at the resulting triangular formation on the 4-hour candlestick Time frame graph, it is easy to conclude that both buyers and sellers are careful. Buyers are reluctant to enter at higher levels, while sellers do not seem willing to lower prices, creating a narrowing of price action since 15 April. The result is a compression of volatility, which can break out in both directions.

Image From X: Trader Tardigrade

Image From X: Trader Tardigrade

What will come after the indecision phase?

As shown in the above price card of the Dogecoin, the memecoin is now approaching the tip of the triangle. In this specific case, the structure leans to a bullish breakout, With market behavior that shows signs of upward pressure structure under the surface with an increase of 2.77% in the trade volume in the last 24 hours.

Trader Tardigrade projected an uptrend that cancel the downward trend at the end of March, after the classic pattern of a downward trend, indecision and a resulting upward trend.

A strong bullish candle that is closed above the upper trend line of the triangle is important to validate the predicted update. The projection of the trader Tardigrade shows that if such a movement occurs, Dogecoin could reclaim the $ 0.20 level Within a relatively short period of time before the end of the month.

Dogecoin opened the month of April for $ 0.166. As such, a clean upward outbreak would be followed by a persistent close to $ 0.20 in April a positive finish for Dogecoin.

Related lecture

Such a positive monthly closure would probably affect the market sentiment that goes to May and possibly invite an increased purchase activity. It would also help confirm that the Recent period of areas Is over and helps to restore a bullish structure.

At the time of writing, Dogecoin acted at $ 0.1573

Featured image of 21Shares, graph of TradingView