- Futures traders are very long on doge and show bullish conviction in the short term.

- No strong correlation between DAA spikes and price gains, hints to speculative activity.

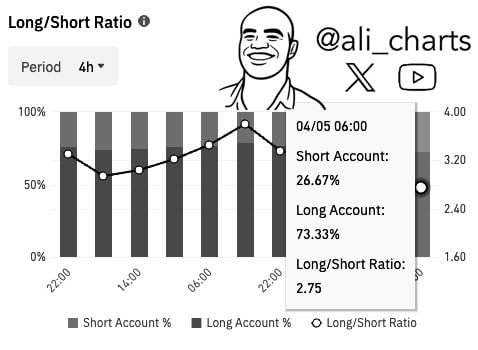

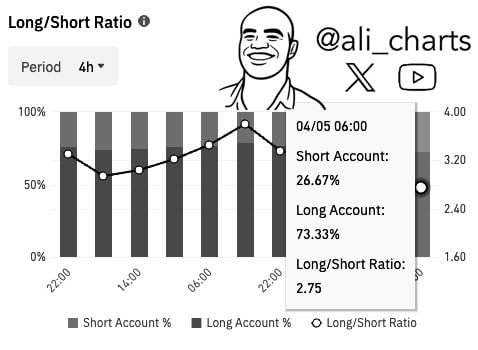

Binance Futures traders seem overwhelming trust in Dogecoin [DOGE]With long positions that surpass shorts over multiple intervals.

According to a graph divided by Ali MartinezLong accounts peaked at 73.33% with a long/short ratio of 2.75 on 5 April.

Source: X

Previous data sets show an even stronger sentiment.

For example, on 3 April, long positions rose to 80.23%, with a long/short ratio of 4.06. In the meantime, short accounts fell sharply to only 19.77%.

By April 6, the long interest rate had decreased somewhat, but was still good for 77.98% of the open positions.

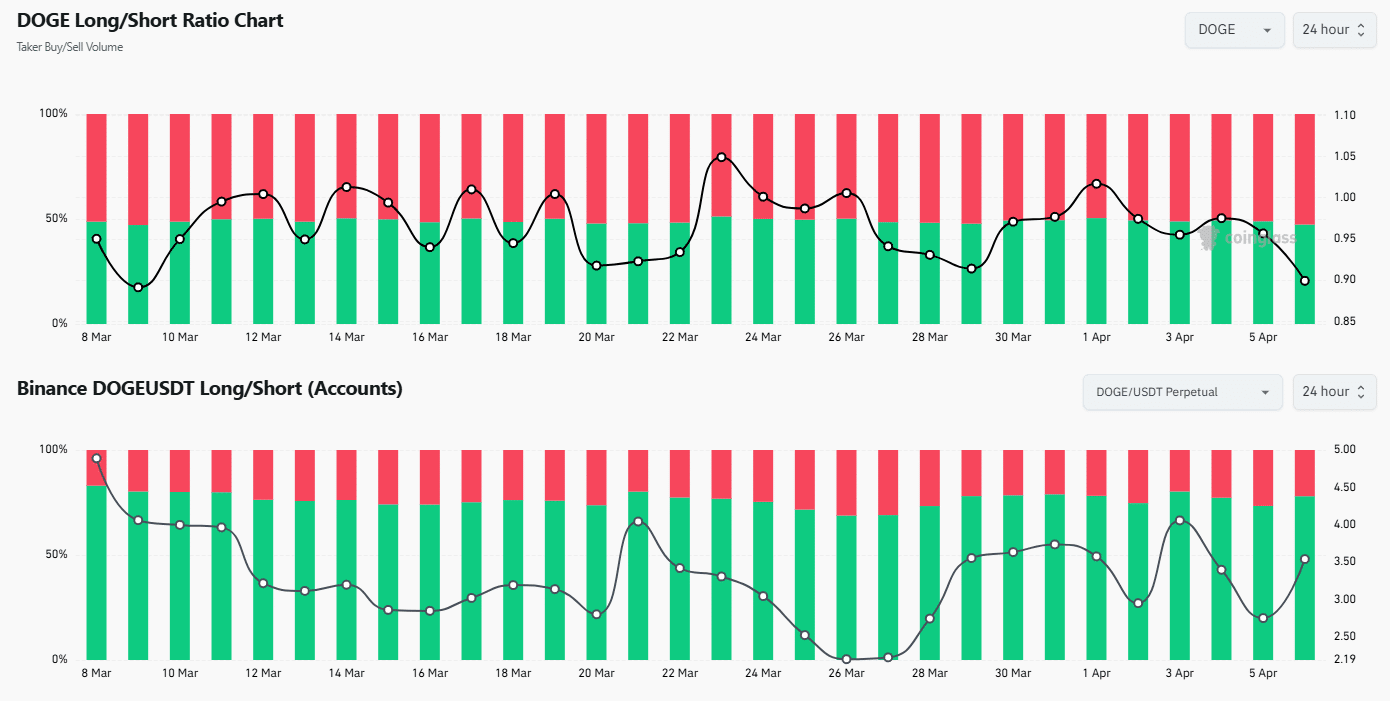

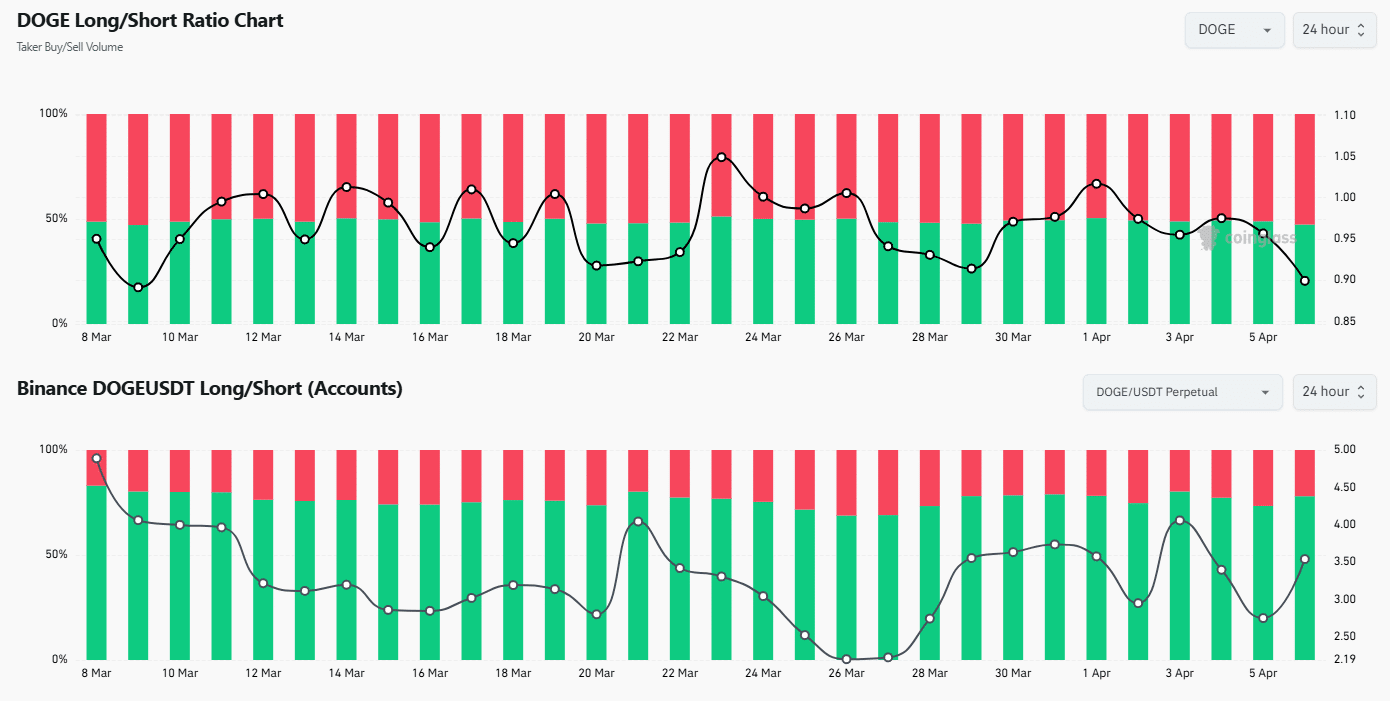

Source: Coinglass

Data of the long/short ratio of Binance Futures Between March 30 and April 6, a grim shift in sentiment will reveal.

Of course the Futures book leaned for a long time at the beginning, but by April, short positions crawled up to 52.66%, while the long interest rate dropped to 47.34%, so that the long/short ratio was pulled to 0.899 – his lowest reading of that week.

The impact is even clearer in doge futures -liquidations

Moreover, this divergence becomes clearer when the spot price and liquidation figures play a role.

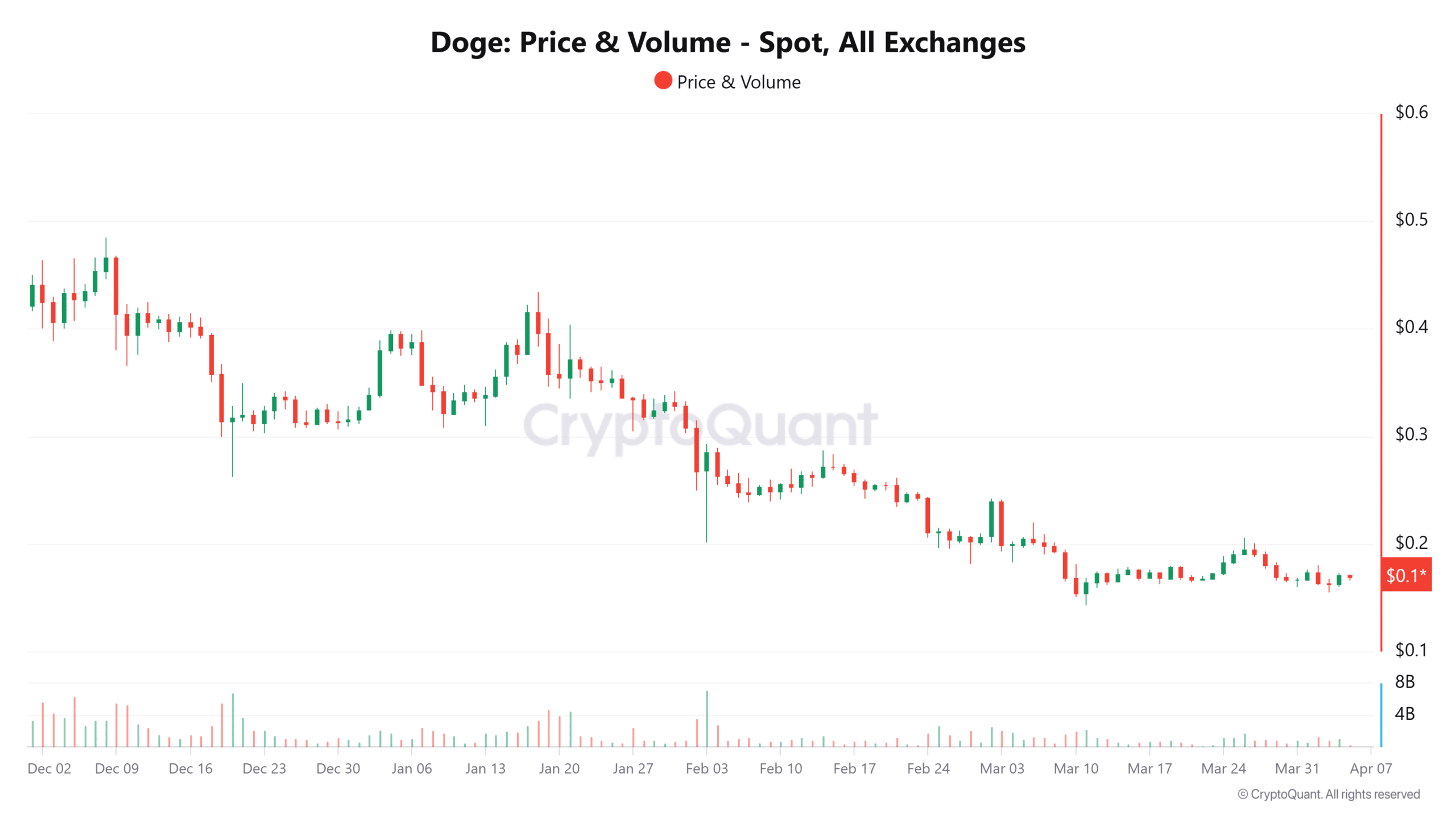

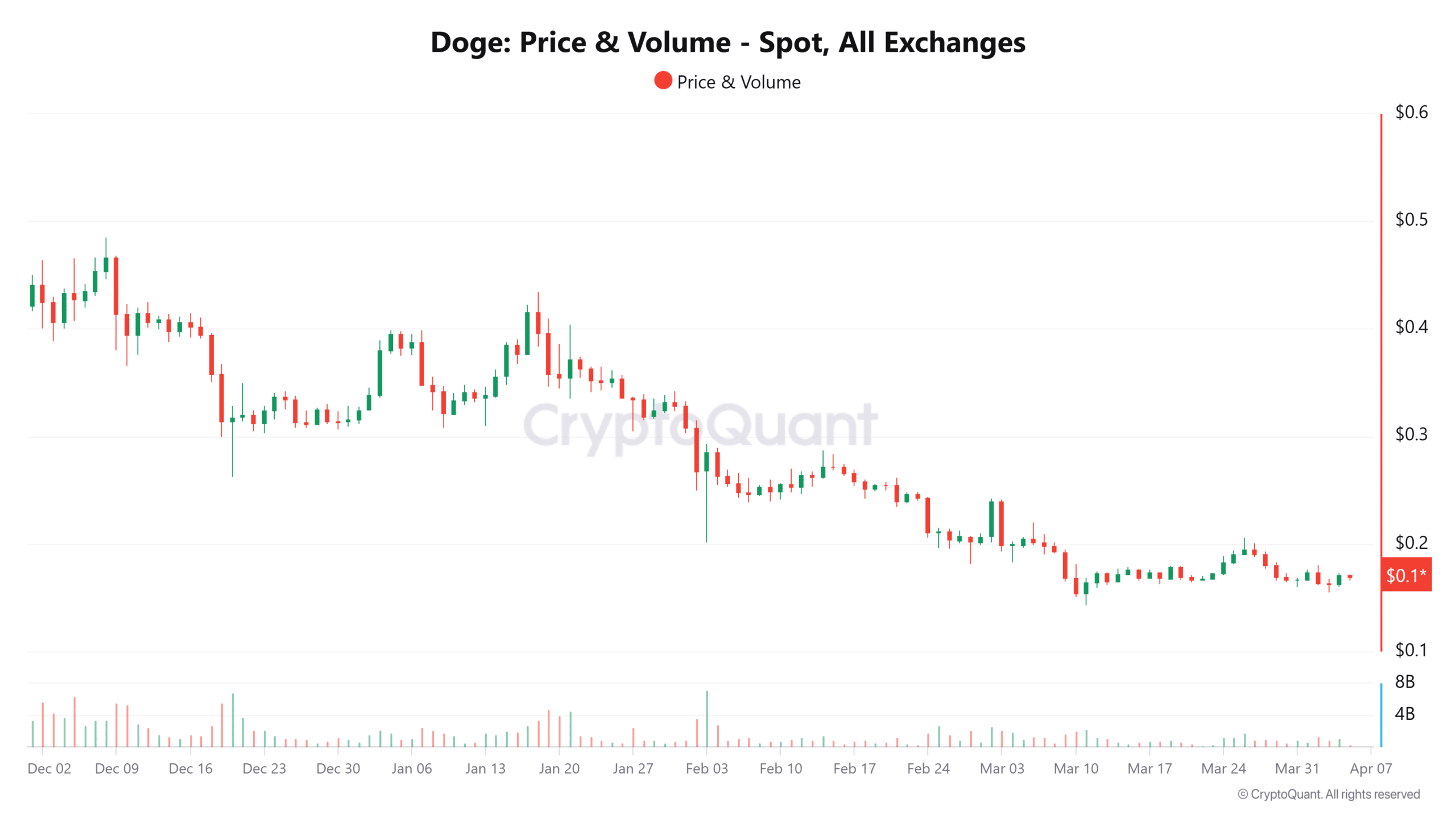

Between February and April, the price of Dogecoin dropped nearly 32%, sliding from $ 0.248 to $ 0.169, as demonstrated spot data.

Moreover, the volume was carried out from 7.18 billion tokens to only 353 million. This stunning dive of 95% hinted on decreasing convictions on the spot market.

Source: Cryptuquant

More revealing is the decrease in whale activity.

On January 21, when Doge nearly $ 0.42 floated, there were 466 transactions more than $ 100,000. By April 5, that figure dropped to only 19, even when the price was kept around $ 0.169.

Of course, such a steep fall in large transactions strongly implies that institutions or high neat-worthy participants have loaded. Or simply avoid doe in the midst of withdrawing prices. Moreover, data projects are on-chain caution.

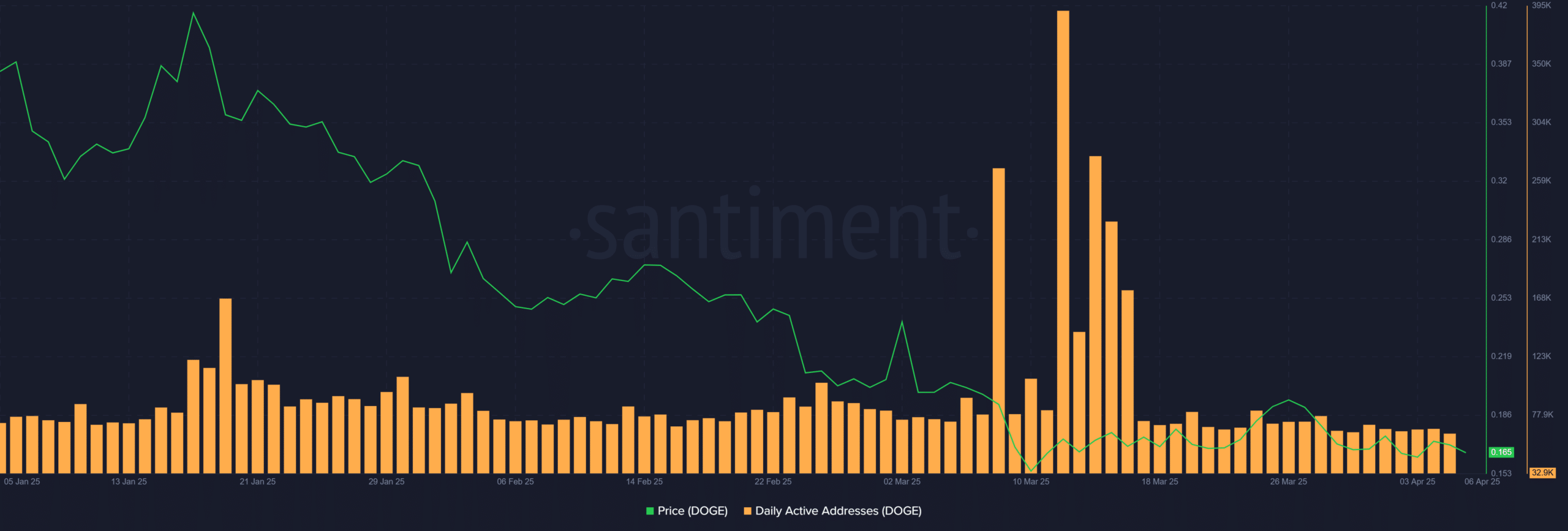

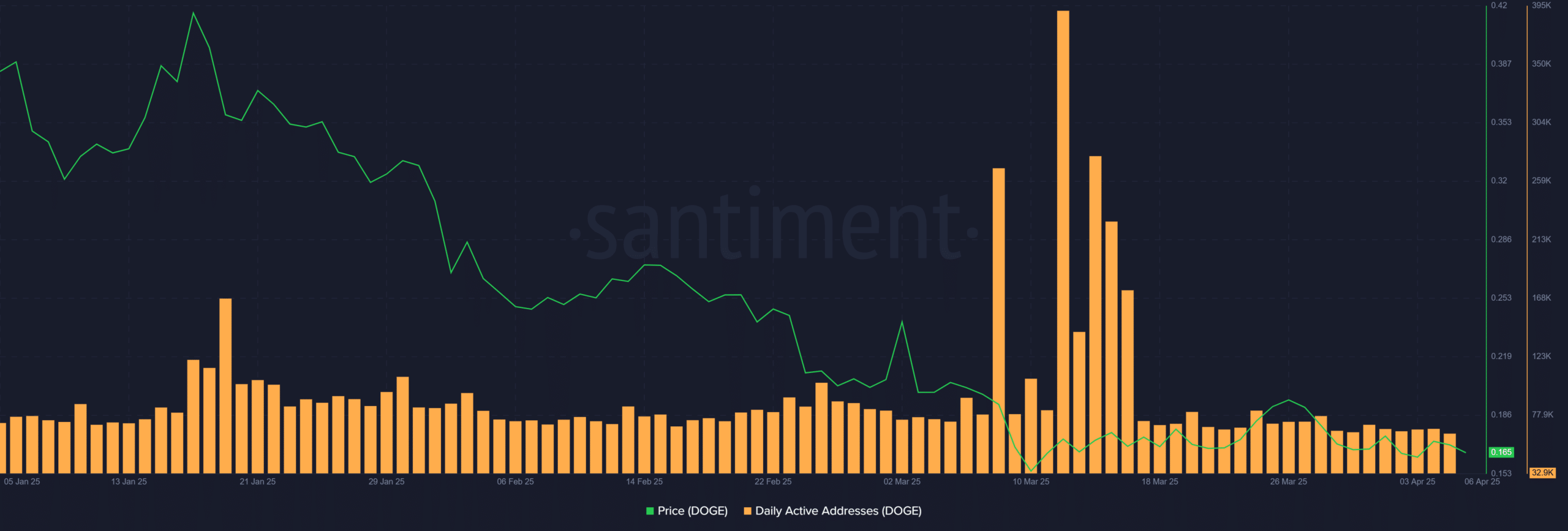

Dogecoin statistics suggest that network health has also deteriorated

Daily active addresses (DAA) peaked on 11 March on 81,861. By April 5, that number fell to 63,736, a decrease of 22%.

Source: Santiment

Interesting is that strong daily active addresses (DAA) do not always match price increases.

At the beginning of April, despite futures traders who showed a strong preference for long positions, other indicators painted a different picture. The whale chanties fell, the spot volumes fell and the network activity weakened.

This reveals a gap between speculative excitement in the short term and wider market hesitation.

In addition, while bullish sentiment has temporarily increased optimism among doge traders, the benefit remains fragile. Spot market and on-chain data emphasize decreasing interest, lower participation of important stakeholders and the current price decreases.

The data shows a market for conflicts. Short euphoria in Futures-Trade contrasts sharply with a cautious prospect in the longer term.